Report Overview

Germany Electric Vehicle Powertrain Highlights

Germany Electric Vehicle Powertrain Market Size:

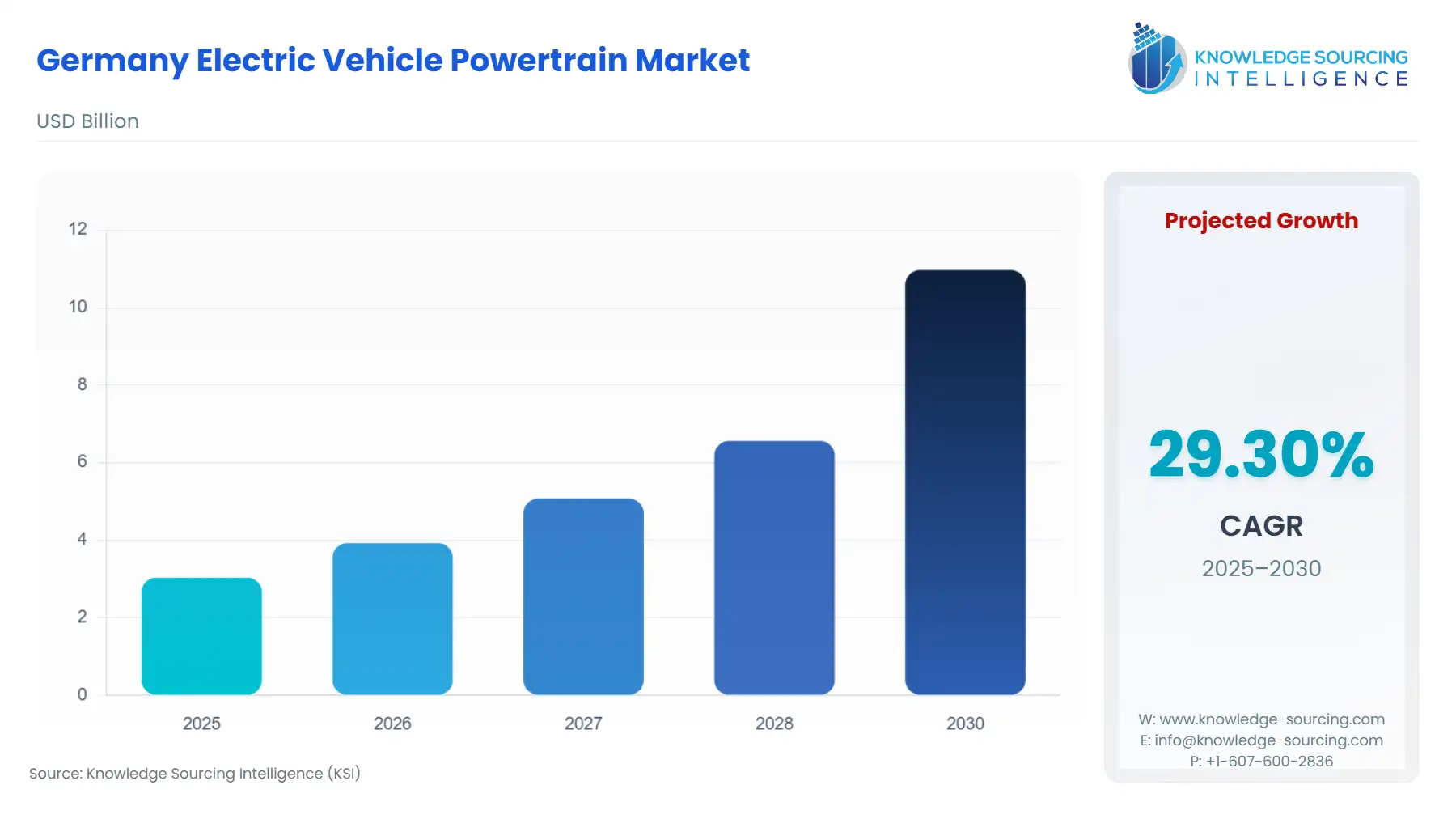

The Germany Electric Vehicle Powertrain Market is projected to expand significantly at a CAGR of 29.30%, climbing to USD 10.97 billion in 2030 from USD 3.035 billion in 2025.

