Report Overview

Filter Cartridge Market Report, Highlights

Filter Cartridge Market Size:

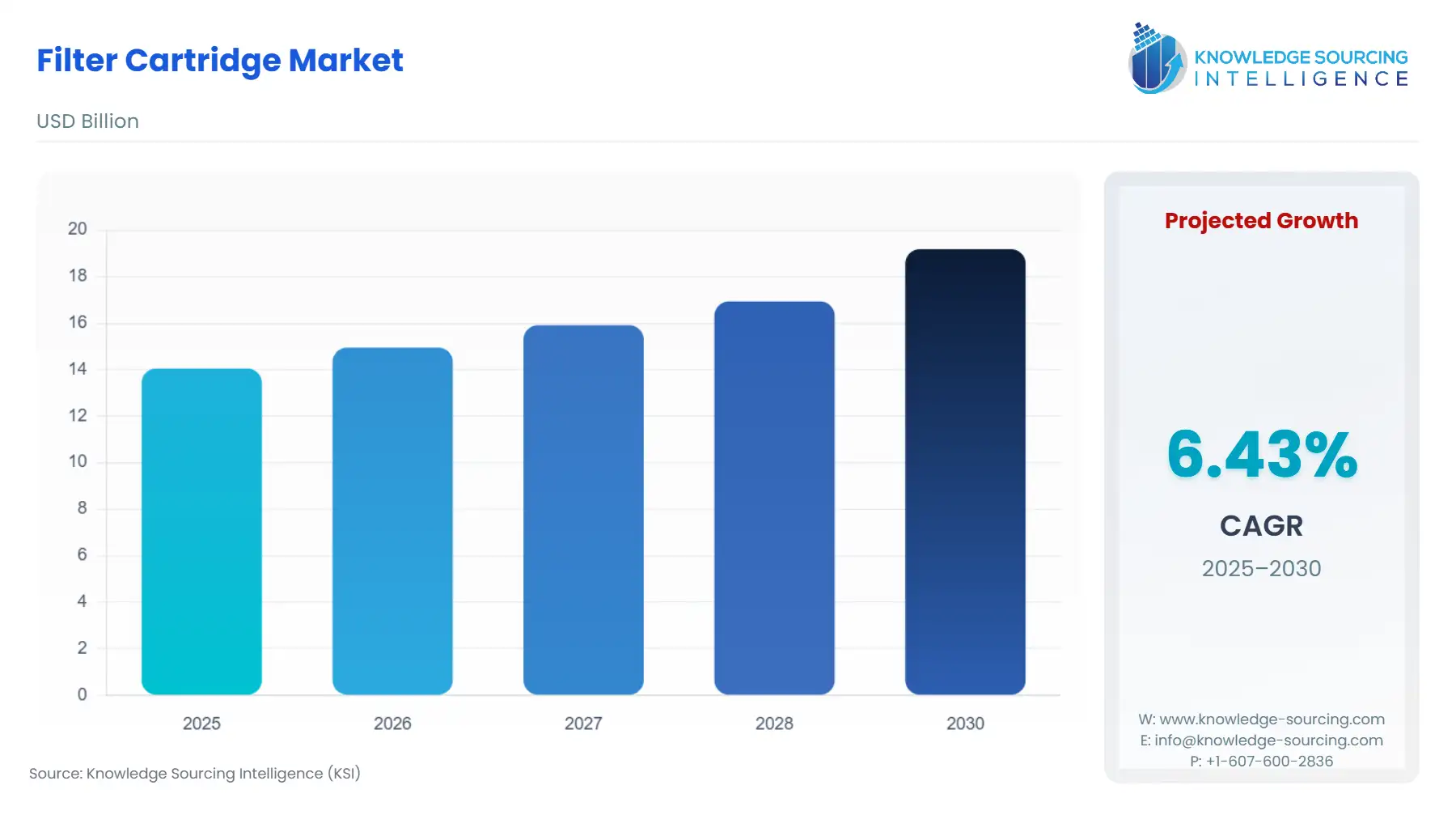

Filter Cartridge Market is projected to expand at a 6.43% CAGR, attaining USD 19.181 billion by 2030 from USD 14.049 billion in 2025.

