Report Overview

Thailand E-hailing Market - Highlights

Thailand E-hailing Market Size:

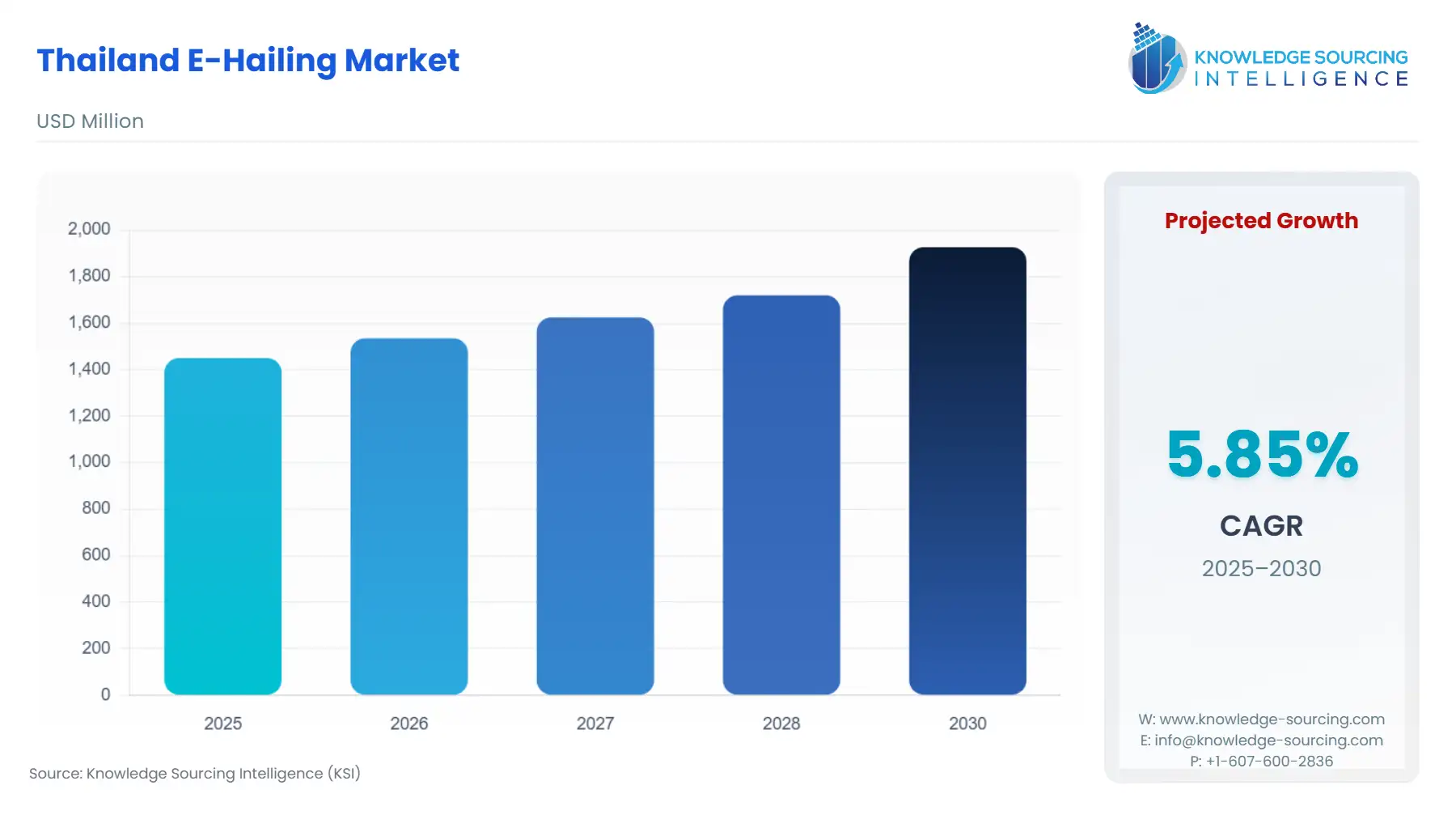

Thailand E-Hailing Market is set to rise at a 5.85% CAGR, increasing from USD 1.450 billion in 2025 to USD 1.927 billion by 2030.

The e-hailing service sector in Thailand is seeing growth acceleration. It is largely fueled by the rising adoption of smartphones and the increasing willingness of consumers to consider new urban mobility options that are more affordable and convenient. Many well-known e-hailing companies give consumers a choice and the ability to go from ride-sharing to premium versions to accommodate their preferences. The e-hailing sector is benefiting from the interest of the government and their promotion of smart transportation options, while influencing and innovating in safety, digital payments, and the use of sustainable vehicles. Rapid urbanization and evolving consumer behavior are creating an attachment with e-hailing as part of Thailand's transport system. People are using this on a day-to-day basis. It is now very popular throughout the country.

Thailand E-hailing Market Overview & Scope

The Thailand E-hailing Market is segmented by:

- Service Type: In terms of ride-hailing service type, ride-hailing has a large share as the consumers choose on-demand point-to-point rides to and from the airport, and for trips in between

- Device Type: Smartphones are the main booking channel, as the high penetration rate of mobile phones and easy-to-use apps make it the preferred channel for bookings.

- Vehicle Type: Four-wheelers lead the category, as they serve both the individual and groups, providing comfort and reliability in domestic travel.

- End User: Personal users represent the largest share, as e-hailing is the preferred form of travel when individuals want ease of movement, which is the main driver for travel.

- Region: Chiang Mai’s e-hailing market is growing. This is driven by an increase in tourism and student populations. The app-based rides have made travel easier, thus promoting the e-hailing market in Thailand.

Top Trends Shaping the Thailand E-hailing Market

- Growth in Digital Payments: There is a rise in the usage of cashless transactions is creating greater convenience and driving greater adoption.

- Environmental Vehicles: There is a continued growth in preference for electric and hybrid vehicles in urban areas.

- App-Based Innovations: The apps have improved features like ride tracking and dynamic pricing improve user experience.

Thailand E-hailing Market Growth Drivers vs. Challenges

Drivers:

- Urbanization and Traffic Congestion: The growth in urbanization is leading to growth in this market. According to the World Bank, the urban population of Thailand grew from 52% of the total population to 53% of the total population.

- Tourism Growth: The rise in tourism is another driver for this market. According to ASEAN, during the first five months of 2023, Thailand welcomed 9.47 million international tourists and is aiming to surpass the total number of 11.5 million foreign visitors that entered during all of 2022 (which was a dramatic decrease from a total of just 427,869 visitors in 2021). Thailand was expecting to have 25 million foreign visitors in 2023, and had a revenue goal of US$71 billion.

Challenges:

- Regulatory Compliance: Managing change in government regulations and licensing requirements presents a primary challenge to the e-hailing market in Thailand.

Thailand E-hailing Market Regional Analysis

- Bangkok: Bangkok’s e-hailing market is growing because of heavy traffic, high smartphone usage, and urban population growth. Consumers prefer convenient, app-based rides. This has made ride-hailing services dominate daily commuting.

Thailand E-hailing Market Competitive Landscape

The market has many notable players, including Uber Technologies Inc., Grab, Bolt, Indrive, among others.

- Collaboration: In June 2025, AION Y Plus ride-hailing fleet's handover ceremony was grandly held at the GAC Phatthanakan Service Center in Bangkok. The first batch of 100 vehicles was officially handed over, marking the initiation of a project designed to reach 2,000 units.

- Partnership: In May 2024, Auto Drive EV announced a strategic partnership with Grab Thailand to launch the "Electric Taxi Rental Project" to provide options for traditional taxi and ride-hailing drivers to rent electric taxis to offer on-demand transportation service using the Grab application.

Thailand E-hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Thailand E-Hailing Market Size in 2025 | USD 1.450 billion |

| Thailand E-Hailing Market Size in 2030 | USD 1.450 billion |

| Growth Rate | CAGR of 5.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Bangkok, Chiang Mai, Pattaya, and Others |

| List of Major Companies in the Thailand E-hailing Market |

|

| Customization Scope | Free report customization with purchase |

Thailand E-hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End User

- Personal (B2C)

- Corporates (B2B)

- By City

- Bangkok

- Chiang Mai

- Pattaya

- Others

Our Best-Performing Industry Reports:

Navigation:

- Thailand E-hailing Market Key Highlights:

- Thailand E-hailing Market Overview & Scope

- Top Trends Shaping the Thailand E-hailing Market

- Thailand E-hailing Market Growth Drivers vs. Challenges

- Thailand E-hailing Market Regional Analysis

- Thailand E-hailing Market Competitive Landscape

- Thailand E-hailing Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 8, 2025