Report Overview

Flight Management System Market Highlights

Flight Management System Market Size:

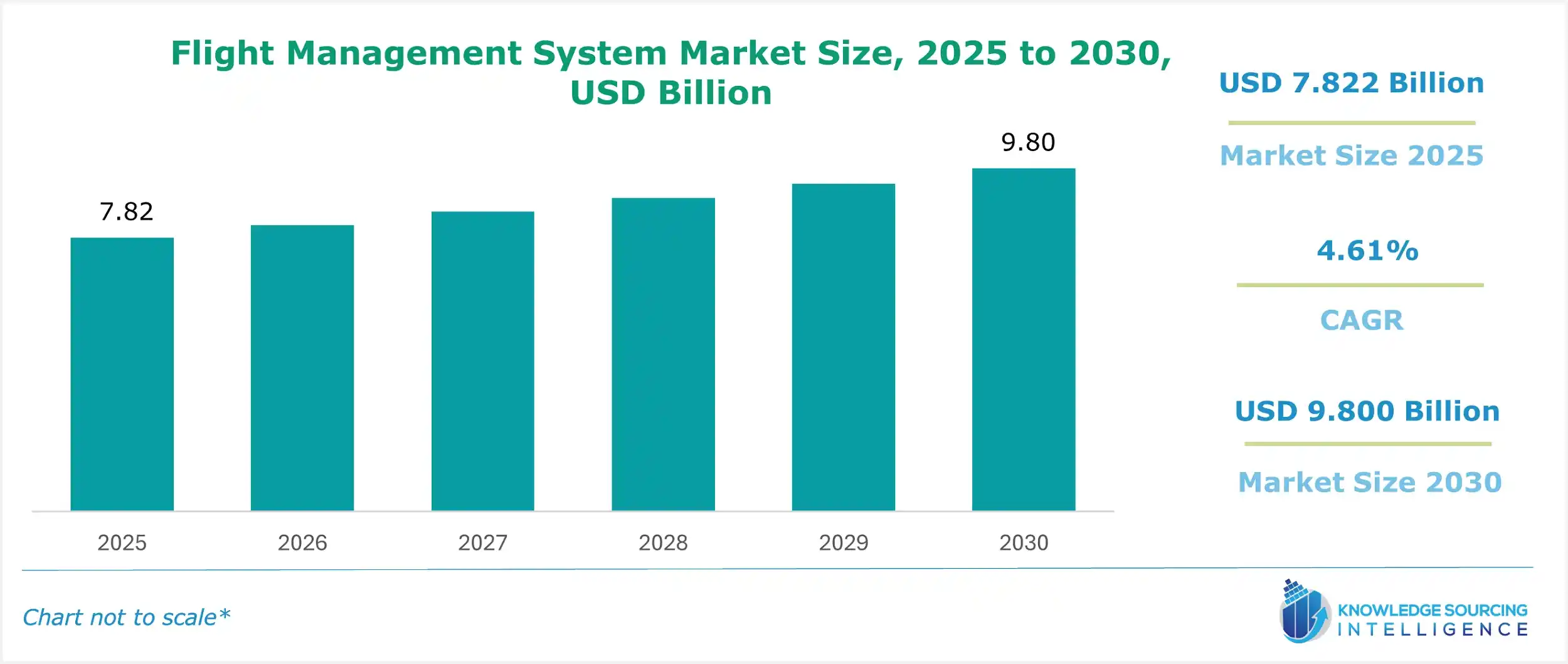

The Flight Management System Market is expected to grow from USD 7.822 billion in 2025 to USD 9.800 billion in 2030, at a CAGR of 4.61%.

Flight Management System Market Trends:

The Flight Management System (FMS) market is a critical segment of the aerospace industry, underpinning the operational efficiency, safety, and navigation capabilities of modern aircraft. It is an interface between the flight crew and the flight desk system, so it is one of the main components in avionics systems, as it performs various in-flight operations automatically. An FMS is an integrated suite of avionics that automates a wide range of in-flight tasks, including navigation, flight planning, trajectory prediction, and performance optimization. By connecting with autopilot systems, navigation databases, and other avionics, FMSs facilitate accurate flight path management, improve fuel efficiency, and ensure adherence to increasingly complex air traffic management regulations. As the aviation sector adapts to the increasing demands of air traffic, environmental sustainability, and technological advancements, the FMS market is experiencing significant growth and transformation.

The FMS market includes hardware, software, and services that support flight operations in commercial, military, and general aviation sectors. These systems are crucial in modern cockpits, allowing pilots to manage complex flight profiles while ensuring compliance with strict safety and regulatory standards. The market comprises various stakeholders, including avionics manufacturers, system integrators, airlines, and regulatory bodies. As the global aviation industry continues to recover steadily from the pandemic and industries place a great emphasis on digitalization, the demand for advanced FMS solutions is increasing. The integration of FMS with emerging technologies, such as artificial intelligence (AI), satellite-based navigation, and data analytics, is reshaping the market, offering enhanced capabilities for real-time decision-making and operational efficiency.

The global aviation sector is expanding, with the International Air Transport Association (IATA) forecasting that air passenger numbers will reach 4.7 billion annually by 2030, driven by growth in emerging markets and increased connectivity. This surge in air traffic underscores the need for robust FMS solutions to manage congested airspace, optimize flight routes, and reduce operational costs. Additionally, the push for sustainable aviation, driven by environmental regulations and net-zero carbon emission goals, is accelerating the adoption of FMS technologies that optimize fuel consumption and minimize environmental impact.

The FMS market is experiencing rapid innovation, fueled by industry leaders and technological advancements. In 2024, Honeywell Aerospace launched an upgraded FMS suite featuring enhanced AI capabilities. This new version enables predictive maintenance and real-time route optimization, reflecting the industry's emphasis on data-driven decision-making. Collins Aerospace partnered with a major airline to retrofit its fleet with next-generation FMSs, enhancing fuel efficiency by up to 5% through advanced trajectory planning. These advancements highlight the market’s shift towards smarter, more sustainable solutions.

Additionally, the FAA’s ongoing efforts to refine FMS guidance material, as outlined in its 2023 report on flight path management systems, are expected to streamline certification processes and encourage innovation. The integration of FMS with urban air mobility (UAM) platforms, such as eVTOL aircraft, is another emerging trend, with companies like Joby Aviation exploring FMS applications for autonomous flight operations

Flight Management System Market Drivers:

- Adoption of Performance-Based Navigation (PBN)

The global transition to Performance-Based Navigation (PBN), a satellite-based navigation framework, is a major driving force in aviation. PBN allows for more precise and flexible flight paths, which helps reduce fuel consumption and improve the efficiency of airspace. The International Civil Aviation Organization (ICAO) has mandated the adoption of PBN in many regions, with implementation deadlines extending into the late 2020s. ICAO's Global Air Navigation Plan (2023–2030) highlights PBN as an essential element of contemporary air traffic management, urging airlines and aircraft manufacturers to enhance or retrofit Flight Management Systems (FMS) to comply with Required Navigation Performance (RNP) standards. In 2024, Eurocontrol reported that more than 70% of European airspace operations had transitioned to PBN-compliant procedures, highlighting the need for compatible FMS solutions. This regulatory push is spurring demand for advanced FMS hardware and software capable of supporting RNP and Area Navigation (RNAV) procedures, particularly for complex airspace environments like high-density airports. Moreover, PBN enables optimized descent profiles, such as Continuous Descent Operations (CDO), reducing fuel burn by 10% during approach phases, further incentivizing FMS upgrades.

