Report Overview

France Electric Vehicle Powertrain Highlights

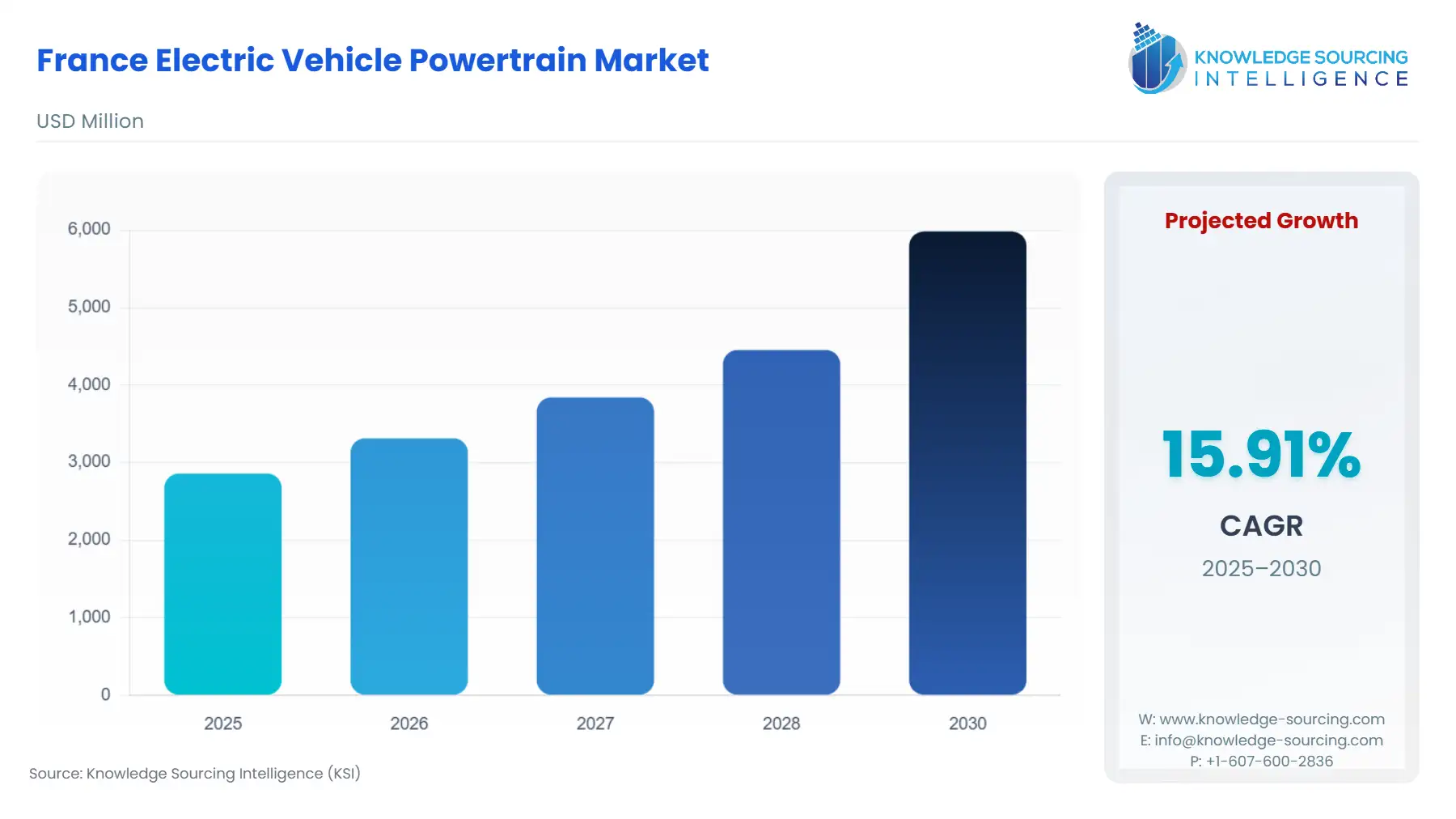

France Electric Vehicle Powertrain Market Size:

The France Electric Vehicle Powertrain Market is expected to advance at a CAGR of 15.91%, attaining USD 5.983 billion in 2030 from USD 2.86 billion in 2025.

