Report Overview

Global Cranes Market Size, Highlights

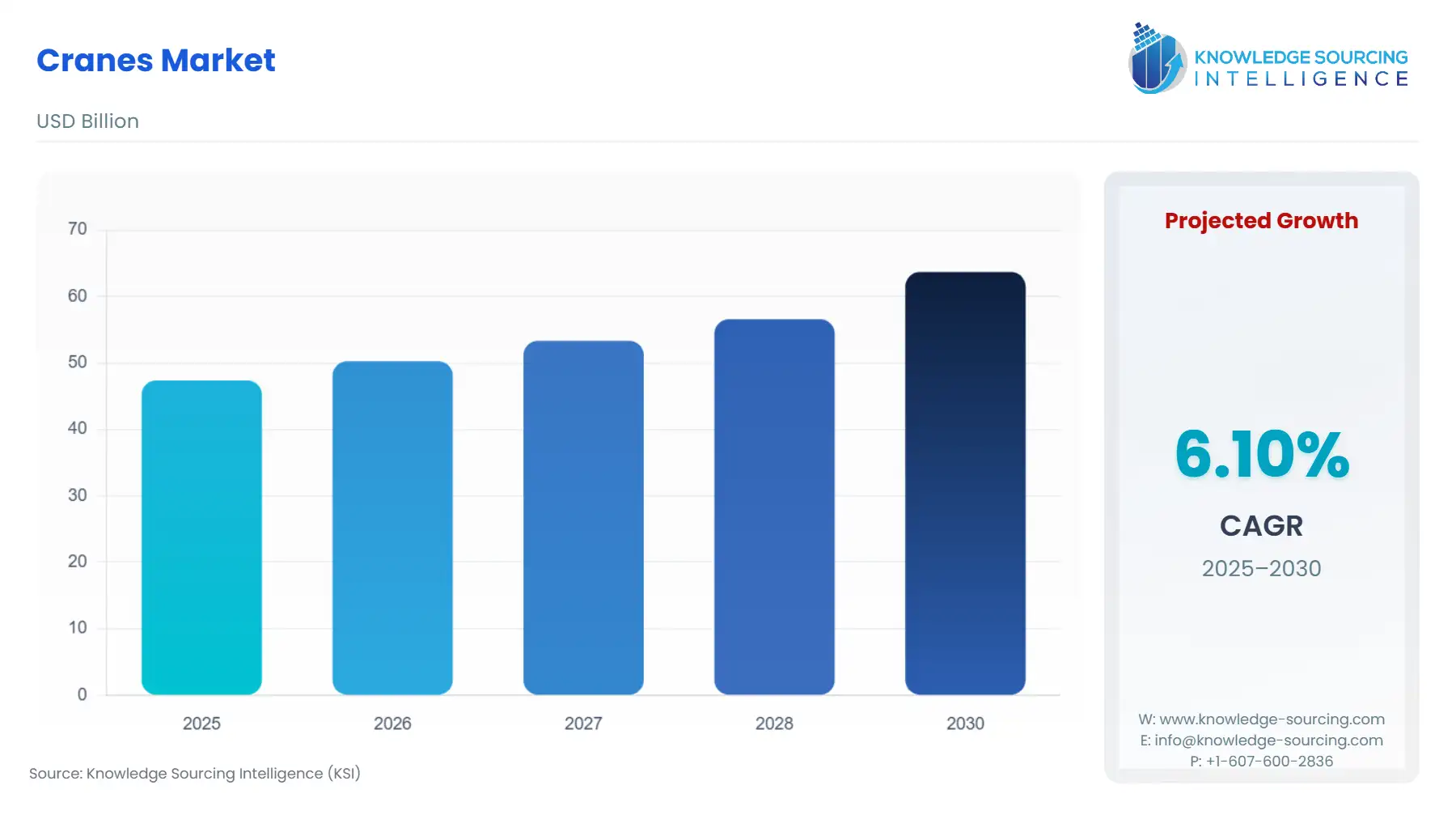

Cranes Market Size:

The global cranes market is estimated to attain a market size of US$ 63.709 billion by 2030, growing at a 6.10% CAGR from a valuation of US$ 47.383 billion in 2025, during the forecast period of 2025 to 2030.

Cranes Market Trends:

The global crane market is being propelled by infrastructure development, rising demand for renewable energy, and rapid technological advancements. The demand for emerging technologies like automation and AI is further propelling the latest application of cranes in various sectors. The growing economies around the world and the emergence of e-commerce created the large-scale application of cranes in transportation & logistics. Moreover, growing international trade has created the large-scale application of cranes in the ports across the world, where companies and governments are investing heavily in profitable operations at the ports.

