Report Overview

Real-Time Location System (RTLS) Highlights

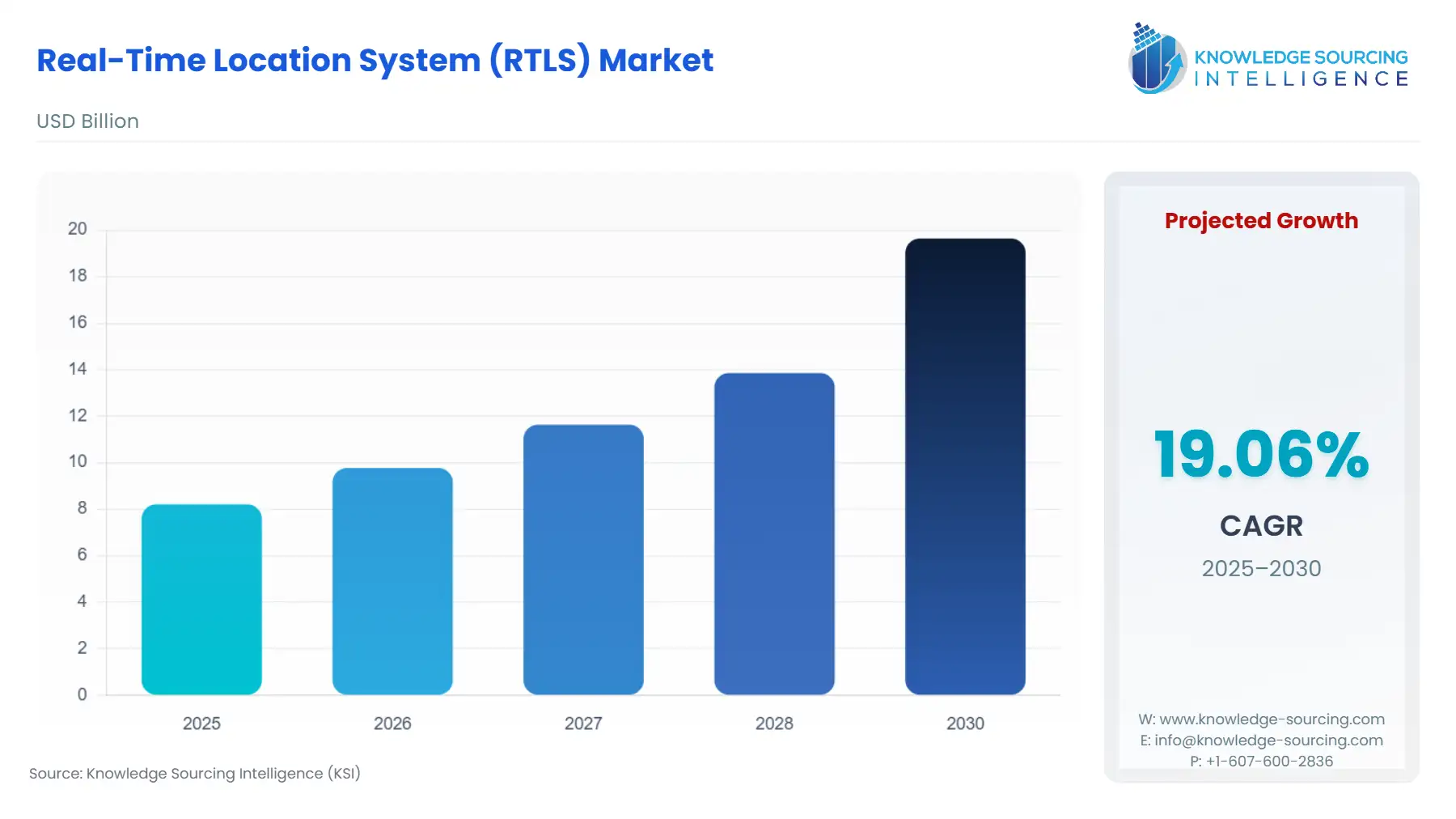

Real-Time Location System (RTLS) Market Size:

The Real-Time Location System (RTLS) Market is expected to grow from US$8.208 billion in 2025 to US$19.640 billion in 2030, at a CAGR of 19.07%.

