Report Overview

France E-Hailing Market - Highlights

France E-Hailing Market Size:

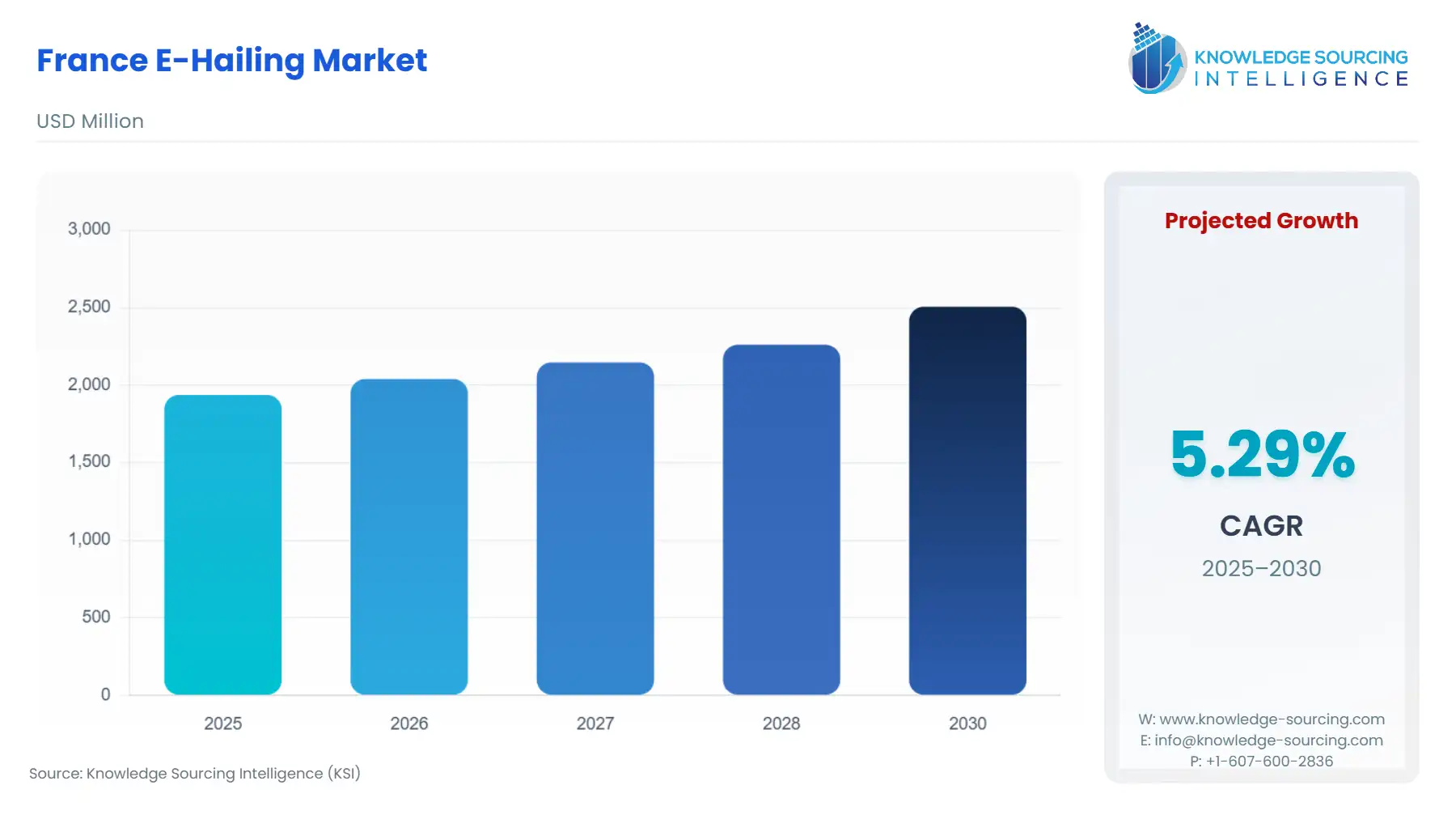

France E-Hailing Market, with a 5.29% CAGR, is forecasted to expand from USD 1.937 billion in 2025 to USD 2.506 billion by 2030.

France E-Hailing Market Key Highlights:

- The growth is being driven by shifting consumer preferences toward digital and on-demand mobility, supported by widespread smartphone and mobile internet use.

- Increased usage of ride-hailing apps in urban centers, combined with the integration of e-hailing services with public transit, is enhancing convenience and coverage, especially in late-night or underserved areas.

The France e-hailing market is being driven by the rapid digital adoption and smartphone penetration, which make app-based mobility services more accessible to a broad user base. Widespread use of mobile internet and secure digital payment systems has significantly improved the convenience of ride-hailing, encouraging more passengers to shift away from traditional taxis.

France E-Hailing Market Overview & Scope

The France E-Hailing market is segmented by:

- By Service Type: The most popular of the service sub-categories in France is the ride hailing with the advantages of convenience and efficiency offered by ride booking apps. The most popular and rising part of ride sharing and other specialty services is the on-demand, and point-to-point ride hailing option.

- By Device Type: Smartphones are by far the most used device to access e-hailing services in France and this is due to the high popularity of ownership of mobile devices and the ease of use of booking/tracking routes and payment through dedicated applications. Tablet computers and other devices are a trivial part of the business, used primarily as specialized fleet bookings or corporate customers.

- By Vehicle Type: The vehicle type with the majority of the e-hailing rides is the four-wheelers that constitute over two-thirds of rides, because of their comfort, safety, and versatility (rider-to-business and rider-to-rider). Particularly popular in this category of cars are SUVs since they are becoming more popular to serve as environmentally friendly and premium-priced utilities.

- By End-User: Personal (B2C) Representing the majority end-user group, individual consumers use e-hailing to travel on a daily basis, during leisure days, and have the flexibility of commuting in the urban market. The corporate (B2B) business is on the rise, especially by volume in employee travel and events but the predominant user is still the individual.

- By City: By Cities, the market has been segmented into Paris, Lyon, Marsellie, Lille, and Bordeaux.

Top Trends Shaping the France E-Hailing Market

- 1. Integration with Public Transport Systems

- A significant factor that have been promoting the market includes integration into the public transport systems in which the e-hailing services are closing up late-night, first-mile, and last-mile service gaps. This complementary role augments the total transport ecosystem and improves adoption.

- 2. Sustainability and Green Mobility

- The market is being redefined with the high levels of policy push towards sustainability and green mobility. Electric vehicle (EV) incentives by the government, and increased consumer awareness in respect to playing a role in reducing carbon emissions are already pushing ride-hailing operators to diversify their fleets, including electric and hybrid vehicles, creating a more appealing environment to eco-savvy riders.

France E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Digital Adoption and Smartphone Penetration: E-hailing market in France is being spurred on by the high rate of digital adoption and smartphone penetration, which renders the app based mobility services more accessible to a large segment of users. Availability of mobile internet and secure means of the digital payment system has very much facilitated the convenience of the ride-hailing, which has motivated more customers to abandon the usual taxis.

- Urbanization and Growing Mobility Demand: Another major driver is the urbanization and growing mobility demand in large French cities such as Paris, Lyon, and Marseille. Increasing traffic congestion and limited parking availability are prompting commuters to opt for flexible, on-demand ride-hailing solutions that save time and reduce the stress of car ownership.

Challenges:

- The provided text does not contain a specific challenge.

France E-Hailing Market Key Developments

The market is fragmented, with many notable players:

- Company Collaboration: In June 2025, Nexar, a leader in AI-powered mobility solutions, announced a groundbreaking collaboration with Flywheel, one of the leading e-hail platform for the taxi industry.

France E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| France E-Hailing Market Size in 2025 | USD 1.937 billion |

| France E-Hailing Market Size in 2030 | USD 2.506 billion |

| Growth Rate | CAGR of 5.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Paris, Lyon, Marseille, Lille, Bordeaux, Others |

| List of Major Companies in the France E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

France E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Cities

- Paris

- Lyon

- Marseille

- Lille

- Bordeaux

- Others

Our Best-Performing Industry Reports:

Navigation:

- France E-Hailing Market Size:

- France E-Hailing Market Key Highlights:

- France E-Hailing Market Overview & Scope

- Top Trends Shaping the France E-Hailing Market

- France E-Hailing Market Growth Drivers vs. Challenges

- France E-Hailing Market Key Developments

- France E-Hailing Market Scope:

- Our Best-Performing Industry Reports: