Report Overview

Global Arachidonic Acid Market Highlights

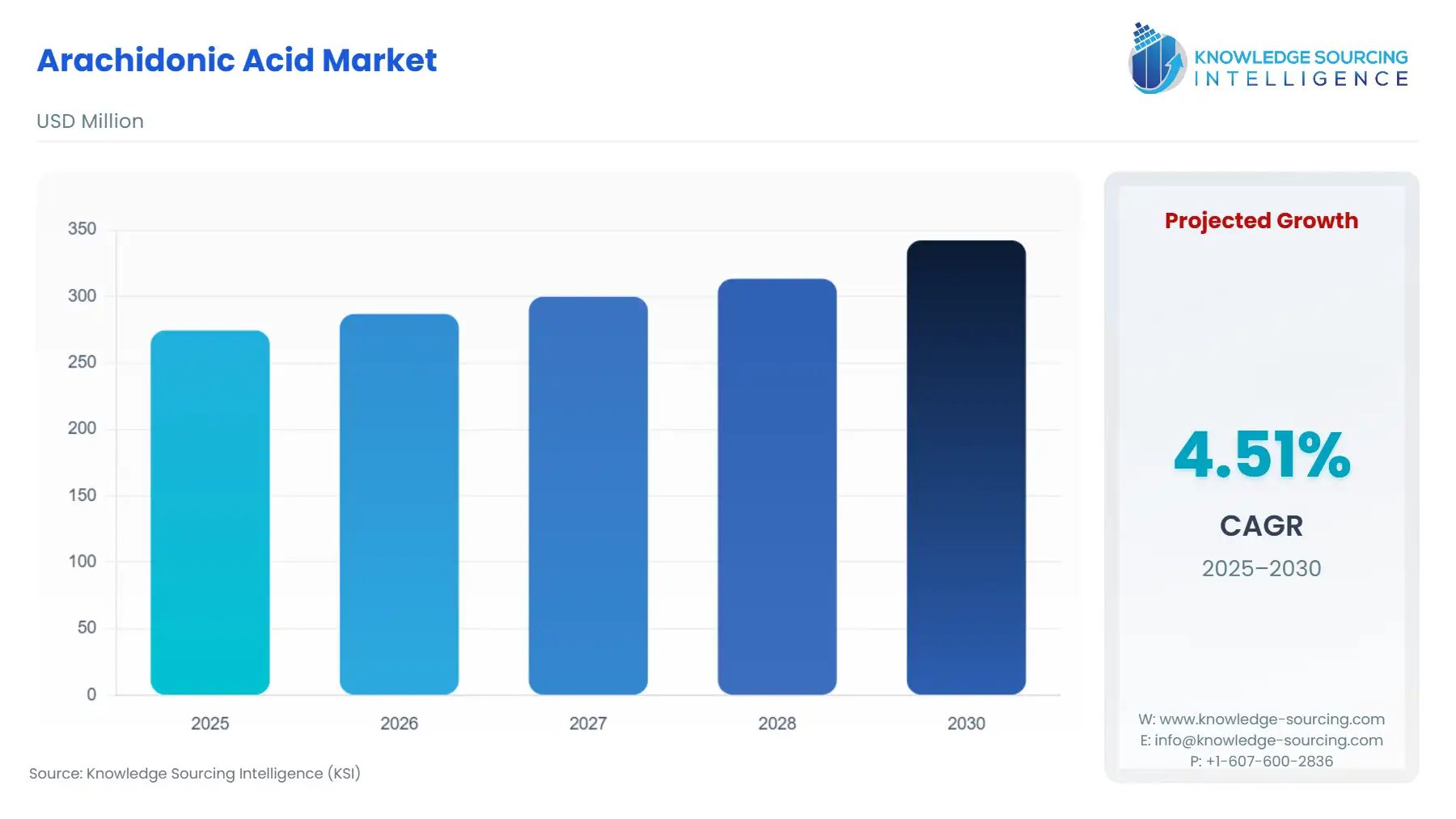

Arachidonic Acid Market Size:

Global Arachidonic Acid Market is expected to grow at a 4.37% CAGR, increasing to USD 354.962 million in 2031 from USD 274.543 million in 2025.