The Real-Time Location System (RTLS) market encompasses technologies that automatically identify and track the location of objects or people in real time, typically within a localized area such as a hospital, warehouse, or factory floor. These systems leverage a combination of hardware (tags, readers, and sensors), specialized software for data processing, and associated services (integration, maintenance). Technologies utilized span Radio Frequency Identification (RFID), Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), and Infrared (IR), each selected based on the required accuracy and environment. The market is fundamentally driven by the operational necessity across major industrial and service sectors to gain hyper-accurate visibility, optimize resource utilization, enhance safety compliance, and ultimately reduce labor and capital equipment costs.

Real-Time Location System (RTLS) Market Analysis

- Growth Drivers

The mounting emphasis on safety, regulatory compliance, and process optimization across enterprises serves as a significant catalyst. In Healthcare, patient safety mandates and the necessity to locate critical mobile assets like infusion pumps and ventilators instantaneously directly increase the procurement of RTLS Hardware and Services. In Manufacturing, the global implementation of "smart factory" concepts under Industry 4.0 drives demand for RTLS to create digital twins of the production floor, optimizing work-in-process (WIP) flow, and tracking high-value tools. Furthermore, the rapid advancements in wireless technologies, particularly the improved precision and battery life of UWB and BLE tags, make deployment feasible in complex environments, directly accelerating adoption by lowering the total cost of ownership for large-scale deployments.

- Challenges and Opportunities

A primary constraint is the inherent trade-off in RTLS design, which forces enterprises to choose between a single solution that offers high range, high accuracy, and low power consumption. This lack of a universal solution, coupled with the high upfront capital expenditure for comprehensive infrastructure deployment and subsequent maintenance, restrains broader adoption, especially in non-critical sectors. Conversely, the market is presented with a major opportunity through the rising demand for hybrid RTLS solutions. These platforms integrate multiple technologies—combining the broad coverage of Wi-Fi or BLE with the centimeter-level accuracy of UWB for choke points—to address the diverse accuracy and range requirements within a single facility cost-effectively. This hybrid approach mitigates the limitation of single-technology systems, expanding the viable use cases and unlocking a new growth trajectory for specialized Software platforms capable of integrating and analyzing disparate location data.

- Raw Material and Pricing Analysis

The Real-Time Location System is fundamentally a physical product market, consisting of specialized Hardware components. The primary raw materials and components include microprocessors, specialized radio frequency (RF) chips (for RFID, UWB, and BLE functionality), printed circuit boards (PCBs), and enclosures typically molded from high-grade polymers. Pricing for RTLS Tags/Badges and Readers/Access Points is highly sensitive to the cost and supply chain of electronic components, including semiconductors and memory chips. The global supply chain for these core electronic components is concentrated in Asia-Pacific, leading to geopolitical and logistical dependencies that can cause volatility in final hardware pricing and extended lead times. The cost of tags, especially the high-performance UWB variants, remains a substantial component of the overall project cost, driving OEMs to continuously optimize tag design for smaller form factors, longer battery life (using specialized batteries), and lower production cost.

- Supply Chain Analysis

The RTLS supply chain is multi-layered, beginning with highly specialized fabrication of RF semiconductors for tags and readers in Asian semiconductor hubs. The next tier involves the manufacturing of printed circuit board assemblies (PCBA) and the final encapsulation of Hardware components (tags, beacons, anchors) in facilities primarily located in North America, Europe, and Asia-Pacific. A critical dependency exists on niche suppliers for high-density, long-life batteries, particularly for BLE and UWB active tags, which require reliable power sources for continuous operation. Logistical complexity is primarily associated with the customs clearance and shipment of complex electronics, as well as the specialized expertise required for on-site installation, calibration, and commissioning of the Services segment. The Software layer, while intangible, relies on a global talent pool for development, which impacts the pricing of recurring subscription and maintenance services.

