Report Overview

Commercial Greenhouse Market Report, Highlights

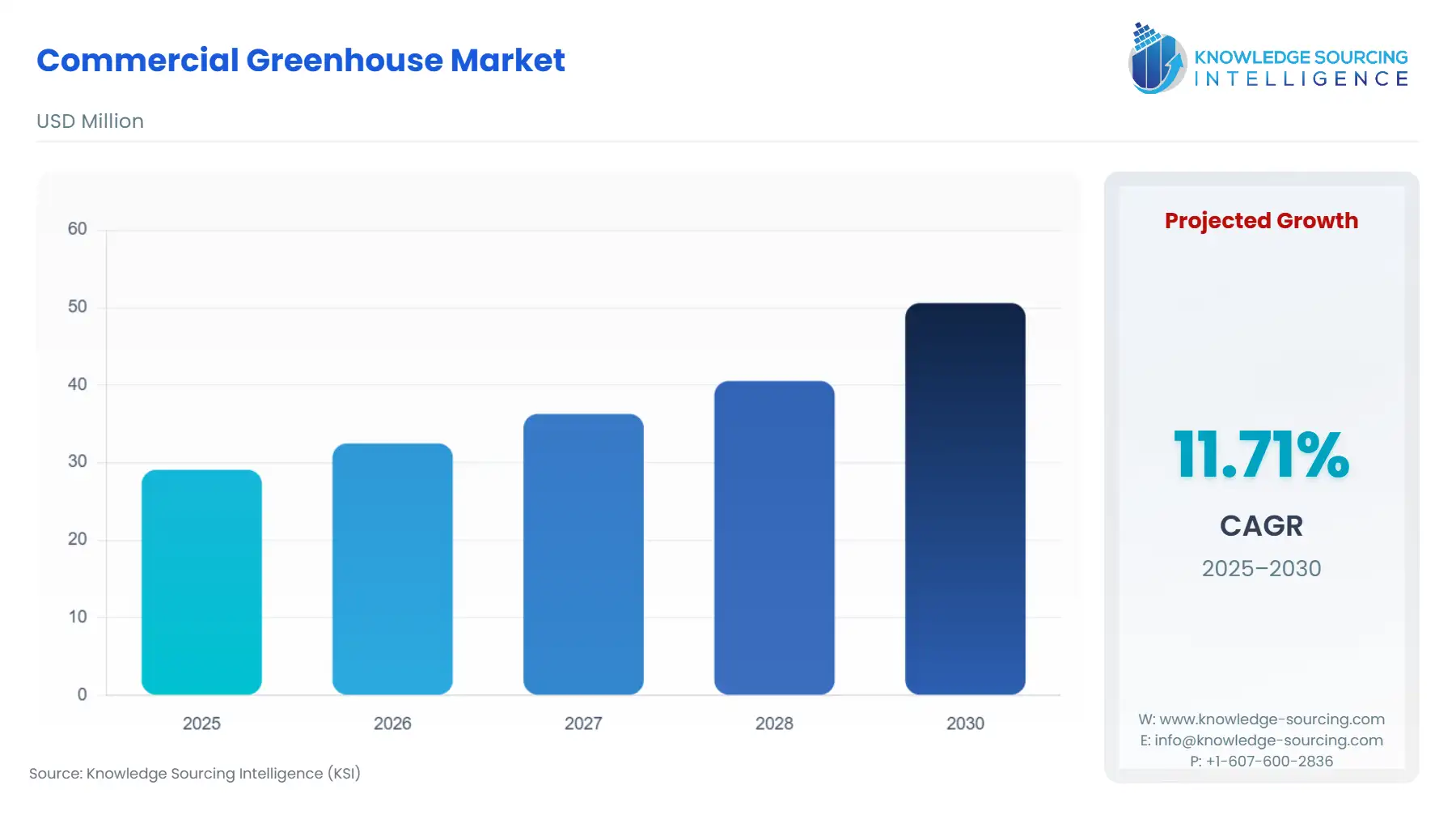

Commercial Greenhouse Market Size:

The commercial greenhouse market will grow from US$29,084 million in 2025 to US$50,594 million in 2030 at a CAGR of 11.69%.

Commercial Greenhouse Market Trends:

A commercial greenhouse is a greenhouse where crops are grown and later sold for commercial consumption. Generally, all commercial greenhouses have high-tech facilities specifically designed to grow the intended crops. These greenhouses grow vegetables, flowers, trees, ornamentals, cannabis, and shrubs. Several greenhouses have transparent rooftops that allow sunlight to grow plants. Other greenhouses could be in buildings and use special lights as sunlight. This enables the reliable growth of greenhouse plants despite the local climate, soil, or topography challenges.

Commercial greenhouses could vary from large farms to neighborhood nurseries. These are utilized to accommodate numerous features, providing controlled conditions according to the need or requirement, which is optimum for the growth of plants. Increasing demand for food due to the growing population, rapid urbanization, less availability of arable land, and climate change affecting crop yield are the driving factors for the commercial greenhouse industry’s expansion.

In addition, the changing climatic conditions during traditional farming have led to the adoption of commercial greenhouses, further fueling market growth. The growing trend of rooftop farming is also major, along with several advantages of commercial greenhouses like optimizing heat, even distribution of sunlight in the greenhouse facility, microclimate control, rain and disease protection, excellent ventilation, and good crop yield.

Commercial Greenhouse Market Growth Drivers:

- The high yield is expected to boost the demand for commercial greenhouses globally.

The utilization and implementation of greenhouse farming give far more control over the environment where crops are grown. Crop producers can maintain the temperature, irrigation process, air humidity, and light efficiently, which produces a good yield for them. By exercising control over the growth of crops, farmers keep them healthier and can predict the amount they are going to harvest. The advantage of controlling the environmental factors enables farmers to grow crops and produce throughout the year.

Growing crops in the safe environment of a greenhouse helps in improving the genetics of the plant, which leads to the growth of a healthy variety of crops. With the multiple benefits of commercial greenhouses, the yield produced using these greenhouses is much more than that traditionally produced. This benefits the farmers as the yield is large in quantity, and the quality is better than the former. As per Our World in Data on crop yields in 2022, the wheat yield was 2.71 tonnes in Africa, 3.51 tonnes in Asia, 4.51 tonnes in Europe, and 3.31 tonnes in North America.

- Rising demand for horticulture crops is anticipated to propel the commercial greenhouse market growth.

The yearly demand for fruits and vegetables is rising worldwide, and greenhouse systems hold a significant market share. Owing to the advantage of growing plants regardless of climatic conditions, the greenhouse system is a major factor in the market. Advancements in technology are contributing to the rise in commercial greenhouses.

In addition, cultivation in greenhouses requires less labor and is aiding in the inclination toward the increasing adoption of greenhouses worldwide. For instance, in September 2023, Pure Harvest partnered with Richel Group for a three-year strategic partnership in the Middle East and Asia, aimed at deploying over $150 million worth of smart growing systems. Richel, a global greenhouse solution provider, supports the design and construction of smart farms in these regions and enhances its efficiency in designing, manufacturing, and building high-tech greenhouses in challenging climates and distant regions.

Commercial Greenhouse Market Restraint:

- Initial high costs and requirements for precision technology could hinder market growth.

The monitoring and accuracy of the natural resources and nutrient levels for constant management and adjustment to suitable levels as per different crop requirements, are the key benefits of producing greenhouse crops. The initial cost of setting up a commercial greenhouse is very high, as there is a requirement for the proper design of the watering systems and supplemental lighting. Thus, setting up these systems involves huge costs, which are difficult for a traditional framer to afford. This could cause a major hindrance to the growth of the commercial greenhouse market, especially in developing regions.

Commercial Greenhouse Market Geographical Outlook:

- Europe region is predicted to dominate the commercial greenhouse marketplace.

Europe's regional markets are projected to grow due to the rising number of low-tech and medium-tech greenhouses in these regions, supported by the adoption of modern farming practices. Due to harsh climatic conditions, cultivating crops in a commercial greenhouse is the most preferred form of cultivation. The demand for commercial greenhouses is expected to witness a rise owing to the growing focus on improvements in the agricultural sector by governments and multiple institutions.

For instance, in October 2023, Tomtech, a leading provider of commercial greenhouse monitoring and control systems, ensured precise monitoring of factors like lighting, humidity, and temperature. Tomtech installed a new control system and upgraded ventilation motors at the University of Reading's School of Biological Sciences. The university's three greenhouses are used for science and conservation while students conduct research. Further, high-tech commercial greenhouses hold the dominant market share and are expected to be the fastest-growing segment owing to their increasing adoption in the region.

Commercial Greenhouse Market Key Developments:

- March 2024- Heliospectra, a leading provider of intelligent lighting technology for greenhouse and controlled plant growth environments, received a new order from a top greenhouse grower in Ontario, Canada, totalling 8.3 million SEK. The order included the modular MITRA X LED light and helioCORE™ system solution, with four deliveries scheduled for 2024 and 2025.

- August 2023- DENSO Corporation acquired a full stake in Certhon Group, a Dutch greenhouse provider, to expand its global agricultural production business.

- November 2022- Gibraltar Industries' agritech business unit, Prospiant, introduced pre-engineered cannabis cultivation solutions like Hybrid Vail, Indoor Grow, and Sealed Venlo to boost revenue and provide customized greenhouse growing solutions.

Commercial Greenhouse Market Players and Products:

- Multi-span greenhouses – Richel offers a range of multi-span greenhouses, ranging from 6.40m to 16m, designed for optimal climate control and outdoor conditions. These greenhouses feature streamlined arches, spacing of 2.5m to 4m, and a Gothic shape for maximum light penetration. The 6.40m - 8.00m models have 50% vents, while the 9.60m model balances volume and ventilation. The 12.80m model offers the best compromise in cold and hot regions. The 16m model is the highest volume greenhouse on the market.

- Dual Atrium – The Dual Atrium is a greenhouse by Prospiant. It provides a protected environment for crop conditioning and steering. It features double roof ventilation, a 42-foot wide-span truss design, and dehumidification. Made of triple-galvanized steel and aluminum, it offers stability in wind and winter conditions. It integrates overhead equipment and is ideal for year-round passive retail ranges in temperate climates.

List of Top Commercial Greenhouse Companies:

- Richel Group SA,

- Argus Control Systems Ltd. (CEL Group)

- Certhon

- Lumigrow, Inc.

- Agra Tech, Inc.

Commercial Greenhouse Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29,084 million |

| Total Market Size in 2031 | USD 50,594 million |

| Growth Rate | 11.69% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Component, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

The commercial greenhouse market is segmented and analyzed as below:

- By Type

- Free Standing

- Gutter Connected

- By Component

- High-Tech

- Medium-Tech

- Low-Tech

- By Application

- Fruits and Vegetables

- Flowers and Ornamentals

- Nursery Crops

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Others

- North America