Report Overview

Global GPS Market Report, Highlights

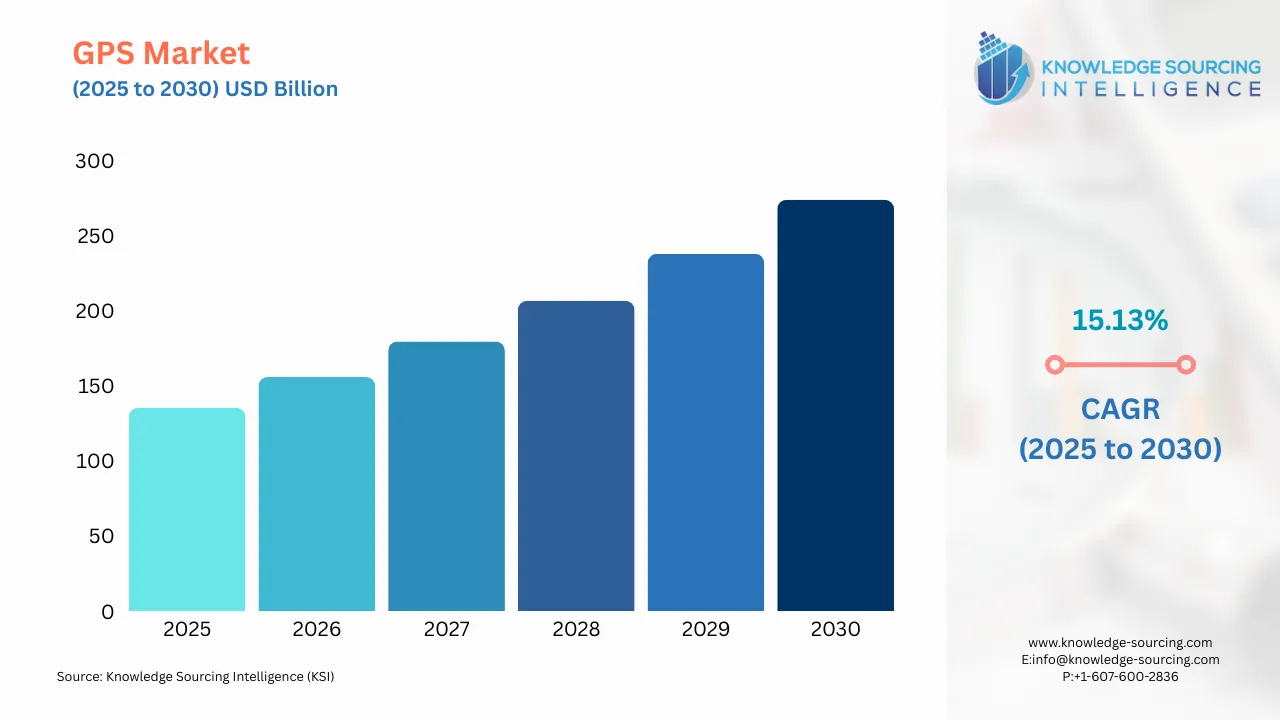

GPS Market Size:

The Global GPS Market is expected to grow from USD 135.389 billion in 2025 to USD 273.858 billion in 2030, at a CAGR of 15.13%.

Global Positioning System (GPS) Market Introduction:

The Global Positioning System (GPS) market has evolved into a cornerstone of modern technology, underpinning a wide array of applications across industries such as transportation, agriculture, defense, logistics, and consumer electronics. GPS, a satellite-based navigation system owned by the United States Space Force, provides precise geolocation and time information to users worldwide through a constellation of satellites. As of 2025, the GPS ecosystem has expanded beyond traditional navigation to enable innovations in autonomous vehicles, smart cities, and Internet of Things (IoT) integrations, reflecting its critical role in the digital economy.

GPS operates through a network of at least 24 satellites that transmit signals to receivers on Earth, enabling precise positioning through trilateration. The system’s accuracy has improved significantly with advancements in satellite technology, ground infrastructure, and augmentation systems like Differential GPS (DGPS) and Real-Time Kinematic (RTK) positioning. Recent upgrades to the GPS constellation, including the launch of GPS III satellites, have enhanced signal accuracy, reliability, and resistance to jamming, supporting mission-critical applications.

The GPS market encompasses hardware (receivers, antennas, chipsets), software (navigation and mapping solutions), and services (location-based services, analytics). Its applications span automotive navigation, fleet management, precision agriculture, disaster management, and consumer devices like smartphones and wearables. The integration of GPS with emerging technologies such as 5G, artificial intelligence (AI), and blockchain is expanding its utility, particularly in IoT ecosystems and smart infrastructure.

The GPS market is witnessing rapid innovation, driven by both public and private sector initiatives. In 2024, the U.S. Space Force completed the deployment of additional GPS III satellites, improving global coverage and signal integrity. In the private sector, companies like Trimble have advanced precision agriculture with GPS-guided autonomous tractors, enhancing crop yields and sustainability. Moreover, the integration of GPS with blockchain for secure location data in supply chains, as explored in recent academic research, signals new opportunities.

The travel and tourism sector is also leveraging GPS for immersive experiences, with location-based augmented reality (AR) apps gaining traction in 2023 and beyond. Additionally, South-South cooperation in digital technologies, including GPS applications, is fostering innovation in developing economies, as noted in recent United Nations reports.

GPS Market Growth Drivers:

- Rise of Autonomous Systems and Smart Mobility

The proliferation of autonomous vehicles, drones, and smart mobility solutions is a significant driver for the GPS market. Autonomous vehicles rely on high-precision GPS, combined with technologies like LiDAR and AI, to navigate complex environments. For example, Waymo’s self-driving cars use GPS for real-time positioning, enabling safe navigation in urban settings. Similarly, drone delivery services, such as those piloted by Amazon’s Prime Air, depend on GPS for accurate routing and obstacle avoidance.

Smart city initiatives further amplify demand for GPS-enabled infrastructure. Singapore’s Smart Nation program integrates GPS into intelligent transportation systems, optimizing traffic flow and reducing congestion. The global smart city market’s growth, projected to accelerate through 2030, underscores the increasing reliance on GPS for urban planning, public transit, and connected infrastructure. These developments highlight GPS’s pivotal role in shaping the future of mobility.

- IoT and Digital Transformation

The Internet of Things (IoT) is transforming industries by connecting billions of devices, with GPS playing a central role in providing location data for applications like logistics, agriculture, and asset management. By 2030, the number of connected IoT devices is expected to surpass 30 billion, driving demand for GPS-enabled solutions. In logistics, companies like FedEx use GPS for real-time shipment tracking, improving supply chain efficiency.

In precision agriculture, GPS-guided equipment optimizes planting, irrigation, and harvesting, boosting crop yields and sustainability. Trimble’s autonomous tractors, for instance, leverage GPS to achieve centimeter-level accuracy, reducing resource waste. Additionally, Qualcomm’s recent advancements in 5G chipsets with integrated GPS enhance connectivity and positioning for IoT devices, enabling seamless data transmission in smart grids and industrial automation. These trends underscore GPS’s integration into the digital transformation ecosystem.

- Defense and Security Applications

GPS remains a cornerstone of defense and security operations, supporting navigation, surveillance, and disaster response. The U.S. Department of Defense’s GPS modernization program, including the deployment of GPS III satellites, enhances signal strength, accuracy, and anti-jamming capabilities, critical for military applications. For instance, GPS-guided precision munitions and unmanned aerial vehicles (UAVs) rely on these advancements for operational success.

Beyond defense, GPS is vital for emergency response during natural disasters. In 2024, GPS-enabled systems facilitated rapid coordination of relief efforts during hurricanes and earthquakes, as reported by global disaster response agencies. The growing emphasis on national security and resilience, particularly in conflict-prone regions, continues to drive investments in GPS infrastructure.

- Consumer Adoption and Wearables

The widespread integration of GPS into consumer electronics, such as smartphones, smartwatches, and fitness trackers, is a key growth driver. Dual-frequency GPS, which improves accuracy in urban environments, has become a standard feature in devices like the Apple Watch Series 10 and Garmin’s latest fitness trackers.

The fitness and outdoor recreation markets are particularly strong, with GPS-enabled devices supporting activities like hiking, cycling, and running. For example, Strava’s GPS-based tracking platform has seen increased adoption among fitness enthusiasts, driving demand for high-accuracy GPS chipsets. The growing popularity of location-based augmented reality (AR) apps in gaming and tourism, such as those developed by Niantic, further fuels consumer demand.