Real-Time Location System (RTLS) Market Government Regulations

Governments and regulatory bodies significantly impact the RTLS market, primarily through mandates concerning data privacy, patient safety, and operational efficiency standards.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Health Insurance Portability and Accountability Act (HIPAA) |

HIPAA privacy rules directly impact RTLS use in Healthcare by mandating that location data linked to a patient's identity (Protected Health Information) must be encrypted and secured. This increases demand for RTLS Software that offers robust data anonymization, audit trails, and role-based access controls to maintain compliance. |

|

European Union |

General Data Protection Regulation (GDPR) |

GDPR mandates strict control over the personal data of individuals, including location tracking of personnel or patients. This acts as a constraint on RTLS deployment for staff monitoring unless clear consent and legitimate interest are established, thereby driving R&D investment into privacy-by-design features like data minimization in RTLS tags. |

|

United States |

Occupational Safety and Health Administration (OSHA) Standards |

OSHA standards for workplace safety, particularly in Manufacturing and Logistics, drive the need for real-time safety monitoring, geofencing, and panic button functionality on RTLS tags worn by workers. This propels demand for RTLS systems capable of two-way communication and high-accuracy, low-latency positioning for emergency response, increasing the value proposition of UWB technology. |

Real-Time Location System (RTLS) Market Segment Analysis

- By Technology: Ultra-Wideband (UWB)

The Ultra-Wideband (UWB) segment is experiencing exceptional demand growth due to its ability to deliver centimeter-level location accuracy, a crucial requirement that technologies like Wi-Fi and standard BLE cannot consistently achieve. This hyper-precision directly drives adoption in critical high-value applications where even minor positional errors are unacceptable. In Manufacturing, UWB is the technology of choice for tracking work-in-process (WIP) on assembly lines, ensuring tools are used in the correct sequence and location, and automating quality control checks, which directly reduces rework costs and production delays. Similarly, in Healthcare, UWB is increasingly mandated for locating portable medical devices in dense clinical environments and for critical workflow applications, such as surgical instrument tracking, where its accuracy enhances patient safety by ensuring immediate availability of essential equipment. This superior technical capability commands a premium price and drives significant capital investment into the necessary anchor infrastructure.

- By Industry Vertical: Healthcare

The Healthcare vertical is the largest consumer of RTLS, with demand primarily fueled by operational inefficiency and regulatory mandates surrounding patient safety. Hospitals procure RTLS to solve the critical problem of asset loss and underutilization, which is estimated to cost facilities millions annually. By tracking critical mobile equipment like infusion pumps and wheelchairs using RFID or BLE tags, hospitals can achieve higher utilization rates and reduce unnecessary capital purchases, directly lowering operational expenditure. Furthermore, the use of RTLS to monitor staff and patient flow enhances compliance with hand hygiene protocols (by tracking staff movement near hygiene stations) and streamlines patient throughput from admission to discharge. This focus on workflow optimization and cost-saving, coupled with the rising global trend of "Smart Hospital" initiatives, makes RTLS solutions an indispensable infrastructure component, sustaining high, inelastic demand for both Hardware and Services.

Real-Time Location System (RTLS) Market Geographical Analysis

- North America (United States)

The United States holds the largest share of the global RTLS market, driven by its technologically advanced Healthcare infrastructure and stringent regulatory environment (OSHA, FDA). High capital spending power within US hospital systems and the proliferation of Ambulatory Surgical Centers (ASCs) create sustained, robust demand for premium RTLS solutions, particularly those utilizing UWB and hybrid Wi-Fi systems. The demand is further amplified by the rapid digital transformation in the manufacturing and logistics sectors, which are aggressively adopting RTLS for Industry 4.0 automation and supply chain visibility, seeking to leverage location data for competitive advantage.

- South America (Brazil)

Brazil’s RTLS market is characterized by emerging but accelerating demand, primarily concentrated in the highly regulated and complex logistics and port management sectors, where asset tracking via GPS and RFID is crucial for security and efficiency. Adoption in Healthcare remains fragmented, often focused on cost-effective Wi-Fi-based solutions in high-volume public hospitals seeking basic asset visibility. Market growth is constrained by initial capital investment limitations and a less mature IT infrastructure compared to North America, favoring basic, localized systems over full-scale enterprise deployments.

- Europe (Germany)

Germany serves as a sophisticated hub for RTLS demand, largely driven by its globally leading Manufacturing sector and its commitment to the Industry 4.0 paradigm. German automotive and complex machinery producers mandate high-accuracy UWB and BLE systems for precise work-in-process (WIP) tracking and automated quality assurance on factory floors. While the Healthcare sector shows strong interest, deployment is rigorously influenced by the EU's GDPR, which necessitates that RTLS solutions designed for staff or patient tracking incorporate robust data privacy safeguards, making compliance a key purchasing criterion.