Filter cartridges are used as porous devices for filtration across a broad spectrum of industries and applications. These devices typically take on a cylindrical shape and are comprised of a permeable material that enables fluid to flow through while effectively trapping and eliminating undesirable particles or impurities. Filter cartridges can be implemented in numerous sectors such as water filtration systems for drinking water, industrial procedures, and wastewater treatment plants. Furthermore, they are employed in HVAC air filtration and cleanroom settings for critical manufacturing operations. Additionally, filter cartridges play a crucial role in the pharmaceutical and biotech fields for filtering gases, liquids, and solids, ensuring that the product meets stringent purity standards. In the food and beverage industry, filter cartridges are frequently used to eliminate contaminants and improve the quality and clarity of the final product. Hence, the market for filter cartridges is expanding due to the growth of its major end users along with government initiatives to increase clean water accessibility.

Filter Cartridge Market Growth Drivers:

- The filter cartridge market is expected to experience a surge in growth due to the increasing investments being made in water treatment plants.

Filter cartridges are essential components of water treatment plants as they perform the vital function of removing impurities and contaminants from water. By using filter cartridges in the water treatment process, the water is purified to a high degree of quality, making it safe for consumption and other purposes, such as irrigation or industrial applications. Therefore, filter cartridges significantly contribute to ensuring that water is free from harmful substances and can be used in a wide range of beneficial ways. Increasing investments made in the development of such water treatment plants will drive the growth of the filter cartridge market. For instance, in August 2022, The Biden-Harris Administration disclosed its plan to invest $75 million in providing clean drinking water and safe wastewater infrastructure for rural areas of West Virginia. Additionally, the City of Lewisburg secured $52.7 million in loans and grants from the USDA to upgrade its water treatment facility. Similarly, in September 2022, the United States and Mexico agreed to invest $474 million in the expansion of wastewater plants, underscoring their commitment to enhancing wastewater management infrastructure. Furthermore, in a move to bolster water and wastewater infrastructure in Romania, the European Commission approved funding of over €65 million in September 2022. Canada and Ontario revealed their plans to invest approximately $190.2 million in 144 community water infrastructure projects in April 2022. Likewise, The European Investment Bank (EIB) allocated roughly €50 million to enhance water treatment plants in 36 municipalities throughout Italy in August 2022. Thus, the rising investments in water treatment plants are expected to drive substantial growth in the filter cartridge market.

Filter Cartridge Market Geographical Outlook:

- The North American region is expected to witness substantial growth in the filter cartridge market.

The North American region is a significant market for filter cartridges, with strong demand from various industries such as food and beverage, pharmaceuticals, and water treatment. For instance, The Food and Beverage industry generated a revenue of around US$ 1.264 trillion in 2021, accounting for a 5.4% share of the United States' total GDP, as per the U.S. Department of Agriculture. Similarly, the Government of Canada reports that in 2019, the food and beverage processing industry produced $117.8 billion in revenue, which constituted 17% of total manufacturing sales and 2% of the national Gross Domestic Product (GDP). Filter cartridges are also widely used in the pharmaceutical industry for the filtration of liquids and gases. They are an essential component in the manufacturing process of pharmaceutical products, including medicines, vaccines, and other medical products. Data from the European Federation of Pharmaceutical Industries and Associations shows that the pharmaceutical expenditure in the United States in 2019 amounted to US$ 64,375 million. Bayer, a multinational pharmaceutical company based in Germany, announced an investment of US$ 361 million towards the development and enhancement of the pharmaceutical industry in Mexico, in September 2022. In addition, the increasing investments in water treatment plants in this region are expected to further fuel the growth of the filter cartridge market. For instance, a water treatment plant project in Camagüey, Cuba, received a $40 million investment from The Saudi Fund for Developments (SFD) in December 2021. Thus, all these factors combine to drive the market growth of filter cartridges in the North American region.

Filter Cartridge Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 14.049 billion |

| Total Market Size in 2031 | USD 19.181 billion |

| Growth Rate | 6.43% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Filter Type, Cartridge Type, Process, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Filter Cartridge Market Segmentation:

- FILTER CARTRIDGE MARKET BY FILTER TYPE

- Surface Cartridge Filter

- Depth Cartridge Filter

- FILTER CARTRIDGE MARKET BY CARTRIDGE TYPE

- Stainless Steel Cartridge

- Activated Carbon Cartridge

- Melt Blown Cartridge

- Woud Cartridge

- Oil-Block Cartridge

- Others

- FILTER CARTRIDGE MARKET BY PROCESS

- Microfiltration

- Ultrafiltration

- Reverse Osmosis

- Others

- FILTER CARTRIDGE MARKET BY END-USER

- Food & Beverage

- Chemicals

- Pharmaceuticals

- Water Treatment

- Oil & Gas

- Others

- FILTER CARTRIDGE MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America