Report Overview

Global Allulose Market Size, Highlights

Allulose Market Size:

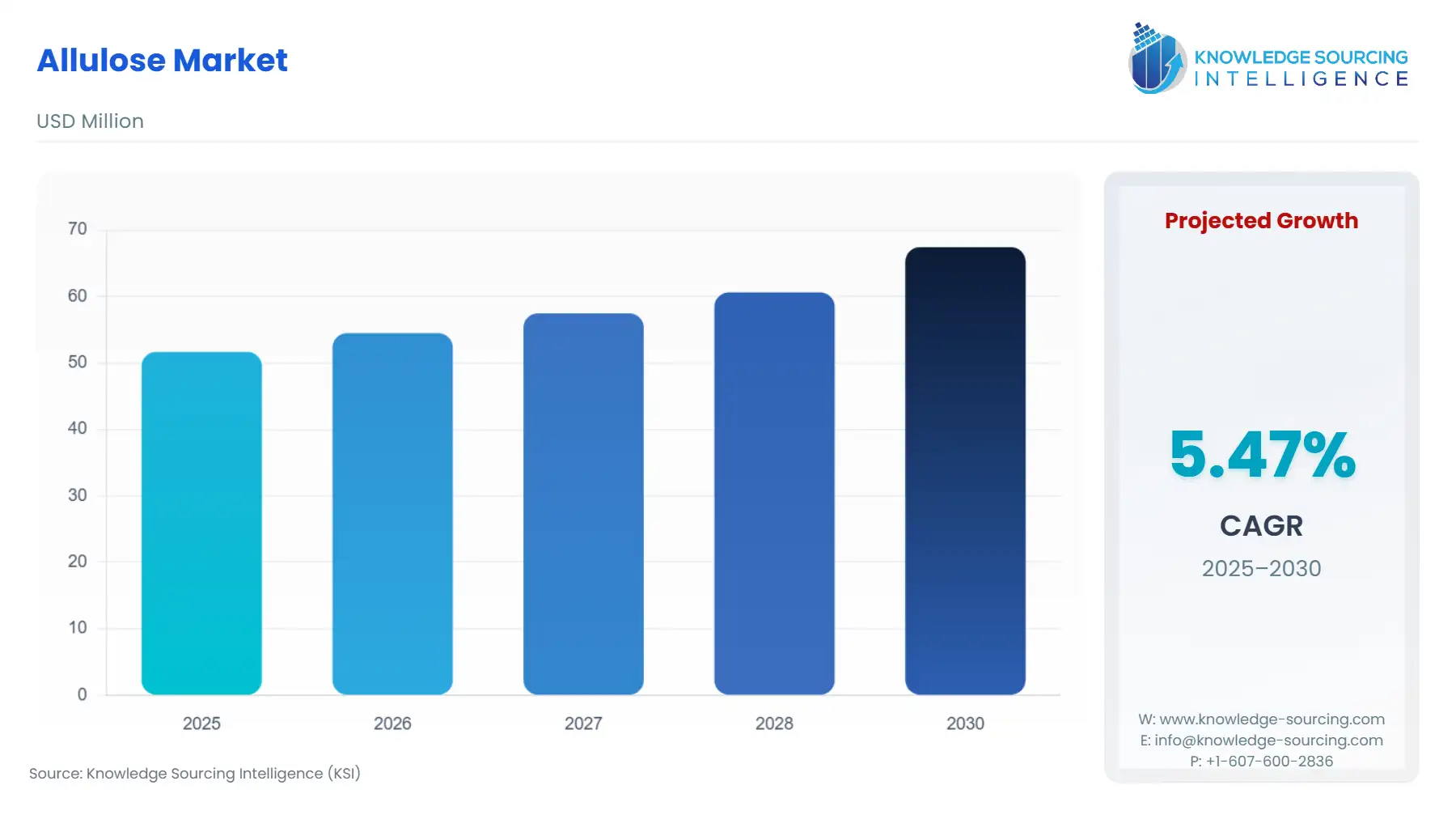

The global allulose market is anticipated to grow at a CAGR of 5.47% over the forecast period, increasing from USD 51.678 million in 2025 to USD 67.446 million by 2030.

The rising health-consciousness and increasing prevalence of obesity and health-related issues due to sugar intake are driving the demand for sugar alternatives, which in turn is leading to allulose market growth. The increasing demand for plant-based and functional food is driving the market. The rising product launches and product formulations propel the market. The market is witnessing advancements in production technology and growing demand in emerging markets. There is an increasing focus by the key players to advocate for regulatory support in the EU and the UK.

