Report Overview

Global Cardiac Mapping Market Highlights

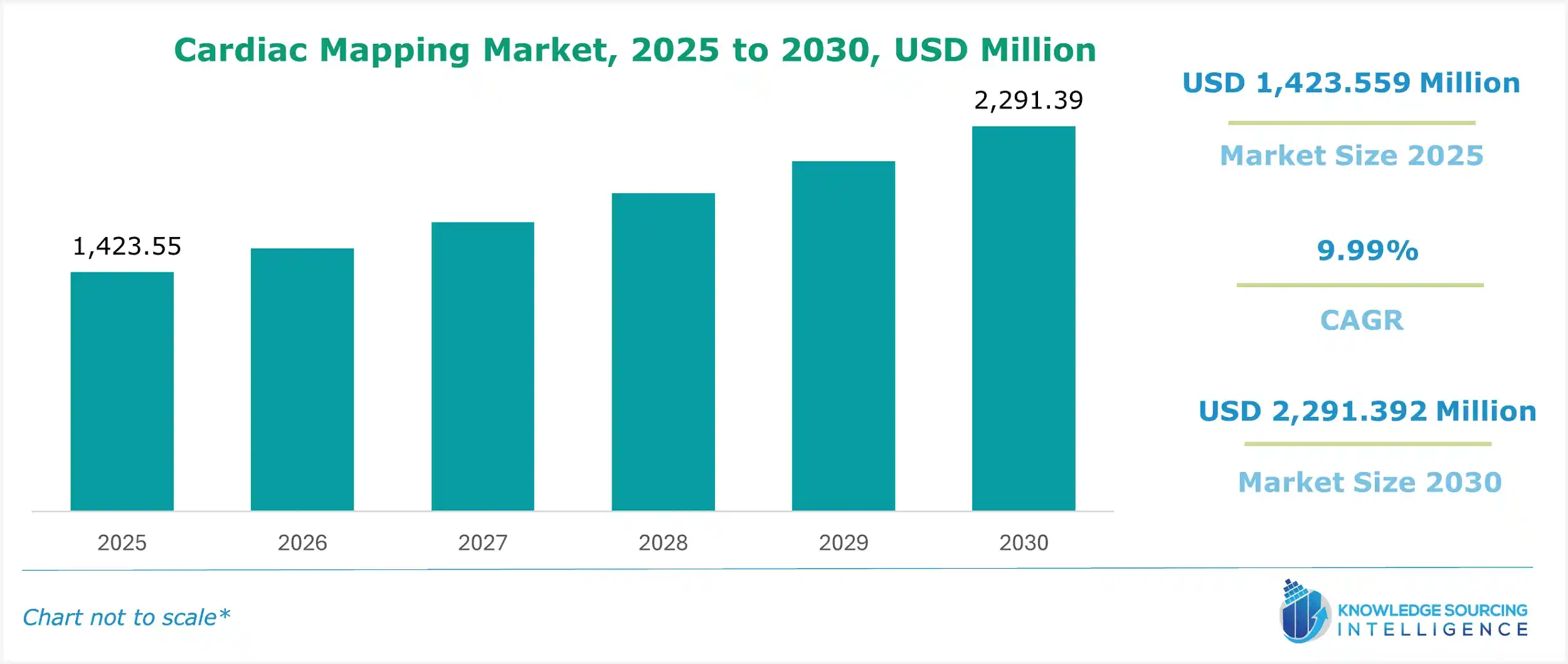

Cardiac Mapping Market Size:

The global cardiac mapping market is estimated at US$1,423.559 million in 2025 and is expected to grow at a CAGR of 9.99% to attain US$2,291.392 million in 2030.

Cardiac mapping is the study of electrophysiology or EP. The cardiac mapping process helps in identifying various types of temporal and spatial distribution in the heart. This system also helps in accurately recognizing various sites of abnormal rhythm and delivers radio-frequency catheter ablation therapy. The increasing global prevalence of cardiovascular diseases is the major factor propelling this market’s growth during the forecasted timeline. Similarly, technological advancements in cardiac mapping devices are also estimated to propel market expansion. New and effective techniques for the successful treatment of atrial fibrillation are offering market players valuable opportunities to enhance their competitive position and accelerate overall market growth.

Global Cardiac Mapping Market Overview & Scope:

The global cardiac mapping market is segmented by:

- Product: By product, the global cardiac mapping market is categorized into EP ablation catheters, EP laboratory devices, EP diagnostic catheters, and access devices. The EP ablation catheter category is estimated to grow significantly.

- Indication: By indication, the market is divided into Atrial Fibrillation, Atrial Flutter, Atrioventricular Nodal Reentry Tachycardia, and Wolff-Parkinson-White syndrome. The Atrial Flutter category is forecasted to grow rapidly.

- End-User: The end-user segment of the cardiac mapping market is divided into hospitals & clinics and diagnostic centers. The hospitals and clinics category is estimated to grow significantly due to the increasing governmental investment in the development of the hospital infrastructure.

- Region: The Asia Pacific region is estimated to increase its share over the forecast period due to the initiatives being taken and the investment being made to develop the medical infrastructure in countries such as India to provide better healthcare facilities.

Top Trends Shaping the Global Cardiac Mapping Market:

1. Growth of the healthcare infrastructure

- The growing global advancements in healthcare infrastructure and the introduction of significant governmental policies are key factors driving the demand to develop cardiac mapping systems.

2. Increasing awareness of early disease detection

The increasing individual awareness of early diagnosis is also estimated to boost the demand for cardiac mapping systems. The cardiac mapping system helps detect various types of cardiovascular disease, including arrhythmias and coronary artery disease.

Global Cardiac Mapping Market Growth Drivers vs. Challenges:

Opportunities:

- Growing global cases of cardiovascular diseases: The major factor propelling the growth of the cardiac mapping market during the forecasted timeline is the increasing global prevalence of cardiovascular diseases. The cases of cardiovascular diseases, like arrhythmias, heart attacks, and coronary artery disease, witnessed a major increase. The Center for Disease Control and Prevention of the USA, in its report, stated that in 2022, the total cases of cardiovascular diseases were recorded at 702,880.

- Rising technological advancements: The increasing advancement in medical technology and the accuracy and efficiency of cardiac mapping systems are estimated to grow, raising its demand.

Challenges:

- Higher cost of cardiac mapping procedure: The higher cost of cardiac mapping procedures is among the major factors challenging the cardiac mapping market growth during the estimated timeline.

Global Cardiac Mapping Market Regional Analysis:

- North America: The North American region is estimated to hold a significant share over the forecast period due to the well-established healthcare industry and the availability of quality healthcare services, coupled with the early adoption of advanced and enhanced medical devices and detection products, which are being made available the market players. In addition, the growing geriatric population and the increased risk of heart problems are among other reasons for the rising demand for cardiac mapping in countries such as the US.

Global Cardiac Mapping Market Competitive Landscape:

The market is fragmented, with many notable players including Biosense Webster, Inc., Medtronic, Abbott, BIOTRONIK SE & Co KG, Acutus Medical, Boston Scientific Corporation, AMETEK Inc., Catheter Precision Inc., Medical Device Business Services, Inc. (Johnson&Johnson), MicroPort Scientific Corporation, Koninklijke Philips N.V, and Kardium Inc. among others.

- Product Launch: In October 2024, Boston Scientific Corporation, a global leader in the biotechnology market, launched a next-generation cardiac mapping system, FARAPULSE Pulsed Field Ablation System. The system provides visualization for cardiac ablation procedures.

Cardiac Mapping Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cardiac Mapping Market Size in 2025 | US$1,423.559 million |

| Cardiac Mapping Market Size in 2030 | US$2,291.392 million |

| Growth Rate | CAGR of 9.99% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cardiac Mapping Market | |

| Customization Scope | Free report customization with purchase |

Global Cardiac Mapping Market is analyzed into the following segments:

By Product

- EP Ablation Catheters

- EP Laboratory Devices

- EP Diagnostic Catheters

- Access Devices

By Indication

- Atrial Fibrillation

- Atrial Flutter

- Atrioventricular Nodal Re-entry Tachycardia

- Wolff-Parkinson-White Syndrome

By End-User

- Hospitals and Clinics

- Diagnostic Centers

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa