Report Overview

Home Health Technology Market Highlights

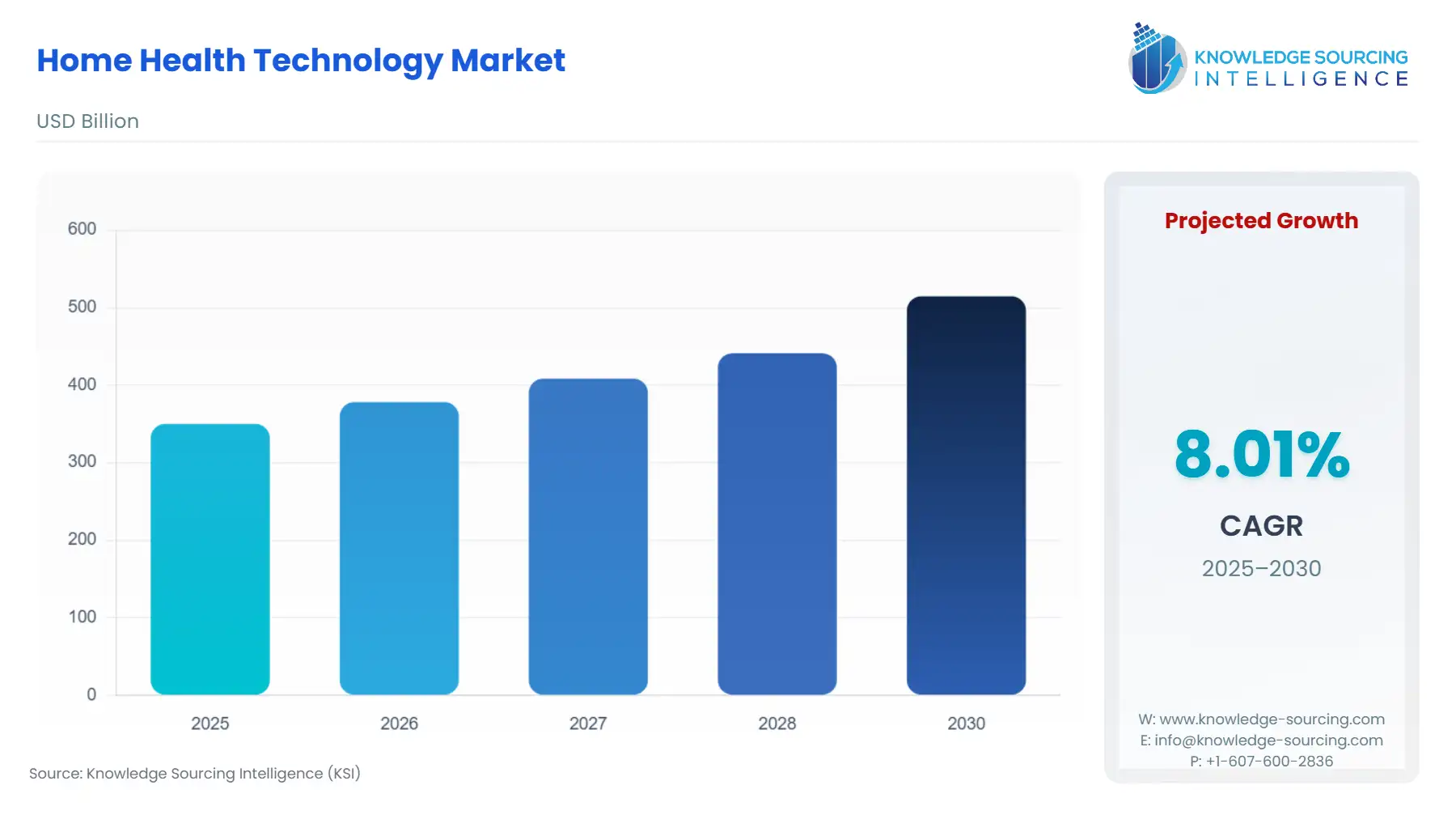

Home Health Technology Market Size:

The Home Health Technology Market is anticipated to climb from USD 350.098 billion in 2025 to USD 514.647 billion by 2030, driven by an 8.01% CAGR.

