Report Overview

Global Proteomics Market Report, Highlights

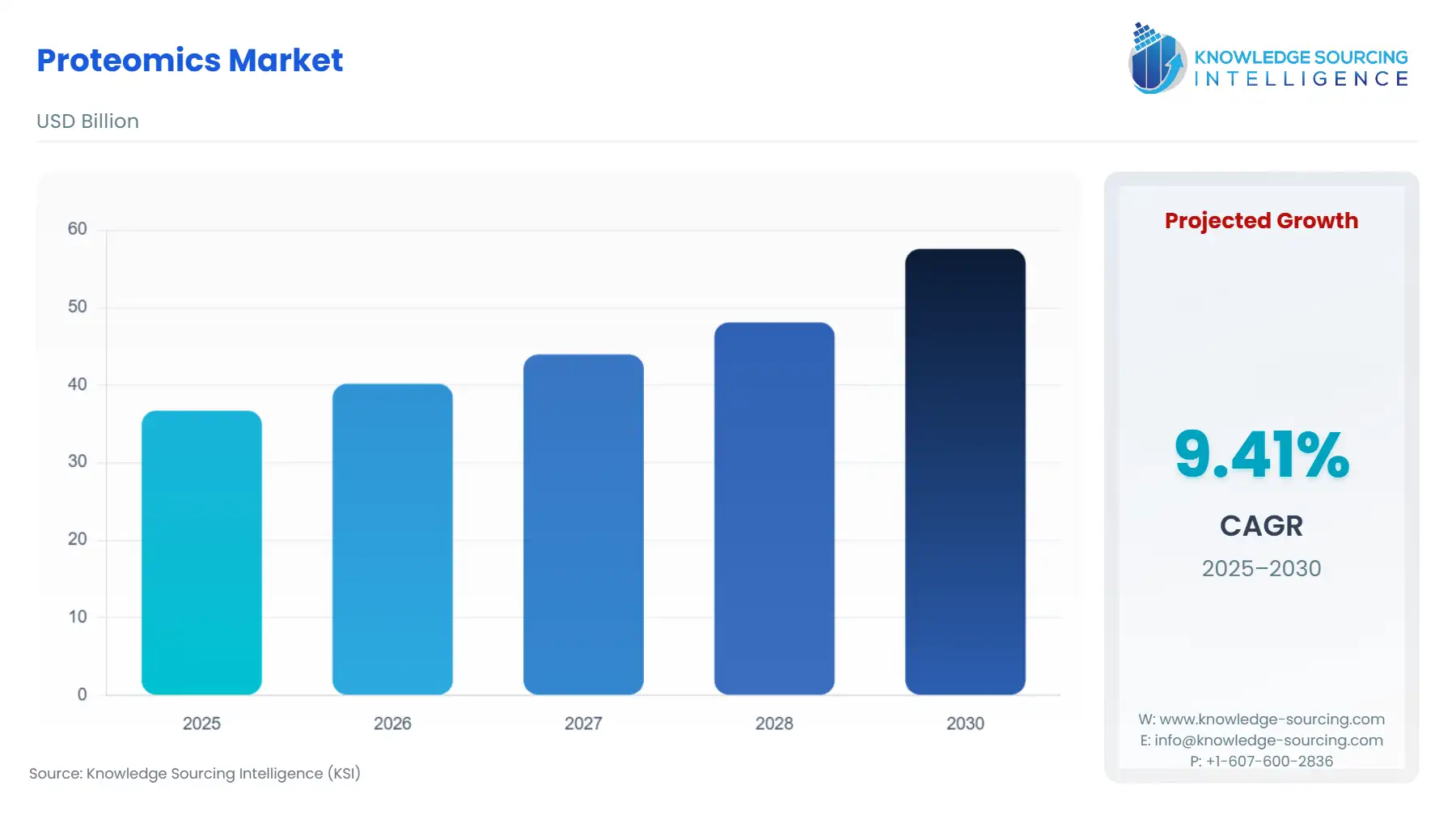

Proteomics Market Size:

The global proteomics market is expected to grow from USD 36.720 billion in 2025 to USD 57.582 billion in 2030, at a CAGR of 9.42%.

The Global Proteomics Market focuses on the large-scale study of proteins, the fundamental operational molecules of biological systems. This market is shifting from purely descriptive protein identification to high-throughput, quantitative, and functional analysis. The confluence of technological advancements in high-resolution instrumentation—particularly the development of advanced mass spectrometry platforms—and sophisticated bioinformatics tools is creating an unprecedented capacity to map the human proteome's complexity. This technological maturation is rapidly accelerating the transition of proteomics from a core academic research tool into an indispensable platform for commercial applications, including clinical diagnostics, drug target validation, and the development of personalized medicine strategies. The market dynamic is increasingly characterized by a service component, as researchers and clinicians outsource complex, data-intensive proteomic workflows to specialized Contract Research Organizations (CROs) and core laboratory facilities.

