Report Overview

France AI in Luxury Highlights

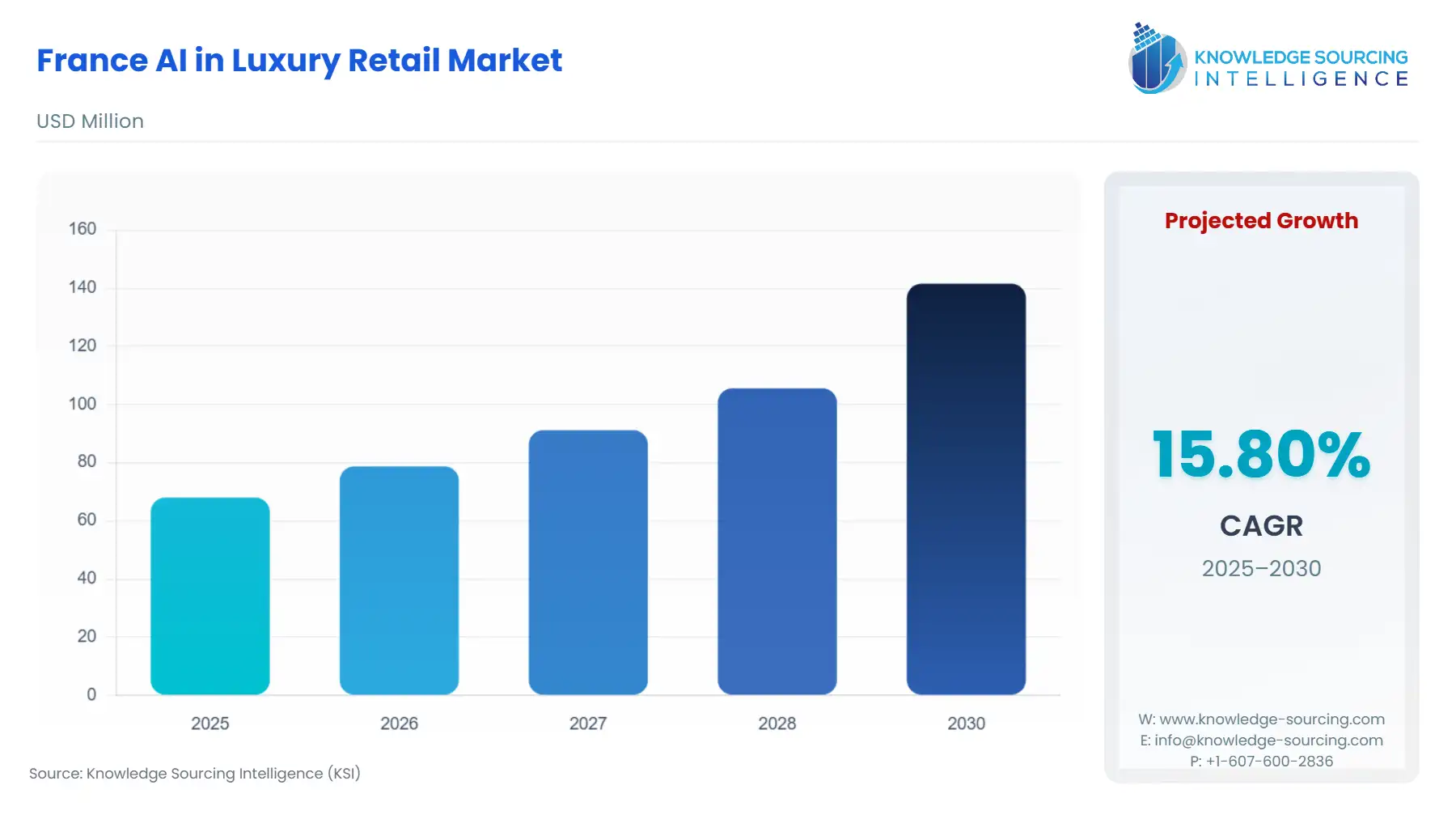

France AI in Luxury Retail Market Size:

The France AI in Luxury Retail Market is expected to grow at a CAGR of 15.80%, reaching USD 141.586 million in 2030 from USD 67.995 million in 2025.

The French AI in the luxury retail market represents a fusion of the nation’s heritage in high-end goods and its robust technological innovation ecosystem. This sector is characterized by its reliance on brand exclusivity, meticulous craftsmanship, and an unparalleled customer experience. As digital transformation accelerates, luxury brands are turning to artificial intelligence to preserve and enhance these core tenets. The application of AI is moving beyond simple data analysis to become a strategic tool that directly impacts the customer interface, supply chain efficiency, and creative processes. The market’s trajectory is directly influenced by the strategic decisions of major French luxury houses, which are setting the standards for AI integration and creating a competitive landscape where technological sophistication is a key differentiator.

