Report Overview

Potassium Hydroxide Market - Highlights

Potassium Hydroxide Market Size:

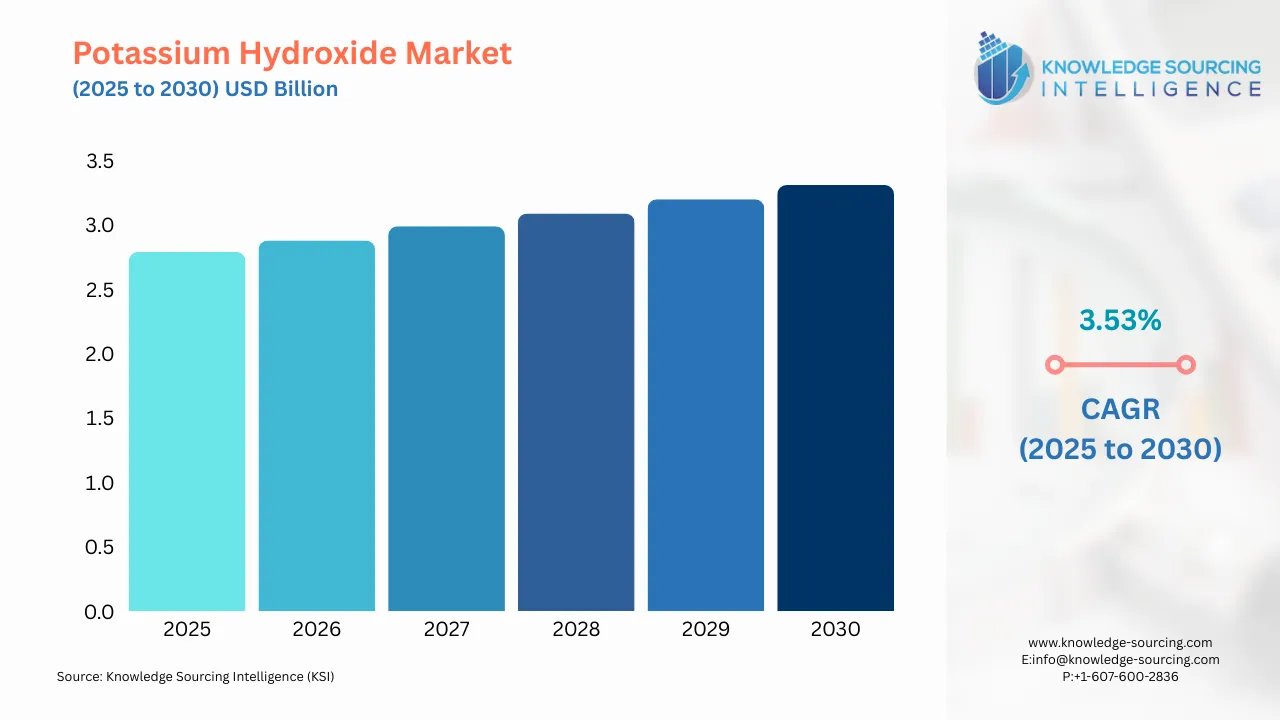

Potassium Hydroxide Market is projected to grow at a 3.53% CAGR, increasing from USD 2.785 billion in 2025 to USD 3.312 billion by 2030.

Potassium Hydroxide Market Overview & Scope:

The potassium hydroxide market is segmented by:

- Form: Liquid potassium hydroxide predominates the global potassium-based hydroxide market principally because its aqueous solubility facilitates swift dissolution, permitting its widespread use in chemical synthesis and in the management of aqueous chemical equilibria. Being in the liquid state, the reagent exhibits reduced dusting risks, is easier to dose, and incurs lower costs for transfer and storage in bulk installations. Consequently, industrial enterprises favour the liquid form over the solid variant for the generation of potassium salts, the transesterification associated with biodiesel, and for the synthesis of selected speciality compounds, thereby reinforcing its enduring commercial dominance.