GPS Market Restraints:

- Signal Interference and Security Concerns

GPS signals are vulnerable to jamming and spoofing, which disrupt critical applications in aviation, defense, and maritime navigation. Recent incidents in conflict zones, such as GPS spoofing in the Middle East, have highlighted these risks, affecting both civilian and military operations. Mitigating these threats requires advanced anti-jamming technologies, such as those being developed by Lockheed Martin, but these solutions are costly and complex to implement. The increasing sophistication of cyberattacks targeting GPS infrastructure poses a persistent challenge, necessitating ongoing investment in cybersecurity.

- High Costs of Advanced Systems

While consumer-grade GPS devices are affordable, high-precision systems like Real-Time Kinematic (RTK) GPS, used in surveying and agriculture, are expensive. For example, RTK systems can cost thousands of dollars, limiting adoption among small and medium enterprises (SMEs) and farmers in developing regions. The high cost of deploying and maintaining ground-based augmentation systems, such as DGPS stations, further restricts market penetration in cost-sensitive sectors. This financial barrier hinders the scalability of advanced GPS applications in emerging markets.

- Competition from Alternative Navigation Systems

The GPS market faces competition from regional satellite navigation systems, including Europe’s Galileo, China’s BeiDou, and Russia’s GLONASS. Galileo, for instance, offers high-precision services and is gaining traction in Europe and beyond, with full operational capability achieved in recent years. BeiDou’s global expansion, particularly in Asia-Pacific, provides an alternative for countries seeking to reduce dependence on GPS. These systems offer comparable accuracy and, in some cases, regional advantages, challenging GPS’s dominance in specific markets and complicating interoperability for multinational applications.

GPS Market Segmentation Analysis:

- By Application, the navigation segment is expected to grow substantially

Navigation is the largest and most critical application segment in the GPS market, underpinning a wide range of industries, including automotive, aviation, marine, and consumer electronics. GPS navigation provides real-time positioning, routing, and mapping, enabling efficient travel, logistics, and location-based services. Its dominance stems from widespread adoption in smartphones, in-vehicle navigation systems, and emerging technologies like autonomous vehicles and smart city infrastructure. Navigation applications account for a significant portion of the GPS market revenue due to their universal utility and integration with advanced technologies like 5G and AI.

The navigation segment is driven by the growing demand for precise, real-time location data. In automotive applications, navigation systems are integral to advanced driver-assistance systems (ADAS) and autonomous driving. For instance, Tesla’s Full Self-Driving (FSD) technology relies on GPS navigation for route planning and real-time traffic updates. In smart cities, GPS navigation supports intelligent transportation systems, as seen in Singapore’s Smart Nation initiative, which uses GPS to optimize traffic flow and public transit.

Consumer navigation apps like Google Maps and Waze, which leverage GPS for turn-by-turn directions and traffic insights, have billions of users globally, further solidifying this segment’s dominance. Recent advancements, such as dual-frequency GPS in smartphones (e.g., Apple iPhone 16), enhance navigation accuracy in urban environments, driving adoption. Additionally, the integration of GPS with AR for navigation in tourism and gaming, as seen in Niantic’s Pokémon GO, expands its consumer appeal.

The navigation segment is poised for continued growth, fueled by autonomous systems, IoT, and smart infrastructure. Innovations like Galileo’s High Accuracy Service and GPS III satellites will further enhance navigation precision, reinforcing its market leadership.

- By End-User, the automotive sector is anticipated to grow rapidly

The automotive sector is the leading end-user segment in the GPS market, driven by its integration into navigation systems, telematics, fleet management, and autonomous driving technologies. GPS is critical for in-vehicle navigation, real-time traffic updates, and vehicle tracking, making it indispensable for both consumer and commercial automotive applications. The segment’s dominance is attributed to the global growth of vehicle production, the rise of electric and autonomous vehicles, and increasing demand for connected car technologies.

