Report Overview

USA E-Hailing Market - Highlights

USA E-Hailing Market Size:

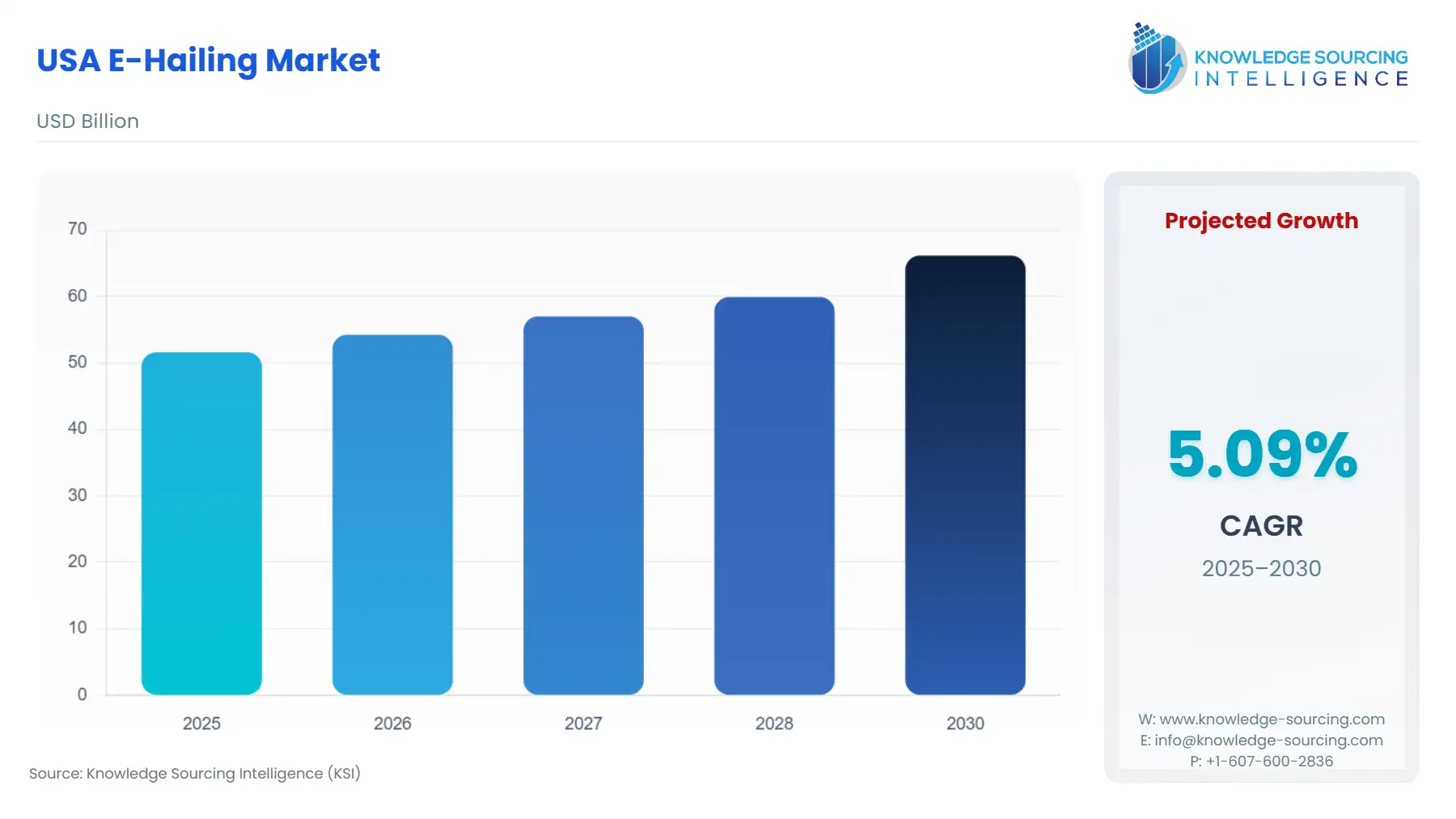

USA E-Hailing Market, with a 5.09% CAGR, is anticipated to rise from USD 51.627 billion in 2025 to USD 66.182 billion by 2030.

The USA have a very large e-hailing market, and it is expected to be growing robustly during the coming years. The huge market is due to strong urban demand, widespread technology adoption, and shifting consumer preferences. The presence of densely populated cities such as New York, Los Angeles, Chicago, and San Francisco drives the high volume of daily commutes and airport travel, significantly creating the demand for e-hailing. The market is expected to grow further in the coming years significantly, driven by rising cost of car ownership, cost-effective e-hailing services, and increasing consumer preferences for e-hailing.

