Report Overview

Ground Transportation Fuel Market Highlights

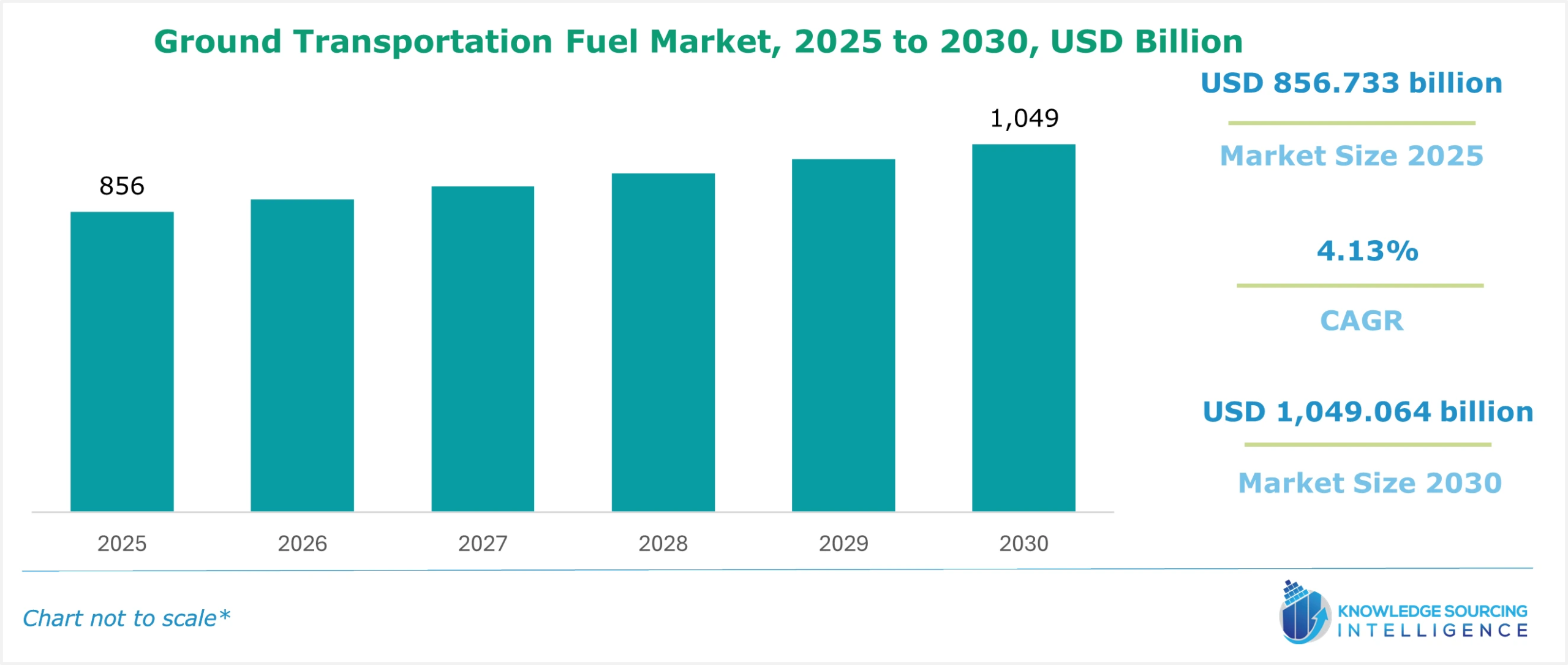

Ground Transportation Fuel Market Size:

The ground transportation fuel market is estimated to grow at a CAGR of 4.13%, from US$856.733 billion in 2025 to US$1,049.064 billion in 2030.

Road transportation is the largest fuel market, accounting for 90% of global transportation fuel use (energy.gov). The importance of maritime and aviation fuel markets in supporting global trade should not be underestimated despite their relatively small size. Furthermore, each transportation sector favors a particular fuel quality linked to its performance and amount of reliance. People have started to opt for private transport over public transport as it includes more advantages in terms of comfort, less time to travel, and affordability.

The rising sales of automobiles worldwide are forecasted to boost the sales of global ground transportation fuel. With the increasing sales of automobiles across the globe, the demand for different types of fuels, like petrol, gasoline, CNG, and hydrogen, among others, will increase significantly. Similarly, the growing global crude oil production is also estimated to boost the ground transportation fuel market.

Ground Transportation Fuel Market Growth Drivers:

- Increasing sales of automotive is propelling the market

A major factor propelling the global ground transportation fuel market is the increasing sales of automobiles worldwide. The International Organization of Motor Vehicle Manufacturers, or OICA, in its sales report, stated that global passenger vehicle sales increased. The organization stated that in 2021, the total sales of passenger automobiles were recorded at 57.276 million, which increased to 58.644 million in 2022. In 2023, the global sales of passenger automobiles increased to 65.272 million units.

The report further stated that in 2023, the Asia/Oceania/Middle East region is among the biggest producers of automobiles, selling about 42.572 million units of passenger automobiles, whereas the sales of passenger vehicles in the European region reached 14.998 million. Similarly, in 2023, about 6.9 million units of passenger automobiles were sold in the American region.

- Introduction of alternative fuel vehicle

The introduction of alternative fuel vehicles in the global automotive industry is expected to propel the ground transportation fuel market growth. The demand for new energy vehicles, including fuel like hydrogens, has witnessed significant growth in the global automotive market. The European Automobile Manufacturers Association (ACEA), in its report, stated that the sales of new energy vehicles have increased significantly over the past few years. In 2022, among the total car registrations in Europe, the share of hybrid electric vehicles was 22.7%, which increased to about 25.8% in 2023.

Similarly, the U.S. Energy Information Administration, or EIA, in its report, stated that hydrogen electric vehicles (HEVs) drive the growth of electric cars in the USA. The agency further noted that in 2023, sales of HEVs in the nation increased by about 30.7% over the past year. During the first quarter of 2024, the sales of hybrid vehicles accounted for about 8.6% of the total sales in the nation, whereas in the second quarter of 2024, it was recorded at about 9.6%.

- Growing production of crude oil across the globe.

The increasing production of crude oil is also estimated to propel the ground transportation fuel market growth. The Enerdata, in its report, stated that in 2021, about 712 Mt of oil was produced by the USA, whereas the total oil production of Russia and Saudi Arabia were recorded at about 529 Mt and 515 Mt, respectively. In 2022, the total oil production by the USA was recorded at 756 Mt, whereas about 598 Mt was produced by Saudi Arabia, and about 544 Mt of oil was produced by Russia. Similarly, in 2023, the total oil production in the USA was recorded at about 820 Mt, whereas in Saudi Arabia and Russia, about 542 Mt and 535 Mt of oil were produced, respectively.