Further, the leading crane companies are investing in advanced equipment to support the construction and infrastructure development worldwide. In April 2025, Maxim Crane Works, L.P., acquired the tower crane assets of Sims Crane & Equipment Co. This acquisition would align with the company's goals to meet the growing demand from infrastructure projects worldwide. The opportunities lie in the fast-growing markets, electrification, and the adoption of intelligent crane technologies.

The rise in massive construction activity, especially in developing nations such as China and India, will increase the demand for crawler cranes during the projected period. Moreover, the rise in renewable energy-related projects, like onshore wind farms and hydrogen energy projects increasing the necessity of a diverse type of crawler cranes.

Global Cranes Market Overview & Scope:

The Global Cranes Market is segmented by:

- Type: The global cranes market is segmented by type into tower cranes, rough-terrain cranes, crawler cranes, floating cranes, and others. The tower cranes are driven by the growing high-rise construction and the growth of residential and commercial buildings.

- Mobility: By mobility, the global cranes market is segmented into static and mobile. Static cranes, such as tower and overhead cranes, are mainly required for port functions and various infrastructure activities.

- Capacity: By capacity, the global cranes market is segmented into up to 50 tons, 50 to 100 tons, and greater than 100 tons. The choice of crane capacity depends on project scale, with the trend toward higher-capacity cranes driven by increasing investments in large infrastructure.

- End-User Industry: The global cranes market is segmented by end-user industry into construction, mining, transportation & logistics, oil & gas, manufacturing, and others (including energy and marine applications). The rise in urbanization globally is increasing the construction projects such as buildings, metro systems, and bridges, which increases the requirement for heavy lifting. As per Our World in Data, the urban population globally accounted for 4.54 billion in 2022, which was reportedly increased to value for 4.61 billion. The increase in investment by the government and the private sector in large-scale infrastructure projects is also contributing to boosting the demand for cranes across the globe

- Region: By geography, the global cranes market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Europe comprises Germany, France, the UK, Spain, and other countries. Asia Pacific comprises China, Japan, China, India, and other countries. Asia Pacific is poised to hold a prominent position in the global cranes market, particularly due to the high urbanization rates. In the European Union, building construction increased by 1.1% from 2022 to 2023, and civil engineering increased by 4.1%. Countries with significant increases are Romania, Poland, and Belgium, which are the top countries showing significant growth in the region.

Top Trends Shaping the Global Cranes Market:

1. Increasing adoption of automation & smart cranes for enhanced safety and efficiency.

- The crane industry is undergoing a significant transformation driven by the integration of artificial intelligence, automation, and advanced materials. These advancements are reshaping crane operations.

Global Cranes Market: Growth Drivers vs. Challenges

Drivers:

Challenges:

- High upfront costs: The price volatility due to the supply-chain constraint is a serious challenge in the industry. These challenges are increased by recent tariff policies.

Global Cranes Market Regional Analysis:

Region-wise, North America and Asia Pacific are projected to account for a considerable market share fueled by the ongoing adoption of capital-intensive techniques in industrial operations, followed by favorable growth in major end-users such as oil & gas, logistics, and construction.

Improvement in logistics and establishment of ports, followed by investment in construction activities, has escalated the demand for heavy machinery such as cranes in major regional economies.

Global Cranes Market Competitive Landscape:

The market is fragmented, with many notable players including Terex Corporation, Gorbel Inc., Mitsubishi Heavy Industries, Hyundai Motor Company, Sumitomo Heavy Industries Construction Cranes Co., Ltd., Tadano Ltd., Mazzella Companies, JC Bamford Excavators Ltd., The Volvo Group, TIL Limited, and Liebherr Group, among others.

A few strategic developments related to the market:

- Expansion: In April 2025, Crane Service Company, Inc., based in the Mid-Atlantic, expanded its fleet by acquiring several mobile cranes in Munich, Germany. The purchase included the LTM 1300-6.2 and LTM 1650-8.1 mobile cranes.

- New Launch: In January 2024, Kobelco Construction Machinery announced the launch of a telescopic boom crawler crane, namely, TKE750 Kg, in Europe. It is designed to lift a capacity of 75 metric tons and is developed as per the EU Stage V-compliant.

Cranes Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cranes Market Size in 2025 | US$47.383 billion |

| Cranes Market Size in 2030 | US$63.709 billion |

| Growth Rate | CAGR of 6.10% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cranes Market |

|

| Customization Scope | Free report customization with purchase |

Global Cranes Market Segmentation:

By Type

- Tower Cranes

- Rough-terrain Cranes

- Crawler Cranes

- Floating Cranes

- Others

By Mobility

- Static

- Mobile

By Capacity

- Up to 50 Tons

- 50 to 100 Tons

- Greater than 100 Tons

By End-user Industry

- Construction

- Mining

- Transportation & Logistics

- Oil & Gas

- Manufacturing

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Australia

- Others