Report Overview

Hydrogen Fluoride Market - Highlights

Hydrogen Fluoride Market Size:

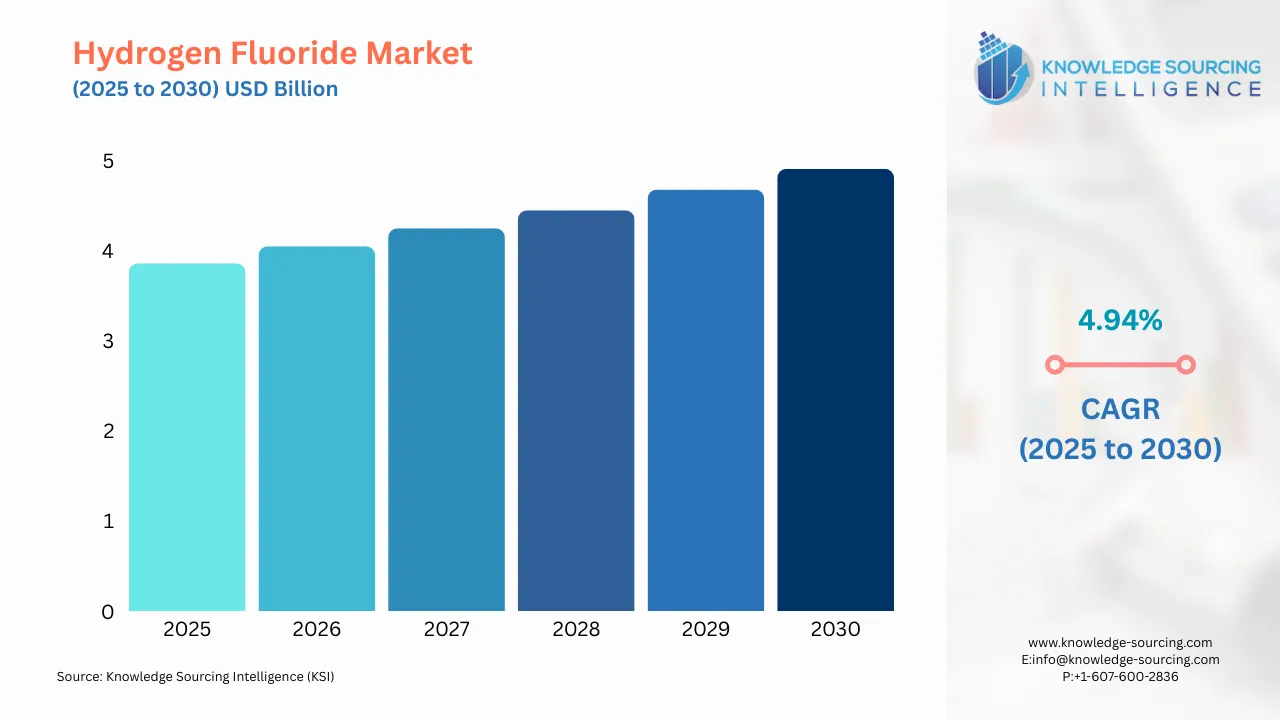

Hydrogen Fluoride Market is expected to expand at a 4.94% CAGR, reaching USD 4.906 billion by 2030 from USD 3.855 billion in 2025.

Hydrogen Fluoride Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope

The Hydrogen Fluoride Market is segmented by:

- Product Type: Anhydrous hydrogen fluoride commands a significant portion of the market because of its purity level, range of applications, and uses in industrial applications. It is essential for fluorination reactions, the manufacture of refrigerants and speciality chemicals, all of which include water-free HF as part of the process, as moisture-free HF has consistent reactivity and yields for chemical manufacturers. Its use in etching and glass treatment, coupled with these characteristics, makes wet hydrogen fluoride versatile in industries within both consumer and industrial manufacturing processes.

- End User: The semiconductor and electronics segment has a substantial share of the hydrogen fluoride market, as liquid hydrogen fluoride serves as a critical component in the wafer etching and cleaning processes of integrated chip manufacture. The purity of liquid hydrogen fluoride is required, which includes strict manufacturing quality control conditions as precision and contamination must be controlled within any manufacture of an integrated circuit, the growing demand for integrated circuits that serve to power new consumer products such as smartphones, computers and other IoT devices, and the current and future proliferation of integrated circuit manufacturing in part because of the increasing use of computers within the semiconductor segment also has encouraged further consumption of hydrogen fluoride.

- Region: The Asia-Pacific hydrogen fluoride market is growing rapidly due to a healthy level of growth in the electronics, chemical, and pharmaceutical industries. Some of the largest players in the market, such as China, Japan, and South Korea, are leaders in manufacturing semiconductors and aluminium production. Rising industrialisation and government investments in technology, as well as increasing demand for refrigerants and speciality chemicals, provide an opportunity for hydrogen fluoride consumption to increase. Additionally, increasing research into safe and scalable methods of HF production will also support the expansion of the hydrogen fluoride market in the region.

Top Trends Shaping the Hydrogen Fluoride Market

- Rising Semiconductor Application: There has been an increase in the use of hydrogen fluoride for wafer cleaning, etching, and surface treatment. This growth is driven by rapid growth in the electronics and semiconductor industry.

- Integration into Lithium-Ion Battery Production: Hydrogen fluoride is increasingly used in producing lithium hexafluorophosphate (LiPF6). It is a key electrolyte in lithium-ion batteries. This trend is expected to accelerate as the global clean energy transition drives higher demand for advanced battery materials.