The French EV powertrain market is fundamentally shaped by a national industrial strategy aimed at creating a sovereign, low-carbon automotive value chain. Government policy, particularly the shift to an environmentally-conditioned bonus system, actively manages consumer purchase incentives to promote domestically and European-produced electric vehicles. This regulatory push, combined with significant capital investments by major OEMs into local production capabilities for components like e-motors and power electronics, forces an accelerated transformation of the traditional automotive manufacturing base into a hub for electric mobility hardware. The resulting dynamic positions France not merely as a consumer market, but as a critical production nucleus within the broader European electrification mandate.

France Electric Vehicle Powertrain Market Analysis:

- Growth Drivers

The primary factor propelling the growth of the French EV powertrain market is the regulatory pressure from the EU's average CO2 emissions ceiling for new vehicles. This standard compels OEMs to rapidly increase their mix of zero- and low-emission vehicles to avoid substantial fines, translating directly into a mandatory, sustained demand for BEV and PHEV powertrain components. Furthermore, the expansion of the public charging infrastructure—with a growth of over 50% in fast-charging points in 2024—alleviates range anxiety. This enhanced network increases the utility and convenience of electric vehicles, effectively creating additional end-user demand for vehicles, which in turn necessitates a higher volume of electric powertrains.

- Challenges and Opportunities

A critical challenge is the cost disparity between locally manufactured European batteries and cheaper imported units from third countries, which places a financial constraint on the final pricing of French-assembled electric vehicles. These dynamic limits the potential demand for domestic BEV powertrains by reducing their competitive edge in the cost-sensitive segments. Conversely, an immense opportunity lies in the commercial vehicle segment's electrification. Government support for fleet electrification and the imposition of Crit'Air low-emission zones in urban areas are driving logistics companies to transition their fleets, creating a robust, yet-to-be-fully-captured demand for heavy-duty electric powertrains and commercial vehicle-specific Battery Management Systems (BMS).

- Raw Material and Pricing Analysis

The EV powertrain market, a physical product, is acutely exposed to global raw material supply chain dynamics. Powertrain components, particularly the battery pack, rely on processed critical minerals such as lithium, nickel, and cobalt. The European continent's low domestic extraction and processing capacity for these materials means French manufacturers must primarily rely on imports, subjecting them to geopolitical price volatility. For instance, price spikes following geopolitical events, such as the 2022 nickel price surge, directly increased the raw material cost component of battery packs. This pricing pressure compresses OEM margins or necessitates a pass-through to the consumer, which can negatively impact final vehicle demand.

- Supply Chain Analysis

The French EV powertrain supply chain exhibits an increasing trend toward regionalized sourcing, catalyzed by the European preference policies. While battery cells often originate from Asia, final assembly of battery modules and packs is moving to French gigafactories. Key production hubs for e-motors are concentrated in France at sites like Trémery and Cléon, which serve as logistical anchors for the final assembly lines of domestic OEMs. The supply chain's complexity arises from the interdependence on specialized power electronics from Asian vendors, creating a critical dependency for components like inverters and DC/DC converters, which introduces logistical risk and potential bottlenecks.

France Electric Vehicle Powertrain Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

France |

Ecological Bonus/Malus System (ADEME) |

The system increasingly ties subsidies (bonus) to a vehicle's production carbon footprint, primarily favoring European-made vehicles. This directly increases demand for domestic powertrain components by making eligible EVs more financially attractive to buyers, while making non-eligible imports less competitive. |

|

France |

Loi d'orientation des mobilités (LOM) |

Sets the long-term strategic direction, including the legal objective to end the sale of new fossil-fuel passenger and light commercial vehicles by 2040. This creates a non-negotiable, long-term demand forecast for EV powertrains, justifying OEM investment in local capacity. |

|

EU |

CO2 Emissions Standards for Cars and Vans |

Mandates a progressive reduction in fleet-wide average CO2 emissions. This top-down pressure forces OEMs to accelerate their model transition, creating an immediate, mandatory demand for EV powertrains to meet compliance targets. |

France Electric Vehicle Powertrain Market Segment Analysis

- By Propulsion Type: Battery Electric Vehicle (BEV) Powertrain

The BEV segment constitutes the foundational long-term growth driver, yet its short-term growth is inherently linked to public policy stability and infrastructure maturity. The need for BEV powertrains is specifically driven by the corporate fleet market, where companies benefit from significant tax exemptions and are often required to comply with internal or municipal decarbonization mandates. The adoption of the newer, more efficient ePT-160kW synchronous motor (developed without rare earths for some models) demonstrates a technological push to secure supply and reduce production costs, which directly enhances the commercial viability and therefore the demand for French-produced BEV powertrains. Any national policy that increases BEV charging accessibility, such as dedicated fast-charging corridors or simplified residential installations, is a direct catalyst for increased BEV powertrain demand.

- By Vehicle Type: Commercial Vehicle Powertrain

The Commercial Vehicle (CV) powertrain segment is experiencing a structural increase, primarily driven by the regulatory shift in urban logistics. The implementation of Low Emission Zones (ZFE-m) in major French metropolitan areas restricts the circulation of higher-polluting vehicles, creating an existential need for businesses operating last-mile delivery fleets to adopt electric vans and trucks. This segment requires robust, high-torque electric motors, larger battery packs, and specialized thermal management systems to sustain high operational uptime and arduous duty cycles. Furthermore, the French government's targeted purchase incentives for electric trucks and LCVs directly subsidizes the initial high investment cost, thereby accelerating fleet renewal and creating a segmented, high-value demand for the specific attributes of commercial EV powertrains.

France Electric Vehicle Powertrain Market Competitive Analysis:

The French EV powertrain market is dominated by two domestic OEMs—Stellantis and Renault Group—whose industrial strategies dictate the core demand for local component manufacturing. Both groups are actively pursuing vertical integration and regionalization to secure their supply chains and benefit from European incentives.

- Stellantis is strategically positioned through its dedicated joint ventures and internal capabilities, focusing on achieving a massive scale for core components. The company's goal to surpass one million e-motor production capacity annually at the Trémery plant by 2024 solidifies its control over a critical powertrain element. Furthermore, their collaboration with CEA (Commissariat à l'énergie atomique et aux énergies alternatives) on next-generation battery cell technology, announced in July 2024, is a forward-looking step to reduce long-term dependency on external battery design and processing, thereby enhancing the sovereignty and cost-competitiveness of their complete EV powertrain.

- Renault Group is leveraging its industrial heritage, transforming sites like the Cléon plant into a major electric motor production center. The Cléon facility, with an investment of €620 million since 2018, aims to produce over one million electrified motors per year from 2024, including the ePT-160kW motor, which notably uses a wound rotor synchronous technology that avoids the use of rare earth elements. This technological choice provides a strategic advantage by mitigating the supply chain risk and cost volatility associated with rare earth mineral dependency, directly supporting the sustained demand for their in-house powertrain solutions.

France Electric Vehicle Powertrain Market Developments:

- July 2024: Stellantis announced a five-year collaboration with France's CEA to pursue the in-house design of next-generation battery cells for electric vehicles, focusing on higher performance and lower carbon footprint to support the Dare Forward 2030 strategy.

- December 2024: Stellantis announced the ramp-up of its all-new M3 electric vehicle motor production at the Trémery manufacturing plant in France, with a production capacity expected to reach more than one million electric motors per year by 2024.

- July 2022: Renault Group inaugurated a new production line for the ePT-160kW electric motor at the Cléon plant, part of a €620 million investment since 2018, expanding the plant's electrified motor production capacity to over one million units per year from 2024.

France Electric Vehicle Powertrain Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.86 billion |

| Total Market Size in 2031 | USD 5.983 billion |

| Growth Rate | 15.91% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Propulsion Type, Vehicle Type |

| Companies |

|

France Electric Vehicle Powertrain Market Segmentation:

- BY COMPONENT

- Battery Pack

- Transmission

- Power Electronics

- Battery Management System

- Thermal Management System

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- BY VEHICLE TYPE

- Passenger Car

- Commercial Vehicle

- Others