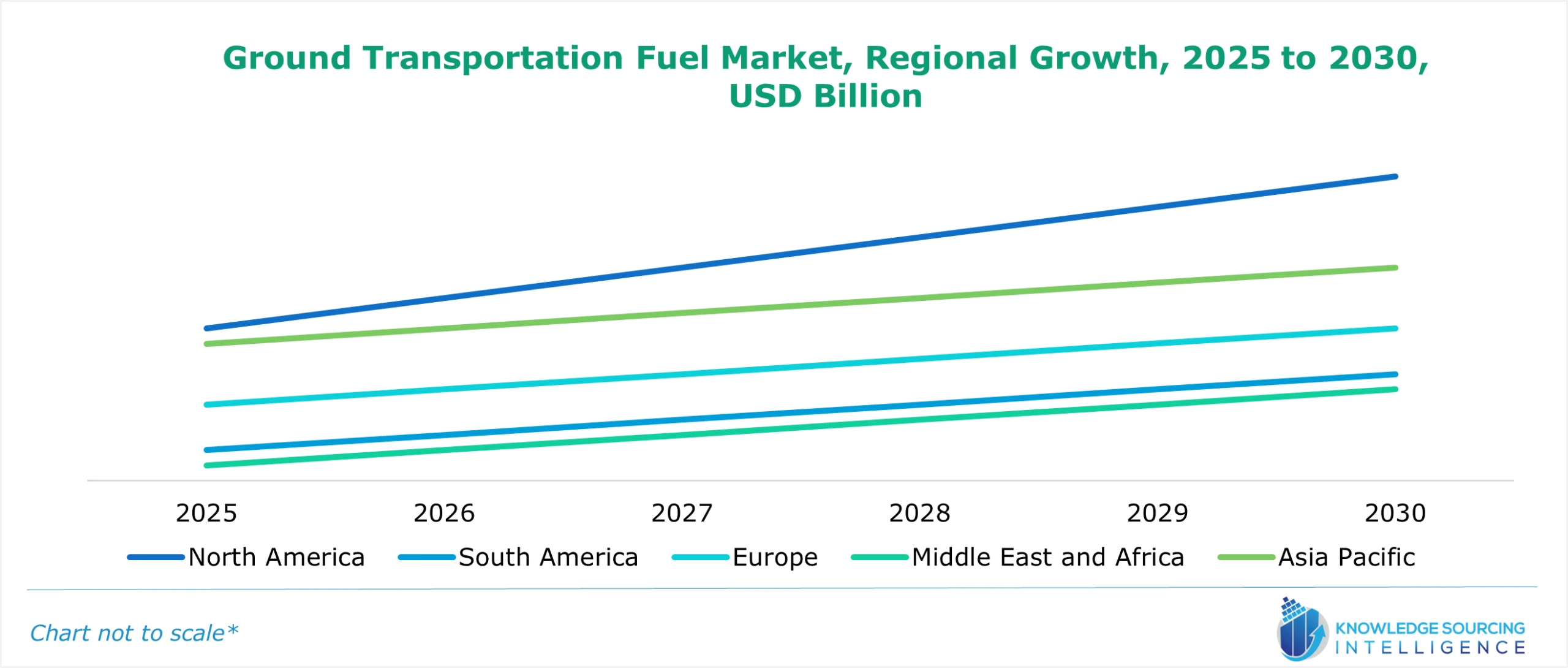

Ground Transportation Fuel Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the ground transportation fuel market.

The Asia Pacific region is estimated to attain a greater market share during the forecasted timeline. The Asia Pacific region is among the biggest producers of automobiles across the globe. The sales of automobiles in the Asia Pacific region, especially in nations like India, China, Japan, and South Korea, increased massively over the past few years. The International Organization of Motor Vehicle Manufacturers (OICA), in its global sales report for 2023, stated that the sales of automobiles in Asia observed massive growth compared to the other regions. The organization stated that in China, about 21.518 million automobiles were sold in 2021, which increased to about 23.563 million in 2022 and 26.062 million in 2023. Similarly, in India, the sales of automobiles were recorded at about 3.082 million in 2021, which surged to 3.792 million in 2022. In 2023, a total of about 4.101 million automobile units were sold nationwide.

Ground Transportation Fuel Market Major players and Products:

- British Petroleum Plc is among the leading global oil and gas companies based in the UK. The company offers a wide range of oil-based products and solutions, which include lubricants, gasoline, and gas. In the global ground transportation fuel market, the company provides automotive fuel, which offers higher miles per tank and instant engine protection.

- Exxon Mobil Corporation is among the biggest multinational oil and gas producers worldwide. The company offers transportation, modern living, industrial, and energy solutions. In the global ground transportation fuel market, the company offers Synergy gasoline and diesel fuel, which helps the vehicles reach their performance capabilities.

Ground Transportation Fuel Market Key Developments:

- In July 2024, the Ministry of Petroleum & Natural Gas of the Indian Government announced the launch of the Global Biofuel Alliance, which PM Modi launched. The alliance was inaugurated during the G20 Summit, and it included the leaders of the USA, Brazil, Argentina, Bangladesh, Mauritius, and UAE, among others. The alliance aims to form close cooperation with the global leader of biofuel producers. It also intends to facilitate technical support and capacity-building exercises for other nations.