Following a decade of robust growth, the German Electric Vehicle (EV) powertrain market entered a period of recalibration, marked by a sharp contraction in new battery-electric vehicle registrations in 2024. This segment, which relies entirely on integrated electric powertrains, experienced a significant year-on-year sales decline following the withdrawal of government incentives. Despite this immediate headwind, the market structure remains fundamentally electric-centric, with BEVs retaining a dominant share of electrified vehicle registrations. The long-term trajectory is being shaped by ambitious governmental targets, the necessity for a localized supply chain, and the domestic automotive industry's strategic pivot toward advanced, high-efficiency powertrain architectures, such as 800-volt systems. The current challenge for industry stakeholders lies in navigating this transitional demand fluctuation while maintaining aggressive investment in advanced manufacturing capacity.

Germany Electric Vehicle Powertrain Market Analysis:

- Growth Drivers

Stringent EU and national carbon dioxide (CO2?) emission targets act as a primary catalyst, compelling German Original Equipment Manufacturers (OEMs) to escalate the production volume of low and zero-emission vehicles. This regulatory pressure directly increases the procurement demand for all core powertrain components—electric motors, power electronics, and high-voltage battery packs—as OEMs must meet fleet-wide CO2? average targets to avoid substantial financial penalties. Furthermore, the comprehensive rollout of the Deutschlandnetz, a federally funded program to expand the fast-charging infrastructure, alleviates one of the core concerns of range anxiety for consumers. This improved infrastructure directly stimulates consumer confidence and adoption of BEVs, translating directly into sustained demand for high-performance powertrain systems capable of 800V architecture and High-Power Charging (HPC) capabilities.

- Challenges and Opportunities

The primary challenge constraining expansion is the elevated upfront cost of electric vehicles, a factor acutely amplified by the sudden cessation of federal subsidies in late 2023. This withdrawal immediately rendered BEVs comparatively more expensive, leading to a demonstrable decline in private purchases and slowing overall market penetration. Concurrently, a significant market opportunity lies in the development and industrialization of next-generation integrated powertrains. The transition to advanced silicon carbide (SiC) power electronics enables the production of more efficient and compact e-axle systems. Companies capable of vertically integrating SiC technology and delivering 800V-capable components will capture increased market share by allowing OEMs to reduce vehicle cost, improve driving range, and satisfy consumer demand for faster charging.

- Raw Material and Pricing Analysis

The EV powertrain, being a physical product centered on the high-voltage battery pack, is critically dependent on strategic raw materials like nickel, cobalt, lithium, and natural graphite. While global deposits of these materials exceed projected demand, Europe possesses limited indigenous resources, creating significant supply chain dependency on refining countries like China. This dependency introduces geopolitical risk and price volatility, directly impacting the manufacturing cost of the battery pack, the most expensive powertrain component. The necessity for battery-grade nickel, a material essential for high-energy-density cells favored by German premium automakers, is particularly robust. The growing push to expand European refining capacity for lithium is a strategic effort to enhance regional supply chain resilience, aiming to stabilize long-term material pricing and, consequently, the final price of the battery pack.

- Supply Chain Analysis

The German EV powertrain supply chain exhibits an increasing trend toward regionalization and vertical integration but remains globally dependent. Core components, especially power electronics and battery cells, rely heavily on production hubs in Asia. German Tier-1 suppliers maintain lead-plant roles for e-axle assembly and system integration within Europe, leveraging proximity to domestic OEMs. A critical logistical complexity is the transportation of large, heavy battery packs, necessitating localized production near assembly plants to mitigate high transport costs and environmental risks. The supply chain dependency on specific materials and refining processes poses a vulnerability that regulatory actions, such as the EU's Critical Raw Materials Act, are attempting to mitigate through domestic investment and diversification strategies.

Germany Electric Vehicle Powertrain Market Government Regulations:

The regulatory environment actively shapes the demand and technical specifications for the German EV powertrain market.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Germany / EU |

Emission Standards |

Mandates the progressive reduction of fleet-average CO2? emissions for new vehicles, which acts as a non-negotiable floor for EV production, directly increasing OEM demand for electric powertrains to meet compliance targets. |

|

Germany |

Fast Charging Act (SchnellLG) |

Requires a comprehensive, high-power public charging network (Deutschlandnetz). This regulatory push drives OEM demand for 800V powertrain architectures and compliant charging components to ensure system interoperability and fast-charging capability. |

|

Germany / EU |

Battery Regulation (2023) |

Establishes requirements for battery sustainability, including mandatory minimum recycled content targets for critical materials. This regulation directly influences the procurement strategy for the Battery Pack component, shifting demand toward suppliers who can prove robust material traceability and recycling infrastructure. |

