Report Overview

Medical Electronics Market Report, Highlights

Medical Electronics Market Size:

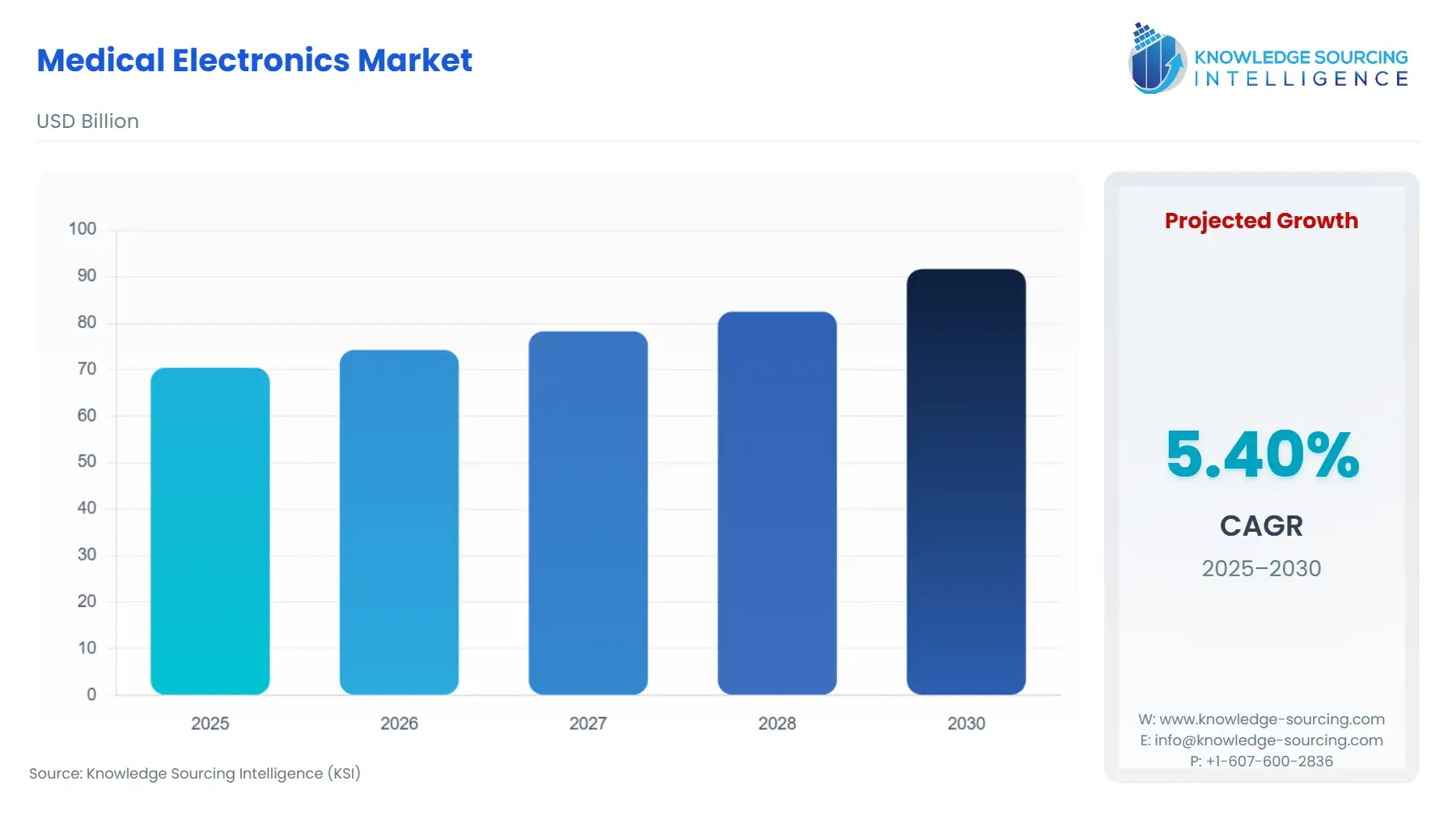

The Medical Electronics market is anticipated to grow at a CAGR of 5.41% over the forecast period to reach US$91.614 billion by 2030, increasing from an estimated value of US$70.421 billion in 2025.

Medical electronics comprises devices used in healthcare facilities, clinical service points, and institutes for monitoring patients. Preferences for such devices are witnessing significant growth fueled by the growing volume of minimally invasive surgical procedures. Furthermore, technological innovations in medical devices and efforts to improve overall patient monitoring, followed by favorable government schemes and investments to bolster medical electronics and components manufacturing, are anticipated to drive market expansion.

Medical Electronics Market Growth Drivers:

- Favorable regulations and government initiatives are propelling market growth.

Furthermore, various healthcare regulations by governing authorities are driving the medical electronics market concerning the need for research and development. Moreover, technological developments will lead to the medical device market’s growth. Additionally, there’s an increasing focus on integrating advanced technology within the devices, and this move stems from the increasing convenience of accurate and efficient diagnosis and treatment.

