Report Overview

Cardiac Implant Devices Market Highlights

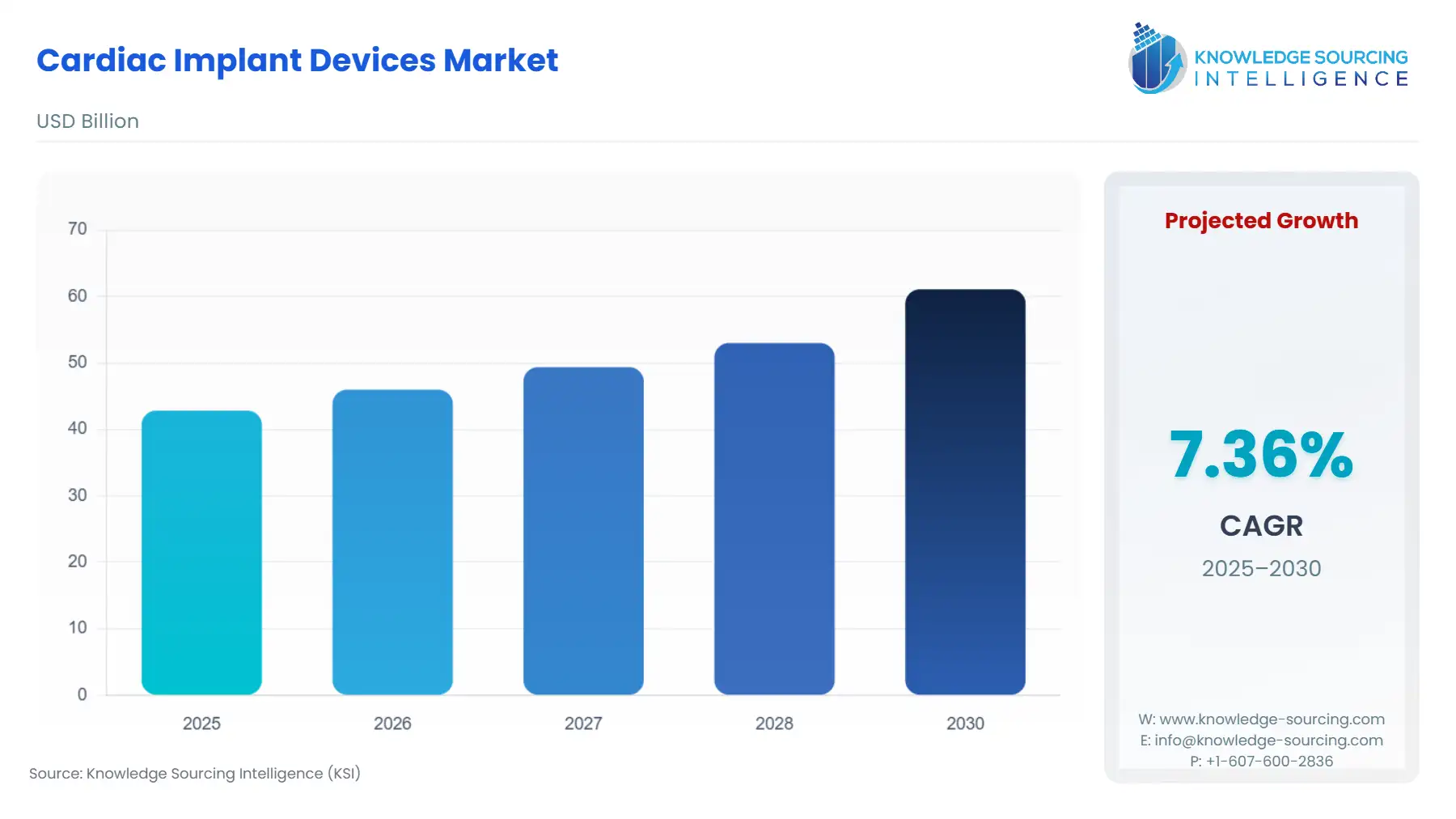

Cardiac Implant Devices Market Size:

The Cardiac Implant Devices Market is anticipated to rise from USD 42.845 billion in 2025 to USD 61.101 billion by 2030, at a CAGR of 7.36%.

