Report Overview

Global Automotive Radiators Market Highlights

Automotive Radiators Market Size:

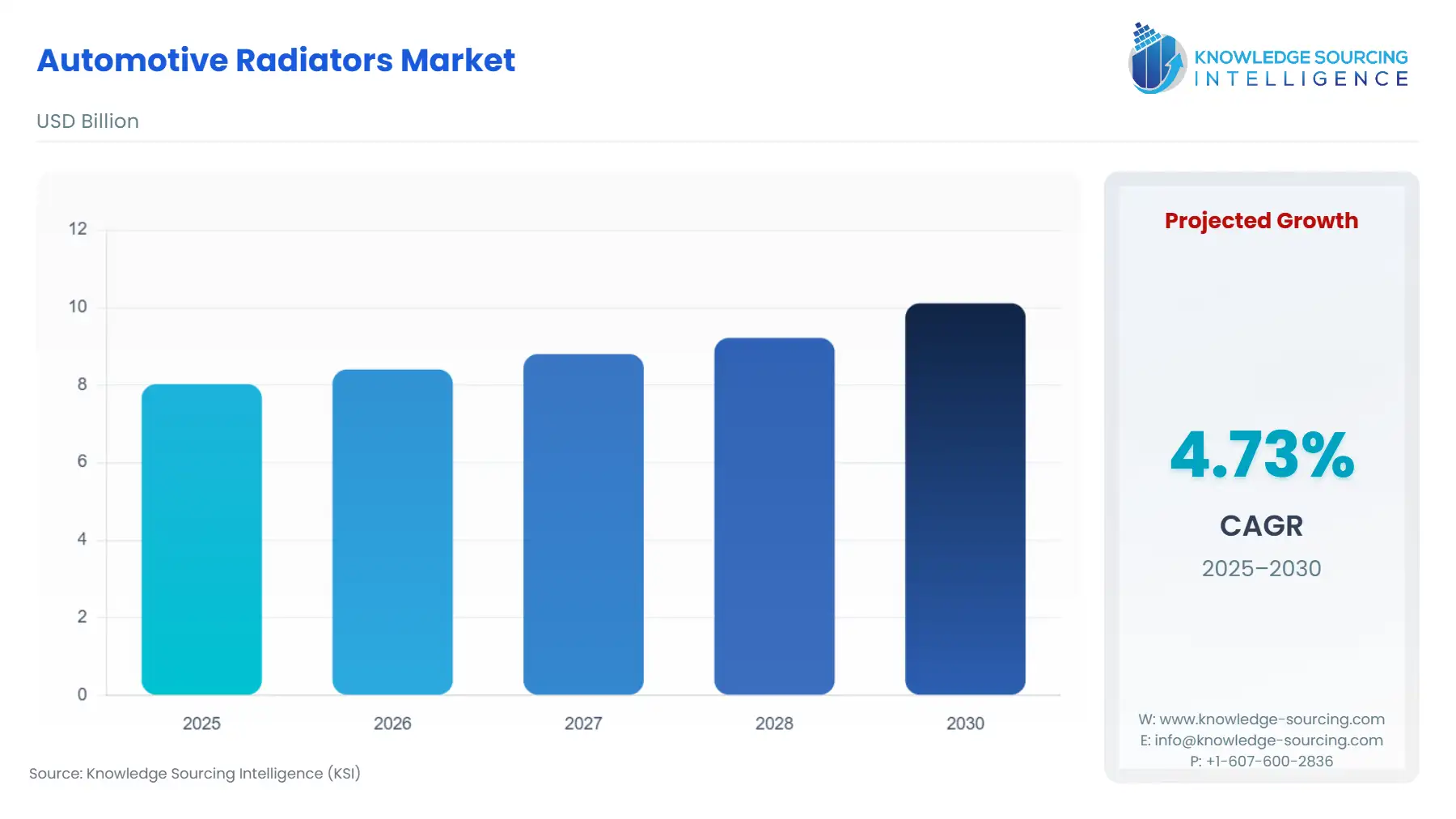

The Global Automotive Radiators Market is expected to grow from USD 8.026 billion in 2025 to USD 10.113 billion in 2030, at a CAGR of 4.73%.

The automotive industry is witnessing an increase in the production of passenger and commercial vehicles, causing the demand for radiators to rise, thereby contributing to market growth. Moreover, the stringent norms and regulations regarding engine emissions encourage manufacturers to produce good-quality radiators, contributing to the market's growth. Nanofluid has recently been discovered to be useful for cooling motors. Research is being done to increase the effectiveness of the radiators used in automobiles. For this, Titanium Dioxide water nanofluid was used as a cooling fluid at a concentration of 2%, and it was found that the effectiveness increased by 10%. The market has good growth potential due to improving the cooling fluid and radiator-related materials.

Furthermore, the increasing investments and participation of market players in research and development to improve these radiators and make them lighter and more efficient are expected to bolster the market growth over the forecast period.

The automotive radiator market has been segmented based on material type, vehicle type, end-user, and geography. The market has been divided into two categories based on material types: aluminium, brass, and aluminium. The market is divided into three categories according to vehicle type: passenger cars, light commercial cars, and heavy commercial cars. The market has been segmented by end-user into OEMs and aftermarkets.

Automotive Radiators Market Segment Analysis:

- Aluminium to hold a significant market share

By material type, aluminium is expected to hold a significant share in the automotive radiator market, which is attributable to the mass production of aluminium radiators is cheaper for the makers than radiators made of copper and brass. Its reduced weight than radiators made of copper and brass is an additional benefit.

- The passenger vehicle segment will continue to account for major demand

By vehicle type, passenger vehicles are expected to hold a significant share in the market owing to the rising production of passenger vehicles coupled with rising demand for these vehicles attributable to people's increased ability to buy thanks to an increase in their disposable income.

The radiator is a crucial part of the car since it makes removing heat from the engine simple, allowing it to cool down more quickly and without any problems. By end-user, OEMs are expected to hold a significant share in the market because the vehicles that the automakers produce are equipped with aluminium, copper, or brass radiators.

Automotive Radiators Market Geographical Outlook:

- The fastest rate of regional market expansion would be seen in the Asia Pacific.

By geography, Asia Pacific is expected to hold a significant amount of market share, which is attributed to the increasing production of vehicles in countries of this region like India and China, as well as certain other countries in this region, which are seeing a surge in demand for passenger cars, which is made possible by people's growing disposable income. In a joint venture called Spotlight Automotive Limited, the BMW Group, one of the biggest automakers in the world, and Great Wall Motor intend to invest about 650 million euros on November 29 in developing a new vehicle production facility in China with a capacity of 160,000 vehicles annually.

In a joint venture called Spotlight Automotive Limited, the BMW Group, one of the biggest automakers in the world, and Great Wall Motor intend to invest about 650 million euros on November 29 in developing a new vehicle production facility in China with a capacity of 160,000 vehicles annually.

This report features several important businesses, including MAHLE GmbH, DENSO CORPORATION, and Delphi Automotive.

Automotive Radiators Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | 8.026 billion |

| Total Market Size in 2031 | 10.113 billion |

| Growth Rate | 4.73% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Radiators Market Segmentation:

- By Material Type

- Copper and Brass

- Aluminum

- By Application

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By End-User

- OEM’s

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America