Allulose Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope

The Global Allulose Market is segmented:

- By Form: The global allulose market is segmented by powder, liquid, and crystal form. Powder Form holds the largest market share due to its wide usage in baking and dry mix products such as cookies, cakes, and protein bars. The liquid segment also has a significant share due to its usage in beverages and syrups. The crystal form is gaining traction in confectionery.

- By Industry: The global allulose market, by industry, is into food, beverage, pharmaceuticals, and others. The food industry is a key driver, as allulose is used widely, especially in bakery, confectionery, and dairy alternatives, driven by consumer preference for low-calorie and clean-label products.

- By Distribution Channel: The global allulose market, by distribution channel, is segmented into offline and online. Offline is segmented further into hypermarkets and others. The offline channel dominated the distribution channel.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America has a key market share, driven by consumer demand for keto, diabetic-friendly, and clean-label products and early FDA approval of allulose as GRAS. Europe has a slower adoption rate due to regulatory lag, while Asia-Pacific is an emerging market, particularly in Japan and South Korea.

Top Trends Shaping the Global Allulose Market

1. Emerging applications in pharmaceuticals

- Allulose, a rare low-calorie monosaccharide, is gaining popularity within the pharmaceutical sector due to several significant growth drivers. One of the leading reasons is its non-glycemic and non-insulinemic nature, thus presenting itself as a perfect sweetener and excipient in products for diabetic and metabolic disorder patients. As per the IDF Diabetes Atlas, in 2021, people with diabetes were 5,141.3 thousand in Spain, which is anticipated to increase to 5,576.0 thousand in 2030. Amongst this, Type 1 diabetes in children and adolescents was 9.7 thousand in 2021. Patients with diabetes mellitus (type 1 or 2) have a total lifetime risk of a diabetic foot ulcer complication as high as 25%.

- In addition to its role as an inert excipient, studies have shown that allulose could impart antioxidant, anti-inflammatory, and fat-reducing functionality. These properties make it an attractive additive in therapeutics targeting obesity, NAFLD, and metabolic syndromes. As the pharmaceutical industry moves toward the inclusion of ingredients that provide both therapeutic and formulation advantages, allulose fits with the trend of creating multifunctional health-supporting products.

2. The online distribution channel is growing

- The online distribution channel for the allulose industry is growing rapidly, led mostly by the worldwide growth in e-commerce and online health platforms. With consumers becoming more health-oriented and demanding easy availability of specialty ingredients, online channels have become an important sales channel for allulose, particularly within the nutraceutical, functional foods, and dietary supplement industries. In this regard, as of March 2022, e-commerce sales in Canada amounted to approximately US$2.34 billion, as stated by Statistics Canada. It is estimated that retail e-commerce sales in the nation will total US$40.3 billion by the end of 2025. The capacity to compare offerings, view extensive information, and see peer reviews online gives consumers the ability to make informed purchasing decisions, further fueling the demand.

- With further maturation in online platforms, the online distribution channel will become essential for expanding the allulose market globally.

Allulose Market Growth Drivers vs. Challenges

Opportunities:

- Rising awareness for sugar reduction in diets: One of the other key factors driving the allulose market is the increasing awareness among consumers to reduce their sugar intake, as it is leading to various health-related issues. The study by Ingredion incorporated highlighted that 64% of the consumers worldwide are trying to reduce their sugar intake for health reasons, 42% are trying to lose weight by sugar reduction, and 20% of the consumers are switching from full-calorie beverages to low- or no-calorie choices to limit or avoid sugars. This highlights the growing trend for sugar reduction. This trend is also significantly impacting the demand for sugar alternatives to fulfill the taste while reducing the adverse health impact of sugar, driving the market for allulose. Allulose has good sweetening features with low calories. For instance, the allulose sweetener offered by Cargill Inc. is 70% as sweet as sugar but has 90% fewer calories, providing 0.4 kilocalories per gram.