The provisions to subsidize medical expenditures in emerging economies further make them a lucrative market for medical electronics. For instance, according to the April 2023 PIB press release, the Union Cabinet approved the “National Medical Device Policy 2023,” which aims to make India a global leader in medical devices and innovations and increase its market share from 1.5% to 10-12% in the next 25 years.

- A growing number of minimally invasive surgical procedures has stimulated the market demand.

Minimally invasive surgeries enable surgeons to have access to a patient's organs through a small cut or incision, thereby reducing the time of wound healing. Such surgeries are linked to lesser pain and complications. Such surgeries require advanced medical devices and surgical robots to further enhance the recovery timing and limit the operating time. The growing prevalence of such surgical procedures in major nations has provided major growth prospects. For instance, according to the American Society of Plastic Surgeons, in 2022, cosmetic minimally invasive surgeries stood at 87,35,591, which represented a significant increase of 73% in the number of procedures conducted in 2019. Furthermore, as per the same source, Non-Invasive fat reduction surgeries witnessed 77% growth in the same year.

Additionally, the prevalence of brain tumors is witnessing significant growth in various nations, which is further expected to drive the demand for medical electronic devices required to keep a constant check on patient’s brain health. For instance, according to the Brain Tumor Charity’s data, over 12,000 people in the United Kingdom are diagnosed with a brain tumor every year, and the brain, along with other central nervous system tumors, is the 9th most common cancer detected in the UK and accounts 3% of new cancer cases.

- Growing healthcare spending has propelled the market growth

Medical electronics constitute an integral part of the medical products conducted for various diagnostic purposes, such as during CT & MRI scans, X-rays, and ultrasound. The growing healthcare has paved the way for future market growth. According to the Canada Institute of Health Information, in 2022, the country’s healthcare spending reached $332 billion or approximately $8,563 per Canadian, representing an 8.5% increase over 2020. Moreover, according to the Eurostat, in 2021, the general government expenditure on healthcare in the EU accounted for 8.1% of the overall GDP.

Additionally, the booming old age population and chronic disease prevalence are further anticipated to create a positive drive in the medical electronics market demand. According to the World Bank, in 2022, the population aged 65 years and above accounted for 10% of the global population, which signified a 2% increase over 2015.

Medical Electronics Market Geographical Outlook:

- North America is anticipated to account for a considerable market share.

North America is expected to show significant growth. It will account for a significant portion of the overall market fueled by the growing investments in healthcare infrastructure by the major regional economies, namely the United States and Canada. For instance, according to the “2024 Edition American Hospital Association”, the total number of hospitals in the United States stood at 6,120 in 2022, representing an increase of 27 units compared to 2020. Additionally, as per the November 2023 press release by the Government of Newfoundland and Labrador, the province has completed the construction of Western Memorial Regional Hospital. This will provide varied medical & diagnostic services, inclusive of cancer diagnostics.

Medical Electronics Market Key Development:

- In May 2024, GE Healthcare launched a new Radiation Therapy (RT) computed tomography (CT) solution at the “European Society For Therapeutic Radiology and Oncology (ESTRO: 2024 Congress”). The new product aims to address the challenges faced during oncology care by increasing image accuracy and providing the required personalization and diligence for diagnosis and treatment procedures.

- In July 2023, Abbott Laboratories received FDA approval for its dual-chamber leadless pacemaker system “AVEIR™ DR.” This would treat people with abnormal or slow heart rhythms in the US. The pacemaker will be the world’s first dual-chamber pacemaker.

- In April 2023, Medtronic Plc, in collaboration with DaVita Inc., launched a new company, “Mozarc-Medical,” which will provide innovative, patient-centric technological solutions for kidney health monitoring. The strategic collaboration aimed to transform kidney care procedures globally.

- In May 2022, Max Ventilator launched a non-invasive (NIV) ventilator with built-in oxygen therapy and humidifiers to serve patients suffering from pneumonia. The product would also be used in neonatal care.

- In January 2022, OES Medical introduced a new ventilator at Arab Health. The Gemini-G100 is a new mains-powered ICU ventilator designed to assist hospitals in managing oxygen demand. It reduces hospitals' reliance on oxygen deliveries, especially during peak demand.

Medical Electronics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Medical Electronics Market Size in 2025 | US$70.421 billion |

| Medical Electronics Market Size in 2030 | US$91.614 billion |

| Growth Rate | CAGR of 5.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Medical Electronics Market |

|

| Customization Scope | Free report customization with purchase |

Medical Electronics Market Segmentation:

- By Product Type

- Implantable Cardioverter-Defibrillators

- Neurostimulation Devices

- Pacemakers

- Respiratory Care Devices

- Surgical Robots

- By Diagnostics

- CT Scanners

- MRI Scanners

- Patient Monitoring Devices

- PET/CT Devices

- Ultrasound Devices

- X-ray Devices

- By End-User

- Ambulatory Surgical Centers

- Clinics

- Hospital

- By Geography

- North America

- USA

- Canada

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America