- Shift Toward Eco-Friendly Refrigerants: There are growing restrictions on high global warming potential (GWP) fluorocarbons, which are pushing demand for HF in producing next-generation, low-emission refrigerants.

Hydrogen Fluoride Market Growth Drivers vs. Challenges

Drivers:

- Rising Demand from the Aluminium Industry: One of the key drivers of the hydrogen fluoride market is the growth in demand for aluminium. China dominates the aluminium production output with an estimated 3,870 thousand metric tonnes, representing well over half of the global total in July 2025. Europe and Russia produced 596 thousand metric tonnes, while the Gulf Cooperation Council accounted for 520 thousand metric tonnes, indicating their strong smelting capacity. The other regions are relatively smaller proportions, with Asia (excluding China) total volume being 411 thousand metric tonnes and North America at 330 thousand metric tonnes. Approximately 214 thousand metric tonnes were projected to be unreported to the International Aluminium Institute (IAI), indicating gaps in the overall global reporting.

- Expanding Fluorochemicals and Refrigerants Market: Hydrogen fluoride acts as a basic feedstock to fluorocarbons, fluoro-polymers, and refrigerants. As the demand for air conditioning, refrigeration, and advanced polymers for automotive and electronics continues to grow, the market will continue to grow.

- Growth in Electronics and Semiconductor Manufacturing: Hydrogen fluoride is widely used for glass etching, cleaning, and surface treatment in the semiconductor and electronics industries. The Semiconductor Industry Association (SIA) announced that global semiconductor sales reached $627.6 billion in 2024, an increase of 19.1% over the 2023 total of $526.8 billion. Total sales accounted for $170.9 billion in Q4, which was 17.1% more than Q4 2023, and was 3.0% more than Q3 2024 (which accounted for $165.5 billion). Also, global sales in December 2024 were $57.0 billion, which is a 1.2% decline from the prior month of November 2024. Monthly sales are reported by the World Semiconductor Trade Statistics (WSTS) organisation that utilises a 3-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and almost two-thirds of non-U.S. chip companies.

- Increasing Use in Pharmaceuticals and Agrochemicals: There has been an increase in demand for pharmaceuticals. The hydrogen fluoride chemical is used in the preparation of medicine as well as fertilisers, thus an increase in demand for pharmaceuticals and agrochemicals will lead to an increase in demand for hydrogen fluoride. According to PIB, the rapid growth of India’s drug and pharmaceutical exports. Exports increased from $2.13 billion in July 2023 to $2.31 billion in July 2024 (an increase is 8.36% growth year over year). Long-term, exports were up significantly from $15.07 billion in 2013–14 to $27.85 billion in FY 2023–24, as illustrated through an infographic comparing both periods. India is now the third largest pharmaceutical producer globally by volume, exporting to almost 200 countries and territories. The top five export destinations are the USA, Belgium, South Africa, the UK, and Brazil. The pharmaceutical industry in India is expected to grow steadily by 10–12% and aims to reach $100 billion by 2025.

Challenges:

- Stringent Environmental Regulations: The hydrogen fluoride market faces some obstacles because of stringent and complicated environmental and safety regulations, considering that hydrogen fluoride is very toxic and corrosive. The risk of the chemical increases costs related to handling, transportation, and storage. Severe regulation on fluorochemicals as refrigerants and emissions control will slow the growth of demand, while adding areas that markets need to overcome globally.

Hydrogen Fluoride Market Regional Analysis

- United States: The U.S. hydrogen fluoride market is driven by its strong chemical and pharmaceutical industries. The high demand for aluminium production and refrigerants also supports market growth.

- Germany: Germany’s market benefits from advanced manufacturing and automotive sectors. Strict environmental regulations encourage the adoption of high-purity hydrogen fluoride in industrial processes.

- China: China leads in hydrogen fluoride consumption due to its expanding chemical and electronics industries. Rapid industrialisation and infrastructure development further boost the demand in this market.

- Japan: Japan’s market is driven by its semiconductor and electronics manufacturing sectors. The emphasis on high-quality production standards ensures and increases steady hydrogen fluoride usage.

Hydrogen Fluoride Market Competitive Landscape

The Hydrogen Fluoride market is competitive, with a mix of established players such as Honeywell International Inc., Solvay SA, Arkema Group, LANXESS AG, Daikin Industries, Ltd., Orbia, Sinochem Group, Dongyue Group, Linde plc, Yingpeng Chemical, among others.

- Approach for production: In July 2025, the researchers from Shibaura Institute of Technology, Japan, presented their new approach for generating hydrogen fluoride in a safe and scalable manner. They used the cation exchange method using potassium fluoride (KF) and Amberlyst 15DRY, generating HF and subsequently converting it into amine-3HF complexes, thus increasing the number of complexes available for the fluorination reactions.

Hydrogen Fluoride Market Segmentation:

- By Product Type

- Anhydrous Hydrogen Fluoride

- Aqueous Hydrogen Fluoride

- By End-User

- Semiconductor and Electronics

- Pharmaceutical

- Automotive

- Chemical Industry

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Hydrogen Fluoride Market Key Highlights:

- Hydrogen Fluoride Market Overview & Scope

- Top Trends Shaping the Hydrogen Fluoride Market

- Hydrogen Fluoride Market Growth Drivers vs. Challenges

- Hydrogen Fluoride Market Regional Analysis

- Hydrogen Fluoride Market Competitive Landscape

- Hydrogen Fluoride Market Segmentation:

- Our Best-Performing Industry Reports: