Report Overview

Global Analytical Standards Market Highlights

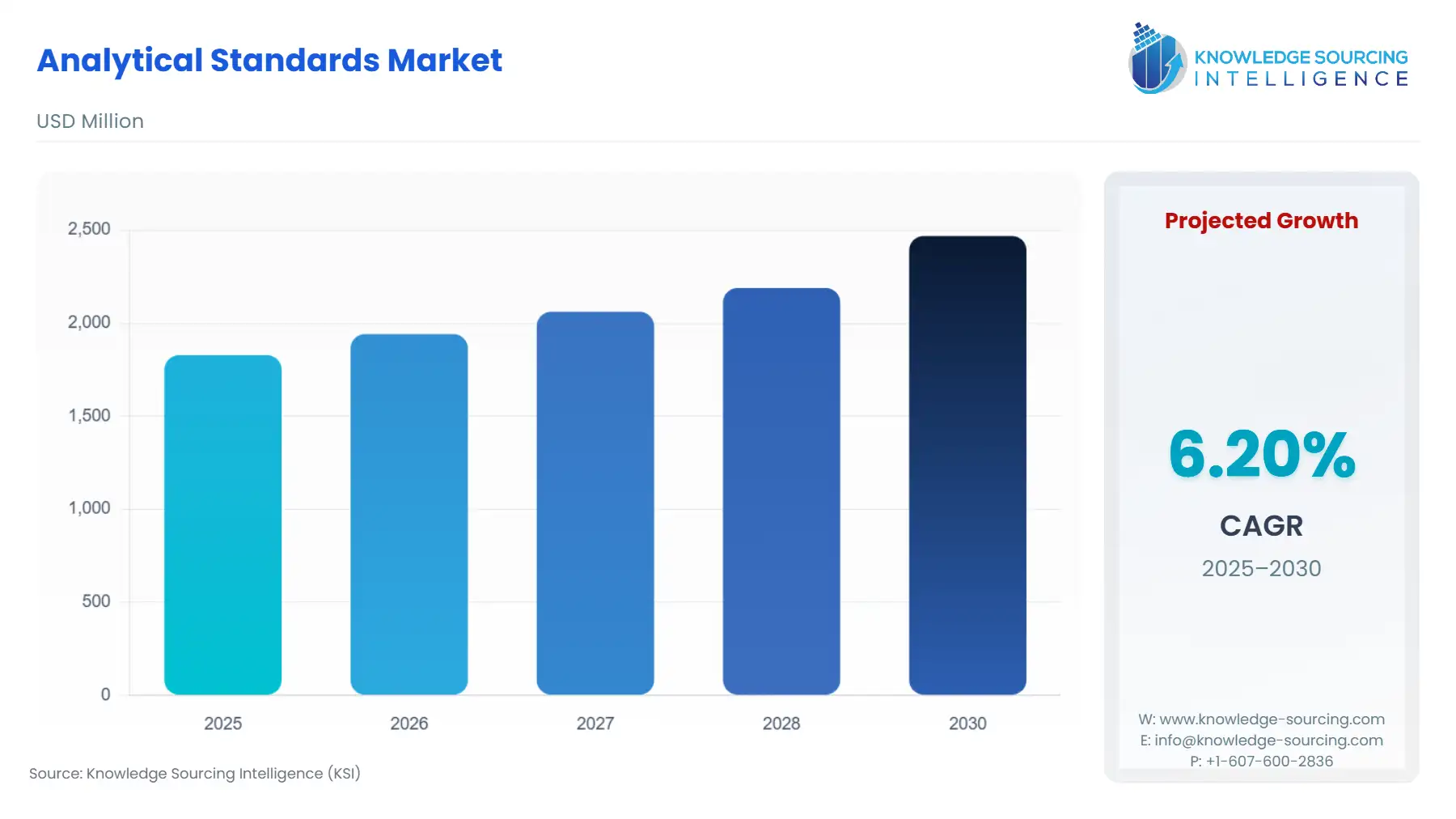

Analytical Standards Market Size:

Global Analytical Standards Market, with a 6.20% CAGR, is projected to increase from USD 1.828 billion in 2025 to USD 2.469 billion in 2030.

