Report Overview

Enterprise Data Loss Prevention Highlights

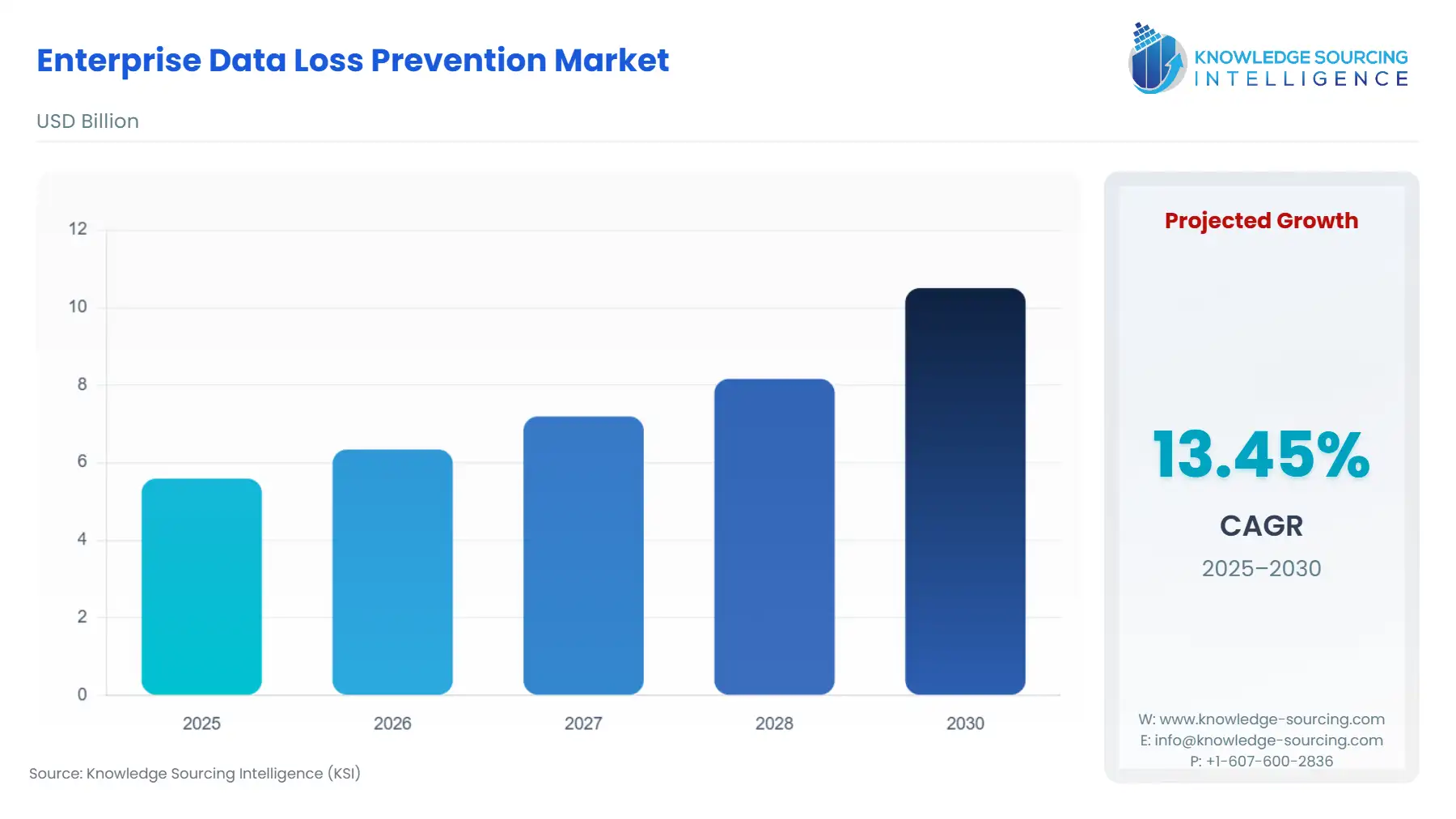

Enterprise Data Loss Prevention Market Size:

The enterprise data loss prevention market is expected to grow from USD 5.589 billion in 2025 to USD 10.504 billion in 2030, at a CAGR of 13.45%.

The Enterprise Data Loss Prevention (DLP) market is undergoing a significant strategic pivot, transitioning from a perimeter defense tool to an integrated, data-centric security framework. Historically viewed as a compliance checkbox, DLP has evolved into a critical business continuity and risk mitigation imperative due to the exponential growth of enterprise data and its distribution across hybrid environments. This evolution is driven not merely by the volume of cyberattacks but by the pervasive and costly regulatory environment surrounding Personally Identifiable Information (PII) and Protected Health Information (PHI). Modern DLP systems, particularly those delivered via a Security Service Edge (SSE) architecture, are now expected to offer uniform policy enforcement, advanced content-aware detection, and rapid incident response capabilities across the entire data lifecycle—in motion, at rest, and in use—to effectively safeguard corporate assets against both external exfiltration and internal misuse.

Enterprise Data Loss Prevention Market Analysis

Growth Drivers

Evolving global data privacy regulations, such as GDPR and CCPA, directly propel DLP demand by creating a high-stakes compliance requirement where failure incurs massive financial penalties. Enterprises must deploy DLP to classify, monitor, and prevent unauthorized data exfiltration to meet these verifiable legal obligations. Furthermore, the pervasive adoption of cloud computing and hybrid work models necessitates security that follows data outside the traditional network perimeter. This transition drives specific demand for Cloud DLP solutions that secure data across SaaS applications, IaaS platforms, and distributed endpoints, enabling productivity while mitigating the increased risk of accidental exposure. Finally, the consistently high average cost of data breaches forces organizations to invest proactively in DLP as a necessary financial risk reduction strategy.

Challenges and Opportunities

A primary challenge is the complexity and resource-intensity of DLP deployment, which often leads to an overwhelming number of false positive alerts. This requires significant IT personnel to tune policies, increasing operational costs and creating friction that limits effective adoption, especially among small and medium-sized organizations (SMEs). The key opportunity lies in leveraging Artificial Intelligence and Machine Learning (AI/ML) to develop DLP solutions that utilize advanced behavioral analytics. By integrating AI/ML for accurate content classification and contextualizing user actions, vendors can dramatically reduce false positives and automate policy fine-tuning, thus lowering the operational burden and driving increased demand from resource-constrained SMEs.

Supply Chain Analysis

The Enterprise DLP market is an intangible software and service market, meaning its supply chain is defined by development, talent, and distribution, not physical materials. The primary supply chain components involve intellectual property (IP) creation, software development resources concentrated in high-technology hubs (e.g., Silicon Valley, Tel Aviv, and Bangalore), and professional services delivery. Key logistical complexities include maintaining continuous policy updates and content definitions to keep pace with evolving regulations and new data formats. Dependence rests heavily on the availability of highly skilled cybersecurity engineers and the ability to distribute software updates rapidly and seamlessly via cloud infrastructure, making access to top-tier technical talent the primary constraint.

Enterprise Data Loss Prevention Market Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | General Data Protection Regulation (GDPR) | GDPR mandates strict protocols for handling EU citizens' PII, driving non-negotiary demand for DLP solutions that provide advanced data discovery, classification, and cross-border data transfer control, ensuring compliance with its "privacy by design" principles. |

United States | Health Insurance Portability and Accountability Act (HIPAA) | HIPAA strictly governs the protection of Protected Health Information (PHI). The high civil and criminal penalties for non-compliance compel healthcare organizations to adopt DLP focused on securing PHI across endpoints and email, directly increasing demand in the Healthcare vertical. |

Global | Payment Card Industry Data Security Standard (PCI DSS) | While a trade standard, PCI DSS effectively mandates controls for handling credit card data, compelling financial institutions and any entity processing card data to implement DLP to monitor, identify, and protect Cardholder Data (CHD) in motion and at rest. |

Enterprise Data Loss Prevention Market Segment Analysis

By Solution: Cloud DLP

The Cloud DLP segment is experiencing the highest growth trajectory, directly proportional to the enterprise migration towards multi-cloud and SaaS environments. This expansion is a defensive response to the lack of visibility and control inherent in data shared across applications like Microsoft 365, Google Workspace, and Salesforce. The specific growth driver is the need for a unified policy engine that can extend an organization's security posture to data residing entirely outside the corporate network perimeter. Enterprises require Cloud DLP to identify, classify, and apply preventive actions (like encryption or blocking sharing) to sensitive data within sanctioned and unsanctioned cloud applications. This capability is paramount for maintaining regulatory compliance and mitigating accidental exposure caused by misconfigured cloud security settings or careless employee sharing, issues that traditional Network DLP cannot address.

By Industry Vertical: Banking, Financial Services, and Insurance (BFSI)

The BFSI sector demonstrates consistently high, inelastic demand for DLP solutions, driven by the critical confluence of immense regulatory pressure and the intrinsic value of its data assets (account numbers, client PII, proprietary trading algorithms). This necessity is non-negotiable because compliance with regulations such as PCI DSS, GLBA, and various national banking mandates is a prerequisite for operation, not merely a best practice. This sector requires multi-layered DLP, integrating Network, Endpoint, and Cloud capabilities, focusing on the highest accuracy for structured and unstructured data matching (e.g., Exact Data Matching). The core growth driver is the need to prove, through auditable logs and automated enforcement, that highly sensitive data is never inadvertently or maliciously exfiltrated, protecting the institution from severe regulatory fines and reputational damage that could trigger mass customer attrition.

Enterprise Data Loss Prevention Market Geographical Analysis

US Market Analysis

The US market is the largest consumer of DLP solutions globally, characterized by complex, driven by state-specific privacy laws (e.g., CCPA/CPRA in California) and sector-specific federal regulations (HIPAA for Healthcare, GLBA for Finance). This regulatory patchwork forces enterprises to adopt comprehensive DLP platforms capable of granular, location-aware policy enforcement. Local factors also include the strong early adoption of cloud services and a well-established security budget culture, where the high visibility and frequency of large-scale data breaches make security investment a core fiduciary responsibility, directly increasing demand for advanced detection and response capabilities.