Germany Electric Vehicle Powertrain Market Segment Analysis:

- By Propulsion Type: Battery Electric Vehicle (BEV)

The BEV segment commands the most significant portion of the German EV market, accounting for 68% of the electrified vehicle volume in 2024. The growth driver for BEV powertrains is the segment’s unique, total reliance on all-electric systems, requiring high-specification components not needed by hybrid alternatives. The market is specifically centered on single-unit, highly integrated e-axles, multi-cell battery packs, and sophisticated Battery Management Systems (BMS) to maximize range and performance. Government and municipal incentives that previously prioritized purely zero-emission transport further accelerated this demand. The market now mandates continuous performance improvements in the BEV powertrain to overcome the affordability gap post-subsidy withdrawal, driving OEM preference for suppliers offering superior efficiency, lighter weight, and scalability across multiple vehicle platforms.

- By Vehicle Type: Passenger Car

The passenger car segment is the undisputed volume driver for the entire German EV powertrain market. This segment’s expansion is dictated by private consumer purchasing power, tax incentives for company fleets, and a strong preference for domestic premium and mid-range electrified models. The market profile is highly differentiated, spanning small BEV powertrains for urban commuters to high-power, dual-motor e-axle systems for performance-oriented premium SUVs. Fleet electrification mandates from large German corporations are a significant demand catalyst, favoring cost-efficient and reliable powertrains that offer favorable Total Cost of Ownership (TCO). This high-volume segment necessitates a scalable, modular component supply, pushing Tier-1 suppliers to standardize interfaces and maximize parts commonality across various vehicle classes to reduce final component cost.

Germany Electric Vehicle Powertrain Market Competitive Analysis:

The competitive landscape is dominated by large, established German Tier-1 suppliers and a growing presence of international specialists and domestic OEMs engaging in strategic vertical integration. Competition centers on delivering integrated, modular powertrain solutions that enhance system efficiency, power density, and cost-competitiveness.

- Robert Bosch GmbH: Positioned as a full-system provider, Bosch offers a comprehensive portfolio including power electronics, electric motors, and the integrated eAxle. Their strategy focuses on leveraging deep in-house domain expertise in controls and software to offer a highly scalable and adaptable eAxle system that can be quickly customized for various OEMs and vehicle types.

- Vitesco Technologies GmbH: Vitesco specializes in power electronics and electrification technologies, with a strong strategic focus on the e-axle and Battery Management Systems (BMS). The company’s positioning emphasizes the modularity and high-voltage capability of its components, directly addressing the industry trend toward 800V architectures.

- Volkswagen Group (Vertical Integration): The company represents the definitive vertical integration threat to traditional suppliers. Volkswagen is strategically building its own component manufacturing capabilities, particularly for battery cells and power electronics, to secure supply and reduce costs. This shift directly impacts demand for external suppliers for certain mass-market platform components.

Germany Electric Vehicle Powertrain Market Developments:

- July 2024: onsemi Secures Volkswagen Group SiC Supply Deal: onsemi, a power semiconductor supplier, announced a multi-year deal to be the primary supplier of a complete power box solution for Volkswagen Group’s next-generation traction inverter, based on their EliteSiC M3e platform. The agreement includes plans for onsemi to expand silicon carbide manufacturing in the Czech Republic, establishing an end-to-end European production facility, which secures a critical component supply for Volkswagen’s Scalable Systems Platform (SSP).

- July 2024: Daimler Truck Opens Battery Testing Center: Daimler Truck announced the opening of a state-of-the-art Battery Technology Center (BTC) in Mannheim, Germany, to focus on the research and development of lithium-ion batteries and related components, including the Battery Management System (BMS), for its electric truck and bus portfolio. This investment is a capacity addition that supports the future ramp-up of electric commercial vehicle production.

Germany Electric Vehicle Powertrain Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.035 billion |

| Total Market Size in 2031 | USD 10.97 billion |

| Growth Rate | 29.30% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Propulsion Type, Vehicle Type |

| Companies |

|

Germany Electric Vehicle Powertrain Market Segmentation:

- BY COMPONENT

- Battery Pack

- Transmission

- Power Electronics

- Battery Management System

- Thermal Management System

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- BY VEHICLE TYPE

- Passenger Car

- Commercial Vehicle

- Others