Report Overview

Mexico E-Hailing Market - Highlights

Mexico E-Hailing Market Size:

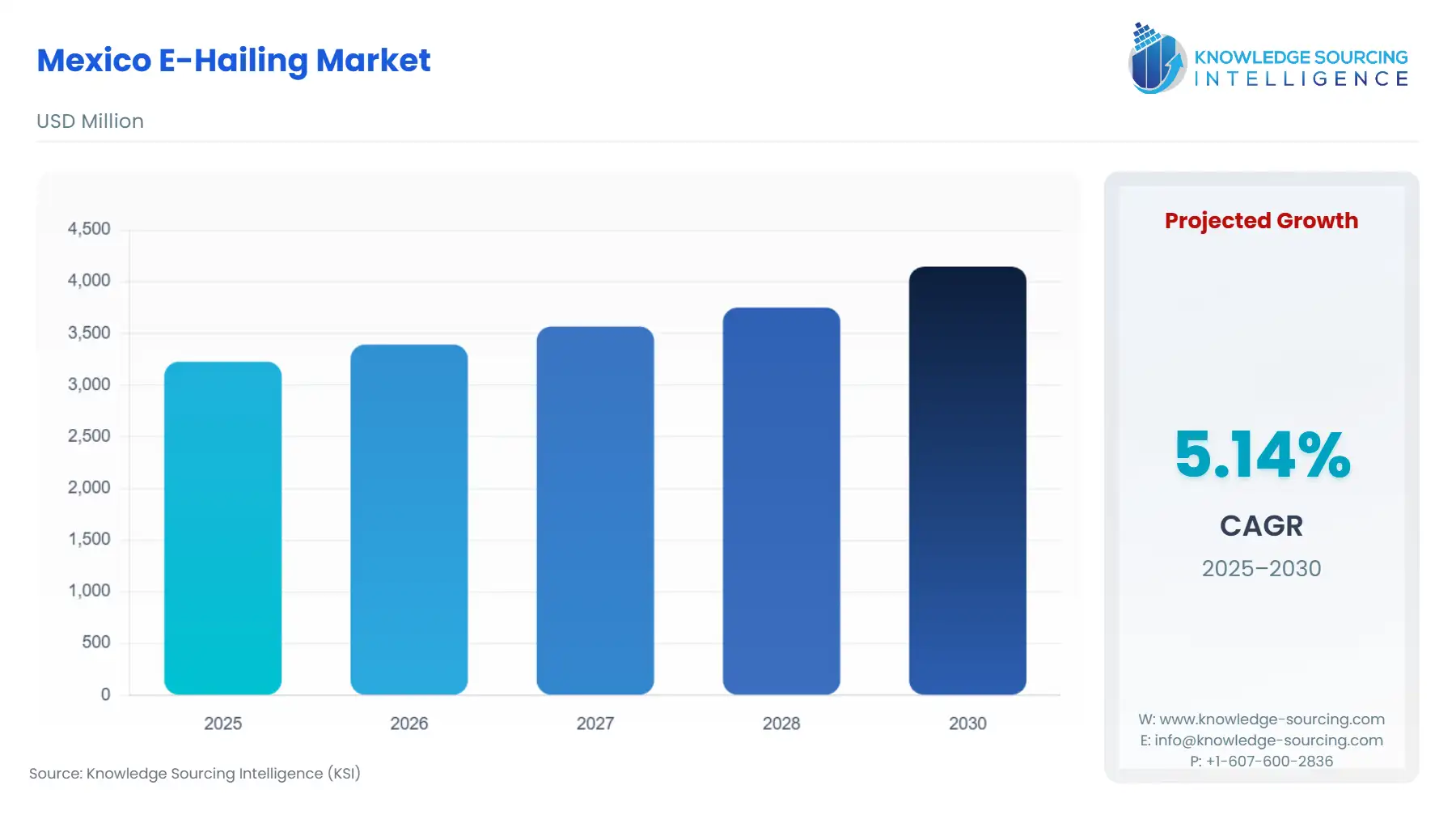

Mexico E-Hailing Market is projected to increase at a 5.14% CAGR, growing from USD 3.227 billion in 2025 to USD 4.146 billion by 2030.

The Mexican e-hailing market is witnessing significant growth driven by diverse factors, primarily rising urbanization, increasing digital adoption, and the rapid rise in consumer preferences for e-hailing services. Furthermore, increasing population and urbanization in major cities such as Mexico City, Guadalajara, and Monterrey will lead to traffic congestion and a demand for efficient transportation systems. This will contribute to an increase in the adoption of these e-hailing services regionwide, as it offers affordability and flexibility in payments. Moreover, corporates are also adopting these services, along with the growing tourism and EV expansion, which are boosting market growth.

Mexico E-Hailing Market Overview & Scope

The e-hailing (electronic hailing) market is a sector that allows passengers to book, hail and pay for rides through a digital platform, typically using a mobile app or a website. This market disrupts traditional taxi services by using GPS technology, real-time tracking, and digital payment methods that connect passengers to drivers or passengers using personal vehicles. Mexico’s e-hailing market is among the most active in Latin America, largely due to rapid urbanization, high adoption rate of smartphones, and an increasing middle class.

Mexico has an urbanization rate of 82% of the total population as of 2024, the country has about 107.13 million people living in urban areas in 2024, an increase from 104.56 million in 2022, according to World Bank data. The largest cities in Mexico, such as Mexico City, Guadalajara, and Monterrey, experience heavy traffic, long commuting times, and a lack of parking spaces, leading commuters to turn to ride-hailing platforms as a more convenient alternative. Public transport or private car ownership is unattractive compared to services that make booking easier, optimize the route for users, and save their time. With growing urbanization, the cities grow bigger, which leads to last-mile connectivity problems. This will also contribute to an increase in the need for reliable e-hailing solutions to provide mobility across both densely populated and semi-urban areas.

Moreover, the rise in internet penetration and smartphone use has made the user base for app-based transport large and growing, consequently lowering customer acquisition friction. The World Bank data states that between 2022 and 2023, the rate of internet usage in the country rose from 79 percent to 81 percent.

Moreover, according to the data from the International Trade Administration of November 2023, about 98% of the country’s internet users are connected through a smartphone. Thus, the deployment of improved mobile networks and the provision of user-friendly apps have made it easy for all riders and drivers to use digital platforms for booking, navigation, and payment services. The growing acceptance of digital wallets, debit and credit cards and instant payment solutions in the country has helped riders and drivers to travel with ease, boosting overall market growth.

Additionally, the electrification and sustainable mobility, which are increasingly becoming the main focus in the country, are seen as substantial growth drivers for the market in the coming years. Moreover, the stringent government sustainability objectives in the country for low carbon emissions and adoption of EVs is leading to consumers acknowledging and demanding the EV integration into ride-hailing services.

Mexican E-Hailing Market Segments:

The Mexican E-Hailing Market is segmented by:

- Service Type: By service type, the market is segmented into ride sharing, ride hailing and others. Ride sharing reduces costs and also promotes sustainability. On the other hand, a ride-hailing service is for exclusive use. There is growth of niche or emerging services as well, such as luxury ride service or air taxi bookings.

- Device Type: By type of devices passengers use to access e-hailing services, the market is segmented into smartphones, tablets, and others, such as desktop computers or wearable devices. Smartphone is the most dominant market, driven by e-hailing service booking through apps, which is the most convenient way and can be done easily. Tablets are also used, but more particularly by corporates. Others' adoption is limited.

- Vehicle Type: Two-wheeler, three-wheeler, and four-wheeler are major types of vehicles used for e-hailing services, which affect cost, comfort, and capacity. In Mexico, two-wheelers are growing at the fastest rate, while four-wheelers are currently dominating.

- End User: The market is segmented into personal and corporate as end-users. Personal users are individual users booking rides for daily commuting, social visits, or personal travel. Corporations use rides for employees, clients, or corporate events. The personal segment has the largest share, due to a large base and rising adoption in the middle-class population.

- City: The market is segmented into Mexico City, Guadalajara, Monterrey, Puebla, Cancún, and Others. Mexico City largest and most mature e-hailing market, driven by population density, traffic congestion, and high digital adoption.

