Report Overview

Global Automotive Displays Market Highlights

Automotive Displays Market Size:

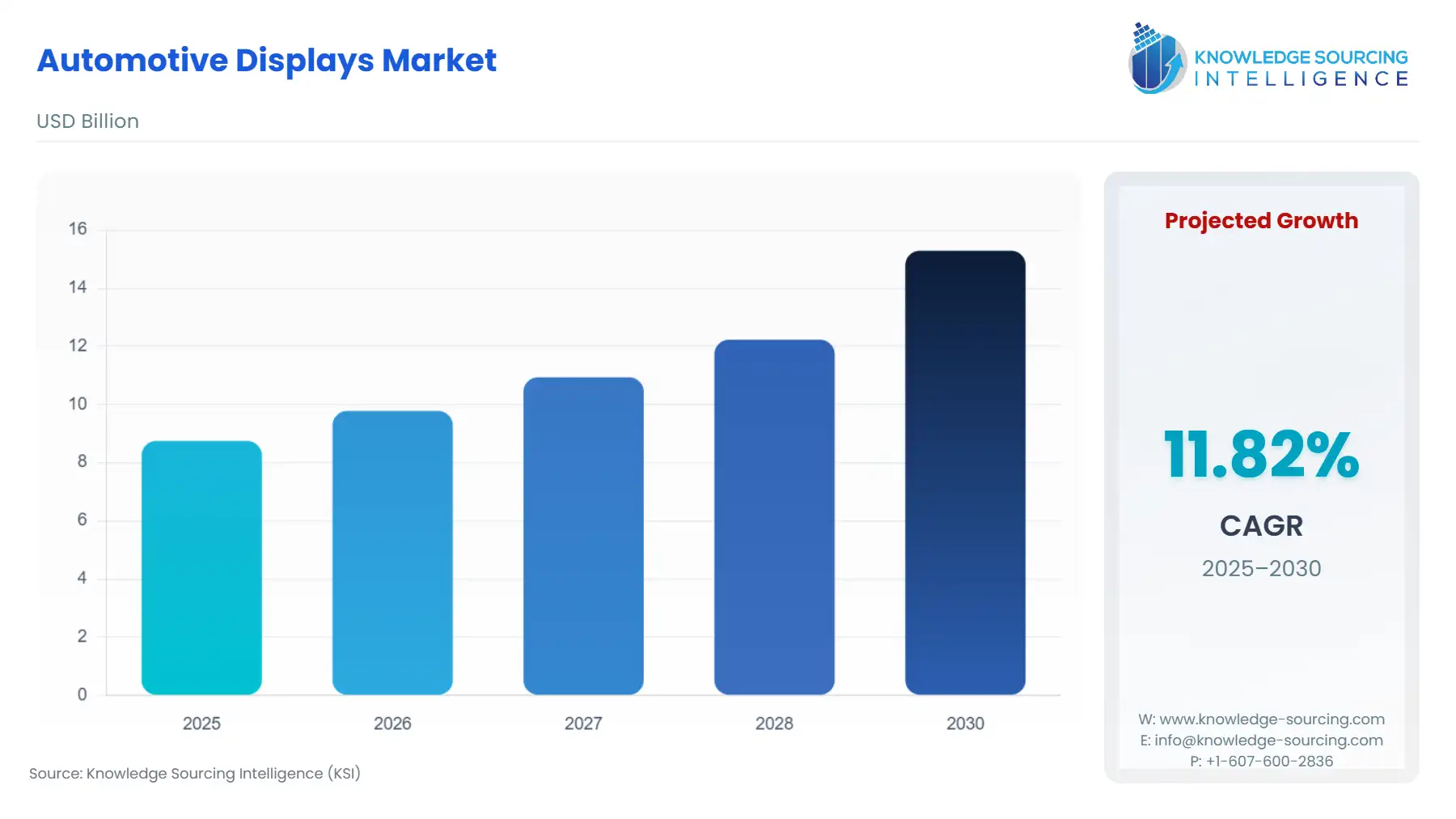

The global automotive displays market is expected to grow from USD 8.747 billion in 2025 to USD 15.293 billion in 2030, at a CAGR of 11.82%.

Automotive displays are used widely in automobiles for a variety of purposes. These displays can provide information, navigation, and other details to the driver while driving, thus making the driving process easier, safer, and more efficient.