- Grade: Industrial/technical grade holds a substantial share of the potassium hydroxide (KOH) market due to its wide-ranging applications across multiple industries. This grade is primarily used in manufacturing soaps and detergents, fertilizers, dyes, and various inorganic chemicals, making it highly versatile.

- Application: Agricultural fertilisers consume an appreciable fraction of potassium hydroxide since the supply of this macronutrient is a precondition for enhanced plant metabolism. Potassium hydroxide serves as a precursor to potassium salts employed in NPK formulations and in potassium magnesia fertilisers, thereby sustaining improvements in biomass yield, biomass-quality indices, and soil bioavailability. The reagent’s ionic solubility guarantees rapid foliar and root-zone absorption, which suits precision agriculture and fertigation schedules. The interplay of accelerating global cereal and horticultural output targets and the rise of precision sustainable agriculture amplify potassium hydroxide’s market vis-à-vis potassium-based nutrients.

- End User: The chemical sector is the principal consumer sector of potassium hydroxide, exploiting its high electrolyte dissociation to furnish alkaline media in the manufacture of potassium-based and biodiesel-related soaps, anionic surfactant precursors, and specialty chemical precursors in chemical synthesis routes. Its large anionic capacity is extensively employed in saponification, neutralisation, and transesterification procedures. The sustained enlargement of chemical process capacity, especially in the Asia-Pacific region, underwrites significant incremental demand, thereby conferring on this consumer sector a decisive share in global potassium hydroxide consumption.

- Region: The potassium hydroxide market is led by the Asia-Pacific region, driven by rapid industrialisation, increasing chemical production, increasing fertiliser production, as well as many end-use industries expanding, such as agriculture, soaps, and detergents. Demand for potassium hydroxide is high in countries such as China and India, and currently, there's a surge in manufacturing and infrastructure investment in those countries, which adds to the consumption of KOH. In addition to demand factors, Asia-Pacific is known for cheap raw materials, cost-effective manufacturing, as well as favourable government polices that look to support stronger supply chains.

Top Trends Shaping the Potassium Hydroxide Market:

- Increased Demand in Batteries: There is growing usage of KOH electrolytes in alkaline and emerging EV batteries will continue to raise long-term demand.

- Transition to High-Purity Grades: Higher demand for food, pharma, and electronic applications will shift producers toward premium-grade KOH.

- Sustainable Production: Energy-efficient and safe production methods are gaining traction, driven by increased environmental policies.

- Increased Role in Agriculture: Increased use of KOH-based fertilisers and agrochemicals will drive growth in emerging economies.

Potassium Hydroxide Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Demand from Batteries and Energy Storage: KOH is used as an electrolyte in alkaline batteries, becoming more relevant in electric vehicle (EV) and renewable energy storage systems. KOH will have strong long-term demand. According to IEA, in 2024, electric vehicle sales increased by 25% to 17 million cars. This resulted in yearly battery demand exceeding 1 terawatt-hour (TWh) - the first time. After years of investment, battery manufacturing capacity reached 3 TWh globally in 2024, and the next five years could see an additional tripling in production capacity if all announced projects are completed.

- Increasing usage in Agriculture and Agrochemicals: As the world becomes more populated and food demand increases, KOH-based fertilisers and crop protection chemicals are being used more often, particularly in developing economies; therefore, providing constant growth in the market. According to FAO, the global output of primary crops in 2023 was 9.9 billion tonnes, which represents an increase of 3 per cent since 2022 and 27 per cent since 2010. During the period from 2022 to 2023, cereal production grew by 61 million tonnes, or two per cent, and an increase in maize production was the principal component of the increase. Maize, wheat, and rice accounted for 91 per cent of total cereal production in 2023. Total world production of sugar crops increased during 2022 and 2023 by 122 million tonnes. Sugar cane was by far the dominant sugar crop, with greater than 2 billion tonnes compared to 281 million tonnes of sugar beet. The global production of roots and tubers increased by 2 per cent from 2022 to 2023 due mainly to the moderate increases in production of cassava and potatoes. World fruit and vegetable production in 2023 was 2.1 billion tonnes, an increase of 1 per cent from 2022. Total world production of oil palm fruit, soya beans, and rapeseed, which are the main oil crops, recorded production of 893 million tonnes in 2023.

