Report Overview

Enterprise Artificial Intelligence (AI) Highlights

Enterprise AI Market Size:

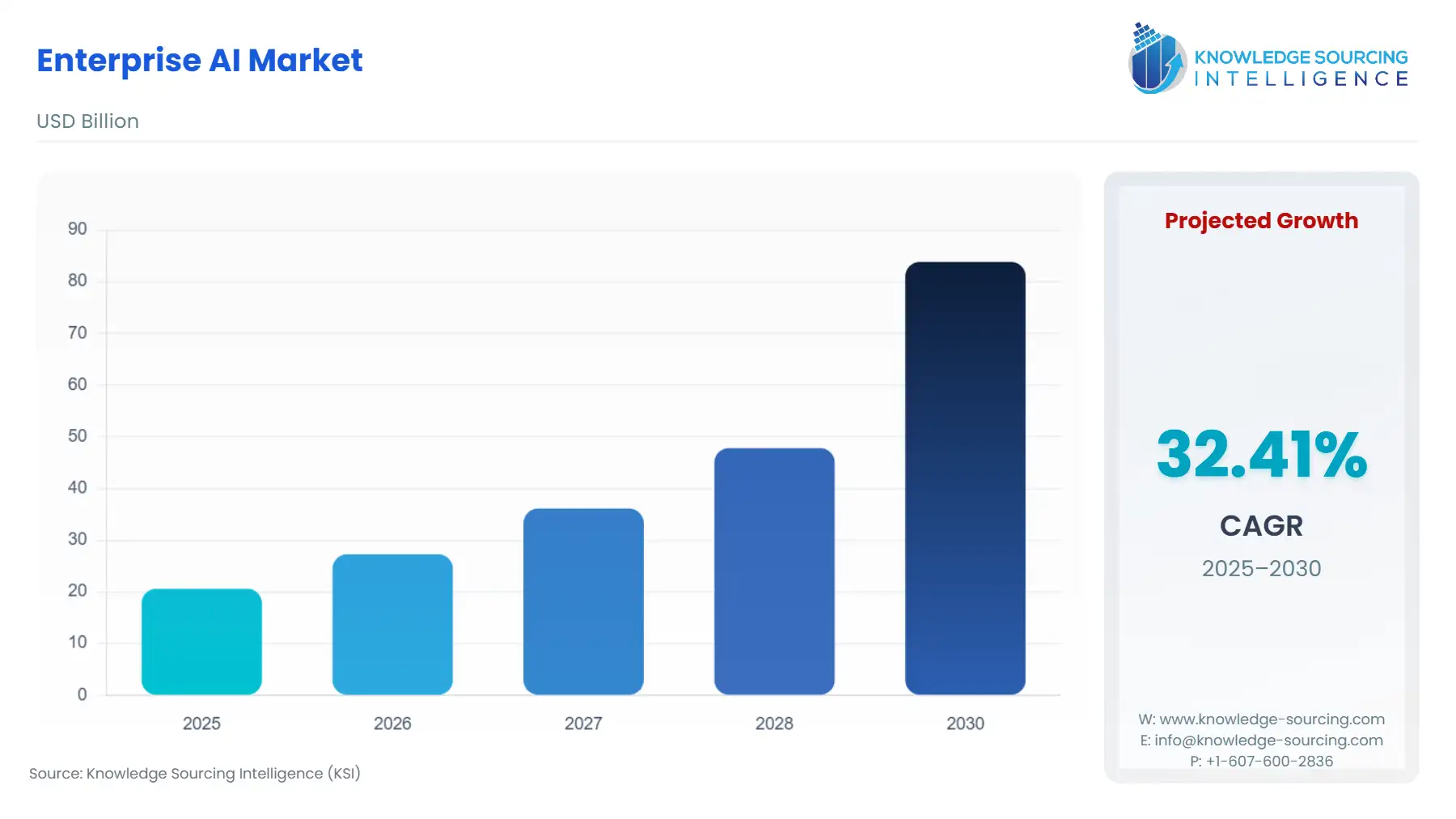

The Enterprise Artificial Intelligence (AI) Market is expected to grow at a CAGR of 32.41%, reaching a market size of US$83.850 billion in 2030 from US$20.600 billion in 2025.