Automotive displays can be classified on the basis of display type, application, and screen size. Automotive displays come in some basic variants, such as TFT-LCD, OLED, AMOLED, and others. While TFT-LCD is commonly used, the other types are also gaining popularity slowly and are coming in some higher models. These displays can be used for applications such as advanced instrument cluster displays, center stack touchscreen displays, rear-seat entertainment touchscreen displays, and others. There are many screen sizes also in which these displays are available like 3’’-5’’, 6’’-10’’ and more than 10’’. Typically, 3''-'5'' display sizes are used in smart rear-view mirrors, rear-seat entertainment units, and so on, whereas 6''-10'' display sizes are used in center stack display modules, advanced instrument clusters, rear-seat entertainment units, and so on, and more than 10'' is used in premium and autonomous or semi-autonomous vehicles.

The key players are involved in bringing better technologies and advancements to this industry. For example, a company called HIMAX Technologies has launched its new product, which is a flexible OLED display, and its controller for BOE Technology Group Co, Ltd which is one of the largest display manufacturers in China. Another company, Continental AG has collaborated with Leia to develop a 3-D light field automotive display that will display 3-D information around vehicles. Robert Bosch GmbH is working on a new dual-view automotive display unit that will allow the driver to engage in navigation and entertainment at the same time.

The global automotive displays market is expected to grow significantly during the forecast period, as demand for better technologies to improve driver-vehicle interaction and driving experience so that people can enjoy a comfortable and safer drive rises.

Automotive Displays Market Segmentation Analysis:

- By Display Type

On the basis of display type, the global automotive displays market is segmented as TFT-LCD, OLED, AMOLED, and others. The TFT-LCD type holds a notable amount of share in the market owing to the fact that these types of displays are less expensive and are used in many lower-end cars. They can tolerate more adverse temperatures than LEDs, OLEDs, and AMOLEDs.

- By Application

On the basis of application, the global automotive display market is segmented into advanced instrument cluster displays, center stack touchscreen displays, rear-seat entertainment displays, and others. Centre stack displays hold a significant amount of share in the market due to the rising demand in navigation and diver vehicle interaction systems and the center stack touchscreen displays being used in many vehicles.

- By Screen Size

On the basis of screen size, the global automotive displays market is segmented as 3’’-5’’, 6’’-10’’ and more than 10’’. 3’’-5’’ hold a notable amount of share in the market owing to the fact that these types of screens are incorporated in almost every car which has a rear-view camera or smart rear-view mirror or provisions for rear-seat entertainment.

- By Vehicle Type

On the basis of vehicle type, the global automotive displays market is segmented as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles hold a significant share of the market due to increasing production and demand for passenger vehicles and better driver-vehicle interaction systems.

- By Sales Channel

The global automotive display market is divided into two segments based on sales channels: OEMs and aftermarkets. OEMs hold a notable amount of share in the market due to the fact that most of the vehicles produced come with some type of display fitted to make the interaction with the vehicle easier.

Automotive Displays Market Geographical Outlook:

By geography global automotive displays market is segmented as North America, Europe, Middle East & Africa, Asia-Pacific, and South America. Asia-Pacific holds a significant amount of market share in the market owing to the fact that the demand and production of vehicles are higher in this region.

Automotive Displays Market Competitive Landscape:

The global automotive display market is competitive due to the presence of a diverse set of international, regional, and local players. The competitive landscape describes the strategies, products, and investments made by key players in various technologies and companies to increase their market presence.

Automotive Displays Market Key Developments:

- Hyundai Mobis developed the first adjustable automotive display in May 2022. This new technology has adopted a novel idea of an extremely large, curved screen that is movable and has been optimised for autonomous vehicles. This innovation gives it a competitive advantage over its rivals.

- Magnachip developed the next-generation OLED DDIC for automotive displays in January 2022. It is suitable for both rigid and flexible OLED displays and supports a wide range of resolutions, including FHD. With the help of this technology, consumer safety, functionality, and convenience will continue to improve.

Automotive Displays Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.747 billion |

| Total Market Size in 2031 | USD 15.293 billion |

| Growth Rate | 11.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Display Type, Application, Screen Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Displays Market Segmentation:

The global automotive displays market has been segmented by display type, application, screen size, vehicle type, sales channel, and geography.

- By Display Type

- TFT-LCD

- OLED

- AMOLED

- Others

- By Application

- Advanced Instrument Cluster Display

- Centre Stack Touchscreen Display

- Rear Seat Entertainment Touchscreen Display

- Others

- By Screen Size

- 3’’-5’’

- 6’’-10’’

- More than 10’’

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Sales Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America