Top Trends Shaping the Mexico E-Hailing Market

Integration of cash payments alongside digital wallets. Due to lower or limited banking penetration, many riders still prefer cash payments. Thus, to leverage this trend, many players, such as DiDi, Cabify, and all others are offering cash payment options, along with digital wallet options.

Mexico E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Rising Urbanization and rise in the middle class: The growth in socio-economic structure in Mexico is the key factor driving the e-hailing market. Mexico is a highly urbanized country with nearly 80% of its population living in urban areas. During the last decade, the urbanization share has grown from 78% to 82% in 2024. The country has experienced a huge rise in the middle class. During the last decade, 17% of Mexico’s population joined the middle class in a decade. These factors are driving the Mexico e-hailing market and are creating a high demand.

- Rising smartphone and internet penetration: The rapid rise in smartphone and internet access across Mexico has been a major driver of growth for the e-hailing market. This growing digital ecosystem has made e-hailing applications like Uber, Didi, and Cabify more available and easier to use. With the adoption of smartphones nearly universal, more users can download, register, and access mobility needs through an application-based online platform. Additionally, improved mobile internet coverage is being further facilitated by government-led programs aimed at expanding broadband networks. One such initiative is the Programa de Conectividad en Sitios Públicos, managed by the Secretaría de Infraestructura, Comunicaciones y Transportes (SICT). This program aims to increase capacity for stable connectivity across urban and semi-urban regions. For personal users, enhanced connectivity means greater convenience, dependability and availability of services in real-time. Improvements in internet connectivity - and the arrival of emerging 5G networks – allow for quicker ride bookings, GPS monitoring of drivers for more accurate ETAs, secure in-app payments and services, which lead to confident use of e-hailing applications.

The steady upward trend in smartphone ownership and increased internet penetration across Mexico provides a technological base and availability to further enhance the process of e-hailing in Mexico. The rise in Mexico’s population from 129.7 million in 2023 to 130.8 million in 2024 indicates a steadily expanding consumer base for e-hailing services. A larger population, especially concentrated in urban centers like Mexico City, Guadalajara, and Monterrey, directly increases mobility demand. With more individuals requiring daily transportation for work, education, and personal needs, the e-hailing market benefits from higher ride frequency and broader adoption. This demographic growth also supports greater driver availability and market scalability, ultimately reinforcing the sector’s long-term expansion and revenue potential.

Challenges:

- Driver Low-Pay and Safety Concerns: In many Mexican cities, ride-hailing drivers face risks such as carjackings, robberies, and assaults, particularly in high-crime neighbourhoods. This discourages driver participation, raises insurance and operational costs. It also impacts the user's trust. Along with safety, low driver pay also impacts the driver supply.

Mexico E-Hailing Market Regional Analysis

- Mexico City: Mexico City is the largest market. It is driven by its high population density, high use of ride-hailing services due to the high middle class and affordability. Tourists and corporations are also major drivers for the market.

- Puebla: Puebla also has a significant share in the market. It has 3.4 million people and is also the fourth-largest metropolitan. Its industrial strength and growing commerce are driving its market.

Mexico E-Hailing Market Competitive Landscape

The market is highly competitive, though moderately fragmented. The dominance is due to the presence of major share coverage by Uber and DiDi Chuxing. Some other major players are KEKO, Beat, and others.

- Expansion: DiDi is planning to expand electric cars to 100,000 in Mexico by 2030 and is investing 50.3 million US dollars to do so. The goal is to build the largest fleet of electric cars in Mexico and Latin America. In collaboration with partners like BYD, Didi has been integrating more EVs into its platform, particularly in Mexico City.

Mexico E-Hailing Market Segmentation Analysis:

- By Device Type: Smartphones

By device type, the Mexico e-hailing market is segmented into smartphones, tablets, and others. Smartphones are the primary device through which most new users and existing users of the ride-hailing services in the Mexican e-hailing market interact with the market. The proliferation of reasonably priced smartphones, along with the 4G that is already well distributed and 5G, which is still in the process of being deployed, has essentially revolutionized the way customers connect to and use the ride-hailing services. According to the BankMyCell.com 2024 report, there are 59.6, 54.7, and 49.6 million smartphone users in Mexico, the UK, and France, respectively.