The Home Health Technology market encompasses the devices, software, and services that enable medical and wellness care delivery outside of traditional clinical settings. This includes Remote Patient Monitoring (RPM), mHealth applications, and electronic health records (EHR) utilized by patients and providers in the home environment. The imperative to manage rising healthcare expenditures while simultaneously catering to an aging demographic and chronic disease burden is rapidly propelling home-based care from a niche service to a strategic core component of global health systems. This evolution is fundamentally a data and logistics challenge, positioning technology as the crucial link for maintaining clinical quality, ensuring patient safety, and streamlining operations for providers.

Home Health Technology Market Analysis

- Growth Drivers

The primary catalyst for sustained market growth is the global demographic shift toward an aging population coupled with a rising prevalence of chronic conditions like heart disease, diabetes, and COPD. This reality immediately escalates the volume of individuals requiring continuous, rather-than-episodic, care management. In the US, the 2018 revision of Medicare's Remote Patient Monitoring (RPM) reimbursement structure, specifically the unbundling of CPT codes and the allowance for home health agencies to report costs, removes a financial barrier for providers. This regulatory mechanism directly increases the addressable market for RPM devices and software platforms, as providers now have a clear path to generating revenue from these services, thus compelling investment in technology acquisition. Furthermore, the demonstrated cost-effectiveness of home care over hospitalization fuels institutional demand, as payers and health systems seek solutions to mitigate expensive inpatient stays.

- Challenges and Opportunities

The market faces significant headwinds, primarily concerning regulatory harmonization and data security. The fragmented, country-specific nature of medical device approval and data privacy laws creates significant compliance overhead for global technology firms, slowing the time-to-market and increasing costs, which can constrain the supply-side response to demand. However, this same complexity generates a substantial opportunity for interoperable and secure software platforms. The industry demands solutions that can seamlessly integrate disparate home-monitoring data into existing Electronic Health Record (EHR) systems. Companies delivering platforms with robust cybersecurity, regulatory-compliant data handling, and proven interoperability stand to capture premium market share by solving the most critical pain point for institutional purchasers. The increasing consumer adoption of digital health also presents an opportunity for direct-to-consumer models, bypassing traditional healthcare gatekeepers for wellness and non-regulated monitoring devices.

- Raw Material and Pricing Analysis

The Home Health Technology market, being predominantly comprised of hardware and integrated systems (wearables, sensors, gateways), is directly exposed to global semiconductor and raw material supply chain dynamics. Key components include specialized microcontrollers (MCUs) for low-power operation, various sensors (e.g., optical for SpO2, electrochemical for glucose), and specialized power management integrated circuits (PMICs). Pricing for the final product is inherently linked to the volatile semiconductor market, which has historically experienced capacity constraints and geopolitical friction. For example, the increasing integration of edge-AI capabilities into IoT chips, while technically beneficial for latency and privacy, heightens the reliance on advanced, dedicated intellectual property (IP) blocks and specialized foundry processes. This dependence maintains upward pressure on unit manufacturing costs, forcing technology companies to seek greater operational efficiency or pass costs through to institutional buyers, which impacts the final consumer's accessibility.

- Supply Chain Analysis

The global supply chain for Home Health Technology is complex, starting with concentrated production of specialized electronic components in Asia-Pacific manufacturing hubs. This structure creates geopolitical and logistical dependencies, exemplified by reliance on a limited number of foundries for advanced semiconductor fabrication. Finished goods assembly often occurs in multiple regions to manage tariffs and distribution logistics. A critical logistical complexity arises from the necessity of maintaining stringent quality controls, as the components are destined for medical devices requiring ISO 13485 certification. The supply chain is further complicated by the 'last mile' problem: the need for highly specialized logistics to distribute devices directly to patient homes, often requiring certified delivery and in-home setup services, a capability often handled by specialized home medical equipment (HME) distributors or the service arms of major technology companies.

Home Health Technology Market Segment Analysis

- By Application: Remote Patient Monitoring (RPM)

The Remote Patient Monitoring (RPM) segment serves as a central pillar of home health technology due to its direct utility in managing high-cost, chronic diseases. The demand is structurally driven by the necessity for proactive clinical intervention rather than reactive emergency treatment. For a patient managing Congestive Heart Failure (CHF), continuous data streams of weight, blood pressure, and heart rate, collected via smart scales and connected blood pressure cuffs, allow a provider to detect a sub-clinical decline—such as fluid retention—before it escalates into an acute event requiring hospitalization. This prevention of high-cost events is the fundamental demand driver for payers and health systems globally. Furthermore, the explicit inclusion of RPM under structured reimbursement programs in the U.S. (CMS) shifts the investment model from a cost center to a profitable service line for providers, creating immediate, quantifiable demand for devices that are validated, FDA-cleared, and easily integrated into the provider's workflow. The segment's future demand is directly tied to the expansion of use cases for higher-acuity conditions.

- By End-User: Homecare Agencies and Providers

Homecare Agencies and Providers represent a crucial and rapidly professionalizing end-user segment, with demand driven by operational efficiency imperatives and the need to scale their clinical capacity. As the volume of patients demanding home-based skilled nursing and therapy services rises, agencies face constraints on staffing and travel time. Technology, particularly scheduling software, mHealth communication platforms, and portable diagnostic devices, becomes indispensable for optimizing clinical routes and maximizing the number of patients a single nurse can safely manage per day. The mandate for agencies to report on quality outcomes for reimbursement, often tied to metrics like reduced hospital readmissions, further compels investment in RPM and advanced documentation technology. Adoption is not just about cost-cutting; it is a clinical quality tool, enabling compliance with best practices and facilitating timely communication between field clinicians, the supervising physician, and the patient, thereby improving clinical fidelity and driving demand for integrated operational platforms.

Home Health Technology Market Geographical Analysis

- United States Market Analysis (North America)

The U.S. market is the most mature for Home Health Technology, with demand driven less by basic adoption and more by complex payment reform and integration requirements. The primary demand catalyst remains the actions of the Centers for Medicare & Medicaid Services (CMS), which has continually refined reimbursement for telehealth and RPM services, creating a financial pull for technology adoption by hospitals and physician practices seeking to transition to value-based care models. This economic shift fundamentally drives demand for systems that facilitate interoperability with established Electronic Health Record (EHR) platforms and provide validated clinical data streams necessary for quality reporting and risk adjustment. The high burden of chronic disease and the robust venture capital investment in digital health further accelerates product launch and commercialization.

- Brazil Market Analysis (South America)

The Brazilian market faces a distinct set of demand drivers centered on geographic disparity and public health necessity. The sheer size of the country and the concentration of advanced medical facilities in major metropolitan areas create a critical need for remote care solutions. Demand for mHealth applications is strong, leveraging high mobile penetration to deliver basic diagnostic support and patient education in underserved regions. However, the adoption of high-cost, sophisticated RPM hardware is constrained by fragmented public and private payer systems and currency volatility, pushing the immediate demand toward low-cost, scalable software and service offerings that utilize existing consumer devices. Government initiatives focused on improving primary care access in rural areas drive regional demand.

- Germany Market Analysis (Europe)

The German market is characterized by a high standard of care and strict data privacy regulations, which dictate technology demand. The primary drivers are the national imperative to manage costs in an advanced healthcare system and the country’s significantly aging population. Demand focuses on high-quality, clinically validated, and highly secure digital health applications ("DiGAs") that can achieve regulatory approval and subsequent reimbursement. The Digital Healthcare Act and similar legislation explicitly open pathways for digital solutions to be covered by statutory health insurance, creating specific, verified demand for technology that meets the stringent security and efficacy criteria of the Federal Institute for Drugs and Medical Devices (BfArM).

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market demand is heavily influenced by large-scale, government-led digital transformation initiatives under Vision 2030. Investment is primarily directed at establishing foundational digital infrastructure, including robust telehealth networks and centralized electronic health records. This centralized public sector focus creates high demand for enterprise-level technology platforms and system integration services. The market prioritizes technologies that facilitate the rapid deployment of care across vast, low-density geographical areas and helps manage lifestyle diseases, such as diabetes, which are highly prevalent. Demand for consumer-grade devices remains nascent but is growing, primarily driven by a young, tech-savvy population and high disposable income.

- China Market Analysis (Asia-Pacific)

China’s market size and unique regulatory environment generate immense demand. The government’s "Healthy China 2030" plan is the dominant demand driver, explicitly pushing for the development of smart health and elderly care systems. This policy environment creates an immediate, government-backed demand signal for domestic and international companies providing solutions for chronic disease management and institutional elderly care. The vast population base and scale challenges require highly scalable software platforms, AI-driven diagnostics, and mass-market-accessible wearable devices. Localized innovation and the necessity of navigating the National Medical Products Administration (NMPA) approval process guide the specific product features and market strategy.