- Rising obesity and other health issues are driving demand: Most health professionals, nutrition experts, and regulatory agencies are looking for ways to reduce calories in the diet to improve the health of consumers. In the US, for example, as per the CDC, 69% of Americans are obese, and nearly 10% of the U.S. population suffers from diabetes. Allulose has no impact on blood glucose nor interferes with insulin. As a result, it is ideal for those looking to lose or manage their weight and a model sweetener for people with diabetes who want more choices. As per the report by the National Library of Medicine by the United States Government, there is an increasing demand for low-calorie and LCS-containing beverages as sugar intake, especially sugar-sweetened beverages, contributes to obesity, type 2 diabetes, cardiovascular disease, and dental caries. This has boosted the demand for low-calorie sugar.

- Rising demand for sugar substitutes: One of the factors that is driving the global allulose market is the increasing demand for sugar substitutes. Many factors, like rising cases of obesity and diabetes, increasing trend in health-consciousness, and rising demand for low-carb diets, are the key factors driving the market. There has been an increase and acceleration in the number of health-conscious and fitness-focused consumers worldwide, driving the demand for sugar alternatives with fewer calories and more fibre. The rising demand for low-calorie and high-fibre food products has significantly increased the demand for allulose, as allulose generally provides the sweetness of sugar with only a fraction of the calories.

The report by Ingredion Incorporated on sugar reduction highlights the growing demand for sugar substitutes. As consumers become increasingly aware of the negative health effects of sugar, such as weight gain, obesity, heart disease, and type 2 diabetes, there is a clear shift in behaviour toward limiting or avoiding sugar. Sixty-four per cent of the consumers worldwide are trying to reduce their sugar intake for health reasons, and 42% are trying to lose weight by reducing sugar intake. This highlights the growing trend for sugar reduction. In addition, 20% of consumers are switching from full-calorie beverages to low- or no-calorie choices for their beverages.

Challenges:

- Higher price than traditional sugar: One of the key restraints faced by the market is limited adoption of allulose as a sugar substitute, as it has a higher production cost, leading its market price to increase. This limits its adoption.

Allulose Market Regional Analysis:

- North America: The North American region holds a significant share of the global allulose market during the forecast period. The market will surge in the coming years, due to the increase in consumer awareness of better products for their health, ease in government restrictions, and other related factors. For instance, the United States’ allulose market has experienced significant growth, driven by increasing consumer demand for low-calorie sweeteners and heightened health consciousness. The rising awareness regarding the adverse effects of excessive sugar consumption, such as diabetes, obesity, and cardiovascular diseases, has spurred the demand for healthier alternatives like allulose. Allulose, a rare sugar with 70% of sucrose’s sweetness but only 10% of its calories, has minimal impact on blood glucose levels, making it ideal for diabetic and low-carb diets, including the popular keto diet in the U.S.

Allulose Market Competitive Landscape:

The market is moderately fragmented, with some key players including Matsutani Chemical Industry Co., Ltd., Tate & Lyle PLC, CJ CheilJedang Corporation, Bonumose Inc., Cargill Inc., Ingredion Incorporated, Samyang Corporation, Anderson Global Group LLC, Apura Ingredients Inc., Quest Nutrition LLC, Savanna Ingredients GmbH, and Daesang Corporation.

- Matsutani Chemical Industry Co., Ltd.: Matsutani is a key player in the global allulose market, particularly in Asia-Pacific. It is in Hyogo, Japan, and offers allulose as part of its rare sugar sweetener. It mainly deals with the production and sales of modified starch products, dietary fiber products, and others, having a key presence in the allulose market through its product ASTRA Allulose. It collaborates with companies like Ingredion to produce and sell allulose in America.

- Cargill Incorporated: Cargill Inc. is also a key player in the allulose market. It supplies allulose for bakery, beverages, cereals, confectionery, and many other. It offers solid as well as liquid allulose.

- Ingredion Incorporated: Ingredion Incorporated is also a key player in the global allulose market. It produces and offers allulose under its Astraea® Allulose brand, particularly in the Americas, through a strategic partnership with Matsutani Chemical Industry Co., Ltd. It has a production plant in Mexico.

Allulose Market Scope:

| Report Metric | Details |

| Allulose Market Size in 2025 | USD 51.678 million |

| Allulose Market Size in 2030 | USD 67.446 million |

| Growth Rate | CAGR of 5.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Allulose Market |

|

| Customization Scope | Free report customization with purchase |

Global Allulose Market Segmentation:

By Form

- Powdered

- Liquid

- Crystal

By Industry

- Food

- Beverage

- Pharmaceuticals

- Others

By Distribution Channel

- Offline

- Hypermarkets

- Others

- Online

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others