Brazil Market Analysis

The Brazilian market's is principally driven by the introduction and rigorous enforcement of the Lei Geral de Proteção de Dados (LGPD), which mirrors the core principles of the EU’s GDPR. This governmental mandate created a sudden, non-discretionary surge in DLP demand, as organizations urgently required tools to achieve compliance with PII handling rules and breach notification requirements. The market also sees demand from the financial sector, which is highly digitized, but adoption across SMEs is constrained by cost sensitivity and the complexity of initial deployment.

United Kingdom Market Analysis

DLP demand in the UK remains robust, primarily anchored by the continuity of the UK GDPR and the high penetration of cloud and hybrid IT environments. Financial services and the public sector are major buyers, compelled by rigorous data governance standards set by the Financial Conduct Authority (FCA) and the ICO. The market displays a strong preference for integrated DLP solutions that align with a broader security strategy, such as Security Service Edge (SSE) platforms, reflecting a sophisticated buyer base focused on unified visibility and operational efficiency.

Saudi Arabia Market Analysis

The Saudi Arabian DLP market is accelerating, largely catalyzed by the implementation of the Personal Data Protection Law (PDPL). This law, enforced in 2023, establishes new requirements for data localization and cross-border transfer, directly driving demand for Storage/Data Center DLP and policy-driven Network DLP solutions. The market is dominated by large government entities and energy companies that possess vast amounts of critical intellectual property, prioritizing highly secure on-premise and private cloud DLP deployments.

Japan Market Analysis

The Japanese market is characterized by the nation’s stringent approach to PII protection under the Act on Protection of Personal Information (APPI). The primary growth drivers include the large presence of multinational manufacturing and technology firms needing to protect valuable Intellectual Property (IP), making the protection of design documents and source code a key focus. The local market exhibits a preference for high-accuracy, low-false-positive DLP solutions that integrate seamlessly into complex, highly structured enterprise IT environments with minimal disruption to end-user productivity.

Enterprise Data Loss Prevention Market Competitive Environment and Analysis

The Enterprise DLP market competition is dominated by established cybersecurity vendors who integrate DLP capabilities into broader security suites, often leveraging their existing customer base and platform capabilities. The competitive edge shifts toward solutions that can unify policy enforcement across cloud, endpoint, and network layers, demonstrating superior data classification accuracy and leveraging AI/ML to minimize false positives. This favors large players with deep R&D budgets and expansive portfolio integration capabilities.

Broadcom (CA Technologies/Symantec)

Broadcom, through its acquisition of Symantec's Enterprise Security business, maintains a strong presence, particularly in the legacy large enterprise and government sectors. Its strategic positioning revolves around Symantec Data Loss Prevention (DLP), a mature, highly accurate, and scalable solution trusted for complex on-premise deployments. The product offers extensive coverage, including Network, Endpoint, and Storage DLP, augmented by advanced content-aware detection technologies like Exact Data Matching (EDM) and Described Content Matching (DCM). Broadcom's strategy is to integrate DLP within its broader security portfolio, including Secure Web Gateway and CASB, to provide a unified data protection policy across hybrid and multi-cloud environments.

Trend Micro Incorporated

Trend Micro focuses on providing a comprehensive, platform-based approach to data security, integrating DLP capabilities across its Trend Vision One platform. Its strategic positioning targets a balance of advanced threat protection and data security, particularly appealing to organizations facing complex, multi-layered cyber threats. The company provides Network, Endpoint, and Cloud DLP, emphasizing the security of sensitive data in motion and at rest. Trend Micro leverages its deep expertise in threat intelligence to refine its DLP policies, ensuring content classification and policy enforcement are adaptive to evolving attack vectors like multi-channel exfiltration and threats targeting AI datasets.

Enterprise Data Loss Prevention Market Developments

November 2025: Zscaler announced the acquisition of SPLX, an innovative AI security pioneer. This move is designed to secure the enterprise AI lifecycle by integrating AI security capabilities into the Zscaler Zero Trust platform, enhancing data security.

September 2024: Absolute Security completed the acquisition of Syxsense, a company focused on IT and security vulnerability management. This merger expands Absolute's capacity for resilient, proactive enterprise security, integrating data visibility with endpoint security actions.

Enterprise Data Loss Prevention Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.6 billion |

| Total Market Size in 2031 | USD 11.6 billion |

| Forecast Unit | Billion |

| Growth Rate | 12.0% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Solutions, Deployment Model, Organization Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Enterprise Data Loss Prevention Market Segmentation:

By Solutions

Network DLP

Storage/Data Center DLP

Endpoint DLP

Cloud DLP

Services

Consulting

System Integration and Installation

Managed Security Services

Training and Education

Risk and Threat Assessment

Others

By Deployment Model

On Premise

Cloud

Hybrid

By Organization Size

Small

Medium

Large

By Industry Vertical

Aerospace and Defense

Banking, Financial Services, and Insurance (BFSI)

IT and Telecommunications

Government

Healthcare

Manufacturing

Retail and Logistics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others