Report Overview

Global Implantable Cardioverter Defibrillator Highlights

Implantable Cardioverter Defibrillator (ICD) Market Size:

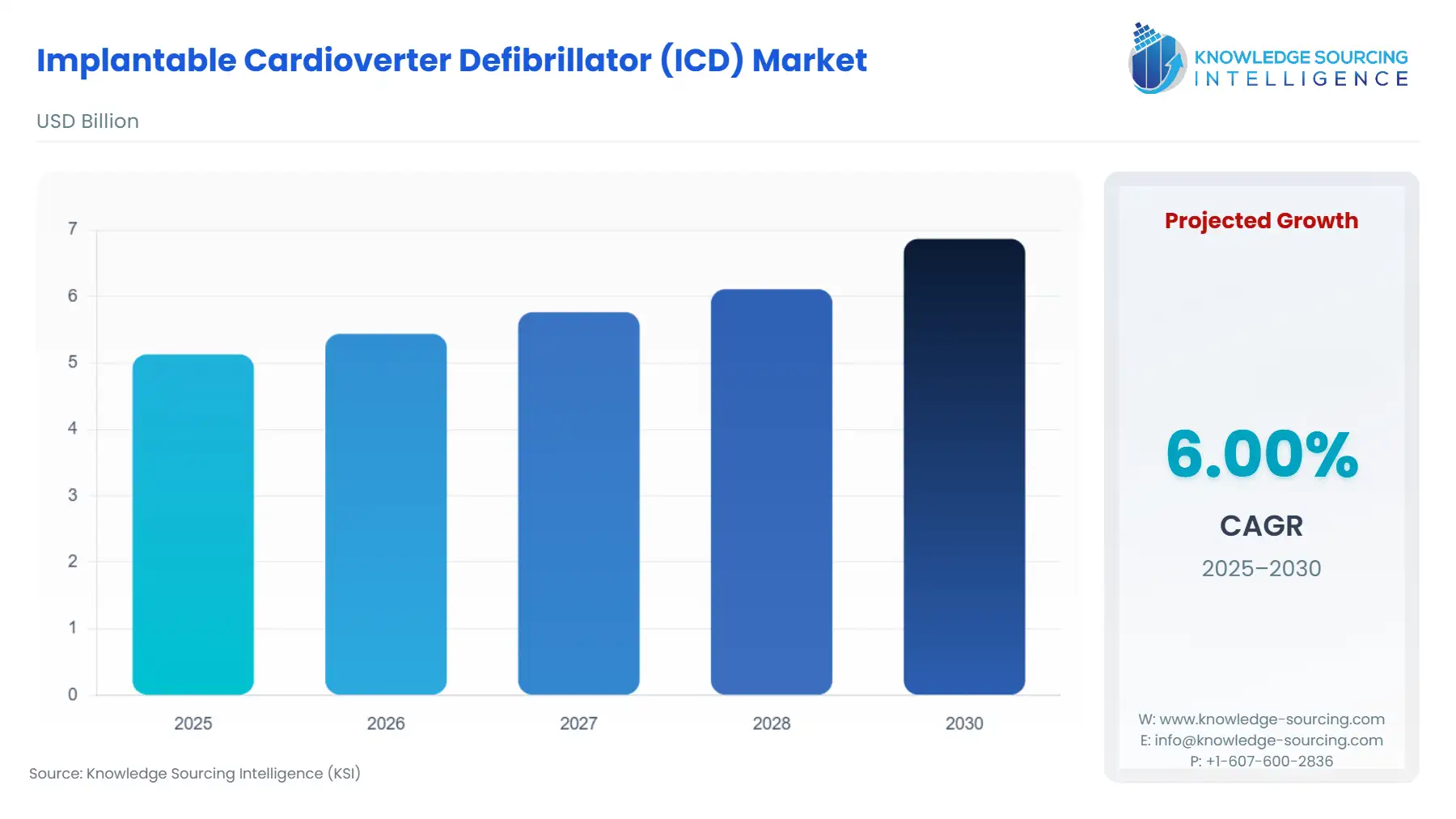

The global implantable cardioverter defibrillators market will grow at a CAGR of 6.00% to be valued at US$6.868 billion in 2030 from US$5.131 billion in 2025.

The Global Implantable Cardioverter Defibrillator (ICD) Market is a critical segment of the cardiovascular devices industry, focusing on implantable medical devices designed to monitor and treat life-threatening cardiac arrhythmias, such as ventricular tachycardia (VT) and ventricular fibrillation (VF), which can lead to sudden cardiac arrest (SCA). ICDs are battery-powered devices implanted in the chest to deliver electric shocks or pacing therapies to restore normal heart rhythm, significantly improving survival rates for patients with heart failure, cardiomyopathy, or coronary artery disease. The market serves hospitals, cardiology clinics, and ambulatory surgical centers, with North America leading due to advanced healthcare infrastructure and Asia-Pacific emerging as a growth hub driven by rising cardiovascular disease prevalence. Global ICD market trends emphasize technological advancements, minimally invasive procedures, and remote monitoring capabilities, enhancing patient outcomes and market expansion.

The ICD Market encompasses transvenous ICDs (T-ICDs), subcutaneous ICDs (S-ICDs), and cardiac resynchronization therapy defibrillators (CRT-D), addressing cardiac rhythm disorders with high precision. ICDs continuously monitor heart rhythms, delivering therapeutic interventions like defibrillation or cardioversion when abnormalities are detected, preventing SCA. The market is driven by the rising prevalence of cardiovascular diseases (CVDs), with the World Health Organization noting CVDs as the leading cause of global mortality, affecting millions annually. ICD clinical trials, such as the EV ICD trial by Medtronic, demonstrate improved safety and efficacy of extravascular ICDs, expanding treatment options. The ICD market share is dominated by North America and Europe, supported by favorable ICD reimbursement policies and robust clinical infrastructure.

ICDs vs. Pacemakers: Differences and Applications:

ICDs and pacemakers are both implantable cardiac devices, but they serve distinct purposes. An ICD is designed to detect and treat life-threatening arrhythmias, such as VT or VF, by delivering high-energy shocks or pacing to restore normal rhythm, primarily for patients at risk of SCA due to heart failure or cardiomyopathy. Pacemakers, conversely, manage bradycardia (slow heart rate) by sending low-energy electrical pulses to maintain a steady heartbeat, often for patients with heart block or sinus node dysfunction. ICDs incorporate pacemaker functions but are equipped with defibrillation capabilities, making them more complex. For example, CRT-D devices combine pacing for heart failure with defibrillation for arrhythmia management. ICDs require advanced programming and remote monitoring, as seen in Biotronik’s DX models for single-chamber ICDs. Pacemakers are simpler, focusing on rate regulation, making ICDs more suitable for high-risk patients.

The global ICD market trends are driven by several factors. First, the increasing prevalence of CVDs, fueled by aging populations, obesity, and sedentary lifestyles, heightens demand for ICDs. Second, technological advancements, such as leadless ICDs, longer battery life, and AI-driven diagnostics, enhance device efficacy, as seen in Medtronic’s EV ICD. Third, favorable ICD reimbursement policies in North America and Europe encourage adoption, with CMS and European health systems covering ICD implantation. Finally, growing awareness of preventive cardiology boosts demand for ICDs in emerging markets like the Asia-Pacific.

The market faces restraints such as high device costs, limited accessibility in low-resource regions. Stringent regulatory approvals, requiring extensive ICD clinical trials, delay market entry, as seen with the FDA and EMA standards. Complications, such as lead infections or device malfunctions, and cybersecurity concerns for remote monitoring, pose challenges. Additionally, limited reimbursement in some European and developing countries hinders market expansion.

The ICD competitive landscape is led by companies like Medtronic Plc, Boston Scientific Corporation, Abbott Laboratories, and Biotronik SE & Co. KG, focusing on innovation and strategic partnerships. Recent advancements, such as Biotronik’s DX models and MicroPort’s INVICTA leads, underscore the ICD competitive landscape’s commitment to innovation and patient outcomes, positioning ICDs as essential for modern cardiovascular care.

Implantable Cardioverter Defibrillator (ICD) Market Overview:

An implantable cardioverter defibrillator is an implantable electronic device that is used for treatment in case of sudden cardiac arrest and arrhythmia. The device can be used to detect an abnormal heart rate and to deliver electric shocks if required to the patients. The rapidly increasing geriatric population in many regions worldwide is a major factor responsible for the growth of the implantable cardioverter defibrillators market.

The increasing prevalence of sudden cardiac arrests, often triggered by ventricular arrhythmia or other causes, is fueling demand for advanced implantable cardioverter defibrillators (ICDs). These devices monitor a patient's heartbeat and restore normal rhythm when abnormalities are detected. For example, the British Heart Foundation reported that the United Kingdom sees over 30,000 out-of-hospital cardiac arrests annually, with emergency services attempting resuscitation. ICDs play a critical role in such scenarios, potentially saving lives and reducing mortality rates.

Ongoing technological improvements are enhancing the efficiency and reliability of implantable cardioverter defibrillators, driving their adoption among end-users. These advancements are expected to further strengthen demand for ICDs throughout the forecast period, as healthcare providers and patients increasingly rely on these life-saving devices. Some of the major players covered in this report include Medtronic Plc., Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, MicroPort Scientific Corporation, among others.

Implantable Cardioverter Defibrillator (ICD) Market Trends:

The ICD Market is advancing rapidly, driven by technological innovations enhancing patient safety and treatment efficacy for cardiac arrhythmias. ICD remote monitoring enables real-time data transmission, reducing hospital visits and improving patient management, as seen in Biotronik’s DX models with home monitoring capabilities. Wireless ICD systems, like Medtronic’s Aurora EV-ICD, eliminate transvenous leads, minimizing infection risks and simplifying implantation. MRI-conditional ICD devices, such as MicroPort’s INVICTA defibrillation leads, ensure safe MRI scans for patients, expanding diagnostic compatibility. Advances in ICD battery life, with next-generation batteries lasting over 10 years, reduce replacement surgeries, as demonstrated by Medtronic’s Micra VR2. AI-enabled ICD systems leverage machine learning for arrhythmia prediction, enhancing therapeutic precision, as shown in recent clinical trials. These global ICD market trends highlight innovation, patient-centric care, and improved outcomes in cardiovascular management.

Implantable Cardioverter Defibrillator (ICD) Market Drivers vs. Challenges:

Drivers:

Rising Prevalence of Cardiovascular Diseases: The Global ICD Market is driven by the increasing prevalence of CVDs, such as ventricular tachycardia, ventricular fibrillation, and heart failure, which heighten the risk of sudden cardiac arrest (SCA). CVDs, fueled by aging populations, sedentary lifestyles, and comorbidities like hypertension, are a leading cause of global mortality, as reported by the World Health Organization. ICDs provide life-saving interventions by delivering electric shocks to restore normal heart rhythm, making them critical for high-risk patients. The global burden of CVDs, particularly in emerging markets like India and Brazil, drives demand for ICDs, supported by improved healthcare access and awareness. Innovations like subcutaneous ICDs (S-ICDs) further enhance adoption rates, boosting market growth through effective cardiac rhythm management.

Technological Advancements in ICD Design: Technological advancements in ICD design significantly propel this market’s growth, enhancing device efficacy and patient safety. Innovations such as wireless ICD systems, like Medtronic’s Aurora EV-ICD, eliminate transvenous leads, reducing infection risks and simplifying implantation. MRI-conditional ICD devices, such as MicroPort’s INVICTA leads, ensure safe MRI compatibility, addressing diagnostic needs. AI-enabled ICD systems leverage machine learning for real-time arrhythmia prediction, improving therapeutic precision, as seen in Biotronik’s DX models. Advances in ICD battery life reduce replacement surgeries, enhancing patient outcomes. These developments drive market expansion by aligning with clinical demands for minimally invasive, reliable cardiac solutions in hospitals and cardiology clinics.

Supportive ICD Reimbursement Policies: Supportive ICD reimbursement policies in North America, Europe, and parts of Asia-Pacific are a key driver for the ICD Market, facilitating wider adoption of ICDs. Policies from CMS in the U.S. and European health systems cover ICD implantation costs for high-risk patients, as highlighted by the American Heart Association. These policies reduce financial barriers, encouraging hospitals and clinics to invest in advanced ICDs, such as CRT-D devices, for heart failure management. Reimbursement frameworks support ICD clinical trials, like the EV ICD trial, which validated extravascular ICD safety. This driver fosters market growth by enhancing accessibility and promoting innovative cardiac care in developed and emerging markets.

Challenges:

High Device Costs: High device costs pose a significant restraint for the ICD market’s growth, limiting accessibility in low-resource regions. ICDs, such as subcutaneous and CRT-D devices, require advanced components like long-life batteries and AI-enabled systems, increasing manufacturing expenses. For instance, wireless ICD systems, like Medtronic’s Aurora EV-ICD, involve costly R&D, elevating price points. Hospitals in developing countries face budget constraints, hindering the adoption of MRI-conditional ICD and AI-enabled ICD technologies. Maintenance costs, including remote monitoring infrastructure, further strain healthcare budgets. This restraint slows market penetration, necessitating cost-effective innovations and public-private partnerships to enhance affordability for cardiac rhythm management.

Regulatory Complexities: Regulatory complexities significantly restrain the ICD market’s expansion, as ICDs require rigorous clinical validation to meet safety and efficacy standards set by agencies like the FDA, EMA, and China’s NMPA. For example, ICD clinical trials for Biotronik’s DX models underwent extensive testing for FDA approval, delaying market entry. Regional variations in regulatory frameworks, such as CE Mark requirements for MicroPort’s INVICTA leads, complicate global commercialization. These restraints increase development costs and time-to-market, particularly for wireless ICD and MRI-conditional ICD innovations, requiring streamlined regulatory pathways to support market growth and patient access to advanced cardiac therapies.

Implantable Cardioverter Defibrillator (ICD) Market Segmentation Analysis:

The use of Transvenous Implantable Cardioverter Defibrillators (TV-ICDs) is rising rapidly: Transvenous Implantable Cardioverter Defibrillators (TV-ICDs) dominate the procedure segment of the ICD market due to their proven efficacy and widespread adoption in treating life-threatening arrhythmias. TV-ICDs involve leads inserted through veins into the heart, delivering electric shocks or pacing therapies to manage ventricular tachycardia and ventricular fibrillation, preventing sudden cardiac arrest (SCA). Their versatility supports arrhythmia management and heart failure treatment, with cardiac resynchronization therapy defibrillators (CRT-D) enhancing cardiac function. Biotronik’s DX models, featuring ICD remote monitoring, improve patient outcomes through real-time diagnostics. TV-ICDs leverage MRI-conditional technology, as seen in MicroPort’s INVICTA defibrillation leads, ensuring safe imaging. Their dominance drives market growth by addressing complex cardiac conditions in hospitals and cardiology clinics globally.

The Arrhythmia Management segment is expected to be the leading application: Arrhythmia Management leads the application segment of the ICD market, driven by the urgent need to treat life-threatening arrhythmias like ventricular tachycardia and ventricular fibrillation, which pose risks of SCA. ICDs deliver targeted shocks or pacing to restore normal heart rhythm, with AI-enabled ICD systems enhancing arrhythmia detection. Medtronic’s Aurora EV-ICD, part of the EV ICD trial, demonstrated high efficacy in arrhythmia management, reducing mortality risks. ICD remote monitoring improves real-time tracking, minimizing hospitalizations, as seen in Boston Scientific’s wireless ICD advancements. The rising prevalence of cardiovascular diseases, particularly in aging populations, fuels demand for ICDs, positioning Arrhythmia Management as the primary application for market expansion through technological innovation and improved patient care.

North America is predicted to dominate the market share: North America, particularly the United States, dominates the ICD market due to its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and favorable ICD reimbursement policies. The region leads in adoption of TV-ICDs and subcutaneous ICDs, supported by robust clinical research and FDA approvals. For instance, Abbott’s Gallant ICD with MRI-conditional technology enhances patient safety and diagnostic compatibility. North America benefits from ICD clinical trials, like Cleveland Clinic’s leadless pacemaker-defibrillator trial, advancing minimally invasive solutions. The region’s investment in cardiac care and awareness of preventive cardiology drive market growth, particularly for arrhythmia management and heart failure treatments.

Implantable Cardioverter Defibrillator (ICD) Market Key Developments:

Launch of Cardiac Contractility Modulation with Defibrillation (CCM-D) Device in the US (August 2025): This development marks a significant advancement by combining two distinct therapies into one device. The new system is designed not only to provide life-saving protection against sudden cardiac death through defibrillation but also to enhance heart function and improve symptoms for heart failure patients. This single, rechargeable device is implanted in the chest. It represents a shift toward more comprehensive and integrated cardiac care solutions, aiming to improve both the survival and overall quality of life for patients with advanced heart failure.

In March 2025: Medtronic launched its Aurora EV-ICD MRI System and Epsila EV MRI Lead in Japan. This extravascular ICD system is notable because it places the lead outside the heart's vascular system, under the breastbone, but still inside the chest cavity. This design aims to offer the benefits of an ICD, such as defibrillation therapy, while reducing the long-term risks associated with leads placed inside the heart and veins. The system is also MRI conditional, allowing patients to undergo MRI scans.

In December 2024: Abbott announced the first in-human procedures for its investigational AVEIR Conduction System Pacing (CSP) leadless pacemaker system. While not a traditional ICD, this technology represents a significant advancement in cardiac rhythm management. The system is designed to pace the left bundle branch area of the heart, mimicking the natural electrical conduction system, which physicians believe could offer a more physiological response. This leadless approach also eliminates the risks associated with traditional leads and device pockets.

October 2024: A key development in the Asia-Pacific market was the approval and launch of the first ICD manufactured within China. This local production is expected to increase accessibility and provide a more effective option for the high number of Chinese patients at risk of sudden cardiac death. The approved devices, including both single- and dual-chamber models, feature exceptional longevity to reduce the need for device replacements and are equipped with advanced algorithms to prevent inappropriate therapy. This signifies a major step in localizing advanced medical technology within the country.

List of Top Implantable Cardioverter Defibrillator (ICD) Companies:

Medtronic Plc

Boston Scientific Corporation

Abbott Laboratories

Biotronik SE & Co. KG

MicroPort Scientific Corporation

Implantable Cardioverter Defibrillator (ICD) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 5.131 billion |

| Total Market Size in 2030 | USD 6.868 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.00% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Procedure, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Implantable Cardioverter Defibrillator (ICD) Market Segmentations:

Implantable Cardioverter Defibrillator (ICD) Market Segmentation by product type:

Single-Chamber ICDs

Dual-Chamber ICDs

Biventricular ICDs (CRT-D)

Implantable Cardioverter Defibrillator (ICD) Market Segmentation by procedure:

Transvenous Implantable Cardioverter Defibrillators (TV-ICDs)

Subcutaneous Implantable Cardioverter Defibrillators (S-ICDs)

Implantable Cardioverter Defibrillator (ICD) Market Segmentation by application:

Arrhythmia Management

Heart Failure

Other Applications

Implantable Cardioverter Defibrillator (ICD) Market Segmentation by end user:

Hospitals

Specialty Clinics

Ambulatory Surgical Centers (ASCs)

Implantable Cardioverter Defibrillator (ICD) Market Segmentation by regions:

North America (USA, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)