Ground Transportation Fuel Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ground Transportation Fuel Market Size in 2025 | US$856.733 billion |

| Ground Transportation Fuel Market Size in 2030 | US$1,049.064 billion |

| Growth Rate | CAGR of 4.13% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Ground Transportation Fuel Market |

|

| Customization Scope | Free report customization with purchase |

Ground Transportation Fuel Market Segmentation:

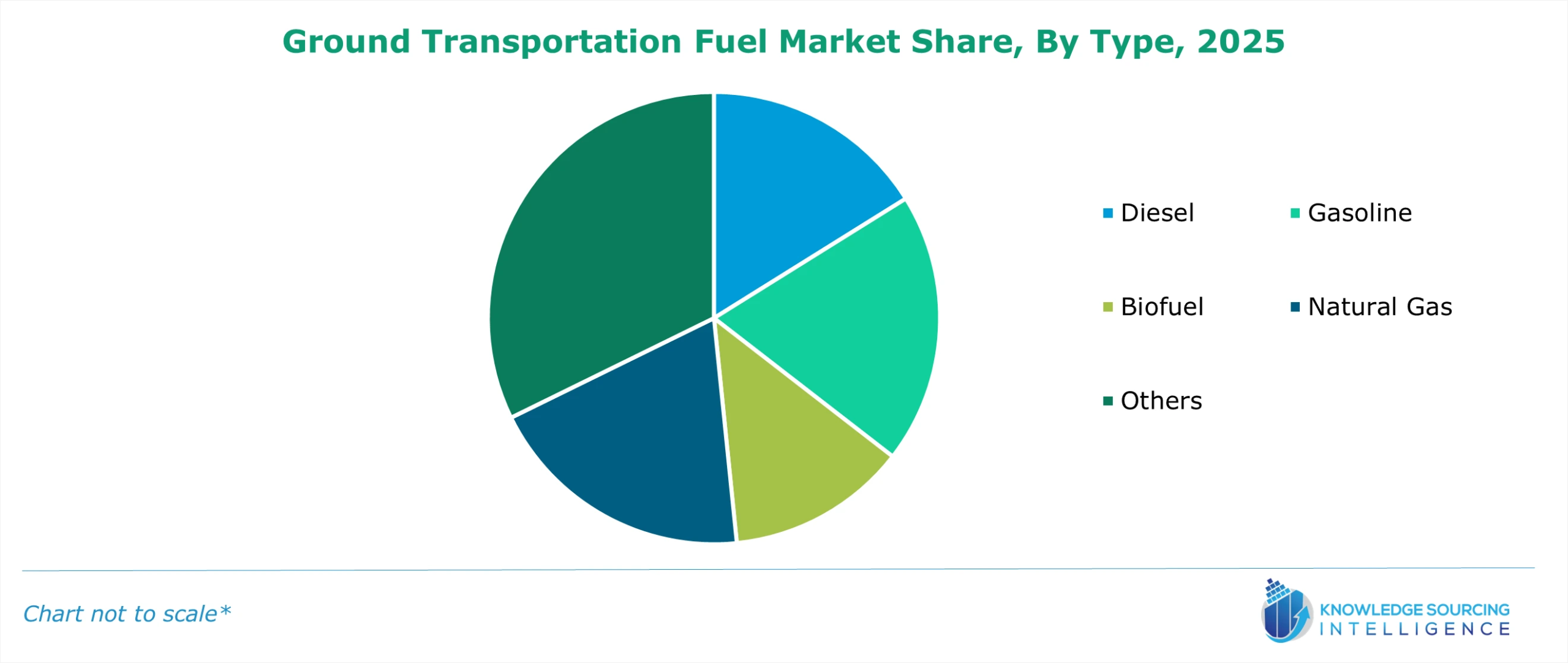

- By Type

- Diesel

- Gasoline

- Biofuel

- Natural Gas

- Others

- By Vehicle Type

- Light Vehicle

- Heavy Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America