- Growth in Chemical Industry: Potassium hydroxide is a critical feedstock in the manufacture of a wide variety of chemicals, including soaps and detergents, fertilisers, and speciality chemicals. With increasing global consumption of personal care products, cleaning products, and agricultural chemicals, the demand for KOH is also increasing. In addition to soaps and detergents, KOH is used in the manufacture of pharmaceuticals and water treatment. The soap, cleaning, and detergents market prices grew to 235.137 in July 2025, according to the US Labour Statistics.

Challenges:

- High Cost: The potassium hydroxide market encounters challenges, including variable raw material costs, increasing environmental regulation pressures, and large energy requirements to produce; the possibility of improper production or handling hazards; and the availability of substitutes. Distribution chain disruptions and varying current demand across batteries, chemicals, and agriculture also impact steady profitability.

Potassium Hydroxide Market Regional Analysis:

- United States: A mature, high-spec KOH market with uses in electronics and food/pharma grade, biodiesel, and a substantial proportion of industrial cleansers. A predominance of established chlor-alkali producers, robust logistics, and a demanding quality culture are conducive to stable and value-added demand.

- Germany: A key hub in Europe with strong specialities, batteries, pharma, and high-purity applications. Tight environmental standards and chemical clusters support a constant flow of premium-grade products with resilient intra-EU trade.

- India: The consumption is fast-growing as agriculture, speciality chemicals, soaps & personal care, and pharma grow. Both capacity additions and import dependence are drivers, with urbanisation and manufacturing-led policies buoying demand.

- China: The biggest potassium hydroxide (KOH) market worldwide with enormous growth in downstream uses of batteries, agrochemicals, soaps/detergents, and pharmaceuticals. The major domestic chlor-alkali base, combined with pervasive EV supply-chain growth, sustains utilisation rates and favourable pricing.

Potassium Hydroxide Market Competitive Landscape:

The market is comprised of many notable players, including Olin Corporation, Occidental Petroleum, Evonik Industries AG, UNID Co., Ltd., Tessenderlo Group, Asahi Glass Co., Ltd., International Chemical Investors Group, Tokyo Chemical Industry, Inner Mongolia Ruida Taifeng Chemical, and Shandong Changyi Haineng Chemical, among others.

- Potassium Hydroxide (Pellets): It is a product of Tokyo Chemical Industry. Potassium hydroxide (KOH) is a solid chemical with a molecular weight of 56.11. KOH is greatly hygroscopic and therefore should be stored under inert gas in a cool, dark environment, ideally below 15 °C, to maintain stability. KOH is supplied in plastic bottles of 500 g, with a purity level of greater than 85%.

Potassium Hydroxide Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Potassium Hydroxide Market Size in 2025 | USD 2.785 billion |

| Potassium Hydroxide Market Size in 2030 | USD 3.312 billion |

| Growth Rate | CAGR of 3.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Potassium Hydroxide Market |

|

| Customization Scope | Free report customization with purchase |

Potassium Hydroxide Market Segmentation:

- By Form

- Liquid Potassium Hydroxide

- Solid Potassium Hydroxide

- By Grade

- Industrial/Technical Grade

- Reagent Grade

- Food Grade

- Speciality Grade

- By Application

- Fertilizers

- Soaps and Detergents

- Biofuel

- Others

- By End User

- Agriculture

- Automotive

- Chemical Industry

- Food Industry

- Pharmaceutical

- Textile

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Others

- North America