- Rising Demand for Fuel Efficiency and Sustainability

With aviation contributing approximately 2–3% of global carbon emissions, the industry faces intense pressure to decarbonize. The aviation industry’s commitment to sustainability, driven by environmental regulations and net-zero carbon emission targets, is a significant catalyst for FMS market growth. FMS plays a pivotal role in optimizing flight paths, reducing fuel burn, and minimizing emissions. Recent advancements in FMS software enable real-time trajectory optimization, factoring in weather conditions, air traffic constraints, and aircraft performance. For instance, Airbus and Boeing have integrated advanced FMS features into their latest aircraft models, such as the A350 and 787, to support sustainable operations. The push for sustainability is further amplified by initiatives like the European Union’s Fit for 55 package, including measures to reduce aviation emissions by 55% by 2030 compared to 1990 levels. The current regulations are prompting airlines to invest in upgrades and retrofits of FMS, especially for older aircraft, to meet emissions targets and avoid penalties. Furthermore, there is a growing trend toward integrating FMS with sustainable aviation fuel (SAF) management systems. This integration allows operators to monitor and optimize SAF usage, maximizing its environmental benefits.

- Digital Transformation and Connectivity

The emergence of digital flight operations, supported by enhanced connectivity and data-sharing capabilities, is transforming the FMS market. Modern FMSs are increasingly integrated with digital platforms that enable real-time data exchange between aircraft, air traffic control (ATC), and ground operations. NASA’s Digital Flight initiative emphasizes the capability of connected FMS to enhance situational awareness and operational efficiency through digital information services. This trend is increasing the demand for next-generation FMS solutions that can manage large datasets and support AI-driven analytics. In 2024, Thales introduced an FMS upgrade with enhanced connectivity features, enabling integration with Electronic Flight Bag (EFB) applications and cloud-based flight planning tools. This allows pilots to access live updates on airspace restrictions and weather conditions, optimizing flight paths in real time. The adoption of AI-driven analytics in Flight Management System (FMS) platforms is a significant trend that enables predictive trajectory optimization and anomaly detection. For instance, Collins Aerospace's partnership in 2024 with a major Asian airline resulted in a 4% reduction in operational delays due to the enhanced capabilities of AI in the FMS. The increasing use of the Aircraft Communications Addressing and Reporting System (ACARS) and Controller-Pilot Data Link Communication (CPDLC) highlights the need for Flight Management Systems (FMS) that ensure secure, high-speed data exchange and drive market growth.

- Growth in Air Traffic and Fleet Modernization

The expected growth in global air traffic requires advanced FMS solutions to effectively manage complex airspace environments. Airlines are updating their fleets with next-generation aircraft that feature advanced flight management systems to comply with regulations and improve operational efficiency. For example, the adoption of FMS in new aircraft deliveries, such as the Boeing 737 MAX and Airbus A320neo, reflects the market’s growth trajectory.

Flight Management System Market Restraints:

- High Development and Integration Costs

Developing and integrating advanced FMS solutions is capital-intensive, requiring significant investment in research, testing, and certification. The challenge of integrating FMS with existing avionics systems, especially in older aircraft, presents a significant barrier for smaller operators. Furthermore, the certification process overseen by organizations like the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) is demanding and time-intensive, causing delays in the market entry of new systems. The FAA’s Advisory Circular on Flight Management Systems (AC 20-138D), updated in 2023, details extensive airworthiness certification requirements that can take years and cost millions of dollars to complete. Upgrading older aircraft with modern Flight Management Systems (FMSs) is particularly challenging because it involves the integration of new technologies with existing avionics, often necessitating custom solutions. In 2024, a report from Aviation Week Network indicated that retrofitting a single narrow-body aircraft with a next-generation FMS could cost over $500,000, not including downtime expenses. The high costs associated with these requirements serve as a significant barrier for smaller airlines and operators in emerging markets, restricting their ability to enter the market. Furthermore, the continuous need for software updates to meet evolving navigation standards, such as PBN, increases the long-term financial burden, especially for operators with large and diverse fleets.

- Cybersecurity Concerns

As FMSs become more interconnected and reliant on digital infrastructure, they are increasingly vulnerable to cyber threats. The integration of real-time data exchange and connectivity features enhances operational efficiency but also exposes FMSs to potential cyber risks, including unauthorized access, data breaches, and system manipulation. The aviation industry has faced increasing concerns regarding cybersecurity, as highlighted by an incident reported by the International Air Transport Association (IATA) in 2024, which involved an attempted cyberattack on an airline's avionics systems. This incident underscores the vulnerability of connected FMS. Maintaining robust cybersecurity while ensuring system performance is challenging, as FMSs need to achieve low latency and high reliability under all conditions. The implementation of advanced encryption, intrusion detection systems, and secure data protocols can significantly increase development costs and complexity. In 2024, Honeywell Aerospace emphasized the need for “cyber-resilient” FMS designs, noting that balancing security with real-time performance remains a technical hurdle. Regulatory bodies are also tightening cybersecurity requirements, with EASA’s 2024 cybersecurity framework mandating enhanced protections for avionics systems, further complicating FMS development and certification. These concerns may slow the adoption of connected FMS solutions, particularly among operators wary of potential vulnerabilities.

- Regulatory and Standardization Challenges

The global aviation industry’s fragmented regulatory landscape and inconsistent standardization pose significant challenges for the FMS market. While initiatives like PBN drive demand, varying implementation timelines and regional standards create complexities for manufacturers and operators. For example, while Europe and North America have advanced in PBN adoption, Eurocontrol reports a compliance rate of 70% in European airspace by 2024. However, regions such as parts of Africa and Asia are lagging due to infrastructure limitations and differing regulatory priorities. This discrepancy necessitates that Flight Management System (FMS) manufacturers create solutions tailored to specific regions, which in turn raises design and certification costs. Furthermore, harmonizing FMS requirements across different jurisdictions is a complex task because regulatory bodies such as the FAA, EASA, and the Civil Aviation Administration of China (CAAC) each have their own distinct standards regarding navigation, safety, and performance. A 2024 study by the ICAO emphasized that differing global standards for FMS interoperability obstruct smooth operations for airlines operating across multiple regions. The complexity of adhering to various regulations can lead to delays in product launches and increased costs, especially for smaller avionics companies. Additionally, the rapid development of technologies such as urban air mobility (UAM) and autonomous flight systems creates further regulatory uncertainty, as current Flight Management System (FMS) standards may not adequately meet the requirements of new platforms like electric Vertical Takeoff and Landing (eVTOL) aircraft.

Flight Management System Market Segmentation Analysis:

- By Aircraft Size, large aircraft are experiencing significant growth

Large aircraft, including wide-body jets like the Boeing 787, Airbus A350, and Airbus A380, dominate the FMS market due to their crucial role in long-haul commercial aviation and the requirement for advanced navigation systems to manage complex, high-density airspace. These aircraft typically carry over 250 passengers and operate on international routes where precise navigation, fuel optimization, and compliance with global standards are crucial. The demand for FMS in large aircraft is fueled by rising long-haul travel, particularly in high-growth regions like Asia-Pacific and the Middle East. The International Air Transport Association (IATA) forecasts that long-haul passenger traffic will increase at a CAGR of 4.5% through 2030. Large aircraft are expected to drive significant demand for fleet management systems due to their operational complexities and high retrofit potential.

The global adoption of PBN is a primary driver, requiring advanced FMSs to meet Required Navigation Performance (RNP) standards for precise routing in congested airspace. For example, the Airbus A350 FMS incorporates RNP capabilities, which facilitate optimized descent profiles that can decrease fuel consumption by as much as 7% on long-haul flights. Sustainability initiatives, such as the European Union’s Fit for 55 package, aim for a 55% reduction in aviation emissions by 2030, increasing the need for FMS that enable continuous descent operations (CDO) and real-time trajectory optimization. Airlines are modernizing their fleets by upgrading older wide-body aircraft, like the Boeing 777, to comply with current ATC standards and improve efficiency.

In 2024, Emirates Airline launched a $3 billion fleet modernization program, including FMS upgrades for its A380 and 777 fleets to enhance fuel efficiency and PBN compliance. Collins Aerospace introduced a next-generation FMS for large aircraft that features AI-driven trajectory optimization, reducing operational costs by 5% during trials with a major U.S. carrier.

