Report Overview

Extruded Polypropylene (XPP) Foam Highlights

Extruded Polypropylene (XPP) Foam Market Size:

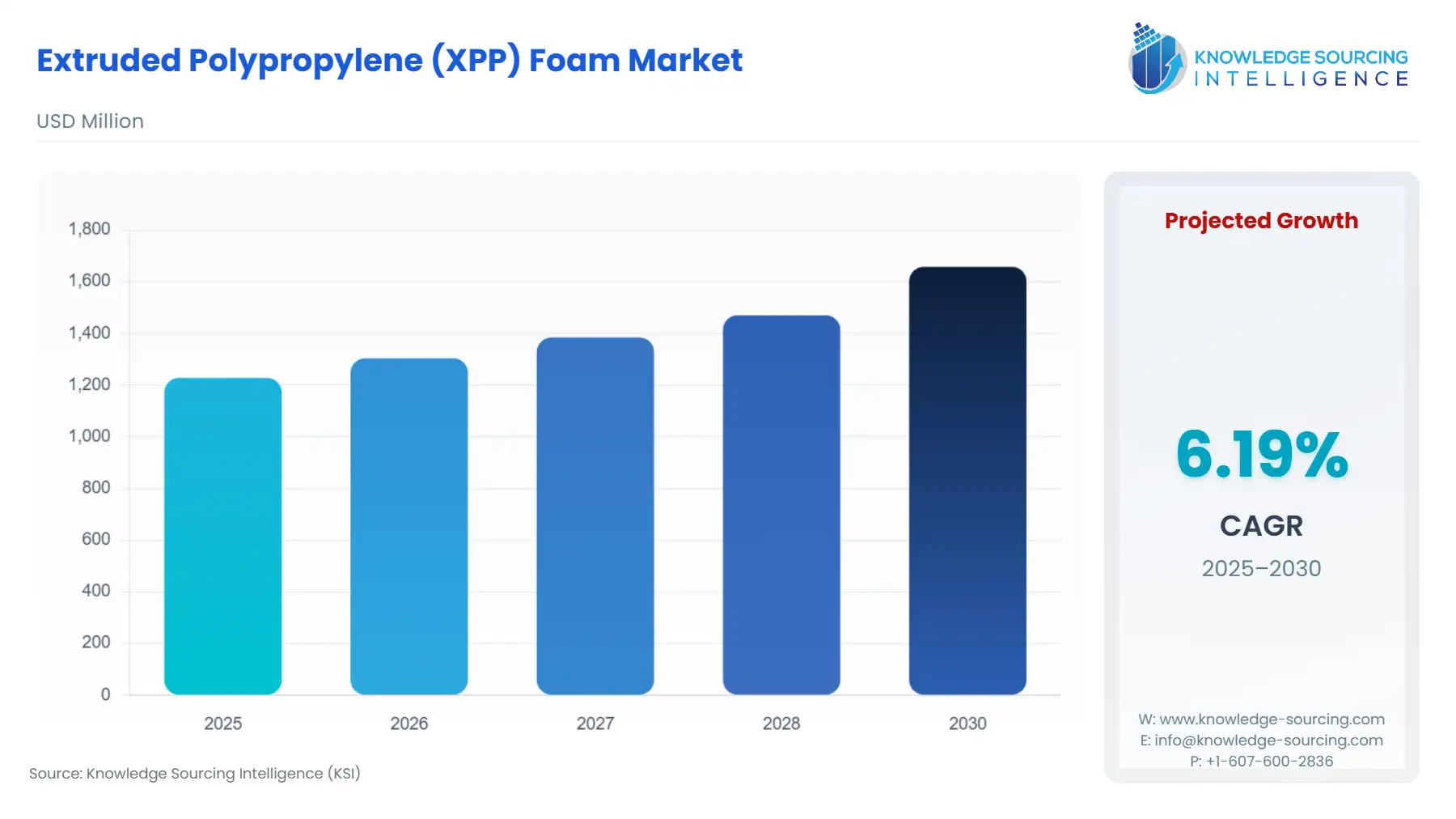

The Extruded Polypropylene (XPP) Foam Market, at a 6.20% CAGR, is projected to increase from USD 1.228 billion in 2025 to USD 1.658 billion in 2030.

Extruded polypropylene (XPP) foam is a type of foam material made from polypropylene resin, which is a thermoplastic polymer. The material is produced by extruding a molten polypropylene resin through a die, which forms a continuous sheet of foam. The foam is then cooled and cut into various shapes and sizes. XPP foam is characterized by its unique cellular structure, which is made up of small, closed cells that are uniform in size and shape. This structure gives the foam excellent cushioning, impact resistance, and thermal insulation properties.

Additionally, XPP foam is lightweight, durable, and resistant to moisture, chemicals, and UV radiation. Due to its properties, XPP foam is used in a variety of applications across various industries. For example, it is commonly used in the automotive industry for car interiors, headliners, and dashboards. It is also used in packaging applications, such as protective packaging for electronics and fragile items, as well as in insulation applications for buildings and appliances. Another advantage of XPP foam is that it is recyclable and can be reused multiple times. This makes it a sustainable and eco-friendly alternative to other foam materials. Additionally, XPP foam is non-toxic and does not emit harmful gases, making it a safe option for both consumers and workers. Researchers have been working on developing new formulations of XPP foam that offer improved properties such as increased stiffness and improved fire resistance. This has helped expand the range of applications for XPP foam.

Extruded Polypropylene (XPP) Foam Market Growth Drivers:

- Increasing demand for lightweight materials

The increasing demand for lightweight materials is mainly driving the growth of the extruded polypropylene (XPP) foam market. This is because XPP foam is a lightweight material that offers excellent cushioning and impact resistance, making it a popular choice for a wide range of applications across various industries. The demand for lightweight materials is being driven by several factors. First, lightweight materials can help reduce fuel consumption and improve energy efficiency in various industries, including automotive, aerospace, and transportation. This is particularly important as the global population continues to grow, leading to increased demand for transportation and energy resources. Second, lightweight materials can also help reduce shipping costs and improve logistics, which is important for companies looking to optimize their supply chain and reduce costs.

- Growing demand for sustainable and eco-friendly materials:

The growing demand for sustainable and eco-friendly materials is another key driver of the growth of the Extruded Polypropylene (XPP) Foam market. There is growing awareness of the impact that human activities have on the environment, and a need to reduce carbon emissions and waste. This has led many companies to look for more sustainable and eco-friendly alternatives to traditional materials. Also, there is increasing demand from consumers for environmentally friendly products, and this has put pressure on companies to use sustainable and eco-friendly materials in their products. For example, XPP foam is widely used in packaging applications for electronics and fragile items, where it provides excellent protection and is also sustainable and eco-friendly. It is also used in insulation applications for buildings and appliances, where it provides excellent thermal insulation and is a sustainable and eco-friendly alternative to traditional insulation materials.

Extruded Polypropylene (XPP) Foam Market Restraints

A key challenge is the price fluctuation of the primary raw material, polypropylene resin, which introduces significant cost uncertainty and can erode manufacturer margins. This volatility makes long-term pricing and contracting complex, constraining market stability. However, an expansive opportunity lies in the burgeoning electric vehicle (EV) market. XPP foam is critical for EV battery thermal insulation, providing a lightweight, fire-retardant barrier that manages the high heat generated by battery packs. This specific application, driven by the non-negotiable requirement for battery fire safety and thermal management, creates a new, high-value demand segment immune to substitution by traditional materials, accelerating growth and premiumization.

- Raw Material and Pricing Analysis

The XPP foam market is structurally dependent on the petrochemical sector, with polypropylene (PP) resin serving as the core feedstock. Pricing dynamics for PP resin are inherently volatile, mirroring fluctuations in crude oil and natural gas prices, as well as the regional capacities of polymer cracking facilities. This volatility is a significant operational constraint for foam manufacturers, as PP resin constitutes a major percentage of the final product cost. Manufacturers utilize bulk purchasing and hedging strategies to mitigate this risk, but price swings are still passed through, impacting the cost of XPP foam sheets and molded parts. The cost of blowing agents, though smaller, also influences production costs, particularly as manufacturers transition to non-HFC, environmentally compliant alternatives.

- Supply Chain Analysis

The global supply chain is centered around Asia-Pacific production, primarily in manufacturing clusters in China, Japan, and South Korea, where large-scale polymer extrusion and foaming facilities are concentrated. Key logistical complexities arise from the bulk, low-density nature of the final product, which limits the volume of material that can be transported per container, significantly increasing freight costs relative to weight. This dependency necessitates local or regional production capacity near key automotive and packaging end-user hubs in North America and Europe to reduce transport overhead and improve lead times. The supply chain moves from petrochemical producers to specialty foam converters, who then mold or fabricate the final foam products for end-users.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

End-of-Life Vehicles (ELV) Directive / REACH Regulation |

The ELV Directive mandates minimum rates for vehicle reuse and recycling, increasing demand for XPP foam as it is a mono-material solution and highly recyclable, facilitating compliance for automakers. REACH regulates the use of hazardous substances in manufacturing. |

|

United States |

Corporate Average Fuel Economy (CAFE) Standards / FMVSS 301, 303 |

CAFE standards enforce higher fuel efficiency, directly driving demand for XPP foam to achieve essential vehicle lightweighting. FMVSS safety standards related to crash protection (e.g., fuel system integrity, rear impact) increase demand for XPP foam's energy-absorbing qualities in structural components. |

|

China |

Energy-Saving and New Energy Vehicle (NEV) Mandates / Green Building Standards |

NEV mandates accelerate the adoption of electric vehicles, creating specific high-performance demand for XPP foam in battery insulation and protection. Green Building Standards increase the required use of high-performance thermal insulation materials in construction. |

Extruded Polypropylene (XPP) Foam Market Segment Analysis:

- By End-User: Automotive

The automotive segment’s need for Extruded Polypropylene (XPP) foam is driven by a critical confluence of non-negotiable safety and efficiency standards. XPP foam’s defining characteristic—its ability to withstand multiple impacts and recover its shape—makes it essential for energy management in vehicle components such as bumper cores, side impact panels, and knee bolster elements. The specific growth driver is the mandatory compliance with stringent crash safety regulations like the US Federal Motor Vehicle Safety Standards (FMVSS) and the EU's General Safety Regulation. Furthermore, the global drive for emissions reduction, underscored by regulations like CAFE standards, directly compels the substitution of heavier traditional materials with XPP foam to reduce vehicle curb weight, thereby improving fuel economy for Internal Combustion Engine (ICE) vehicles and extending the range of Electric Vehicles (EVs). This operational imperative creates an inelastic demand for XPP foam solutions optimized for both mass reduction and superior impact performance.

- By End-User: Packaging

The packaging segment’s need for Extruded Polypropylene (XPP) foam is centered on the imperative to minimize product damage and reduce logistical costs in high-volume supply chains, especially e-commerce. The key growth driver is the material’s verifiable superior cushioning ability compared to alternatives like Expanded Polystyrene (EPS), particularly in handling multiple small shocks during complex transit paths. XPP foam's low compressive creep allows it to maintain its cushioning integrity over time, making it the preferred choice for multi-use packaging, returnable dunnage, and high-value, fragile goods, such as specialized electronics and medical equipment. The secondary, but increasingly critical, growth driver is the push for sustainable packaging. XPP foam, being a monomaterial and fully recyclable polymer, enables companies to meet their internal and regulatory targets for waste reduction and circularity, creating specific, sustained demand for reusable foam inserts and containers.

Extruded Polypropylene (XPP) Foam Market Geographical Analysis:

- US Market Analysis

The US market for XPP foam is strongly influenced by the dominant automotive and packaging sectors. The continual pressure from Corporate Average Fuel Economy (CAFE) standards on automakers, which translates directly into demand for lightweight XPP foam parts to increase vehicle efficiency, propels this growth. Furthermore, the robust manufacturing and logistics infrastructure requires high volumes of durable, reusable XPP dunnage for complex supply chains. Localized demand is also emerging from the increasing focus on energy efficiency in the construction sector, particularly in states with aggressive green building codes, driving the adoption of XPP foam for high-performance insulation.

- Brazil Market Analysis

Brazil’s XPP foam market experiences expansion primarily linked to its large and developing domestic automotive manufacturing industry. The growth driver is the growing middle class, which increases the production volume of passenger vehicles, requiring corresponding volumes of energy-absorbing foam for interiors and safety components. The packaging segment, while price-sensitive, is increasingly adopting XPP foam, especially in the food and beverage sectors, driven by the need for superior thermal insulation to manage the cold chain logistics required in a vast country with a warm climate.

- German Market Analysis

In Germany, the need for XPP foam is characterized by high-performance requirements driven by the world-leading domestic automotive manufacturing sector. The key factor is the premiumization of vehicle safety and acoustic performance, where XPP foam is valued for its superior sound-dampening and structural properties, not just simple energy absorption. Strict European Union (EU) directives, notably the End-of-Life Vehicles (ELV) directive, also propel demand by prioritizing recyclable, monomaterial solutions like XPP foam for easy vehicle disassembly and material recovery.