The enterprises confront a computing paradigm reshaped by artificial intelligence, where systems evolve from passive tools to proactive engines of value creation. This shift manifests in boardrooms and server farms alike, as leaders grapple with integrating AI to sustain competitive edges amid accelerating digital convergence. The global enterprise AI market emerges as a nexus for this transformation, channeling investments into technologies that parse vast datasets, predict disruptions, and orchestrate responses with precision unattainable through legacy methods.

Historical precedents underscore the stakes: just as cloud computing redefined scalability and AI now compels organizations to reengineer core functions from predictive maintenance in manufacturing to fraud detection in finance. Yet, this evolution demands more than technical upgrades; it requires aligning AI deployments with strategic imperatives, ensuring outputs align with business rhythms rather than disrupt them

Enterprise Artificial Intelligence Market Analysis

Growth Drivers

Advancements in machine learning algorithms catalyze demand by enabling enterprises to process unstructured data at scale, directly addressing inefficiencies in decision cycles. IEEE's 2024 Technology Megatrends report details how ML models, integrated into core workflows, shorten time-to-insight from weeks to hours, compelling sectors like manufacturing to adopt these tools for predictive analytics. For instance, ML-driven anomaly detection in production lines reduces downtime by optimizing resource allocation, a necessity amplified by global supply disruptions. This creates a feedback loop as enterprises realize high performance gains per watt in ML workloads, per the report, investment in compatible infrastructure surges, targeting large entities with complex datasets.

Generative AI's maturation propels uptake by automating content and code generation, slashing development costs and accelerating innovation pipelines. Stanford's 2025 AI Index notes a tripling of funded generative AI startups in 2024, with private investment reaching up to USD 33.9 billion from previous year’s funding. Hence, this reflects enterprise hunger for models that synthesize reports or simulate scenarios without human intervention. In BFSI, this manifests as automated compliance documentation, where generative tools parse regulatory texts to produce tailored policies, mitigating fines. Demand escalates as firms seek to embed these capabilities on-premises, avoiding cloud latency in sensitive operations, thus favoring hybrid deployments that blend proprietary data with external models.

Surging private investments underscore a macroeconomic push that heightens enterprise procurement of AI platforms. The Stanford’s AI Index, states investment hitting USD 109.1 billion in the U.S. in 2024, and this capital influx, up 44.5% year-over-year, targets scalable solutions for IT operations, where AI optimizes resource provisioning to cut energy consumption thereby aligning with sustainability mandates. Enterprises in energy-intensive sectors like data centers requires high electricity and to optimize their usage next-generation concepts such as Artificial Intelligence (AI) forms an ideal choice for load balancing, thereby driving bulk acquisitions of edge-compatible hardware. According to the International Energy Agency’s “Energy and AI” report, by 2030 the global electricity demand from data centers will reach up to 954 TWh (Terawatt-Hours), and same source also stated that electricity demand from data center using AI will quadruple by the same duration.

The proliferation of multimodal AI systems further intensifies demand by unifying text, image, and voice processing, essential for customer-facing applications. IEEE's “Technology Prediction 2025” study highlights how these integrations boost operational efficiencies thereby driving their adoption in sectors such as retail. Enterprises, particularly SMEs scaling digitally, demand plug-and-play modules that retrofit existing CRMs. This convergence erodes barriers to entry, spurring a rise in AI-related mergers, where acquirers consolidate tech stacks to dominate application segments like business analytics. Regulatory tailwinds, including the EU AI Act's risk-based framework enacted in August 2024, mandate verifiable AI governance, propelling demand for auditable tools in high-stakes environments. The Act's emphasis on transparency for high-risk systems—covering biometrics and critical infrastructure—forces enterprises to invest in traceable ML pipelines

Digital transformation imperatives, accelerated by hybrid work models, amplify AI's role in enhancing collaboration and analytics. According to the Intapp research study “2025 Technology Perceptions Survey Report” which involved surveying 820 professionals from accounting, finance, legal and consulting stated that 72% of professionals are using AI which showed a significant surge from 48% recorded in 2024’s survey study. Likewise, enterprises in IT and telecom are demanding AI for anomaly detection in networks, and to reduce breach response times. This operational necessity underscores how transformation agendas convert AI from optional to obligatory, funneling budgets toward integrated suites. Moreover, sustainability pressures further galvanize demand, as AI optimizes energy profiles in data-heavy operations.