The Global Analytical Standards Market serves as a foundational and non-negotiable component of the modern quality assurance and regulatory landscape across the life sciences, environmental, and industrial sectors. Analytical standards, encompassing Certified Reference Materials (CRMs) and reference standards, are high-purity substances with precisely known characteristics, essential for calibrating sophisticated analytical instrumentation, validating testing methodologies, and ensuring the accuracy and traceability of all quantitative and qualitative analytical results. The market's growth is inherently linked to two external forces: the pace of technological innovation in analytical instrumentation (e.g., Mass Spectrometry) and the intensification of global regulatory scrutiny. As limits of detection for contaminants and impurities shrink and regulatory dossiers become more complex, the demand for more sophisticated, matrix-matched, and highly traceable analytical standards rises correspondingly, transforming standards from a simple consumable into a critical compliance tool.

Global Analytical Standards Market Analysis

- Growth Drivers

The rising stringency of global pharmaceutical and food safety regulations is the primary factor propelling demand. New guidelines, such as the adoption of ICH Q2(R2) and Q14 for analytical method validation, enforce a "lifecycle" approach, mandating analytical standards for initial qualification, method transfer validation, and ongoing system suitability checks. This structural requirement creates direct, recurrent demand. Furthermore, the proliferation of advanced analytical techniques, such as high-resolution Mass Spectrometry (MS) coupled with Chromatography, drives the need for highly specific and ultra-pure standards to accurately detect and quantify trace-level impurities in complex matrices, particularly for new chemical entities and emerging contaminants like Per- and Polyfluoroalkyl Substances (PFAS).

- Challenges and Opportunities

The key challenge facing the market is the supply chain volatility for specialty chemicals and high-purity starting materials, which can disrupt the manufacturing of Certified Reference Materials and lead to high production costs. This constraint is compounded by the high cost of high-purity CRMs, which can limit their volume consumption, especially in cost-sensitive emerging markets. Conversely, a significant opportunity exists in the demand for customized and matrix-matched standards. As testing matrices become more complex (e.g., environmental samples, biological fluids), end-users require standards that closely mimic the sample environment to eliminate matrix effects and improve accuracy, creating a high-margin opportunity for specialized manufacturers to provide bespoke, value-added products that solve specific analytical challenges.

- Raw Material and Pricing Analysis

The Global Analytical Standards Market is fundamentally a physical product market centered on high-purity chemicals and compounds. The raw materials are often rare, highly specialized Active Pharmaceutical Ingredients (APIs), excipients, contaminants, or stable isotopes. Pricing is not governed by bulk volume but by traceability, purity, and certification (ISO accreditation). Manufacturing costs are dominated by the purification process (e.g., crystallization, chromatography), quality control (QC) testing, and documentation overhead required to certify the product to international standards (e.g., ISO 17025, ISO Guide 34). This high production complexity maintains premium pricing. Supply chain security is critical, as a lack of availability of a single rare impurity standard can halt a customer's entire validation process, driving buyers to favor suppliers with strong vertical integration or established, secure sourcing networks.

- Supply Chain Analysis

The global supply chain for analytical standards is concentrated, characterized by a "make-to-stock" model for common standards and a "make-to-order" model for custom CRMs and impurity standards. Key production hubs are predominantly located in North America and Europe, where the major suppliers operate ISO-accredited chemical synthesis and packaging facilities. The logistical complexity is high due to requirements for precise temperature-controlled shipment, strict regulatory control over hazardous or controlled substances (especially for forensic and drug-of-abuse standards), and the typically limited shelf life of the final product. The market exhibits a heavy dependency on third-party accreditation bodies and highly specialized contract testing labs, which are essential for the final certification and verification of the standards' purity and concentration, making accreditation a critical supply chain bottleneck.