- UAE Market Analysis

The UAE market for XPP foam is dominated by the Building & Construction end-user segment. The necessity is acutely focused on the material’s thermal insulation capabilities. The critical local demand factor is the need to mitigate extreme desert heat, which necessitates highly effective insulation to reduce the massive energy load from air conditioning systems in residential, commercial, and industrial structures. XPP foam provides the high-quality, moisture-resistant barrier required for durable performance in this harsh, arid climate.

- China Market Analysis

China is the largest single-country market, driven by the scale of its massive manufacturing base across automotive, construction, and electronics packaging sectors. A significant local driver is the government's aggressive push for New Energy Vehicles (NEVs), which has created exponential demand for XPP foam for insulating and protecting lithium-ion battery packs. This requirement is further amplified by the country’s vast and growing e-commerce ecosystem, requiring extensive protective packaging for high-volume consumer goods distribution.

Extruded Polypropylene (XPP) Foam Market Competitive Environment and Analysis:

The Extruded Polypropylene (XPP) Foam market is defined by a moderate degree of concentration, with several globally integrated chemical and materials companies competing primarily on technical expertise, scale of production, and application development support. Competition centers on developing specialized foam grades that meet specific requirements for fire retardancy, low volatile organic compound (VOC) emissions (essential for automotive interiors), and high thermal stability, rather than basic commodity pricing. Market leaders leverage global manufacturing footprints to service multinational automotive and packaging clients.

- SEKISUI CHEMICAL CO., LTD

SEKISUI CHEMICAL CO., LTD, through its foam divisions like SEKISUI Voltek and Sekisui Alveo, is positioned as a high-performance polyolefin foam specialist. The company leverages its proprietary extrusion technology to offer highly customized foams, with a strategic focus on the Automotive and High-End Industrial sectors. SEKISUI’s key product, the Volara® line, is an example of a product portfolio optimized for arduous applications like acoustic insulation, headliners, and medical foam components where durability, low emissions, and reliable performance are paramount. This specialization allows them to command premium positioning over commodity foam producers.

- BASF SE

BASF SE operates as a major chemical conglomerate, providing XPP foam as part of a comprehensive performance materials portfolio, giving it a strong strategic advantage in integrated solution development. While its core focus is not solely on XPP foam, the company leverages its global scale, R&D resources, and backward integration into raw material production (polypropylene resin) to offer consistent, high-volume supply and technically advanced materials. BASF focuses on serving large-scale, international clients in the Automotive and Construction sectors who require verified, globally available foam grades that comply with strict regional regulations.

- JSP Corporation

JSP Corporation is a dedicated foam plastics manufacturer and a major force in the market, recognized as the original developer of ARPRO, a leading Expanded Polypropylene (EPP) product. The company’s strategic positioning in the XPP foam market is driven by its deep expertise in foaming technology and its strong global network focused on Automotive and Packaging. JSP constantly innovates to align its materials with circular economy principles, for instance, by promoting the reuse and recyclability of its foam products, which directly supports the sustainability goals of its multinational client base.

Extruded Polypropylene (XPP) Foam Market Developments:

- October 2025: BASF started a new production line in Dilovas?, Türkiye, significantly expanding capacity for dispersions for the construction industries. This expansion strengthens their regional network, focusing on low-VOC products to meet rising demand in the Middle East and Northwest Africa.

- March 2025: SEKISUI Voltek received the 2024 Business of the Year award, recognizing its investment in workforce development and community engagement. This highlights the operational stability and commitment to the manufacturing location in Coldwater, Michigan.

- February 2025: SEKISUI Voltek exhibited its high-performance polyolefin foam solutions at the MD&M West trade show. This strategic participation highlights their commitment to expanding product applications beyond traditional markets into specialized medical device components.

Extruded Polypropylene (XPP) Foam Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.228 billion |

| Total Market Size in 2031 | USD 1.658 billion |

| Growth Rate | 6.20% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Extruded Polypropylene (XPP) Foam Market Segmentation:

- EXTRUDED POLYPROPYLENE (XPP) FOAM MARKET BY TYPE

- Low intensity

- High intensity

- EXTRUDED POLYPROPYLENE (XPP) FOAM MARKET BY END-USER

- Packaging

- Automotive

- Building & Construction

- Others

- EXTRUDED POLYPROPYLENE (XPP) FOAM MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America