France AI in Luxury Retail Market Analysis:

- Growth Drivers

The AI integration in the French luxury retail market is primarily propelled by the industry's deep-rooted imperative for customer personalization and operational excellence. The core mission of a luxury brand is to provide a unique, bespoke experience. AI directly addresses this by enabling hyper-personalization at scale. By leveraging AI algorithms, luxury retailers can analyze extensive customer data, including purchase history, browsing behavior, and stated preferences, to create highly individualized profiles. This capability allows for tailored product recommendations, personalized styling advice, and targeted communications that replicate the intimate service of a personal shopper. This shift enhances customer engagement and directly drives demand for AI software and services.

Furthermore, the need for operational efficiency is a powerful catalyst for AI adoption. Luxury brands must manage complex global supply chains and limited-run inventory. AI-powered predictive analytics enable these companies to forecast demand with greater accuracy, thereby optimizing inventory levels and reducing the risk of overstock or stockouts. This application of AI is a direct response to the economic and logistical challenges of the industry. The integration of AI for supply chain and inventory management not only improves profitability but also supports sustainability goals by minimizing waste, which is increasingly a priority for both brands and consumers.

- Challenges and Opportunities

The primary challenge facing the French AI in the luxury retail market is the high cost and complexity of implementation. Unlike fast-moving consumer goods, luxury retail operates on principles of exclusivity and human connection. The integration of technology must be seamless and non-intrusive, a concept LVMH refers to as "quiet tech." This requires significant investment in both technology platforms and employee training, as AI is intended to augment, not replace, the human touch. The high initial capital expenditure and the need for specialized data scientists and AI experts can be a barrier to entry for smaller or independent luxury houses.

This challenge, however, creates a significant opportunity. The market has a strong need for AI solutions that are specifically designed for the luxury sector, emphasizing discretion and human-centric design. This creates a niche for specialized service providers who can offer bespoke AI models and consulting services that align with the unique brand values of luxury. The opportunity also extends to the development of ethical and responsible AI frameworks, particularly in areas like data privacy and bias. As the EU AI Act takes shape, companies that can demonstrate a commitment to ethical AI deployment will gain a competitive advantage and further drive demand from brands seeking to maintain their reputation for integrity and trust.

- Supply Chain Analysis

The supply chain for AI in luxury retail is fundamentally a non-physical, knowledge-based ecosystem. It does not involve raw materials but is instead built on a network of talent, data, and computational infrastructure. The "production hubs" for this market are not factories, but rather technological hubs in Paris and other French cities, as well as major international innovation centers. The supply chain's dependencies are on the availability of highly skilled data scientists and engineers, access to vast, high-quality customer and operational datasets, and robust cloud computing infrastructure. The logistical complexities involve securing and processing sensitive customer data in compliance with regulations like GDPR. The supply of top-tier AI talent and the ability to leverage a brand's unique data assets are critical constraints on market growth.

France AI in Luxury Retail Market Government Regulations:

The French government's approach to AI regulation is primarily guided by the European Union's legislative framework, particularly the EU AI Act. This creates a structured environment for AI development and deployment within France.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | EU AI Act | While not a specific French regulation, the EU AI Act directly impacts the French market. It classifies AI systems by risk level and imposes strict requirements on high-risk applications, such as those used for hiring or credit scoring. This framework creates a compliance imperative for luxury retailers, as they must ensure their AI systems for customer profiling and marketing are transparent, fair, and adhere to data protection standards. This drives demand for AI solutions that are "explainable" and built with privacy-by-design principles. |

| France | Commission Nationale de l'Informatique et des Libertés (CNIL) | CNIL is the national data protection authority in France and is a key enforcement body for AI regulations, particularly concerning data privacy under the GDPR. CNIL's enforcement actions, such as the penalty against Clearview AI, send a clear signal to the market. Luxury retailers, which handle sensitive customer data, are compelled to prioritize data protection in their AI initiatives. This directly increases demand for AI solutions that are compliant with strict data privacy laws, influencing technology choices and vendor partnerships. |

France AI in Luxury Retail Market Segment Analysis:

- By Application Area: Customer Experience and Personalization

The Customer Experience and Personalization segment is a core growth driver in the French AI in luxury retail market. Luxury brands have a historical legacy of delivering highly personalized, "white-glove" service. AI is required to scale this level of service across digital channels and a global customer base. The market is driven by the need to create a seamless, cohesive journey for the customer, whether they are in a physical boutique, browsing an e-commerce site, or interacting with a brand on social media. Predictive analytics and machine learning are used to analyze customer behavior to provide bespoke product recommendations and styling advice. For instance, brands like Chanel use AI-powered virtual try-on tools to allow customers to visualize products like sunglasses or lipstick, replicating an in-store experience. This technology directly increases customer engagement and conversion rates by reducing the uncertainty of online purchases. The integration of conversational AI through chatbots and virtual assistants also streamlines customer service, providing instant, personalized support. The demand in this segment is a direct response to the need to maintain brand exclusivity and loyalty in a rapidly evolving digital landscape.

- By Technology: Predictive Analytics and Machine Learning

Predictive Analytics and Machine Learning (ML) are foundational technologies driving demand in the French luxury retail sector. The need for these technologies stems from the necessity to make data-driven decisions that impact both the creative and operational sides of the business. On the creative side, ML algorithms are used to analyze fashion trends and consumer sentiment to inform the design and production of new collections. This reduces the risk associated with developing new lines and ensures that products are aligned with market expansion. Operationally, predictive analytics are critical for supply chain and inventory management. Luxury brands, which often have limited production runs and a global distribution network, use AI to forecast demand, optimize logistics, and manage supplier relationships. This capability is vital for ensuring that exclusive products are available to customers at the right place and time. The deployment of predictive analytics directly improves efficiency and profitability, making it a critical investment for luxury retailers. The demand for this technology is a clear indicator that French luxury houses view data as a strategic asset to be leveraged for competitive advantage.

France AI in Luxury Retail Market Competitive Analysis:

The competitive environment is dominated by major French luxury conglomerates, which possess the resources to drive large-scale AI adoption. These players leverage their significant brand portfolios to pilot and scale AI initiatives.

- LVMH: LVMH's strategic positioning is to leverage AI as a "quiet tech" that enhances customer and employee experiences without being intrusive. The company partners with tech giants like Google Cloud to create a centralized data and AI platform that benefits its more than 75 "maisons," including Louis Vuitton and Dior. This allows for a balance between group-wide efficiency and individual brand autonomy. LVMH's initiatives include deploying AI agents for client advisors to provide personalized insights and using predictive AI for supply chain planning and dynamic pricing. This approach demonstrates a focus on using AI to augment human expertise, thereby preserving the unique luxury experience.

- Kering: Kering's strategy for AI is centered on innovation and sustainability. The group integrates AI across its operations to address key challenges, including raw material sourcing and supply chain traceability. Kering’s focus on leveraging technology to reduce its environmental footprint, as evidenced by its Kering Generation Award, demonstrates a demand-side pull for AI solutions that support its sustainability goals. The company has also publicly stated its commitment to using AI for business planning and improving client relations. Kering’s approach highlights the growing intersection of AI, technology, and environmental responsibility within the luxury sector.

France AI in Luxury Retail Market Developments:

- September 2025: Kering announced the 10 finalists of the 4th edition of the Kering Generation Award, a competition that supports startups in sustainable innovation. The finalists showcased a range of solutions utilizing generative AI, advanced materials, and algorithmic technologies to address challenges like water consumption and waste. This event highlights Kering’s strategic focus on sourcing and implementing new technologies to improve its supply chain and operations.

- June 2025: LVMH, in a partnership with Google Cloud, announced the expansion of its "quiet tech" strategy, detailing the use of AI agents for client advisors and the widespread adoption of generative AI systems across various business functions. This development underscores the group's commitment to using AI to enhance personalized client experiences and improve internal productivity.

France AI in Luxury Retail Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 67.995 million |

| Total Market Size in 2031 | USD 141.586 million |

| Growth Rate | 15.80% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application Area, Component, Technology, End-User |

| Companies |

|

France AI in Luxury Retail Market Segmentation:

- BY APPLICATION AREA

- Customer Experience and Personalization

- Sales and Marketing

- Supply Chain and Inventory Management

- Store Operations

- Fraud Detection and Security

- Others

- BY COMPONENT

- Software

- Services

- BY TECHNOLOGY

- Computer Vision

- Natural Language Processing

- Predictive Analytics and Machine Learning

- Generative AI

- Conversational AI

- Edge AI

- BY END-USER

- Luxury Fashion Retailers

- Luxury Beauty & Cosmetics Brands

- Luxury Jewelry Brands

- Luxury Automotive Showrooms

- Luxury Department Stores / Multi-brand Retailers

- Luxury Hospitality & Travel Retail