Analytical Standards Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global |

ICH Q2(R2) & Q14 Guidelines (Analytical Procedure Validation and Development) |

The adoption of these guidelines globally mandates a "lifecycle management" approach to analytical procedures. This directly elevates and sustains demand for Reference Standards used for system suitability testing, method verification, and periodic revalidation throughout a product's life cycle. |

|

United States |

U.S. EPA Method 1633 (Per- and Polyfluoroalkyl Substances - PFAS) |

This environmental regulation for water and soil testing establishes official, low-level limits for emerging contaminants. This creates immediate, high-volume demand for a specific set of PFAS Reference Standards that must be used to calibrate the required chromatographic and mass spectrometry instruments for compliance testing. |

|

European Union |

REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

REACH requires extensive, verifiable toxicological and environmental data for chemicals used in the EU. This compels manufacturers to conduct exhaustive analytical testing, driving continuous demand for Organic and Inorganic Reference Standards to validate the analytical methods used for data generation and compliance dossiers. |

Analytical Standards Market Segment Analysis

- By Application: Bioanalytical Testing

The Bioanalytical Testing segment is a critical growth axis, fueled by the global shift towards complex large-molecule therapeutics, including biologics, cell and gene therapies, and biosimilars. Bioanalytical testing involves the quantitative determination of drugs and their metabolites in biological matrices (e.g., blood, plasma) during non-clinical and clinical trials. The demand for analytical standards is non-discretionary here, driven by the massive increase in ongoing clinical trials and the inherent complexity of biopharmaceuticals. Standards such as stable-isotope labeled internal standards (SIL-IS) are mandatory to ensure the accuracy and reproducibility of mass spectrometry-based assays, particularly in Pharmacokinetic (PK) and Toxicokinetic (TK) studies. The demand is further amplified by the need for precise standards to analyze biomarkers and to validate assays for immunogenicity, accelerating the consumption of specialized standards across the entire biopharma pipeline.

- By Type: Organic

The Organic Standards segment (which includes Volatile Organic Compounds, Pesticides, and Drug Impurities) maintains the largest market share, directly benefiting from the convergence of environmental, food safety, and pharmaceutical regulations. In the pharmaceutical sector, regulations enforce strict controls on organic impurities, residual solvents, and degradation products to ensure drug safety and stability, requiring a vast catalog of highly pure organic impurity standards. For the environmental and food sectors, the continuous emergence of new regulated organic contaminants (e.g., novel pesticides, personal care product residuals in water) necessitates the rapid development and certification of corresponding reference standards. This dynamic, driven by the expanding universe of regulated organic chemical compounds, ensures that the Organic Standards segment experiences sustained, technologically intensive demand, often requiring complex, multi-component mixes.

Analytical Standards Market Geographical Analysis

- North America (United States) Market Analysis

The US market is the leading consumer of analytical standards, with demand intensity driven by the concentration of the world's largest pharmaceutical and biotechnology companies and a highly litigious regulatory environment. The US Food and Drug Administration (FDA) mandates rigorous Good Manufacturing Practice (GMP) and Good Laboratory Practice (GLP) compliance, creating a systematic, high-volume requirement for standards across all stages of drug development and manufacturing. Local factors, such as the federally mandated monitoring of PFAS under the EPA's regulations, create high-urgency, non-deferrable demand for specific environmental standards, making the US a high-value, early-adopter market for new and specialized CRMs.

- South America (Brazil) Market Analysis

Demand in Brazil is primarily fueled by the Food & Beverage sector, given its role as a major global agricultural exporter, which mandates rigorous testing for pesticide residues and contaminants to meet international export standards (e.g., EU and US import rules). The Pharmaceutical sector also drives demand, though consumption may favor more cost-effective secondary standards or pharmacopoeia standards due to cost constraints. Local factors, including the establishment of regional standardization bodies and increasing investment in food safety labs, gradually elevate the volume consumption of internationally traceable standards.

- Europe (Germany) Market Analysis

Germany serves as a sophisticated market, with demand anchored by a mature Chemicals industry and a leading role in Pharmaceutical and Industrial R&D. Regulatory frameworks like REACH drive substantial, continuous demand for standards to characterize new and existing chemicals. The demand is highly focused on traceability and quality, favoring suppliers with ISO 17034 accreditation for Reference Material Producers. The stringent quality expectations of the German automotive and industrial sectors also drive demand for standards used in raw material and advanced material testing.