Global Proteomics Market Analysis

Growth Drivers

Increased government and private sector funding for life sciences research, particularly from entities like the US National Institutes of Health (NIH), constitutes a direct growth catalyst by subsidizing the high capital investment required for state-of-the-art proteomics instrumentation in academic and research institutes. Simultaneously, the accelerating demand for personalized medicine mandates the discovery and validation of specific protein biomarkers that can predict disease susceptibility, monitor progression, and forecast individual therapeutic response, thereby increasing biopharma and clinical demand for high-throughput protein analysis platforms. Furthermore, technological progress in mass spectrometry, including improved resolution and sensitivity, enables the detection of lower-abundance proteins, which are often the most crucial biomarkers, directly elevating the technical utility and resultant market requirement for newer instrument generations.

- Challenges and Opportunities

A significant constraint facing the market is the prohibitively high initial capital cost of acquiring advanced proteomics instrumentation, such as high-resolution Orbitrap mass spectrometers, which restricts adoption for smaller academic laboratories and nascent biotech startups. This high cost creates a major financial barrier to entry, channeling demand toward core facility services rather than direct instrument purchases. The market opportunity, conversely, lies in the functional integration of proteomics with other 'omics' data streams (genomics, transcriptomics) through sophisticated bioinformatics solutions. Developing user-friendly software and standardized data interpretation pipelines will decrease the reliance on specialized experts, democratize access to complex data analysis, and thereby expand the addressable market of proteomics applications into routine clinical and high-throughput industrial settings.

- Raw Material and Pricing Analysis

The Global Proteomics Market, while heavily instrument-dependent, relies critically on the continuous supply of specialized chemical Reagents and Kits for sample preparation and assay execution. Key chemical inputs include stable isotope labels (e.g., SILAC, TMT) for quantitative analysis, high-purity solvents for chromatography, and proprietary enzymatic digestion reagents (e.g., sequencing-grade trypsin). Pricing dynamics for these consumables are generally high due to the necessity of clinical-grade purity, batch-to-batch consistency, and proprietary formulation. The consistent, non-negotiable requirement for these kits and reagents, coupled with the high volume of assays performed, ensures the Consumables segment generates stable, recurring revenue, often insulating manufacturers from the cyclical purchasing patterns observed in the high-cost instrument segment.

- Supply Chain Analysis

The supply chain for proteomics instruments and consumables is highly specialized and consolidated, with core instrumentation manufacturing centered in North America and Europe, notably by a few major global vendors. This centralizes the risk profile around the availability of critical, high-precision electronic components, optical parts, and specialized proprietary reagents. The supply chain moves from these R&D and manufacturing hubs to distribution channels that serve specialized academic core labs, pharmaceutical company R&D centers, and clinical diagnostic facilities globally. Logistical complexities include the secure, temperature-controlled transport of sensitive reagents and the requirement for highly skilled field service engineers to maintain and validate the sophisticated analytical instruments at the end-user site.

Proteomics Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

National Institutes of Health (NIH) Funding |

NIH grants provide direct financial stimulus for basic and translational proteomic research, creating robust, sustained demand for advanced instruments, reagents, and services within US academic institutions. |

|

United States |

Clinical Laboratory Improvement Amendments (CLIA) |

CLIA regulations mandate quality standards for laboratory testing (including protein-based diagnostic assays) performed on human samples in the US, thereby channeling demand toward validated, standardized, and clinically reliable proteomic platforms. |

|

European Union |

In Vitro Diagnostic Regulation (IVDR) |

IVDR enforces stringent regulatory pathways for the commercialization of diagnostic assays, including proteomics-based biomarkers. This increases the cost and time of clinical translation but drives demand for high-quality, validated, and documented proteomic methods suitable for clinical deployment. |

Proteomics Market Segment Analysis

- By Technology: Mass Spectrometry (Spectroscopy)

Mass Spectrometry (MS) technology serves as the central analytical engine for modern proteomics, and its capabilities directly dictate the depth and breadth of proteomic research. The primary growth driver for high-end MS platforms is the escalating technical requirement from biopharmaceutical and academic research to resolve protein complexity and quantify low-abundance species across a wide dynamic range, such as in plasma samples. This necessity is directly addressed by innovations like Orbitrap technology, which delivers high-mass resolution and accuracy, enabling the unambiguous identification of thousands of proteins and their post-translational modifications (PTMs). Furthermore, the introduction of Data-Independent Acquisition (DIA) workflows on MS platforms has revolutionized quantification by offering faster and more reproducible results than older Data-Dependent Acquisition (DDA) methods. This technical superiority creates an imperative for core facilities to continually upgrade their MS instrumentation, sustaining the high-value instrument segment of the market by enhancing research throughput and data quality. The ability of MS to precisely define protein modifications (like phosphorylation and ubiquitination) drives its demand in drug development, where PTMs are critical to understanding drug efficacy and toxicity.

- By Application: Discovery of Protein Biomarkers

The Discovery of Protein Biomarkers segment is an essential application, acting as a crucial demand pivot for the entire proteomics market. The growth here is driven by the urgent global requirement for non-invasive, highly specific diagnostic tools for diseases like cancer, Alzheimer's, and cardiovascular disease, where early detection dramatically improves patient outcomes. Proteomics is uniquely positioned to identify disease-specific protein signatures in bodily fluids (e.g., blood, urine) that represent the physiological state, offering a functional readout that genomics often cannot provide. The high-throughput capacity of modern proteomics—enabled by technologies such as aptamer-based arrays and high-plex mass spectrometry workflows—allows researchers to screen thousands of proteins across large patient cohorts. This ability to move beyond single-protein assays to multiplexed panels accelerates the validation pipeline for new diagnostic candidates. Consequently, the success of biomarker discovery—measured by the number of clinically validated protein targets—directly validates and increases the market's reliance on, and investment in, sophisticated proteomics technology and reagent kits.

Proteomics Market Geographical Analysis

- US Market Analysis

The US market is the established global leader, characterized by an unparalleled concentration of funding, a deep bench of skilled scientific talent, and a powerful ecosystem of major pharmaceutical companies, biotechnology startups, and well-funded academic research institutions. Local factors driving demand include the robust, multi-billion-dollar research budget of the National Institutes of Health (NIH), which consistently fuels the purchase of high-end proteomics instrumentation and consumables in university and medical center core facilities. Furthermore, the strong emphasis on precision medicine, supported by initiatives like the Clinical Proteomic Tumor Analysis Consortium (CPTAC), ensures continuous high demand for technologies that can reliably profile tumor proteomes to guide targeted cancer therapies. The competitive and innovative nature of the US biotech sector drives rapid adoption of novel, high-throughput technologies.

- Brazil Market Analysis

The Brazilian proteomics market, representing a key demand center in South America, faces both significant opportunities and constraints. Demand is concentrated in federal and state-funded universities and research institutes, driven by research focused on endemic diseases, tropical infectious agents, and agricultural biotechnology. The primary constraint is capital availability; purchasing new, high-cost mass spectrometers is challenging, resulting in longer instrument lifecycles and a higher reliance on older-generation equipment. Consequently, the demand shifts toward cost-effective, high-quality reagents and consumables for existing platforms and reliance on outsourced services from regional core labs or international CROs, minimizing large capital expenditure.

- German Market Analysis

Germany maintains a technologically mature proteomics market, highly integrated within Europe’s substantial life science research infrastructure. Demand is generated by world-leading academic research centers (e.g., Max Planck Institutes) and a powerful domestic pharmaceutical and biotech industry. The German market prioritizes high-quality, reliable instrumentation that complies with strict quality management systems (QMS), reflecting a cultural preference for engineering excellence and traceable data integrity. Local governmental funding programs and European Union research grants (e.g., Horizon Europe) stabilize research budgets, ensuring sustained demand for instrument upgrades and specialized, high-purity chromatography and spectroscopy reagents.

- Israel Market Analysis

Israel’s proteomics market is characterized by intense activity driven by its globally recognized high-tech and biotech start-up ecosystem. Demand is highly focused on advanced, disruptive technologies, often relating to early-stage biomarker discovery and functional proteomics linked to therapeutic development. The local factor influencing demand is the close, synergistic relationship between academic institutions, hospitals, and venture-backed private companies, facilitating rapid translation of research breakthroughs into commercially viable diagnostic assays and drug targets. This focus drives high demand for high-plex, low-sample-volume technologies, such as aptamer-based assays, which facilitate rapid screening in early-stage clinical trials.

- China Market Analysis

China represents the fastest-growing major market, propelled by massive state-led investments into science and technology, exemplified by large-scale national protein research programs. The local growth factor is the need to rapidly develop a comprehensive domestic capability in pharmaceutical R&D, moving from generic manufacturing to novel drug discovery. This creates substantial, large-scale demand for high-throughput proteomics systems and core laboratory services, often involving large bulk procurement of instruments and basic reagents. The market shows a high price sensitivity in the mass-market segments, but an increasing appetite for premium, state-of-the-art instruments necessary for world-class research publications and global competitive parity.