Challenges and Opportunities

Talent scarcity constrains AI deployment as the professional still lacks technical knowhow required to integrate Artificial Intelligence (AI) in enterprise operations. The constant effort undertaken by companies to adapt to the growing technological advancements has made it imperative for employees to upgrade their skills which has become a challenging task. According to the Pluralsight LLC’s research study “2025 AI Skills Report” stated, that from 1,200 IT professionals & executive interviewed nearly 70% stated that organizations finds AI-related skills mandatory during hiring, while 84% agree that companies will likely outsource jobs if the employees lacks basic AI skill-set. Such high requirement to match the growing technical trends and diverse perspectives in model training is restraining expansion. Moreover, getting reasonable return by investing on such technology has become another concern for companies, with some finding AI usage lazy.

Ethical risks, including misuse in deepfakes targeted by 50 U.S. state laws in 2024 heighten compliance burdens, suppressing demand for unvetted tools in security-sensitive sectors. Likewise, the concern regarding data confidentiality has further shown friction shown towards new technological adoption which translates to enterprise caution especially, in BFSI, where nonconsensual imagery bans force audits that inflate costs. These constraints redirect investments toward responsible AI frameworks, but slow adoption in SMEs lacking resources.

Opportunities arise in agentic architectures, where modern technological approaches have provided innovative ways of streamlining complex operations thereby enabling high return on investment (ROI) through autonomous task orchestration. Enterprises such as ones operating in IT & telecommunication can leverage this for IT operations, automating most of incident responses and unlocking demand in telecom where high adoption rates signal untapped efficiencies. Furthermore, sustainability integration offers a counterweight, as AI optimizes energy reductions in operations. This aligns with global mandates, spurring demand for green AI in manufacturing, where models forecast waste to comply with EU directives, potentially lifting market share for compliant providers. Multimodal advancements is further boosting adoption rate in SMEs via personalized interfaces. This evolution transforms challenges into demand amplifiers, as firms prioritize versatile platforms.

Supply Chain Analysis

The global enterprise AI supply chain hinges on semiconductor production hubs in China, Taiwan and South Korea, where most of advanced GPUs originate. Hence, logistical complexities arise from geopolitical tensions, with U.S. export controls on high-performance chips delaying deliveries to non-allied regions. Furthermore, dependencies on rare earth minerals from China expose vulnerabilities, as majority of processing occurs there, inflating costs amid 2024 trade frictions. Additionally,

Recent U.S. reciprocal tariffs on Chinese tech disrupt AI hardware flows, compelling enterprises to diversify sourcing toward other nations. This shift increases lead times but stabilizes supply for cloud deployments, as OCI and AWS expand regional fabs. Key hubs like Silicon Valley coordinate assembly, yet hybrid models blending U.S. design with Asian fabrication mitigate risks, ensuring two times density in AI racks without tariff premiums.

Government Regulations & Programs

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | EU AI Act (Regulation (EU) 2024/1689), European AI Office | Imposes risk-based obligations on high-risk systems, boosting demand for transparent Machine Learning tools in BFSI while constraining unverified generative deployments; fosters innovation via sandboxes, projecting high uptake rise in compliant platforms. |

United States | NIST AI Risk Management Framework | Fragmented deepfake prohibitions elevate needs for auditable Natural Language Processing (NLP) in media, driving greater focus on election safeguards; accelerates enterprise investments in federated learning to navigate federal-state variances, enhancing security analytics demand. |

China | National AI Governance Guidelines, Cyberspace Administration of China | Mandates data localization for generative models, spurring on-premise AI adoption in manufacturing; narrows U.S. model lead thereby intensifying competition and demand for localized agentic systems. |

Enterprise Artificial Intelligence (AI) Market Segment Analysis

By Technology: Machine Learning (ML)

By technology, Machine learning (ML) account for a considerable share of enterprise AI technology segments, commanding demand through its prowess in pattern recognition and predictive modeling, essential for operational foresight. According to the Pluralsight LLC’s 2025 research study, 36% of organizations and individuals are using machine learning to bolster their operations. Large enterprise are implementing plans to adopt such technology as it automates anomaly detection, slashing IT response times. This driver stems from ML's adaptability to proprietary datasets, enabling custom algorithms that forecast demand fluctuations in manufacturing.

