Report Overview

Europe Smart Glass Market Highlights

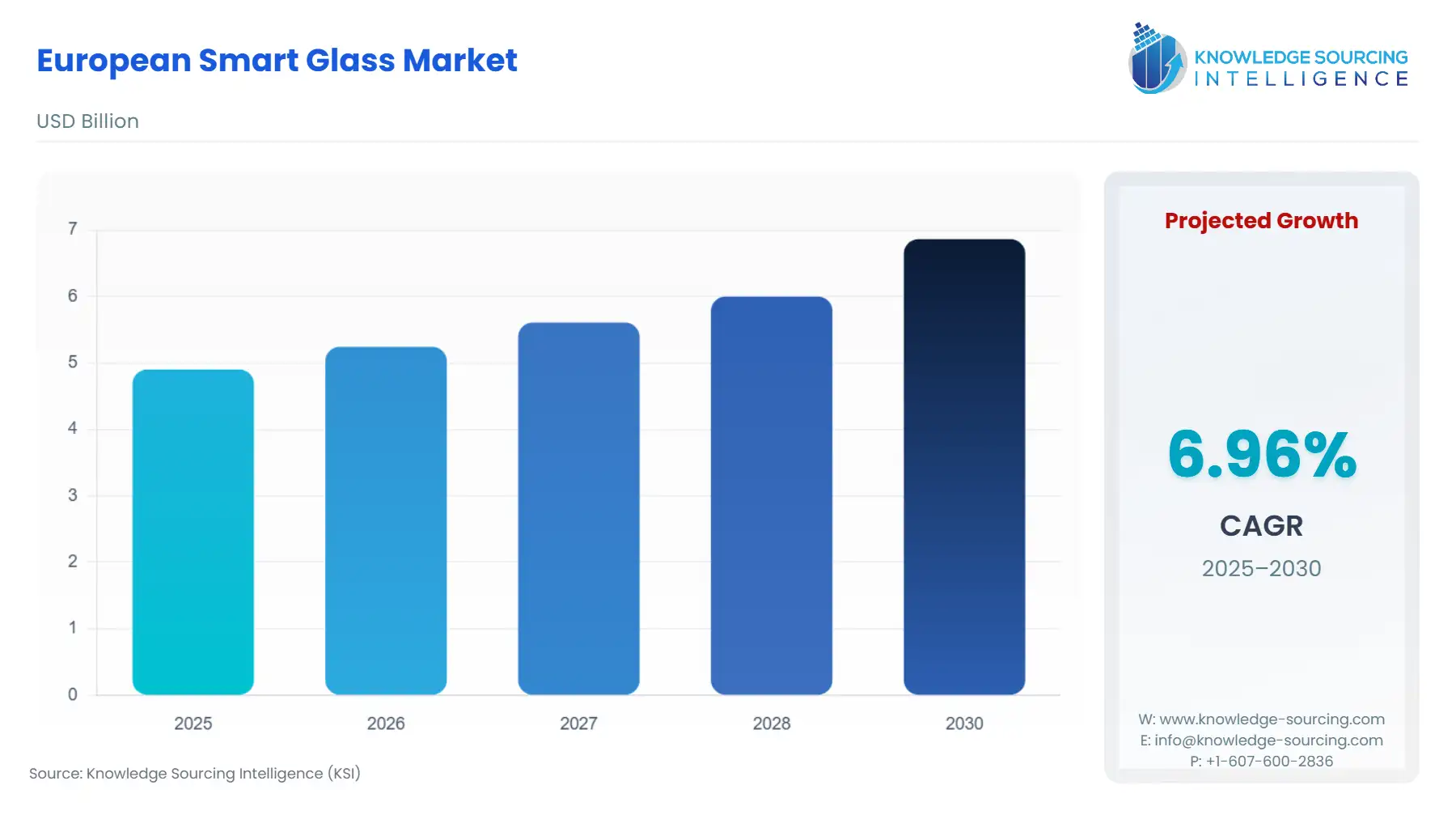

Europe Smart Glass Market Size:

The European Smart Glass Market is expected to grow from US$4.903 billion in 2025 to US$6.864 billion in 2030, at a CAGR of 6.96%.

Europe Smart Glass Market Key Highlights

The European Smart Glass market is experiencing a structural realignment, catalyzed by ambitious continental energy mandates and accelerated technological integration across the continent's pivotal construction and mobility sectors. Smart glass, defined by its dynamic light, heat, and privacy control capabilities via electricity, heat, or light stimuli, is transitioning from a niche, high-end product to an essential component of the sustainable built environment. The core function of this technology is energy optimization, a critical imperative for the European Union, where buildings account for a substantial percentage of total energy consumption. This environmental and regulatory pressure forms the bedrock of demand, pushing architects and developers toward sophisticated glazing solutions that demonstrably reduce operational costs and align with stringent green building certifications.

