Report Overview

Global Dry Bulk Shipping Highlights

Dry Bulk Shipping Market Size:

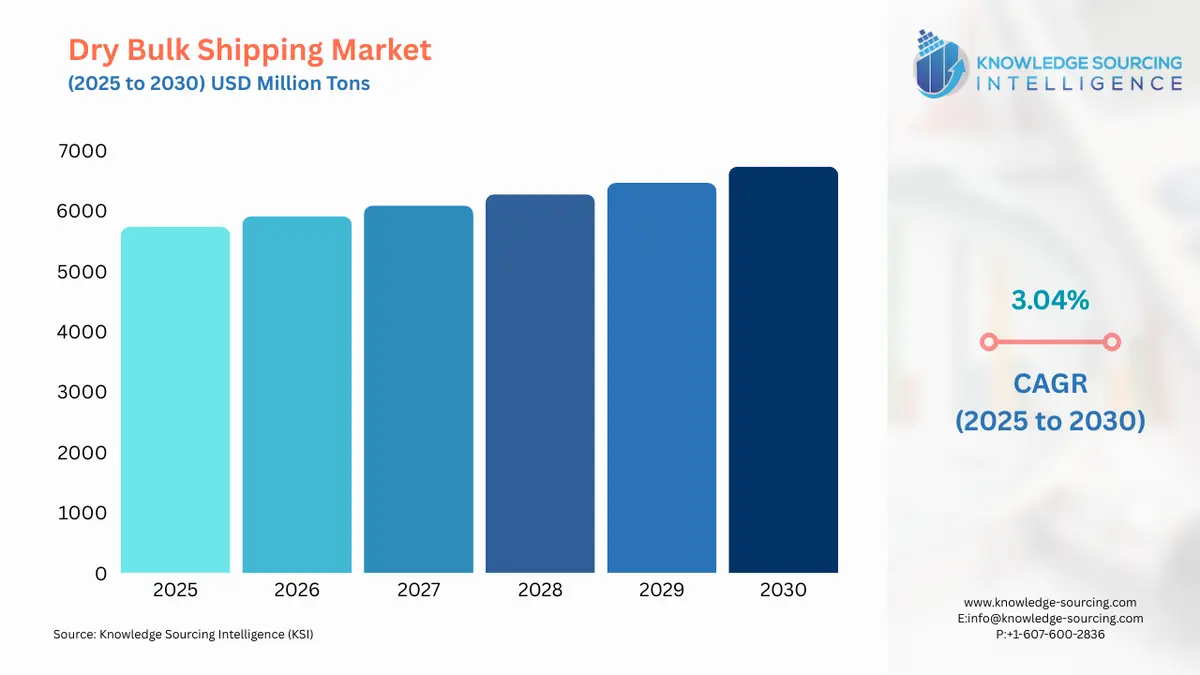

The global dry bulk shipping market is estimated to reach a market size in volume of 6,735 million tons by 2030, growing at a 3.04% CAGR from a valuation of 5,735 million tons in 2025.

Dry Bulk Shipping Market Introduction:

The dry bulk shipping industry is a cornerstone of global maritime trade, facilitating the transport of essential commodities like iron ore, coal, and grains. The bulk carriers market drives seaborne trade, with vessels designed for efficiency in handling large cargo volumes. Shipping logistics play a critical role in optimizing routes and port operations, ensuring cost-effective delivery. As global demand for raw materials grows, the industry faces challenges like fluctuating freight rates and environmental regulations. Nonetheless, the dry bulk sector remains vital to commodity shipping, supporting supply chains and economic growth across continents with robust, scalable maritime solutions.

The dry bulk carriers are called by many different names, including ore bulkers, iron ore ships, and bulk carriers, which could carry large quantities of unprocessed, dry solid materials at sea. Most shipments of dry bulk cargo are unpacked and don't need any special packaging, so they can be shipped in their natural state. Dry bulk goods are typically raw materials used in global production and manufacturing. They are divided into two categories: big lumps and small stuff. A share of approximately two-thirds of the dry bulk trade consists of steam coal, iron ore, and grain.

Moreover, according to UNCTAD (United Nations Conference on Trade and Development), more than 80 percent of world trade is operated via ships, which poses a great demand for carriers that are used for the shipment of dry bulk materials. Additionally, global maritime trade increased by 2.4 percent in 2023 from the previous year. Due to this, market players are investing in their fleets to keep their positions steady.

For instance, in June 2024, JFE Steel Corporation launched the dry bulk carrier vessel, Bright Queen, which was developed by JGreeX, a sustainable steel initiative by JFE Steel. This material substantially decreases CO2 emissions in the process of steel making and is utilized in all shipping materials, which are directly sold to Higako Shipbuilding Co., Ltd.

Moreover, the growing urbanization and rise in infrastructure development, mainly in the Asia Pacific and Africa, are also boosting the demand for dry bulk materials, necessitating the need for dry bulk shipping. According to United Nations data, the world population living in urban areas accounted for 55 percent in 2017, which is predicted to increase to 68 percent by 2050. Additionally, as per the World Bank data, the urban population was 57 percent in 2023. This increase will lead to a rise in industrialization, raising the trade of dry bulk material, and promoting market growth.

However, it is a volatile market as it is dependent on the trade and the demand and supply chain of the material, which has a varying effect on the freight rates. For instance, according to the 2024 Annual Report of Western Bulk, the global demand for dry bulk witnessed a growth of 5% in 2024in exports.

Additionally, the growing shipping of dry bulk commodities is also expected to promote the market. For instance, in November 2024, M.V. AM UMANG bulk carrier arrived at HDC, SMPK with a dry bulk parcel capacity of 39,149 MT of Flux cargo, i.e., Limestone for Tata Steel Ltd., growing from the previous capacity of 39,048 MT recorded in September 2024.

Moreover, Indian Government initiatives, including the inauguration of a dry dock, resulted in an increase in cargo movement, including dry bulk cargo, on National waterways as per the Ministry of Ports, Shipping & Waterways ‘Annual Report 2024-2025. The cargo traffic grew from 126.15 MMT in 2022-2023 to 133.03 MMT in 2023-24. Furthermore, from April to December 2024, the total cargo traffic grew by 7 percent from 100.51 MMT in 2023 to 107.56 MMT. This would attract larger dry bulk vessels like Capesize, potentially increasing demand for such vessels in the Indian waterways region.

Furthermore, in December 2024, President Trump stated that he wanted to retake control of the Panama Canal, stressing its strategic importance for U.S. trade. If such policies are implemented, shipping costs could be lowered for the benefit of dry bulk carriers based in the U.S. This could adversely impact the global maritime shipping rates for the dry bulk shipping market.

Dry Bulk Shipping Market Overview & Scope:

The global dry bulk shipping market is segmented by:

Commodity Type: By commodity type, the global dry bulk shipping market is segmented into iron ore, coal, grain, bauxite, and others. The iron ore segment is increasing with diverse utilization globally. The key factors supplementing the segment’s growth include the global economy’s industrialisation and rapid urbanisation. Furthermore, the coal segment is the most popular type of commodity for power generation in major regions like the Asia Pacific. With the demand for power generation, the need for coal is steady, which will benefit the overall market. For instance, commodity-wise, Cargo handled in India was 77,393,901 tons of coal capacity in April-August 2023-24, which grew to 80,586,469 tons during April-August 2024-25.

Vessel Type: By vessel type, the global dry bulk shipping market is segmented into capesize, handysize, panamax, handymax, and others. The capesize is predicted to be the fastest-growing market share due to its general capacity of 100,000-210,000 deadweight tons (DWT), which is in high demand for shipping commodities like iron ore and coal, and this vessel type is utilized in long-distance routes, increasing its demand. However, the Panamax and Handy Max are the fastest-growing segments due to their capacity to handle grain, iron ore, coal, and fertilizers, among others. Their small volume makes them flexible for smaller ports.

Capacity: By capacity, the global dry bulk shipping market is segmented into up to 40,000 Dwtm, 40,000 to 80,000 Dwt, and greater than 80,000 Dwt. The greater than 80,000 DWT holds a significant market, followed by the 40,000 to 80,000 DWT segment, which is growing considerably. The more than 80,000 DWT segment is driven by the transportation of major bulk commodities, particularly iron ore, which accounts for the majority of dry bulk movement. This capacity range is essential for long-haul shipments, which promotes this segment's growth.

Region: The Asia Pacific region is poised to hold a prominent position in the global dry bulk shipping market, particularly due to its increasing urbanization and robust demand for dry materials from other countries in diverse industries is leading to growth in the regional market. Additionally, the rise in construction and infrastructure projects, along with growing energy needs, determines the growth across the region. Moreover, the growing production and demand for major commodities such as iron and coal are major drivers boosting the dry bulk shipping market expansion. For instance, according to data Government of India, Press Information Bureau of August 2024, the production of finished steel grew from 33.4 million tonnes (MT) in 2023-24 to 35.8 MT in 2024-25. This will increase the trade of iron ore, promoting market growth.

Additionally, the cabinet in India announced the Vadhavan Port Project in June 2024, which is planned to be developed to handle 298 million metric tonnes per annum (MMTPA) by 2035, including dry bulk cargo. This initiative, including the port’s strategic location, large capacity, and modern infrastructure, will contribute to boosting the global dry bulk shipping market.

Top Trends Shaping the Dry Bulk Shipping Market:

1. Growing Demand for Coal

Coal is a major fuel source for power generation in many parts of the world, and as economies grow and urbanize, there is an increasing demand for electricity to power homes, businesses, and industry. As the demand for electricity and coal grows, the demand for dry bulk shipping services also increases. Moreover, according to the cluster collaboration report, the supply of coal has increased to 1371.8 million tons in 2024, which is a 2.4% year-on-year increase. This increase will also bring a surge in the global dry bulk shipping market.

Dry Bulk Shipping Market Growth Drivers vs. Challenges:

Drivers:

Growing Global Trade: The major demand for cargo transportation across the globe determines the development of the dry bulk shipping industry. As a result of the amplification of global trade involving so many raw materials and finished goods, mainly coming from developing countries, there is a growing necessity for well-balanced and cost-effective transport systems to be able to move these products over great distances.

Mainstream shipping has a very critical role in this endeavor. These ocean giants serve the global economy by either moving building materials like iron and steel ore or the necessary things, like coal and oil, from one end of the world to the other. This direct link also means that with the growth of international trading, the bulk shipping industry expands, and therefore, the supply of goods that guarantees an uninterrupted flow to the markets worldwide is assured.

For instance, the World Trade Organization published a report in 2023 that states global trade of goods attained a total size of US$25.3 trillion in 2022, depicting a 12% growth from 2021. This rate was boosted significantly by a commodity price surge. Furthermore, there was substantial growth in the rate of value of international trade in services, which was 15%, US$6.8 trillion. Notably, exports of digitally delivered services alone accounted for US$3.82 trillion in the same period.

Increasing Production of Dry Bulk Materials: The production growth of dry bulk materials like iron, steel, and grains is driving the need for shipping, as the rising production is expected to propel the trade for these materials. For instance, according to the Ministry of Mines, India showed significant growth of 2.5 percent in the production of iron ore in the fiscal year (FY) of 2024-2025, April-December, as compared to FY 2024-2023 April-December. The production of iron ore was 203 MMT (million metric tonnes) in FY 2023-2024 of April-December, which increased to 208 MMT in FY 2024-2025 of April-December. Meanwhile, the total iron ore production accounted for 274 MMT in FY 2024-2025.

Additionally, this increased production of iron ores also catalyzed the production of finished steel, which was 119.89 million tonnes in FY 2022-2023, and grew to 136.29 million tonnes in 203-2024, as per the data published by the Ministry of Steel from December 2024.

Moreover, major commodities handled by major ports in India included coal. Commodity-wise cargo handled grew by 2.48 percent from August 2023 to August 2024, and accounted for a 21.16 percent share of total commodities, as per the Ministry of Ports, Shipping, and Waterways data of August 2024.

Furthermore, the import of finished steel in the country, which is a minor bulk item, was 8.32 million tons in FY 2023-24, which was 6.02 million tons in FY 2022-23. This growing trade is leading to propelled developments by various market players to meet the rising demand, contributing to market expansion.

Rising Resource exploration, and Energy Demand: The majority of the shipping industry is involved because the whole world's consumption of coal and oil requires its constant transportation from extraction sites to refineries and power stations. Bulk shipping vessels contribute greatly to the transportation of these fuels via the sea on routes that are thousands of miles long.

The significance of dry bulk shipping is not only for traditional supplies that are transported but also for the exploration of new energy reserves located in remote areas, where transport is required to be safe and reliable.

Furthermore, according to the International Energy Agency, a published article in 2023 states that the world coal exports are predicted to have achieved the highest level (1 466Mt) in history. Global trade has been further shifted to Asia, with about 83% of imports going to the Asia Pacific region. The prediction is that the shares of Chinese and Indian countries will reach about 47% of global imports, which, in turn, impacts the dry bulk shipping market.

Challenges:

Variations in the Freight Prices: The cargo transportation rates, i.e., a transportation charge for the goods commodity, witness a significant variance in the dry bulk market. These ups and downs are brought about by several factors, such as the availability of ships and cargo, the global economic situation, and political tensions. Such instability makes it very difficult for shipping businesses to taillight profit forecasts and the correct allocation of investments.

Dry Bulk Shipping Market Regional Analysis:

North America: The dry bulk shipping industry in North America is anticipated to undergo significant expansion for several reasons. For instance, the economic performance of the United States has been favorable in creating a high demand for raw materials, including iron ore and coal, which are essential to industrial activities and infrastructure development projects. To meet this increasing demand, efficient transportation solutions like dry bulk shipping have become very important. The exploration and extraction of new natural resources in North America itself require the provision of bulk shipping to move the extracted resources from mines to processing sites.

Additionally, the creation of an internal energy market, especially in the coal sector, has boosted the use of reliable bulk shipping services. The development of agricultural production and the increase in exports in North America have resulted in the need for the efficient transportation of grains and other dry bulk commodities over long distances. Owing to such multifold factors, the dry bulk shipping sector in North America is expected to hold a significant market share during the forecast period.

The industrial productivity of the United States has experienced progression fueled by government-backed polices and schemes to bolster overall output. Hence, the country plays a significant role in the global bulk shipping market and a dominant role in the North American region. The country's market share is primarily influenced by its exports of agricultural commodities, particularly grains. As one of the world's largest grain exporters, including wheat, corn, and soybeans, it plays a significant role in shaping the global bulk shipping market.

According to the statistics from the United States Department of Agriculture, the U.S. exported 21.57 million metric tons of wheat worth US$5.87 billion in 2024. Its wheat export is growing at a CAGR of 0.42% between 2015 and 2024, increasing from US$5.63 in 2015 to US$5.87 in 2024.

Hence, U.S. wheat exports between 2015 and 2024 were largely concentrated in markets such as Mexico, the Philippines, Japan, China, South Korea, Taiwan, and other key regions across Europe and Africa, including the European Union and Nigeria. The data underscores the country's role in agricultural bulk shipping. Hence, the trade routes established by the United States, followed by the strategic and robust port infrastructure built by the country, have enabled it to handle massive dry bulk commodities.

Furthermore, besides the agricultural role in bulk shipping, the U.S. import and export of industrial commodities, such as iron ore and coal, is mainly from Brazil, Australia, and Canada. The ongoing tariff war between the United States and other countries is expected to create friction in global trade, thereby impacting the overall market expansion. In April 2025, the tariff imposed by the U.S. president on imports from countries including Japan and China has led to tighter financing and geopolitical risk for the shipping industry, with the container capacities going unused.

Dry Bulk Shipping Market Key Developments:

November 2025: Diana Shipping Inc. Secures Time Charter Contract for Capesize Vessel. Diana Shipping Inc. announced a time-charter with Dampskibsselskabet Norden A/S for its 179,426 dwt Capesize bulk carrier m/v Santa Barbara, at a gross rate of US$25,500/day, with a minimum charter period through 1 March 2027.

August 2025: Dry Bulk Sector Records “Deep Slump” in Newbuilding Orders in 2025. Industry commentary reports that the dry bulk segment has been one of the slowest in newbuild order activity this year, with orders down significantly compared to 2024 (8.3% of fleet vs 9.3% previously for Capesize) and only 2.5 million dwt ordered in Q3 2025 vs 2.2 million in Q3 2024.

July 2025: BHP chartered COSCO ammonia dual-fuel Newcastlemax dry bulk vessels: BHP Group signed five-year charter contracts with COSCO Shipping Bulk Co., Ltd., for two ammonia dual-fuel Newcastlemax bulk carriers that are set to be delivered in 2028.

June 2025: Inmarsat Maritime partnered with Pacific Basin to install NexusWave connectivity on five dry bulk ships. Inmarsat Maritime will offer NexusWave bonded connectivity service to five dry bulk vessels from the Pacific Basin, increasing crew and company communications and enabling digitalisation.

List of Top Dry Bulk Shipping Companies:

Diana Shipping Inc

Star Bulk Carriers Corp.

Genco Shipping & Trading Limited

GAC

NYK Group

Dry Bulk Shipping Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | 5,735 million tons |

| Total Market Size in 2030 | 6,735 million tons |

| Forecast Unit | million tons |

| Growth Rate | 3.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Commodity Type, Vessel Type, Capacity, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Dry Bulk Shipping Market Segmentation:

By Commodity Type

Iron ore

Coal

Grain

Bauxite

Others

By Vessel Type

Capesize

Handysize

Panamax

Handymax

Others

By Capacity

Up to 40,000 Dwt

40,000 to 80,000 Dwt

Greater than 80,000 Dwt

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Others

Middle East & Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others