Proteomics Market Competitive Environment and Analysis

The Global Proteomics Market is dominated by a few large multinational companies that supply the core instrumentation (Mass Spectrometers and Chromatography Systems) and a highly fragmented ecosystem of specialized firms providing niche reagents, software, and contract services. Competitive differentiation hinges on instrument performance metrics (sensitivity, speed, resolution), the breadth of the service offering (integrated workflows), and proprietary reagent technology. The larger entities compete by offering a comprehensive solution portfolio, combining hardware, consumables, software, and global service support.

- Thermo Fisher Scientific

Thermo Fisher Scientific is strategically positioned as a market leader, providing an end-to-end solution across the entire proteomics workflow. The company leverages its proprietary Orbitrap mass spectrometry technology, which has become a de facto standard in advanced research proteomics due to its high-performance characteristics. Key products include the Orbitrap Fusion and Orbitrap Lumos instruments, along with associated consumables like the TMTPRO isobaric labeling reagents. The acquisition of Olink Proteomics in 2024 further cemented its dominance, providing an established, high-throughput, antibody-based protein quantification platform that directly addresses the rapidly expanding demand for large-scale population proteomics and clinical research. Their strategic strength lies in combining instrumentation excellence with a robust consumables and services revenue base.

- Agilent Technologies

Agilent Technologies maintains a strong competitive position by focusing on high-performance analytical instruments, particularly in liquid chromatography (LC) systems, which are indispensable upstream components for mass spectrometry-based proteomics. The company’s strategy involves providing integrated, high-quality LC/MS systems, such as the Revident LC/Q-TOF and the 6495D LC/TQ for targeted quantification, which appeal to laboratories demanding reliable, high-sensitivity workflows for large-batch sample analysis. Agilent effectively competes by emphasizing the robustness and reliability of its chromatography systems, ensuring high sample throughput and reduced downtime, critical factors for both academic core facilities and commercial drug development labs.

- Biognosys AG

Biognosys AG represents the high-growth segment of specialized proteomics services and kits, with a strategic focus on Data-Independent Acquisition (DIA) technology. The company’s proprietary Hyper Reaction Monitoring (HRM) and PQ500 targeted protein quantification kits capitalize on the market's need for highly reproducible and quantitative proteomics data, particularly for biomarker validation and clinical trials. Biognosys competes by offering a superior service for targeted and deep proteome profiling, which enables pharmaceutical clients to quickly generate high-quality quantitative data without the significant investment in specialized in-house instrumentation and bioinformatics expertise, directly meeting the demand for outsourced, high-performance data generation.

Proteomics Market Developments

- January 2025: The UK Biobank Pharma Proteomics Project (UKB-PPP) selected Thermo Fisher's Olink® Explore Platform to analyze over 5,400 proteins across 600,000 samples. This non-Mass Spectrometry selection validated the utility of antibody-based proteomics for massive population-scale biomarker discovery efforts.

- June 2025: Illumina announced the acquisition of SomaLogic for $350 million. This deal brings SomaLogic's aptamer-based affinity proteomics platform, SomaScan, into Illumina's multiomics portfolio, accelerating its presence in the high-throughput sequencing-based proteomics market segment.

- June 2024: Thermo Fisher Scientific introduced the new Vanquish™ Neo UHPLC system with a Tandem Direct Injection workflow and the TMTPRO 32plex Label Reagents at the ASMS conference. These launches enhance high-throughput LC-MS/MS capabilities, significantly increasing sample analysis capacity and data multiplexing.

Proteomics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 36.720 billion |

| Total Market Size in 2031 | USD 57.582 billion |

| Growth Rate | 9.42% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Component, Reagents, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Proteomics Market Segmentation:

- By Technology

- Microarrays

- Spectroscopy

- X-Ray Crystallography

- Chromatography

- Others

- By Component

- Reagents & Kits

- Consumables

- Others

- By Reagents

- Microarrays Reagents

- Spectroscopy Reagents

- X-Ray Crystallography Reagents

- Chromatography Reagents

- Other Reagents

- By Application

- Discovery of Protein Biomarkers

- Study of Tumor Metastasis

- Neurotrauma and Neurology

- Renal Disease Diagnosis

- Fetal and Maternal Medicine

- Others

- By Geography

- NorthAmerica

- United States

- Canada

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Israel

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- India

- Australia

- South Korea

- Others

- NorthAmerica