- By Components, the software segment is growing rapidly

The software segment is the primary component of the FMS market. It is essential for the core functionalities of FMS, which include navigation, flight planning, and real-time optimization. FMS software processes navigation databases, manages flight plans, and integrates with emerging technologies such as artificial intelligence and digital connectivity platforms. Its dominance stems from the need for frequent updates to comply with evolving navigation standards, such as PBN, and to support digital transformation in aviation. Software’s flexibility allows airlines to enhance existing hardware without costly replacements, making it critical for both new aircraft and retrofits.

The demand for sustainability is driving interest in FMS software that optimizes flight paths and reduces emissions. These systems utilize algorithms that can achieve up to 10% fuel savings during descent phases. Additionally, the integration of AI and machine learning enhances operational reliability by supporting predictive maintenance and anomaly detection. In 2024, Thales launched an FMS software suite with enhanced connectivity to Electronic Flight Bags (EFBs) and cloud-based platforms, enabling real-time flight plan adjustments. The rise of UAM and electric vertical takeoff and landing (eVTOL) aircraft further fuels demand for specialized FMS software for autonomous navigation. NASA’s Digital Flight initiative highlights the role of connected software in enabling data-driven operations, further boosting the segment’s growth.

In 2024, Honeywell Aerospace launched an AI-enhanced FMS software update that achieved a 4% reduction in fuel consumption during trials with a European airline. Additionally, Joby Aviation conducted successful trials demonstrating the integration of FMS software for eVTOL platforms, which supports autonomous navigation in urban airspace.

Flight Management System Market Geographical Outlook:

- The North American market is rising considerably

North America, primarily driven by the United States, is the largest geographical segment in the FMS market.

This is attributed to its advanced aviation ecosystem, which includes major aircraft manufacturers such as Boeing, avionics providers like Honeywell and Collins Aerospace, as well as a high volume of air traffic. The FAA reported over 45,000 daily flights in the U.S. in 2024, underscoring the region’s dominance. North America’s leadership in adopting PBN and modern air traffic management systems and its robust innovation landscape make it a key market for FMS solutions.

In 2024, the FAA reported that 85% of the airspace in the U.S. was compliant with PBN, prompting upgrades to FMS. Collins Aerospace secured a contract in 2024 with a U.S. airline to retrofit its fleet with next-generation FMS technology, resulting in a 5% increase in efficiency. Additionally, Joby Aviation conducted successful trials in 2024 for its eVTOL aircraft in the U.S., demonstrating effective integration of FMS for urban airspace operations.

Flight Management System Market Key Developments:

- Honeywell Aerospace’s AI-Enhanced FMS Software Launch (2024): Honeywell Aerospace launched an AI-enhanced FMS software suite that improves predictive maintenance and optimizes flight trajectories. It ensures real-time adjustments based on weather, air traffic, and aircraft performance, achieving up to a 4% reduction in fuel consumption during trials with a major European airline.

- Universal Avionics’ Wi-Fi-Enabled FMS Certification (2025): The FAA certified Universal Avionics' Wi-Fi-enabled FMS for Part 25 aircraft. This system streamlines pilot workflows by enabling wireless flight plan synchronization with iPads and other devices, reduces database update times, enhances situational awareness with real-time data, and includes advanced cybersecurity protections.

List of Top Flight Management System Companies:

- General Electric Company

- Rockwell Collins

- Honeywell International Inc.

- Universal Avionics System Corporation

- Thales Group

Flight Management System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Flight Management System Market Size in 2025 | USD 7.822 billion |

| Flight Management System Market Size in 2030 | USD 9.800 billion |

| Growth Rate | CAGR of 4.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Flight Management System Market |

|

| Customization Scope | Free report customization with purchase |

The flight management system market is analyzed into the following segments:

- By Aircraft Size

- Small

- Medium

- Large

- Extra Large

- By Components

- Hardware

- Software

- Services

- By Aircraft Type

- Commercial Aircraft

- Business and General Aviation

- Military Aircraft

- By End-User:

- Airlines

- Military

- General Aviation

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America