- Middle East & Africa (Saudi Arabia)

Saudi Arabia is a rapidly growing market, fueled by substantial government-backed investment in new, highly digitized infrastructure, including "Smart City" and specialized healthcare facilities. This investment creates strong, high-value demand for comprehensive, cutting-edge RTLS deployments, often favoring the latest UWB and integrated IoT platforms for security, asset management, and workflow optimization within newly constructed, large-scale hospitals and industrial complexes. Procurement decisions prioritize technological superiority and capacity for large-scale integration.

- Asia-Pacific (Japan)

Japan exhibits a technologically mature and quality-focused RTLS market. Demand is highly sophisticated, concentrated in manufacturing and logistics, where precision and efficiency are paramount. The market has a high rate of adoption for advanced RFID and precise UWB solutions, driven by the need to optimize dense, complex supply chain logistics and mitigate high labor costs through automation. Healthcare adoption is also strong, with a focus on integrating RTLS data with Electronic Health Record (EHR) systems for enhanced patient flow and resource management in a highly organized clinical environment.

Real-Time Location System (RTLS) Market Competitive Environment and Analysis

The RTLS market is characterized by intense competition among diverse vendors, including large diversified technology firms and specialized pure-play RTLS providers. Competition is centered on technological specialization (e.g., UWB precision), solution integration capability with existing enterprise resource planning (ERP) systems, and service delivery across key industry verticals.

- Zebra Technologies Corporation

Zebra Technologies commands a strong position, particularly in Manufacturing and Logistics, by offering a comprehensive portfolio that spans multiple technologies including RFID, Wi-Fi-based tracking, and UWB. The company's strategic advantage is the deep integration of its RTLS hardware and software with its wider enterprise asset intelligence solutions, such as its visibility and location software. This allows customers to leverage location data seamlessly with other enterprise data sets, driving demand for its end-to-end solutions that cover asset management, operational visibility, and workforce management.

- TeleTracking Technologies, Inc.

TeleTracking Technologies is strategically positioned as a specialized healthcare operations management solution provider. The company focuses on patient flow and asset management within hospitals, leveraging RTLS data, often via Wi-Fi and BLE, to drive its flagship capacity management software. Its offering is designed to enhance hospital efficiency, specifically by minimizing patient wait times and optimizing bed turnover, directly linking location data from Tags to clinical workflow outcomes and cementing its position in the high-value Healthcare vertical.

- CenTrak Inc. (Halma plc)

CenTrak is a pure-play RTLS provider that has built significant market share in the Healthcare sector. The company utilizes a multi-technology platform that often combines high-accuracy Infrared (IR) at room-level with lower-cost Gen2-IR, Wi-Fi, and BLE for facility-wide coverage. This hybrid approach caters specifically to the complex, high-accuracy needs of hospitals, providing precise tracking of assets and personnel in clinical spaces, which supports its strategic position as a leader in clinical visibility and regulatory compliance applications.

Real-Time Location System (RTLS) Market Developments

Recent market activity has focused on strategic acquisitions to consolidate software platforms and expand technological breadth across different RTLS technologies.

- October 2024: Cognosos acquired Cox Prosight, a move aimed at consolidating RTLS software platforms. The acquisition gains Cognosos a hospital RTLS software platform designed to serve all location tracking applications on a unified system, enhancing its offering in the Healthcare vertical and increasing the capability of its Software component.

- May 2024: Litum released RTLS Version 6.1, a product launch focused on technology enhancement. This version upgraded its support for both Ultra-Wideband (UWB) and Bluetooth Low Energy (BLE) technologies, directly addressing the growing demand for hybrid solutions that can deliver diverse location accuracy needs across a single facility, particularly in Manufacturing and Logistics. (

Real-Time Location System (RTLS) Market Segmentation:

By Component

- Hardware

- Software

- Services

By Technology

- Infrared

- RFID

- WI-FI

- GPS

- Bluetooth

- Others

By Industry Vertical

- Healthcare

- Manufacturing

- Retail

- Logistics

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others