In other sectors such as BFSI, machine learning fuels fraud prevention by analyzing transaction velocities, reducing false positives via ensemble methods, per academic benchmarks. Enterprises prioritize scalable ML frameworks like those on Vertex AI to integrate with CRMs for real-time scoring. Sustainability imperatives further propel uptake, as ML optimizes energy grids, achieving high watt efficiency in data centers, compelling utilities to embed models for peak shaving.

By End-User: BFSI

Based on end-user, the BFSI sector constituted for significant share fueled by the growing AI demand via stringent compliance and risk imperatives, where such technology fortifies defenses against escalating cyber threats. Regulatory pressures, including February 2024's “Executive Order 14117” on data integrity, mandate AI for audit trails, spurring investments in traceable generative tools for policy simulation. Large banks deploy NLP to parse contracts, reducing review cycles, while SMEs adopt cloud agents for credit scoring, democratizing access amid M&A surges. Sustainability angles emerge as AI optimizes portfolio risks against climate variables, aligning with EU Green Deal mandates and lifting demand for integrated platforms

Enterprise Artificial Intelligence (AI) Market Geographical Analysis

The enterprise artificial intelligence market analyzes growth factor across following regions

North America: Technological advancement has shown a considerable growth in major regional economies namely the United States which is also base for major market players namely Google LLC, IBM, Intel Corporation and Microsoft all of which provides cutting-edge AI-tools enterprise applications. Hence, establishment of strategies such as “AI Action Plan” to bolster AI innovation and industrial adoption has provided a framework in countries like the United States.

Europe: The growing transition word towards automation has transformed the technological landscape of European companies. Hence, major nations are investing to adopt the “Industry 4.0” concepts which further expand the scope of AI usage in enterprises. According to the SAP’s “Value of AI” research study conducted between July to August 2025, it was stated that AI supports nearly 25% task of German firms and this percent share is expected to reach 41% in next two years.

Asia Pacific: APAC based companies are investing to transform their infrastructure with emphasis put on adopting modern technological concepts which has provided new growth prospects for AI adoption. Countries like China is aiming to become AI leader and has set goals to expand it AI industry by 2030.

South America & MEA: Technological landscape in South America based firms is witnessing a constant progression with major regional economies such as Brazil holding high growth prospect for adoption of next-generation digital tools. Favorable regulatory framework followed by strategic investment to bolster digital infrastructure is expected to drive AI adoption in MEA based companies.

Enterprise Artificial Intelligence (AI) Market Competitive Environment and Analysis

The enterprise AI landscape features fierce rivalry among hardware enablers and software integrators, with market share tilting toward those offering end-to-end stacks.

Amazon Web Services, Inc. excels in scalable inference and the company has emphasized on expanding its cutting-edge AI solutions that matches the current enterprise requirements. For instance, the company released Amazon Q in April 2024 as a generative assistant tailored for business queries by building data integration pipelines through natural language.

Microsoft Corporation aims to promote transparency and data integrity through its AI-tools which has enabled the company exercise innovation. For instance, its “M365 Copilot” offers advances agentic workflows enabling autonomous task handling.

Enterprise Artificial Intelligence (AI) Market Developments

November 19th 2025: Workday Inc. announced the launch of its “Workday EU Sovereign Cloud” which enables companies across European Union to use company’s AI-powered finance and HR solution without comprising the integrity of data.

October 2025: EPAM System, Inc. launched “AI/Run.Transform” that AI-based consulting services which assist companies in transforming their operational and technical expertise. The digital platform aims to enhance enterprise wide AI-native transformation.

Enterprise AI Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 20.600 billion |

| Total Market Size in 2030 | USD 83.850 billion |

| Forecast Unit | Billion |

| Growth Rate | 32.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Deployment, Technology, Enterprise Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Enterprise AI Market Segmentation:

By Deployment

Cloud

On-Premise

By Technology

Machine Learning (ML)

Natural Language Processing (NLP)

Generative AI

Speech Recognition

Others

By Enterprise Size

Small & Medium Enterprise (SMEs)

Large Enterprise

By Application

Marketing & Sales

Customer Relationship Management

IT Operations

Business Analytics

Security & Risk Assessment

Others

By End-User

Automotive

BFSI

IT & Telecommunication

Manufacturing

Retail

Healthcare

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Australia

Singapore

Indonesia

Others