- Middle East & Africa (United Arab Emirates) Market Analysis

The UAE market's demand is concentrated in the Petrochemicals and the Food & Beverage import sectors. Petrochemical applications require high-purity standards for quality control in refined fuels and lubricant analysis, often referencing ASTM or ISO methods. For food, the UAE's high dependence on imported goods necessitates stringent quality and contaminant testing at entry ports, driving demand for pesticide, mycotoxin, and metal standards to ensure public health and trade compliance. Demand for standards for the emerging Pharmaceutical manufacturing base is also rising due to government initiatives.

- Asia-Pacific (India) Market Analysis

The Indian market is a high-growth region, driven by its position as a major global center for generic drug manufacturing and a rapidly expanding Food & Beverage industry. The need to meet international regulatory standards (e.g., FDA, EMA) for exported generic drugs creates a massive demand for affordable, high-quality Pharmaceutical Impurity Reference Standards. Local factors, including increasing public concern over food safety and government initiatives to improve environmental monitoring, are now broadening the demand base beyond pharmaceuticals into the Environmental and Food testing segments, favoring competitive, high-volume suppliers.

Analytical Standards Market Competitive Environment and Analysis

The Global Analytical Standards Market is characterized by moderate concentration, dominated by a few major life science and chemical conglomerates that leverage extensive distribution networks and accredited production facilities. Competition is based less on price and more on product breadth, certification credentials (traceability), and customer support for complex method development.

- Company Profile: Thermo Fisher Scientific

Thermo Fisher Scientific is strategically positioned as a comprehensive "instrument-to-analyte" solution provider, a position that grants it a significant competitive advantage. The company offers a vast portfolio of analytical standards, including Inorganic Plasma Standards (Specpure™) and a wide range of organic standards, which are directly integrated with its market-leading analytical instruments, such as the Orbitrap Mass Spectrometers. This synergy drives demand by allowing the company to bundle instruments, consumables, and certified standards, creating a seamless workflow for laboratories. Its strategic focus lies in supporting high-growth applications like proteomics and elemental analysis in environmental and food safety, evidenced by continuous innovation in elemental and isotopic standards.

- Company Profile: Merck KGaA (MilliporeSigma in the US and Canada)

Merck KGaA, through its Life Science business (MilliporeSigma), maintains a dominant global position in the analytical standards market. Its strategy is anchored on unsurpassed quality and comprehensive certification. The company's Certipur® reference materials, including standards for AAS, ICP, and volumetric analysis, are rigorously traceable to international standards and are produced under ISO 17025 and ISO Guide 34 accreditation. This focus on certification is paramount for pharmaceutical and highly regulated industries where compliance is the ultimate purchasing criterion. Merck's vast portfolio, spanning organic, inorganic, and volumetric standards, ensures it remains the go-to supplier for foundational laboratory standards across virtually all end-user segments globally.

- Company Profile: Agilent Technologies, Inc.

Agilent Technologies positions itself as a supplier of highly specialized standards and Certified Reference Materials, tightly integrated with its core analytical instrumentation, particularly Chromatography (GC/LC) and Mass Spectrometry (MS) systems. Its competitive strategy focuses on providing high-value standards for complex, challenging applications, such as environmental analysis (e.g., highly pure standards for pesticide, dioxin, and emerging contaminant testing). By co-developing standards alongside new instrument platforms, Agilent ensures its standards offer maximum performance and compliance for its installed instrument base, driving demand from customers seeking guaranteed compatibility and precision for cutting-edge analytical methods.

Analytical Standards Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.828 billion |

| Total Market Size in 2031 | USD 2.469 billion |

| Growth Rate | 6.20% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Technique, Application, End-User |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Analytical Standards Market Segmentation:

- BY TYPE

- Organic

- Inorfanic

- BY TECHNIQUE

- Chromatography

- Spectroscopy

- Titrimetry

- Physical Properties Test

- Others

- BY APPLICATION

- Bioanlytical Testing

- Stability Testing

- Raw Material Testing

- Microbial Testing

- Others

- BY END-USER

- Food & Beverage

- Pharmaceuticals

- Chemicals

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America