Europe Smart Glass Market Analysis

- Growth Drivers

Strict governmental energy efficiency directives are the single most significant catalyst for smart glass demand. The Energy Performance of Buildings Directive (EPBD) has been instrumental, necessitating compliance with nearly zero-energy standards for new and renovated structures. This regulation creates a direct, non-negotiable demand for high-performance building envelope components, which smart glass meets by dynamically regulating solar heat gain and minimizing reliance on mechanical HVAC systems. Furthermore, the rising adoption of connected, smart home, and smart office ecosystems across Europe explicitly generates demand for switchable, digitally-integrated privacy and light control features. This extends beyond energy savings to improving occupant wellness and architectural flexibility.

- Challenges and Opportunities

The predominant challenge is the elevated initial capital expenditure associated with installing smart glass compared to conventional high-performance insulating glass units (IGUs). This cost differential constrains adoption in budget-sensitive new-build and large-scale renovation projects, particularly in decentralized or residential markets. However, this constraint simultaneously generates a significant opportunity: the burgeoning demand for high-speed switching technologies like SPD and Liquid Crystal Glass in the automotive sector. As European automotive original equipment manufacturers (OEMs) embed these features for luxury and energy management in electric vehicles (EVs), the resulting high-volume manufacturing could drive down per-unit production costs, thereby making the technology more economically viable for the mass architectural market.

- Raw Material and Pricing Analysis

Smart glass is a physical product, essentially a complex IGU featuring active or passive films/layers. Key raw materials for smart glass construction include soda-lime float glass, various metal oxide precursors (e.g., tungsten oxide, nickel oxide for electrochromics), polymer-dispersed liquid crystal (PDLC) films, and interlayers such as polyvinyl butyral (PVB). Pricing stability in the European market is fundamentally affected by the energy-intensive nature of float glass production, making natural gas prices a critical factor. Furthermore, global supply chain dependencies for specialized metal oxides and electronic components, which are often non-European sourced, introduce cost volatility and require significant strategic inventory management by major European fabricators.

- Supply Chain Analysis

The European smart glass supply chain maintains two distinct, critical stages: the large-scale production of base flat glass and the specialized, small-batch lamination/fabrication of the smart glass final product. Base glass production is centered in large, integrated facilities operated by companies like Saint-Gobain and AGC Glass Europe, often located near key raw material sources or high-demand urban clusters. The subsequent smart film/device lamination—where the glass becomes "smart"—is often a complex, low-yield process, relying on highly specialized equipment and technical expertise. Logistical complexity arises from transporting the delicate, large-format specialized glass units across borders for final installation in architectural or automotive applications, necessitating sophisticated, high-cost handling.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Energy Performance of Buildings Directive (EPBD) |

The directive mandates a shift toward Nearly Zero-Energy Buildings (NZEB) and fosters energy-efficient renovations. This regulatory pressure directly increases demand for smart glass as a verifiable solution for achieving necessary thermal and solar management targets, particularly for large-area glazing. |

|

European Union |

REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

Regulates the manufacture and use of chemical substances and their potential impacts on both human health and the environment. This affects the chemical components used in electrochromic and SPD films, forcing manufacturers to use compliant, verifiable, and safe compounds, which can influence material sourcing and production costs. |

|

European Union |

Construction Products Regulation (CPR) |

Sets standards for safety, health, and energy in construction products. Smart glass must adhere to rigorous performance and safety standards, including fire and mechanical resistance, which necessitates costly and time-consuming product certification, thus favoring incumbent manufacturers with established R&D capabilities. |

In-Depth Segment Analysis

- By Technology: Suspended Particle Device (SPD) Glass

The Suspended Particle Device (SPD) technology segment is seeing heightened demand, primarily driven by its rapid, almost instantaneous switching speed and superior control over light transmission. Unlike slower electrochromic alternatives, SPD glass offers real-time control, which is a critical feature in high-value automotive and transportation applications. European automotive manufacturers incorporate SPD glass into panoramic sunroofs and side windows to deliver immediate, personalized glare and privacy control to occupants. This direct enhancement of passenger experience and comfort—coupled with the technology's ability to block a high percentage of harmful UV radiation—is the primary growth factor. In architecture, SPD’s rapid response is leveraged for critical applications like operating room partitions and high-end corporate conference rooms requiring immediate, reliable privacy on demand, commanding a price premium over other technologies.

- By End-User: Architecture and Construction

The Architecture and Construction segment remains the largest volume consumer, fundamentally shaped by the European Union’s energy-saving agenda. The push for green building standards, such as those that qualify buildings for favorable financing or reduced taxes, mandates verifiable energy-saving technologies. Smart glass is leveraged as an integral component of the high-performance building envelope, specifically addressing solar heat gain through dynamic tinting. This active management capability is especially critical for large commercial office buildings and high-rise structures prevalent in urban centers like Frankfurt and London, where expansive glass façades are common. The economic rationale for adoption is compelling: reduced reliance on peak-hour air conditioning leads to significant, quantifiable energy cost savings over the building’s lifecycle, thus justifying the higher initial procurement cost. The ongoing renovation wave of older, inefficient commercial stock provides a substantial, long-term avenue for demand conversion.

Geographical Analysis

- United Kingdom Market Analysis

The UK market exhibits robust demand, disproportionately influenced by the commercial real estate sector in major metropolitan areas, particularly London. The city’s high-value, modern commercial tower construction and renovation projects are centered on premium aesthetics and stringent carbon-reduction targets. Local demand factors include a strong emphasis on maximizing natural light penetration—given the UK's high cloud cover—while simultaneously mitigating unwanted solar gain during clear periods. The integration of smart glass is a visible signifier of premium, high-tech property status, directly affecting leasing rates and property valuations, thus fueling its adoption by developers targeting the top tier of the commercial market.

- Germany Market Analysis

The German market is characterized by a dual demand structure: a strong, conservative architectural segment focused on long-term efficiency and a technically advanced, highly innovative automotive sector. Germany’s rigorous building standards and its leading position in green technology adoption drive architectural demand for electrochromic glass, valuing its passive, automated energy-saving performance. Concurrently, the powerhouse automotive industry, particularly in luxury and electric vehicle manufacturing, creates intense demand for technologies like SPD glass for roof and window applications, emphasizing light management, glare reduction, and seamless electronic integration with the vehicle's central control system.

- France Market Analysis

France, as the home base for major global glass manufacturers like Saint-Gobain, benefits from proximity to key production, R&D, and fabrication hubs. The government's large-scale national renovation plans, focused on improving the energy performance of residential and public buildings, underpin structural demand. This creates a market opportunity for retrofitting older buildings, where smart glass provides a sophisticated solution to improve thermal performance without necessitating a complete overhaul of the window frame structure. French consumer preferences also favor advanced aesthetics and seamless technological integration in new high-end residential developments.

- Spain Market Analysis

The Spanish market is profoundly shaped by the country's high solar irradiation levels. The imperative is not merely to save energy, but to prevent catastrophic internal heat loading in summer. This high solar burden creates a clear-cut case for smart glass, which can dramatically reduce air conditioning loads in commercial, hospitality, and residential sectors along the Mediterranean coast. The necessity is focused on solutions with high solar-blocking capabilities in their darkened state, making technologies capable of extreme tinting—like electrochromics—highly valued for their performance in sun-drenched environments.

Competitive Environment and Analysis

The European Smart Glass market is dominated by a few integrated global players with deep historical roots in European flat glass manufacturing. These incumbents command the market through vast production capacities, established distribution networks, and control over critical intellectual property. Competitive differentiation is increasingly centered on two vectors: the development of faster-switching technologies (e.g., SPD and Liquid Crystal) and the creation of lower-carbon, highly circular products to meet institutional procurement mandates.

- Saint-Gobain

Saint-Gobain is positioned as a market leader, leveraging its broad portfolio of high-performance glass products under brands like SageGlass (electrochromic) and Priva-lite (PDLC). Its strategic positioning focuses on delivering integrated, high-value building envelope solutions, not just glass products. The company’s significant investment in sustainability, including the deployment of electric-hybrid melting furnaces, underscores a strategy to capture market share based on superior environmental performance and compliance with green building standards. Their product range enables them to address both the highly regulated architectural market and specialized interior design applications.

- AGC Glass Europe

AGC Glass Europe, a major subsidiary of the AGC Group, maintains a robust strategic position by emphasizing advanced automotive and architectural applications, including the Halio brand of electrochromic glass. The company's core strategic focus involves enhancing the circularity of its production process. A key element of their positioning is the development of glass products for the future mobility sector, including glass antennas and high-performance, sensor-compatible glazing for ADAS, ensuring it remains embedded in the next generation of European vehicle platforms.

Recent Market Developments

- February 2025: The revolutionary Volta flat glass production line, a collaboration between AGC and Saint-Gobain, was inaugurated at AGC’s Barevka plant. This reconstructed line is a significant capacity addition, featuring a hybrid melting furnace that is 50% electrified and 50% gas-fired with oxygen. The new technology allows for a higher ratio of recycled materials compared to industry standards, resulting in a substantial reduction in direct carbon emissions associated with the base glass that forms the core of smart glass units. This capacity upgrade directly supports the production of lower-carbon glass for both companies' smart glass product lines.

- September 2024: AGC Glass Europe entered into a strategic partnership with ROSI to advance circularity in the glass industry. The partnership is explicitly focused on recycling and reusing high volumes of photovoltaic (PV) glass from end-of-life solar panels into the production of flat glass. This development is a direct capacity addition to the supply chain for recycled raw materials, supporting the company’s targets to increase cullet (recycled glass) ratio in flat glass production and reduce the overall carbon footprint of its final smart glass products.

Europe Smart Glass Market Segmentation

By Technology

- Thermochromic Glass

- Suspended Particle Device (SPD) Glass

- Electrochromic Glass

- Liquid Crystal Glass

- Photochromic Glass

- Others

By Applications

- Automotive

- Power Generation

- Consumer Electronics

- Transportation

- Architecture and Construction

- Others

By Country

- United Kingdom

- Germany

- France

- Spain

- Others