Report Overview

Frozen Food Market Report, Highlights

Frozen Food Market Size:

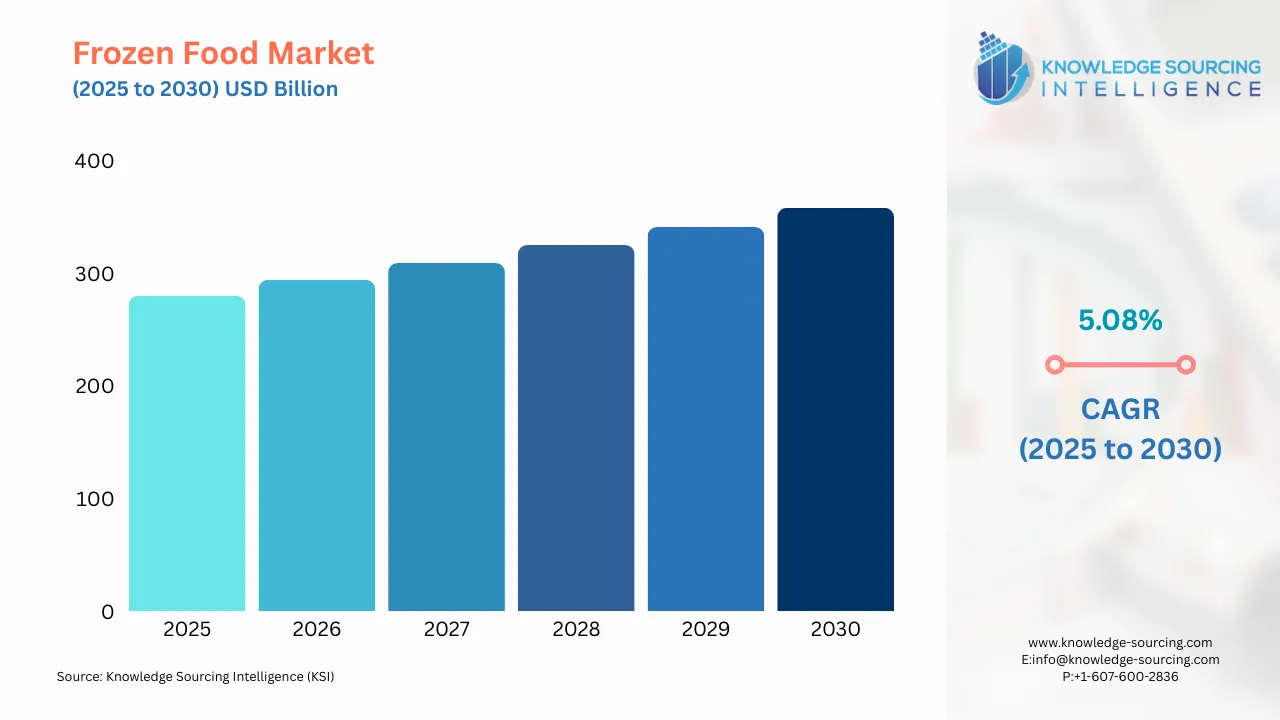

The frozen food market is expected to grow from USD 279.741 billion in 2025 to USD 358.461 billion in 2030, at a CAGR of 5.08%.

Frozen foods are stored at low temperatures to significantly extend their shelf life, making them ideal for long-term use. With fast-paced lifestyles, especially among young professionals, frozen food has become increasingly popular due to its convenience and longevity. These products require minimal preparation, with many ready-to-eat options available in seconds.

The year-round accessibility of seasonal produce and rising disposable incomes are key drivers of growing demand in the frozen food market. Additionally, there's a rising preference for clean-label foods, prompting manufacturers to adopt eco-friendly and sustainable packaging solutions to meet consumer expectations.

Frozen Food Market Growth Drivers:

- Increasing Investments in the Food Sector

Major companies are increasing their production capacity, signaling strong market growth and confidence in the frozen food industry. For example, in February 2022, Tyson Foods announced a $355 million investment to build a new facility in Bowling Green. This facility now produces items for popular brands like Jimmy Dean and Wright Brand, which offer a diverse range of refrigerated and frozen foods. Such strategic investments highlight the rising demand and expanding opportunities within the frozen food market.

- Increasing Demand for Convenience Food

According to World Bank estimates, nearly two-thirds of the global population resides in urban areas, with urbanization expected to continue rising. This shift is increasing the global demand for convenient food solutions. Additionally, World Bank data shows that female labor force participation rose from 46% in 2020 to 47% in 2022, indicating a growing segment with limited time for cooking. Frozen foods offer a practical solution, easy to store, quick to prepare, and ideal for busy lifestyles. These factors are key drivers behind the projected growth of the frozen food market in the coming years.

Frozen Food Market Geographical Outlook:

- Europe is Expected to Grow Considerably

Europe is expected to hold a significant share of the frozen foods market during the forecast period. The United Kingdom is expected to hold a substantial share of the market owing to rising consumer awareness about the benefits of frozen food, which is the major factor contributing to the increasing demand during the forecast period. According to estimates from the British Frozen Food Federation (BFFF), there is growth in the post-pandemic phase in 2021 in various frozen food categories in the UK market, such as ice cream, fish, meat, and poultry. This indicated favorable prospects for the frozen food market till the forecast period.

- Japan is the Largest Importer of Frozen Foods in Asia

The total import value of Japan's frozen vegetables was US$940 million in 2021, making the country the world's second-largest importer of frozen vegetables. The major part of the frozen vegetables exported from China is US$549 million. Countries such as the U.S., Thailand, Chinese Taipei, and Ecuador also played a major role. As per a survey released by the Japan Frozen Food Association on frozen food with 1,250 Japanese people, the survey indicated that 88% of females used frozen foods to prepare meals for their families. And approximately 80% of the men used frozen foods. Hence, the easy convenience of making food is driving the market for frozen food. The change in eating habits, the presence of dual income, and various options available also provide an edge for market growth.

Frozen Food Market Key Developments:

- In June 2023, Unilever PLC, a key market player in frozen food in the UK, agreed to acquire Yasso Holdings, Inc., a frozen food brand in the United States. This agreement is expected to address the growing consumer demand for healthier & different varieties of frozen snacks.

- In April 2022, Nomad Food partnered with Innoget to develop a clean-label paper-based packaging for their frozen food. Such innovative steps by the companies are also driving the market for frozen food.

- In September 2021, Norman Foods, a major supplier of Frozen food in the UK, completed its acquisition of Fortenova Group for around Euro 615 million to expand its frozen food business across different countries of Europe, such as Hungary, Bosnia, Slovenia, Serbia, among others.

List of Top Frozen Food Companies:

- General Mills

- Unilever

- Nestle SA

- Tyson Foods

- Nomad Foods Ltd.

Frozen Food Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Frozen Food Market Size in 2025 | USD 279.741 billion |

| Frozen Food Market Size in 2030 | USD 358.461 billion |

| Growth Rate | CAGR of 5.08% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Frozen Food Market |

|

| Customization Scope | Free report customization with purchase |

Frozen Food Market Segmentation:

- By Type

- Raw Material

- Half-Cooked

- Ready to Eat

- By Product

- Frozen fruits and vegetables

- Frozen meat and poultry

- Frozen seafood

- Frozen ready meals

- Frozen desserts

- Frozen snacks

- Others

- By Distribution Channel

- Offline

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Online Channels

- Offline

- By End-User

- Food Service

- Residential

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Frozen Food Market Size:

- Frozen Food Market Key Highlights:

- Frozen Food Market Growth Drivers:

- Frozen Food Market Geographical Outlook:

- Frozen Food Market Key Developments:

- List of Top Frozen Food Companies:

- Frozen Food Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 19, 2025