GPS adoption in automotive applications is accelerating due to the rise of connected and autonomous vehicles. Companies like Waymo and General Motors use GPS alongside AI and sensors to enable Level 4 autonomy, ensuring precise vehicle positioning. Telematics systems, which rely on GPS for fleet management and vehicle diagnostics, are widely adopted by logistics companies like UPS, improving operational efficiency.

The integration of GPS with vehicle-to-everything (V2X) communication, supported by 5G, enhances road safety and traffic management. For example, Qualcomm’s Snapdragon Automotive 5G Platform incorporates GPS for connected car ecosystems. In consumer vehicles, GPS-enabled infotainment systems, such as those in Ford’s SYNC 4 platform, offer advanced navigation and over-the-air updates, boosting market demand. Additionally, GPS-based stolen vehicle recovery systems, like those offered by LoJack, are gaining traction.

The automotive segment will continue to dominate as electric vehicle (EV) adoption and autonomous driving technologies expand. The push for smart mobility and regulatory mandates for connected vehicles in regions like Europe will further drive GPS adoption.

- The North American market is rising rapidly

North America, particularly the United States, is the largest geographic segment in the GPS market, driven by its advanced technological infrastructure, high adoption of GPS-enabled devices, and significant investments in defense and automotive industries. The region’s leadership is supported by the U.S. ownership of the GPS system, extensive R&D, and widespread use in consumer, commercial, and government applications. The U.S., Canada, and Mexico collectively contribute to North America’s dominance, with the U.S. leading due to its innovation ecosystem and defense spending.

The U.S. is at the forefront of GPS innovation, with the U.S. Space Force’s GPS modernization program, including GPS III satellite deployments, enhancing signal accuracy and anti-jamming capabilities. This supports applications in defense, aviation, and autonomous vehicles. The U.S. automotive industry, with companies like Tesla and GM, drives GPS demand through ADAS and autonomous driving technologies.

In consumer electronics, North America’s high smartphone penetration, with devices like the iPhone and Samsung Galaxy incorporating advanced GPS features, fuels market growth. Canada’s logistics sector leverages GPS for fleet management, supported by companies like Geotab, which provide GPS-based telematics solutions. Mexico’s growing automotive manufacturing sector, a hub for global automakers, further boosts GPS adoption in vehicle navigation and tracking. Recent developments, such as the U.S. Department of Transportation’s initiatives for connected infrastructure, highlight North America’s role in advancing GPS applications.

North America will maintain its leadership due to ongoing investments in GPS infrastructure, autonomous systems, and IoT. Collaboration between public and private sectors, particularly in the U.S., will drive innovations in navigation and tracking, sustaining the region’s dominance.

GPS Market Key Developments:

- Calian GNSS’s CR8894SXF+ Anti-Jamming CRPA: In June 2025, Calian GNSS released the CR8894SXF+, a next-generation Controlled Reception Pattern Antenna (CRPA) designed to counter GPS jamming and spoofing. This product enhances signal reliability for defense, aviation, and critical infrastructure applications by mitigating interference in contested environments.

- Development of L5-Direct GNSS Receiver ASIC by oneNav (2024): oneNav introduced an L5-direct GNSS receiver Application-Specific Integrated Circuit (ASIC), a breakthrough allowing devices to directly acquire and track L5-band satellite signals without relying on the older, more vulnerable L1 signals. This innovation improves positioning accuracy and resilience to interference, benefiting applications in automotive, IoT, and mobile devices. The L5-direct receiver supports the growing demand for robust GPS solutions in urban and high-interference environments, marking a significant step in GNSS technology.

List of Top GPS Companies:

- Letstrack

- Avidyne Corporation

- FEI-Zyfer

- Furuno Electric Co. Ltd.

- Johnson Outdoors Inc.

GPS Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| GPS Market Size in 2025 | USD 135.389 billion |

| GPS Market Size in 2030 | USD 273.858 billion |

| Growth Rate | CAGR of 15.13% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in GPS Market |

|

| Customization Scope | Free report customization with purchase |

Global GPS Market Segmentation:

- By Component

- Hardware

- Software

- By Type

- Assisted GPS

- Simultaneous GPS

- Differential GPS

- Others

- By Application

- Navigation

- Real Time Traffic Updates

- Surveying & Mapping

- Others

- By End-User

- Military & Defense

- Transportation & Logistics

- Healthcare

- Construction

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America