Report Overview

Germany Electric Vehicle Battery Highlights

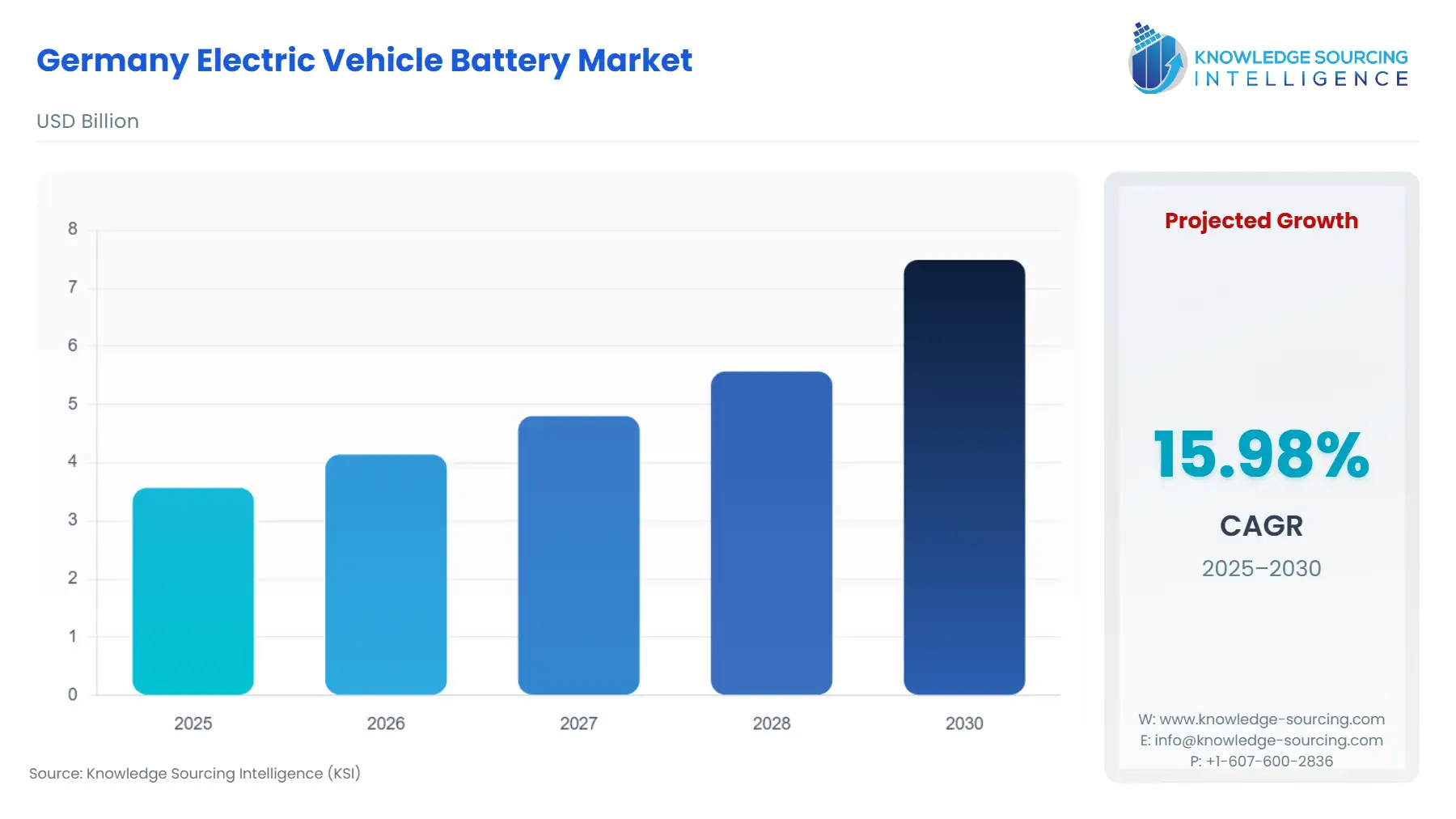

Germany Electric Vehicle Battery Market Size:

The Germany Electric Vehicle Battery Market is forecast to grow at a CAGR of 15.98%, reaching USD 7.491 billion in 2030 from USD 3.569 billion in 2025.

The German Electric Vehicle Battery Market serves as the critical enabler for Europe's largest automotive sector transition. Its dynamics are uniquely defined by an intersection of pioneering domestic automotive production, complex raw material sourcing dependencies, and an evolving regulatory landscape aimed at fostering a circular economy. The market's central function is to supply high-performance lithium-ion cells and packs for a rapidly electrifying vehicle fleet, driven by organic consumer pull and more by OEM production mandates, fleet electrification targets, and the necessity to secure localized, resilient battery supply chains.

Germany Electric Vehicle Battery Market Analysis

- Growth Drivers

The structural shift by Germany's dominant automotive manufacturers from internal combustion engine (ICE) production to Battery Electric Vehicles (BEV) is the singular, most powerful growth catalyst. German EV production accounted for nearly 50% of the European total in 2023, creating a massive, concentrated demand pool for high-capacity battery packs. The imperative to meet the ambitious production volumes of new electric vehicle platforms directly dictates procurement volumes and specifications for German EV battery suppliers. Furthermore, major OEMs, notably the Volkswagen Group, have explicitly committed to strategic initiatives, such as the 'Unified Cell' concept, designed to drive down battery system costs significantly below €100 per kilowatt-hour. This focus on cost parity accelerates the adoption of BEVs and, by extension, propels the sustained demand for cost-optimized battery architectures like the prismatic cell format.

- Challenges and Opportunities

A significant immediate challenge to battery demand stems from the German government's decision to cease the national purchase subsidies for BEVs at the end of 2023. This policy reversal led to a deceleration in new BEV registrations in early 2024, creating a near-term headwind that reduces the immediate pull-demand for new battery packs from domestic sales. An opportunity, however, emerges from the technological roadmap toward Solid-state batteries (SSBs). SSBs offer higher energy density and improved safety characteristics over traditional Lithium-ion batteries. The German market, driven by its premium and high-performance automotive segments, demonstrates a high-growth trajectory for next-generation chemistries, with projected compound annual growth rates for solid-state segments exceeding 30% through 2035. This technological pivot presents a significant opportunity for companies focusing on advanced material science and cell manufacturing in Germany.

- Raw Material and Pricing Analysis

As a physical product, the EV battery market is fundamentally exposed to raw material supply chain volatility. Prices for key battery metals, including lithium, cobalt, and nickel, experienced significant volatility in 2023, though a subsequent oversupply led to a nearly 14% fall in the average battery pack price between 2022 and 2023. While lower commodity prices decrease battery pack production costs, thereby making the final EV more affordable and stimulating consumer demand, the supply remains geographically concentrated. For instance, in 2023, battery demand for lithium stood at approximately 140 kilotons, accounting for 85% of the total lithium requirement. Germany, lacking substantial domestic primary mining capacity, is entirely reliant on global sourcing and strategic partnerships to secure its material pipeline, tying the competitiveness of German-produced batteries to global commodity price fluctuations.

- Supply Chain Analysis

The German EV battery supply chain is characterized by a global dependency on raw materials and a rapid drive toward regional cell manufacturing. The core dependency lies on Asian suppliers, who command a substantial share of global battery cell production. Europe's largest battery producers are Poland and Hungary, which collectively accounted for a majority of regional EV battery production in 2023, while Germany leads in EV manufacturing. The logistical complexity involves shipping vast quantities of cells from these central European hubs and non-European production sites to German assembly plants, which adds cost and vulnerability. The primary dependency is shifting, however, as companies like Contemporary Amperex Technology Thuringia GmbH (CATL) in Arnstadt commence localized cell production. This localization strategy is designed to mitigate geopolitical risks and reduce freight logistics costs, making the German automotive manufacturing base more resilient.

Germany Electric Vehicle Battery Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Germany |

The German Battery Act (BattG) |

Implements the EU Battery Directive's Extended Producer Responsibility (EPR). Directly creates demand for certified take-back and recycling systems, driving investment in end-of-life battery processing and second-life applications. |

|

Germany |

End of Umweltbonus (Purchase Subsidies, Dec 2023) |

The abrupt termination of the subsidy directly led to a decline in new BEV registrations in the short term, dampening consumer demand for new EV battery packs. |

|

European Union |

New EU Batteries Regulation (EU 2023/1542) |

Mandates minimum recycled content targets and establishes a 'Battery Passport' for tracking and sustainability. This forces manufacturers operating in Germany to invest in advanced traceability technology and secure a circular supply of secondary raw materials, thereby shaping future battery design and production processes. |

Germany Electric Vehicle Battery Market Segment Analysis:

- By Technology: Lithium-ion

The Lithium-ion (Li-ion) segment remains the established incumbent, accounting for over 95% of all EV battery packs sold, a fact that cements its dominance in the German market. The necessity for Li-ion cells, specifically those using Nickel Manganese Cobalt (NMC) or Nickel Cobalt Manganese (NCM) chemistries, is driven by their proven high-energy density and performance characteristics, which are non-negotiable for German automotive OEMs focused on premium and long-range vehicles. The continuous advancements in Li-ion technology, including improved thermal management and enhanced charging speeds, further reinforce its position. The growth driver is fundamentally tied to the sheer volume of EV production. For example, the segment's growth trajectory is explicitly supported by German manufacturers' preference for NCM chemistry, which offers the optimal balance for high-performance applications. Any short-term dip in EV sales is absorbed by the vast installed manufacturing capacity and the necessity for global production to fulfill exports.

- By Vehicle Type: Passenger Cars

The Passenger Cars segment is the overwhelming consumer of EV batteries in Germany, reflecting the country's central role as a global powerhouse for passenger vehicle manufacturing and export. The segment’s growth is driven by the mandate of European fleet emission standards and intense OEM-led model proliferation across all vehicle classes, from compact city cars to luxury SUVs. The increasing average battery size in new passenger cars—partly due to the rising market share of larger SUV models—creates a demand multiplier, pushing up the total GWh required even if the unit volume of cars remains constant. The German government's tax-free exemption for BEVs registered by the end of 2025 further stimulated corporate and private leasing models, thereby creating a sustained and predictable demand pipeline for high-voltage battery packs in the passenger car segment.

Germany Electric Vehicle Battery Market Competitive Analysis:

The German EV battery market’s competitive landscape is defined by the strategic presence of international giants and the vertical integration efforts of domestic automotive conglomerates. The primary competition exists in securing long-term supply agreements and localized production capacity.

- Contemporary Amperex Technology Co. Limited (CATL): The Chinese battery giant established a significant footprint in Europe with its gigafactory in Arnstadt, Germany. The company’s strategic positioning is to be a close-proximity supplier to major European OEMs, including the Volkswagen Group. CATL's official commencement of cell production in Germany in 2023 is a direct response to the demand for local supply chain resilience, allowing OEMs to reduce geopolitical risk and logistical costs.

- Volkswagen Group: The German automotive titan is aggressively pursuing vertical integration through its proprietary battery strategy announced on its 'Power Day.' Volkswagen plans to build a total of six gigafactories with partners across Europe, with the first in Germany and Sweden, aiming for a total production capacity of 240 GWh by 2030. This strategy, centered around the 'Unified Cell' format, is designed to bring 80% of its vehicles onto a single, standardized cell architecture, which is an aggressive move to control intellectual property, secure supply, and dramatically reduce cost.

Germany Electric Vehicle Battery Market Developments:

- TotalEnergies Launches Six New Battery Storage Projects in Germany (March 2025): TotalEnergies, via its affiliate Kyon Energy, announced investment decisions for six battery storage projects totalling 221 MW in Germany, with most batteries supplied by its affiliate Saft. While primarily focused on grid energy storage, this development is a capacity addition in advanced battery systems using German-produced cells and strengthens the overall advanced battery manufacturing ecosystem in the country.

- Northvolt Receives State Aid Approval in Principle for Heide Gigafactory (May 2023): The German Federal and State governments announced plans to support the establishment of Northvolt’s 60 GWh battery cell gigafactory in Heide, Schleswig-Holstein. This strategic investment, which will use the Temporary Crisis and Transition Framework (TCTF), aims to unlock a multi-billion Euro private investment, securing a key part of the European value chain against global competition.

- CATL Commences Cell Production in Arnstadt, Germany (December 2022): Contemporary Amperex Technology Co. Limited (CATL) announced the production of the first battery cells at its German factory in Thuringia. This capacity addition significantly increases the localized cell supply for European customers and marks a major step in fulfilling local content requirements for German-manufactured EVs.

Germany Electric Vehicle Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.569 billion |

| Total Market Size in 2031 | USD 7.491 billion |

| Growth Rate | 15.98% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Battery Type, Propulsion, Cell Form, Vehicle Type |

| Companies |

|

Germany Electric Vehicle Battery Market Segmentation:

- BY BATTERY TYPE

- Lithium Ion

- Solid-state

- Lead-Acid

- Hybrid Nickel Metal

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY BATTERY CELL FORM

- Cylindrical cells

- Prismatic cells

- Others

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Others