Cardiac Implant Devices Market Key Highlights:

The cardiac implant devices market is experiencing significant growth, driven by technological advancements, an aging global population, and increasing prevalence of cardiovascular diseases. However, the market also faces challenges such as stringent regulatory environments, supply chain disruptions, and varying reimbursement policies across regions. This report provides an in-depth analysis of the current market dynamics, segment-specific trends, and regional insights to inform stakeholders in the healthcare industry.

Cardiac Implant Devices Market Analysis

Growth Drivers

Technological Advancements: Innovations in cardiac implant devices, such as the development of dissolvable pacemakers, are enhancing treatment options and driving market demand. These advancements offer safer and more effective solutions, particularly for pediatric patients, thereby expanding the potential patient base.

Aging Population: The global increase in life expectancy is leading to a higher incidence of age-related cardiovascular conditions, thereby escalating the demand for cardiac implant devices. Elderly populations are more susceptible to heart diseases, necessitating the adoption of implantable devices for treatment and management.

Rising Prevalence of Cardiovascular Diseases: The growing prevalence of conditions such as atrial fibrillation and heart failure is propelling the demand for devices like pacemakers and implantable cardioverter defibrillators (ICDs).

Challenges and Opportunities

Regulatory Hurdles: Stringent regulatory requirements and lengthy approval processes can delay the introduction of new devices into the market. This not only affects the speed at which innovations reach patients but also impacts the overall market dynamics by limiting the availability of advanced treatment options.

Supply Chain Disruptions: Trade tensions and tariffs, particularly between major manufacturing countries, are causing significant disruptions in the global supply chain for medical devices. These disruptions lead to increased production costs and potential shortages, affecting the timely availability of cardiac implant devices.

Reimbursement Policies: Varying reimbursement policies across different regions can influence the adoption rates of cardiac implant devices. Inconsistent coverage and reimbursement rates may deter healthcare providers from adopting new technologies, thereby affecting market growth.

Supply Chain Analysis

The global supply chain for cardiac implant devices is complex, involving multiple stakeholders including raw material suppliers, manufacturers, distributors, and healthcare providers. Key production hubs are located in North America, Europe, and parts of Asia, with countries like the United States, Germany, and China playing pivotal roles. However, the supply chain faces challenges such as geopolitical tensions, trade tariffs, and regulatory barriers, which can lead to increased costs and delays in product availability.

Government Regulations

Government regulations play a crucial role in shaping the cardiac implant devices market. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) establish stringent guidelines to ensure the safety and efficacy of medical devices. While these regulations are essential for patient safety, they can also result in longer approval timelines and increased development costs for manufacturers.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

USA |

FDA Medical Device Regulations |

Ensures safety and efficacy but may delay market entry |

|

EU |

Medical Device Regulation (MDR) |

Introduces stricter post-market surveillance requirements |

|

India |

CDSCO Medical Device Rules |

Expanding regulatory framework to include more devices |

|

Japan |

PMDA Device Approval Process |

Rigorous testing requirements extend approval timelines |

|

Brazil |

ANVISA Medical Device Regulations |

Requires local clinical trials, increasing time to market |

In-Depth Segment Analysis

By Product Type: Pacemakers

Pacemakers are among the most widely used cardiac implant devices, designed to regulate heart rhythms in patients with arrhythmias. The market for pacemakers is experiencing steady growth, driven by advancements in device technology and increasing patient awareness. Innovations such as leadless pacemakers and MRI-compatible devices are enhancing patient outcomes and expanding the potential patient base. Moreover, the growing elderly population is contributing to the rising demand for pacemakers, as age-related heart conditions become more prevalent.

By End-User: Tertiary Hospitals

Tertiary hospitals serve as specialized centers for advanced medical care, including complex cardiac procedures. These institutions are major consumers of cardiac implant devices due to their capacity to perform intricate surgeries and manage high-risk patients. The demand from tertiary hospitals is influenced by factors such as healthcare infrastructure, availability of specialized medical personnel, and patient demographics. As healthcare systems evolve and expand, the role of tertiary hospitals in the cardiac implant devices market is expected to grow, driven by their central role in providing specialized care.

Geographical Analysis

United States

The U.S. remains a dominant player in the cardiac implant devices market, owing to its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and strong reimbursement policies. The market is further bolstered by the presence of leading medical device manufacturers and research institutions. However, challenges such as regulatory complexities and supply chain disruptions due to trade tensions may impact market dynamics.

Germany

Germany is a key market in Europe, known for its robust healthcare system and high standards of medical care. The demand for cardiac implant devices is driven by an aging population and increasing awareness of cardiovascular health. Regulatory frameworks in Germany are stringent, ensuring the safety and efficacy of medical devices, but may also contribute to longer approval processes.

Brazil

Brazil represents a significant market in South America, characterized by a large and diverse population. The demand for cardiac implant devices is influenced by factors such as urbanization, healthcare access, and government healthcare initiatives. Challenges include regional disparities in healthcare infrastructure and varying reimbursement policies, which can affect the adoption of advanced medical technologies.

Saudi Arabia

In the Middle East, Saudi Arabia is a leading market for cardiac implant devices, driven by substantial healthcare investments and a growing focus on non-communicable diseases. The government's Vision 2030 initiative aims to enhance healthcare services, potentially increasing the demand for advanced cardiac treatments. However, the market faces challenges related to regulatory approvals and the integration of new technologies into existing healthcare systems.

India

India's cardiac implant devices market is expanding rapidly, fueled by a large population, rising disposable incomes, and increasing prevalence of cardiovascular diseases. The demand is further supported by improvements in healthcare infrastructure and government initiatives aimed at enhancing medical access. Despite these positive trends, challenges such as regulatory hurdles and disparities in healthcare access between urban and rural areas may impact market growth.

Competitive Environment and Analysis

Boston Scientific

Boston Scientific is a leading player in the cardiac implant devices market, offering a range of products including pacemakers, ICDs, and heart rhythm treatment devices. The company's strong financial performance is attributed to robust demand for its heart devices, such as Farapulse and Watchman. In 2025, Boston Scientific raised its annual profit forecast, reflecting confidence in continued market growth.

Medtronic

Medtronic is another major competitor, known for its comprehensive portfolio of cardiac implant devices, including pacemakers, ICDs, and heart valves. The company leverages extensive research and development to drive innovation, focusing on improving patient outcomes and expanding market reach.

Abbott Laboratories

Abbott Laboratories focuses on minimally invasive cardiac implant devices and remote monitoring solutions. Strategic acquisitions and technological innovations have strengthened Abbott's position in the global cardiac implant devices market.

Recent Market Developments

- July 2024: The Abu Dhabi Investment Authority (ADIA) signed a $200 million investment agreement for a 3% stake in Meril (Micro Life Sciences). A well-known manufacturer of medical devices, Meril specializes in endo-surgery, cardiovascular, structural heart, surgical robotics, orthopaedics, and in-vitro diagnostics.

- April 2024: Johnson & Johnson acquired Shockwave Medical for $12.5 billion, enhancing its heart device business with intravascular lithotripsy technology.

- March 2024: Medtronic launched its latest leadless pacemaker technology, offering a minimally invasive solution for patients with cardiac rhythm disorders.

Cardiac Implant Devices Market Segmentation

- By Product Type:

- Pacemakers

- Cardiac Resynchronization Therapy (CRT) devices

- Implantable Cardioverter Defibrillator (ICD)

- Transcatheter Heart Valves (TAVR/TAVI) & Surgical Prosthetic Valves

- Ventricular Assist Devices (VADs/LVADs)

- Cardiac Monitoring Implants

- Left Atrial Appendage (LAA) Closure Device

- Coronary Stents

- Prosthetic Heart Valves

- Insertable Cardiac Monitor (ICM)

- Implantable Heart Pump

- Leads, Generators, and Delivery Systems

- Others

- By Distribution:

- Tertiary Hospitals

- Community Hospitals

- Ambulatory Surgery Centers

- Cardiac Clinics

- By Geography:

- North America: USA, Canada, Mexico

- South America: Brazil, Argentina, Others

- Europe: UK, Germany, France, Italy, Spain, Others

- Middle East & Africa: Saudi Arabia, UAE, Others

- Asia Pacific: China, Japan, India, South Korea, Taiwan, Thailand, Indonesia, Others

Cardiac Implant Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cardiac Implant Devices Market Size in 2025 | US$33.276 billion |

| Cardiac Implant Devices Market Size in 2030 | US$47.741 billion |

| Growth Rate | CAGR of 7.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cardiac Implant Devices Market |

|

| Customization Scope | Free report customization with purchase |