Home Health Technology Market Competitive Environment and Analysis

- Wettbewerbslandschaft und Analyse

The competitive environment in Home Health Technology is highly variegated, featuring legacy medical device giants competing directly with agile, specialized digital health startups and consumer technology firms. Competition centers not just on product features, but critically on regulatory clearance, data interoperability, and the ability to secure strategic partnerships with major health systems and payers. The ongoing consolidation through mergers and acquisitions is a key competitive strategy, allowing companies to integrate disparate monitoring devices with proprietary software platforms, thereby locking in both the clinical data stream and the provider workflow.

The market's major players are positioned strategically across the value chain, from hardware manufacturing and sensor technology to enterprise software and data analytics. The need for end-to-end solutions, connecting the patient device to the provider's EHR, intensifies competitive pressure on pure-play device manufacturers, compelling them toward strategic service or software acquisitions.

- Company Profile: Medtronic Plc

Medtronic Plc, a global leader in medical technology, strategically focuses its home health technology efforts on managing high-acuity chronic conditions, most notably in the areas of diabetes and cardiac care. Its positioning is leveraging its long-standing relationships with hospitals and clinicians as a major medical device supplier. Key products, such as the MiniMed™ integrated system for insulin delivery and glucose monitoring, represent a foundational home health technology that combines an embedded sensor (Continuous Glucose Monitoring, CGM) with a connected device. Medtronic's strategy is to integrate these high-value, clinically essential devices with digital health platforms, ensuring the data is actionable for both the patient and the care team, thereby sustaining demand by providing a high-fidelity, provider-trusted solution. The company’s verifiable strategic moves include continually seeking FDA clearance for next-generation systems, such as the MiniMed 780G system, reinforcing its commitment to regulated, closed-loop technology in the home.

- Company Profile: Omron Healthcare, Inc.

Omron Healthcare, Inc. is a major competitor focused on democratizing access to clinical-grade personal health monitoring devices, establishing a strong presence in blood pressure management, a cornerstone of home health. The company's positioning is built on the verified accuracy of its devices and the transition from standalone monitors to connected, Bluetooth-enabled devices. Products like the HeartGuide wearable blood pressure monitor and a range of connected blood pressure cuffs drive demand by appealing directly to consumers and indirectly to providers seeking reliable data. Omron's strategy is to establish its ecosystem of connected devices, with its Omron Connect app serving as the central data hub. Its verifiable key activity includes the development and marketing of FDA-cleared and clinically validated upper-arm blood pressure monitors, emphasizing the clinical utility and trustworthiness of patient-generated data for physician review.

Home Health Technology Market Developments

- September 2025: Quipt Home Medical Completes Strategic Acquisition of Hart Medical

Quipt Home Medical Corp. announced the acquisition of Hart Medical, which added approximately $60 million in revenue and strengthened health system partnerships, particularly in the U.S. Midwest. This merger is a verifiable instance of consolidation in the home medical equipment (HME) and respiratory care segment, aimed at creating an end-to-end platform for home-based respiratory services. The move directly increases the scale and reach for deploying connected respiratory devices and associated software services.

- August 2025: Quipt Home Medical Partners With Three Major Health Systems to Form Strategic Joint Venture

Quipt Home Medical Corp. confirmed the formation of a strategic joint venture with three major health systems. This transaction added 29 new locations and deep health system relationships, including entry into the Michigan market. This verifiable development signifies a clear trend where HME providers actively partner with hospital systems to integrate services, ensuring a seamless patient transition from acute care to high-acuity home care, which fuels the demand for integrated logistics and technology solutions.

- May 2025: BWX Technologies Closes Acquisition of Kinectrics’ Isotope Business

BWX Technologies announced the closing of its acquisition of the Kinectrics medical isotope business, which included its stake in the Isogen joint venture. Though specific to the nuclear medicine sector, this capacity addition is part of the broader trend of major technology and industrial firms securing and enhancing critical components of the medical supply chain to ensure long-term, specialized product delivery, which underpins the reliability of home-based nuclear medicine diagnostics and therapies.

Home Health Technology Market Sope:

Home Health Technology Market Segmentation:

By Offering

- Hardware

- Software

- Services

By Technology

- Artificial Intelligence (AI)

- Internet of Things (IoT)

- Machine Learning

- Others

By Applications

- Remote Patient Monitoring

- Virtual Reality (VR) Therapy

- Wearable Devices

- mHealth

- Electronic Health Records

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others