Report Overview

Consumer Robot Market - Highlights

Consumer Robot Market Size:

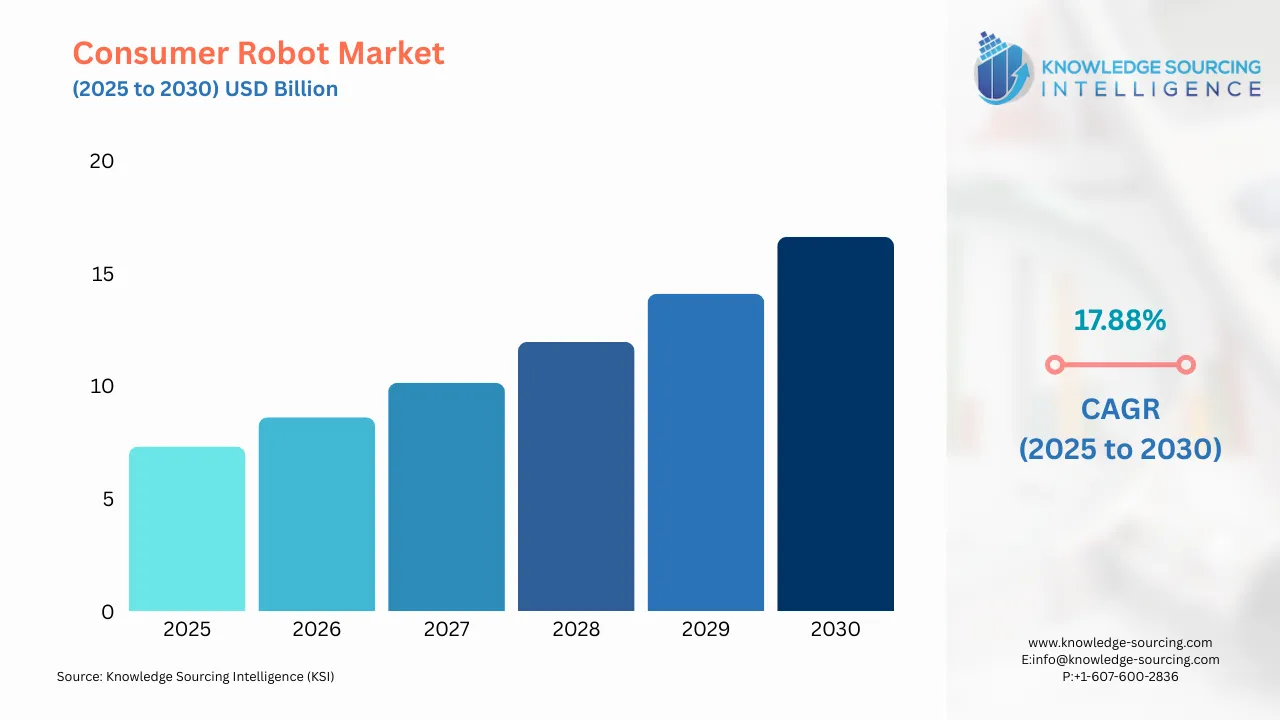

The Consumer Robot Market is projected to grow at a CAGR of 17.88% to reach US$16.608 billion in 2030 from US$7.297 billion in 2025.

Consumer Robot Market Introduction:

The consumer robots market is a rapidly expanding segment of the broader robotics industry, encompassing a diverse range of robotic systems designed to enhance convenience, efficiency, and quality of life for individual users in domestic settings. These robots include robotic vacuum cleaners, lawnmowers, pool cleaners, companion robots, and educational robots, which automate household tasks, provide entertainment, or assist with caregiving. Driven by advancements in artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) connectivity, consumer robots are increasingly integrated into smart home ecosystems, offering seamless user experiences through voice assistants and mobile applications. The market is witnessing robust growth as consumer demand for automation rises, fueled by busy lifestyles, aging populations, and technological innovation.

Consumer robots are autonomous or semi-autonomous devices designed for personal use, primarily in households, to perform tasks such as cleaning, lawn maintenance, eldercare, and education. Leading products include robotic vacuum cleaners like iRobot’s Roomba, robotic lawnmowers like Ecovacs’ GOAT G1, and companion robots like SoftBank’s Pepper, which cater to diverse needs from household maintenance to social interaction. These robots leverage advanced technologies, including AI-driven navigation, computer vision, and IoT connectivity, to deliver intelligent, user-friendly solutions. For instance, modern robotic vacuums use lidar and cameras for precise mapping, while companion robots employ natural language processing for human-like interactions. The market serves a broad consumer base, from tech-savvy individuals to elderly users seeking assistance, and is characterized by intense competition among established players like iRobot Corporation and Ecovacs Robotics, alongside innovative startups. The consumer robots market is poised for growth due to increasing adoption in smart homes, but faces challenges such as high costs and consumer skepticism about reliability. The market’s evolution is closely tied to technological advancements and shifting consumer preferences, making it a dynamic field for industry exploration.

Consumer Robot Market Overview:

The falling cost of personal robots, spurred by intensifying market competition, is boosting the uptake of consumer robots and enhancing the growth of the consumer robot market. Additionally, the surging need for home care—driven by an aging population and a higher incidence of diseases—is further accelerating this market’s expansion. Rising consumer purchasing power and a growing demand for convenience, particularly in developed nations, are also key contributors to this growth. Other factors propelling the market include increasing security concerns and rapid innovation. However, performance limitations are impeding the consumer robot market’s progress. Nonetheless, fast-paced innovation continues to drive consumer robot market growth throughout the forecast period.

Some of the major players covered in this report include iRobot Corporation, Neato Robotics, Inc., LG Electronics Inc., Honda Motors Co., Ltd., Samsung Electronics Co., Ltd., and Blue Frog Robotics, Inc., among others.

Consumer Robot Market Drivers:

Advancements in Artificial Intelligence and IoT Integration: The integration of AI and IoT technologies is a primary driver of the consumer robots market, enabling robots to deliver intelligent, user-friendly experiences. AI enhances functionalities such as autonomous navigation, object recognition, and adaptive learning, allowing robots like robotic vacuum cleaners to optimize cleaning paths or avoid obstacles. IoT connectivity enables seamless integration with smart home ecosystems, such as Amazon Alexa or Google Assistant, allowing users to control robots via voice commands or mobile apps.

Rising Consumer Demand for Convenience: Increasingly busy lifestyles and the growing prevalence of smart homes are fueling demand for consumer robots that automate time-consuming household tasks. Robots such as robotic vacuum cleaners, lawnmowers, and pool cleaners reduce the burden of chores, appealing to consumers seeking efficiency and convenience. The proliferation of smart home devices further drives adoption, as consumers prefer robots that integrate seamlessly with existing ecosystems.

Aging Population and Eldercare Needs: The global aging population is driving demand for consumer robots designed for eldercare and companionship. These robots provide social interaction, health monitoring, and assistance with daily tasks, addressing caregiver shortages and supporting independent living. Companion robots, such as SoftBank’s Pepper, use natural language processing and facial recognition to engage with users, offering emotional support and reminders for medication or appointments.

Consumer Robot Market Restraints:

High Initial Costs: The high cost of developing and purchasing consumer robots remains a significant barrier to widespread adoption. Devices equipped with advanced AI, sensors, and IoT capabilities are expensive, which increases retail prices. Maintenance costs, including software updates and repairs, further add to the financial burden, deterring adoption in price-sensitive markets.

Consumer Skepticism and Reliability Concerns: Consumer skepticism regarding the reliability, privacy, and ease of use of robots poses a significant restraint. Many potential users question the effectiveness of robots and express concerns about malfunctions. Privacy issues, particularly with IoT-enabled robots that collect data, also raise apprehensions about data security.

Consumer Robot Market Segmentation Analysis:

The demand for household robots are rising significantly: Household robots dominate the consumer robots market by application, encompassing devices like robotic vacuum cleaners, lawnmowers, pool cleaners, and window-cleaning robots that automate domestic tasks. This segment’s prominence is driven by increasing consumer demand for convenience, time-saving solutions, and integration with smart home ecosystems.

The online distribution channel is expected to dominate the market: The online distribution channel is the leading segment for consumer robots, driven by the global shift toward e-commerce and the convenience of digital purchasing platforms. Online channels offer consumers easy access to a wide range of robots, detailed product information, and customer reviews. The rise of online shopping, accelerated by post-pandemic consumer habits, has made platforms like Amazon and Alibaba key marketplaces for robotic vacuum cleaners, lawnmowers, and companion robots.

North America is anticipated to lead the market expansion: North America, particularly the United States, dominates the consumer robots market by region due to its advanced technological infrastructure, high consumer purchasing power, and strong adoption of smart home technologies. The region leads in the development and sales of household robots, driven by companies like iRobot Corporation and the presence of major e-commerce platforms like Amazon, which facilitate widespread distribution.

Consumer Robot Market Key Developments:

March 2025: iRobot Corporation unveiled eight new Roomba models in March 2025, enhancing the robotic vacuum segment with advanced features like lidar-based navigation and spinning mop pads.

January 2025: Samsung Electronics announced an upgraded version of its Ballie spherical home robot, featuring enhanced AI capabilities for household assistance and smart home integration.

May 2024: Ecovacs Robotics Co., Ltd. expanded its consumer robotics portfolio in May 2024 with the launch of the GOAT G1 robotic lawnmower and DEEBOT PRO vacuum cleaner, featuring AI-driven navigation and advanced obstacle avoidance.

Consumer Robot Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 7.297 billion |

| Total Market Size in 2030 | USD 16.608 billion |

| Forecast Unit | Billion |

| Growth Rate | 17.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Automation, Application, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Consumer Robot Market Segmentations:

By Automation

Autonomous

Semi-Autonomous

By Application

Household Robots

Entertainment Robots

Educational Robots

Others

By Distribution Channel

Online

Offline

By Regions

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others