Arachidonic is a fatty acid that helps in a baby's developing brain. Arachidonic acid (ARA) is a crucial aspect of biological cell membranes because it gives them the fluidity and flexibility necessary for all cells to function properly, especially those in the immune system, skeletal muscle, and neurological systems. It comes from food or linoleic acid undergoing de-saturation and chain elongation. Ion channels, receptors, and enzymes are all affected by free ARA's ability to both activate and inhibit them.

One of the important Omega-6 fatty acids is arachidonic acid. It is regarded as an essential acid. because it is kept inside cell membranes and guides signals of regenerative changes in response to damaging events. A separate intake of arachidonic acid in injections, syrups, or pills is required due to the body's lack of natural arachidonic acid. The main ingredients used to make ARA are, among others, maize, glucose, soy, and yeast.

There is a rising demand for ARA in dietary supplements as consumers become more health conscious. The probability of physical injuries is anticipated to rise with the popularity of outdoor athletic events like car racing and marathons, which are projected to drive the market in terms of rising application rates and generating revenue. Infant feeding formula penetration is rising, and sports nutrition is also being used more frequently, contributing to the market's expansion.

Arachidonic Acid Market Growth Drivers:

Increased use of arachidonic acid in infant formula

The fast technical improvements and new patents filed by the major market players will likely lead to a rise in the use of arachidonic acid in baby feeding during the forecast period. Babies require omega-6 fatty acids since they cannot synthesize the necessary quantity. As a result, the inclusion of ARA in baby food serves to supply the required fatty acids. The main elements that aid in synthesizing cell membranes in developing infants' brains are DHA and arachidonic acid (ARA), a 20-carbon fatty acid. Depending on a mother's diet, the amount of DHA and ARA in breast milk varies greatly between nations.

Athletics is a key area for the growing demand for ARA.

Arachidonic acid is growing rapidly in the world of athletics. Research on ARA supplements has also been conducted in neurology, hepatology, cardiology, and nutrition. Arachidonic acid regulates inflammation, although there are concerns regarding the risks associated with these supplements. The lean BMI, overall strength, and peak power of trained men may all be improved with ARA supplementation.

Utilization of ARA-rich oils is a significant demand driver.

The use of ARA-rich oils obtained from the fungus Mortierella Alpina is well known, and the ingredient has long been used in infants and subsequent formulae. According to EU law, oil extracted from Mortierella Alpina is now allowed in infant formula, follow-on formula, and meals for medical purposes for newborns. The German company BASF and the Chinese company Hubei Fuxing Biotechnology are the leading firms producing ARA-rich oils from the fungus Mortierella Alpina.

Arachidonic Acid Market Geographical Outlook:

North America is projected to be the prominent market throughout the forecast period.

North America is anticipated to be the largest market for arachidonic acid in food applications, second in Europe and Asia Pacific. The regulatory environment in the EU has helped the local market expand. The demand for ARA in infant formula is growing due to the presence of numerous companies, the intense R&D activities carried out with numerous new patents using ARA for infant formula, as well as sports nutrition, and the rising fertility rate in North America, particularly in Mexico. The current trend of utilizing ARA to treat diabetes is anticipated to aid in expanding the market in additional North American nations.

List of Top Arachidonic Acid Companies:

Cargill. Inc

Cabio Biotech (Wuhan) Co., Ltd

Cayman Chemicals

Koninklijke DSM N.V.

Merck Group

Arachidonic Acid Market Segmentation:

By Source Type

Animal-Based

Plant-Based

By Form Type

Dry

Liquid

By Application

Infant Nutrition

Dietary Supplements

Pharmaceuticals

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others