Leading e-hailing apps provide intuitive interfaces and multilingual support that make smartphone-based bookings reachable to a wide demographic. This includes both tech-savvy urban professionals and younger digital-native users. Moreover, smartphone-based geolocation services and GPS accuracy have made the driver-passenger matching process more efficient. This reduces waiting times and improves route optimization, which, in turn, has significantly increased service reliability. The deployment of in-app safety features like SOS buttons, live ride tracking, and driver verification has, therefore, not only helped to raise consumer trust but also their sense of security, which is very important in urban Mexican markets.

The rise of mobile wallets and digital payment methods such as Mercado Pago, PayPal, and bank-linked apps has made using smartphones for cashless transactions more popular, thus promoting financial inclusion. By 2023, more than 97 million people in Mexico were accessing the internet, which is equivalent to 81% of the total population, as reported by the Mexican Federal Institute of Telecommunications. Such a rise has led to a booming e-hailing industry.

Moreover, promotional campaigns through smartphones, loyalty rewards, and referral programs have become indispensable instruments that e-hailing companies use to broaden their customer base and retain users. The trend of smartphone affordability, coupled with the rise of digital literacy initiatives that are supported by both government and private stakeholders, is likely to keep pushing the use of smartphones as the main means of interaction with e-hailing services in Mexico, thereby consolidating their role as a vital factor in the market's sustained growth.

- By Vehicle Type: Four-wheeler

By vehicle type, the Mexico e-hailing market is segmented into two-wheeler, three-wheeler, and four-wheeler. The four-wheeler segment is the dominant shareholder and the main driver of the industry in the Mexican E-Hailing Market. This is mainly due to high consumer preference for comfort, convenience, and flexibility in urban and intercity travel. Four-wheelers, comprising sedans, hatchbacks, and SUVs, have become the most widely used vehicles for e-hailing services as they can accommodate more passengers, have better safety features, and provide a more comfortable ride compared to two- or three-wheelers. The segment’s expansion is fueled by the rising demand for both premium and economy ride options, thus enabling different customer segments, such as daily commuters, tourists, and corporate travelers, to use the services. In 2024, the growth of electric vehicle (EV) and plug-in hybrid electric vehicle (PHEV) purchases in Mexico was 84%. According to a press release by the Latam Mobility organization, the total number of units sold reached 69,713, setting a new record.

One key factor that propel the growth of a new generation of shared urban transit options based on technology and the Internet was the car-based ride-hailing fleets' expansion by major service providers like Uber, Didi, and Cabify. As a result, service availability and reliability have improved in Mexico's main cities, including Mexico City, Guadalajara, and Monterrey. Additionally, the rising trend of shared mobility and carpooling options within the four-wheeler category has contributed to reducing travel costs and traffic congestion, which aligns with Mexico's overall goals for sustainable urban transportation. The improvement of vehicle technology, to mention a few, the inclusion of in-car entertainment, navigation, and real-time tracking systems, has also delighted the users and, thus, increased their loyalty.

The Mexican government has established various programs to promote cleaner and more environmentally friendly transportation, which is a direct help to the e-hailing sector’s transition to low-emission vehicles. The National Electric Mobility Strategy (ENME) is a long-term plan to build EV infrastructure, including installing more public charging stations, in big cities. Several city administrations, particularly that of Mexico City and Jalisco, have introduced policies to encourage the use of zero-emission fleets and improve urban air quality. All these actions are a strong push for the e-hailing market to turn to clean four-wheelers.

Mexico E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mexico E-Hailing Market Size in 2025 | USD 3.227 billion |

| Mexico E-Hailing Market Size in 2030 | USD 4.146 billion |

| Growth Rate | CAGR of 5.14% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Mexico City, Guadalajara, Monterrey, Puebla, Cancún, and Others |

| List of Major Companies in the Mexico E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Mexico E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By City

- Mexico City

- Guadalajara

- Monterrey

- Puebla

- Cancún

- Others