Report Overview

Global Clinical Trials Packaging Highlights

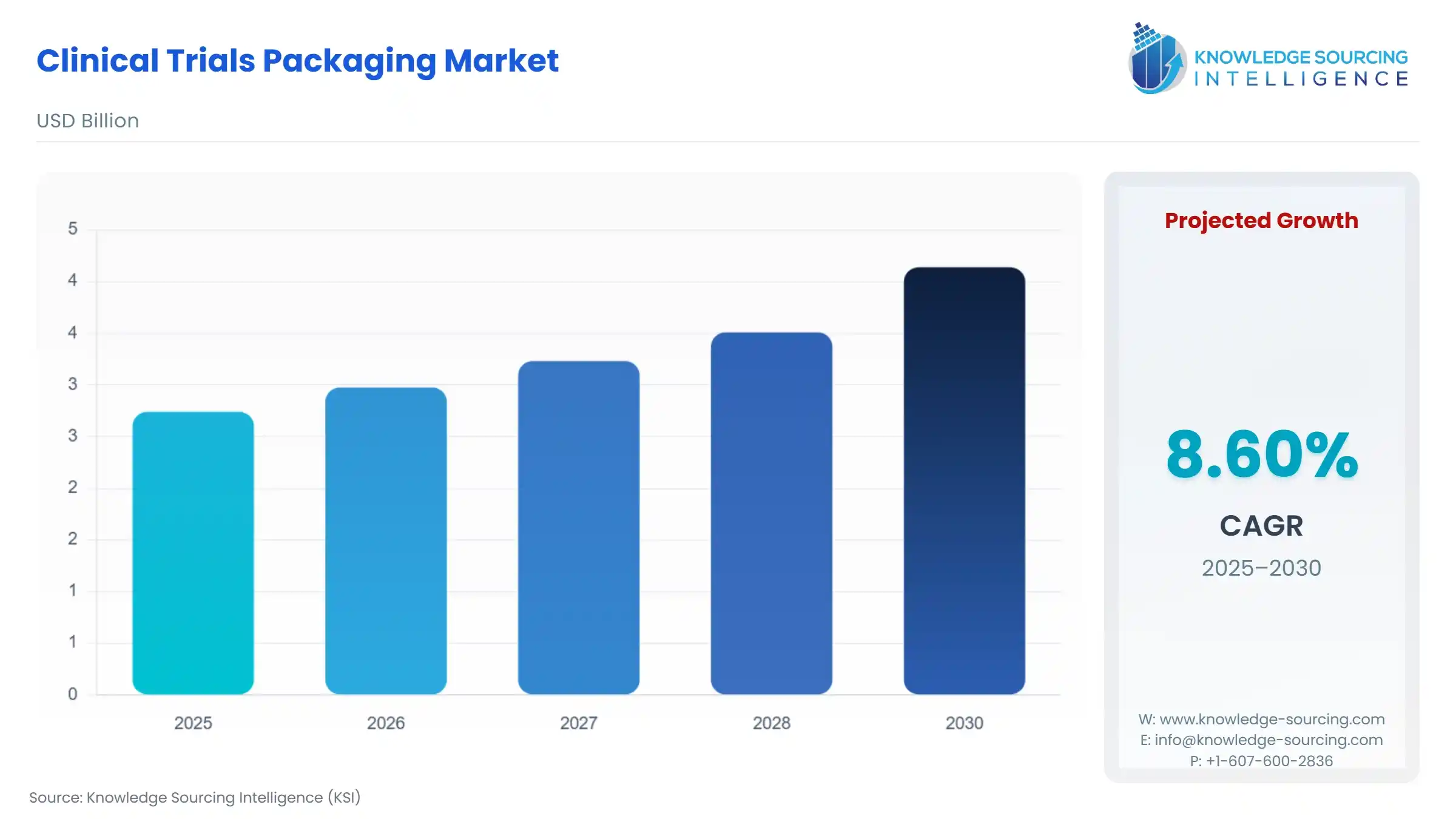

Clinical Trials Packaging Market Size:

The Global Clinical Trials Packaging Market is expected to grow from USD 2.740 billion in 2025 to USD 4.139 billion in 2030, at a CAGR of 8.60%.

Clinical Trials Packaging Market Trends:

As there has been an increase in the number of orphan diseases or rare diseases affecting the population throughout the world, there has been a surge in the number of clinical trials being carried out worldwide. According to the statistics by the U.S. National Library OF Medicine, there are about 165,436 or 49% of the clinal studies and research being conducted in non-U.S. locations, 112,905 or 34% have been conducted in the U.S only, and 17,369 or 5% have been conducted in both U.S. and Non-U.S. locations. Lastly, the data for 39,492, or 12% of clinical trials in other locations, has not been reported. This calls for medicine and pharmaceutical manufacturers to come up with better formulations and competent compositions to control these diseases effectively. Consequently, it is putting a burden on the clinical trial packing companies and players to improve the state and the quality of their packing solutions as there is a critical issue involved in the packaging of sensitive drugs for clinical trials.

In addition, there are 4 phases in clinical trials, Phase I – Phase IV. Each phase requires a stringent packaging requirement. In Phase 1, only a limited number of packs are sent, so packaging called the primary packaging must be good enough as the shelf life of the testing medicine is not much. More importantly, typical secondary packaging contains adequate labelling, which should include the name of the producer, the name of the medication and all of its ingredients, as well as the shelf life of each, as well as any necessary precautions to prevent tampering and counterfeiting. Then the primary packaged medicine, which is done using the cold form or thermoforms techniques, is out inside the secondary package, such as bottles, kits, or others with effective temperature control. Therefore, this has led to an increase in the demand for effective packing solutions by the market players and is a major driving factor in the market growth over the forecast period.

Furthermore, the market is anticipated to expand throughout the forecast period as a result of the rising need for safe, environmentally friendly, and hygienic packaging choices for healthcare products and eCommerce shipping.

Clinical Trials Packaging Market Geographical Outlook:

- The North American region to hold a considerable share over the forecast period due to increasing initiatives taken by the organizations, stringent regulations, and increasing investments

The North American region is expected to hold a significant share over the forecast period, which is attributable to the fact that the pharmaceutical and packing industry in the US is flourishing due to the increasing influx of investments. In addition, there are stringent guidelines in place for the packaging of the medicine to be used for clinical trials by organizations such as the FDA that must be complied with by the market players to minimize their losses and avoid the imposition of heavy penalties.

Clinical Trials Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.740 billion |

| Total Market Size in 2031 | USD 4.139 billion |

| Growth Rate | 8.60% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Material Type, Packaging Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Clinical Trials Packaging Market Segmentation:

- By Product Type

- Vials

- Blisters

- Tubes

- Bottles

- Sachets

- Bags and Pouches

- Others

- By Material Type

- Plastic

- Glass

- Metal

- Paper & Paperboard

- Others

- By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America