USA E-Hailing Market Overview & Scope

The USA E-Hailing Market is segmented by:

- Service Type: By service type, the market is segmented into ride sharing, ride hailing and others. Ride sharing reduces costs and also promotes sustainability. On the other hand, a ride-hailing service is for exclusive use. There is growth of niche or emerging services as well, such as luxury ride service or air taxi bookings. Ride-hailing is one of the most common e-hailing services in the U.S., with platforms such as UberX and Lyft, driven by exclusive demand for safety as well a privacy.

- Device Type: By type of devices passengers use to access e-hailing services, the market is segmented into smartphones, tablets, and others, such as desktop computers or wearable devices. Smartphone is the most dominant market, driven by e-hailing service booking through apps, which is the most convenient way and can be done easily. Tablets are also used, but more particularly by corporates. Others' adoption is limited. Smartphones are the most dominant in the USA.

- Vehicle Type: Two-wheeler, three-wheeler, and four-wheeler are major types of vehicles used for e-hailing services, which affect cost, comfort, and capacity. Two-wheeler is gaining popularity in the U.S, while there are limited three-wheeler. Four-wheeler is the largest segment in the USA, driven by its features like space, comfort, safety, good for family rides, and business travel.

- End User: The market is segmented into personal and corporate as end-users. Personal users are individual users booking rides for daily commuting, social visits, or personal travel. Corporations use rides for employees, clients, or corporate events. The personal segment has the largest share due to the high demand for daily commuting.

- City: The market is segmented into New York City, Los Angeles, San Francisco, Chicago, Miami, Austin, Atlanta, and Boston. New York is the largest market due to its high population (8.26 million as of July 2023) and heavy reliance on private and public demand.

Top Trends Shaping the USA E-Hailing Market

- Shift towards electric vehicles and sustainability-focused rides

As the world is increasingly focusing on climate change and is improving its actions on sustainability, it is also driving the change in the E-hailing market. Companies are increasingly adopting EVs to reduce emissions and meet city regulations, aiming at broader climate change actions.

USA E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Heavy Urbanization and High-reliance on ride-hailing: One of the major factor for the huge market of e-hailing in the USA is the high urbanization, and high reliance on ride-hailing. 84% of the population in 2024 is in urban areas in the USA. Cities like New York, Los Angeles, Chicago, and San Francisco are highly populated areas. Here, residents and a large number of tourists prefer e-hailing for convenience. At the end of 2023, ridership data showed that across the United States passenger volumes reached 79% of pre-pandemic levels, owing to a huge 16% annual increase in trips (as per the UITP).

Challenges:

- Price-Sensitivity: The USA's broader travel market is facing travel costs rise. Introduction of congestion pricing in January 2025 in New York, along with regulatory fees, is impacting the travel cost. Many lower-income residents is facing affordability and accessibility issues in urban transportation, acting as a key challenge in the market growth.

USA E-Hailing Market Regional Analysis

- New York: New York is the largest market due to its high population (8.26 million as of July 2023) and heavy reliance on private and public demand. The city has a population density of 29,302.7, making it one of the densest major cities in the USA. An analysis by the Northern University has highlighted that NYC’s dense population, heavy commuting, and limited parking are the key factors driving the demand for ride-hailing apps like Uber and Lyft by tourists and residents. This demand see a huge surge in extreme weather or emergencies. Within NYC, Manhattan, Brooklyn, and airport connections (JFK, LaGuardia) generate the largest share of trips, particularly during peak hours, bad weather, and holiday seasons.

USA E-Hailing Market Competitive Landscape

The market is dominated by a few key players such as Uber Technologies, Inc., and Lyft, Inc. The market also has the presence of several niche players. Some of the major ride-hailing companies in the U.S. include Uber Technologies Inc., Lyft Inc., Waymo LLC, Curb Mobility, LLC, Via Transportation, Inc., Suol Innovation Ltd., Wingz, Inc., Blacklane GmbH, Moovn Technologies LLC, and Gett Taxi Limited. The market is highly competitive, and has high barriers to entry and intense rivalry on pricing.

- Product Innovation: In March 2024, Curb launched the “Curb Journey Connect”. It is a 360-degree media solution combining in-app, post-ride, and in-vehicle advertising (TaxiTV). The product update improves the Curb Rider APP UL which will help in user engagement and retention as it offers easy navigation.

- Product Launch: In April, 2024, Ivee and Creative Mobile Technologies, LLC (CMT) announced the “Smart Taxi,” which will provide passengers with a personalized, engaging, and authentic experience during their ride.

USA E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| USA E-Hailing Market Size in 2025 | USD 51.627 billion |

| USA E-Hailing Market Size in 2030 | USD 66.182 billion |

| Growth Rate | CAGR of 5.09% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | New York City, Los Angeles, San Francisco, Chicago, Miami, Austin, Atlanta, Boston, and Others |

| List of Major Companies in the USA E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

USA E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By City

- New York

- Los Angeles

- San Francisco

- Chicago

- Miami

- Austin

- Atlanta

- Boston

- Others