Report Overview

Global Lactose-Free Protein Powder Highlights

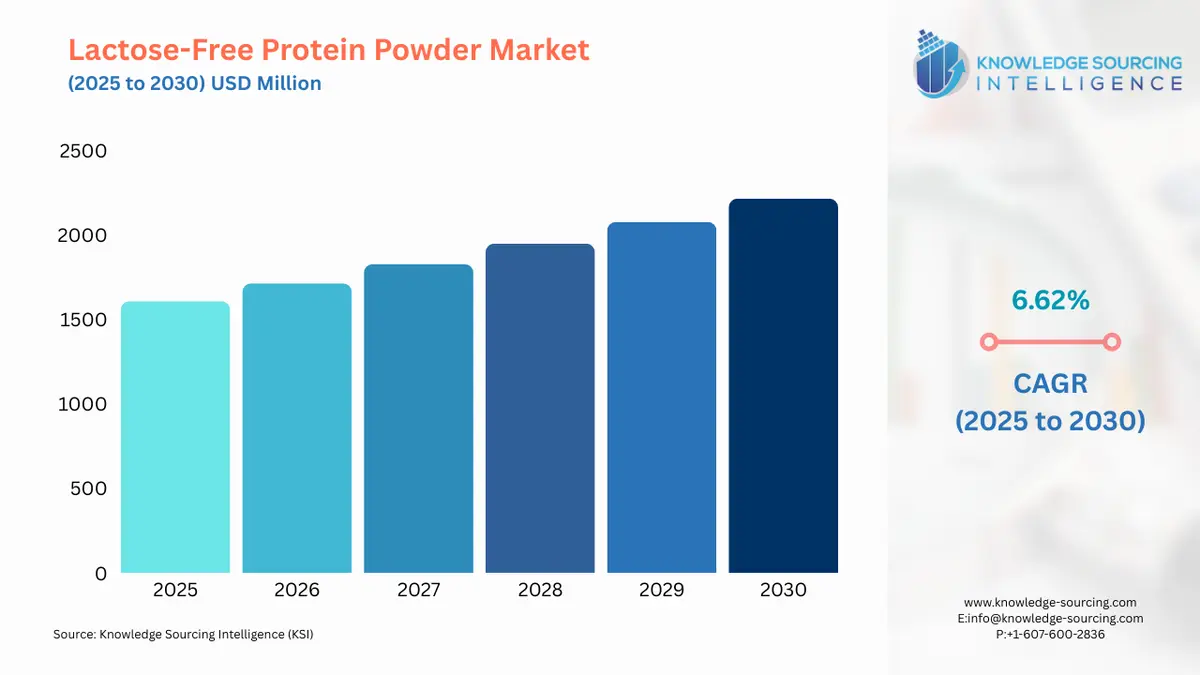

Lactose-Free Protein Powder Market Size:

The Global Lactose-Free Protein Powder Market will witness robust growth at a CAGR of 6.62% during the forecast period, to be worth USD 2,215.051 million in 2030 from USD 1,607.818 million in 2025.

Lactose-Free Protein Powder Market Introduction

The lactose-free protein powder market has emerged as a dynamic and rapidly growing segment within the broader protein supplement industry, driven by increasing consumer demand for dietary solutions that cater to specific health needs and lifestyle preferences. This market addresses the needs of individuals with lactose intolerance, a condition affecting approximately 65% of the global population, as well as those pursuing dairy-free and plant-based protein options for ethical, environmental, or health reasons. With advancements in food technology, such as precision fermentation protein and novel ingredient sourcing, the market is witnessing significant innovation, making it a critical area of focus for market players. The lactose-free protein powder market encompasses a range of products designed to deliver high-quality protein without lactose, a sugar found in dairy products that can cause digestive discomfort for those with lactose intolerance. These products include plant-based protein powders (e.g., pea, rice, hemp, and soy), animal-free whey produced via precision fermentation, and other novel protein sources like algal and mycoproteins.

The market is fueled by growing consumer awareness of lactose intolerance, rising adoption of vegan and flexitarian diets, and an increasing focus on health and wellness. According to a study published by the National Library of Medicine, lactose intolerance affects a significant portion of the global population, particularly in regions like East Asia, where prevalence can reach 90%. This widespread condition has spurred demand for dairy-free protein options that provide comparable nutritional benefits to traditional dairy-based proteins like whey. The rise of plant-based protein trends reflects a broader shift toward sustainable and ethical food choices. Consumers are increasingly opting for vegan protein powders derived from sources like peas, brown rice, and hemp, which are naturally lactose-free and often gluten-free, making them suitable for individuals with multiple dietary restrictions.

Additionally, the emergence of precision fermentation protein has introduced animal-free whey, which mimics the amino acid profile and functionality of traditional whey without relying on dairy production. Companies like Perfect Day and Vivici have pioneered this technology, producing bio-identical whey proteins through microbial fermentation, offering a sustainable alternative that appeals to both lactose-intolerant and environmentally conscious consumers.

Several key factors are driving the growth of the lactose-free protein powder market:

-

Prevalence of Lactose Intolerance: With approximately 65% of the global population experiencing some degree of lactose intolerance, there is a strong demand for protein supplements that avoid digestive issues associated with dairy-based products. This is particularly relevant in regions with high lactose intolerance rates, such as Asia and Africa.

-

Growing Vegan and Flexitarian Diets: The rise in veganism and flexitarianism, driven by concerns about animal welfare, environmental sustainability, and health, has boosted demand for plant-based protein powders. These products align with consumer preferences for clean-label and eco-friendly nutrition.

-

Technological Advancements: Innovations like precision fermentation have enabled the production of animal-free whey, which offers the nutritional benefits of dairy proteins without lactose or cholesterol. For instance, in February 2024, Vivici launched a nature-identical whey protein isolate, beta-lactoglobulin, which is lactose-free and suitable for sports nutrition and functional foods.

-

Health and Wellness Trends: Consumers, including athletes and fitness enthusiasts, are increasingly seeking functional protein powders that offer benefits like muscle recovery, weight management, and immune support. Lactose-free options cater to these needs while accommodating dietary restrictions.

-

Sustainability Concerns: The environmental impact of traditional dairy production, including high greenhouse gas emissions and water usage, has driven interest in sustainable alternatives like plant-based proteins and precision fermentation proteins, which significantly reduce environmental footprints. For example, Verley’s precision-fermented whey proteins are reported to reduce greenhouse gas emissions significantly compared to conventional dairy.

Despite its growth, the lactose-free protein powder market faces several challenges:

-

Cost of Innovation: The production of precision fermentation proteins involves high research and development costs, as well as complex scaling processes, which can limit affordability and accessibility for consumers.

-

Consumer Perception and Acceptance: Some consumers remain skeptical about novel proteins, such as those produced via precision fermentation, due to concerns about genetically modified organisms (GMOs) or unfamiliar production methods. Educating consumers about the safety and benefits of these proteins is critical.

-

Sensory Challenges: Plant-based protein powders can sometimes have off-flavors or gritty textures, which may deter consumers accustomed to the smooth taste and texture of dairy-based whey. Ongoing product development is needed to improve sensory properties.

Can Lactose-Intolerant Individuals Consume Whey Protein?

For individuals with lactose intolerance, consuming traditional whey protein can be problematic due to residual lactose content. Whey protein is derived from milk and comes in three main forms: concentrate, isolate, and hydrolysate. Whey protein concentrate contains higher levels of lactose (typically 4-8%), making it unsuitable for most lactose-intolerant individuals. However, whey protein isolate, which undergoes additional processing to remove most lactose (typically less than 1%), may be tolerable for some with mild lactose intolerance. For those with severe intolerance, even trace amounts can cause discomfort, making traditional whey a risky choice. Animal-free whey, produced through precision fermentation, offers a promising alternative. Companies like Verley and TurtleTree have developed lactose-free whey proteins, such as beta-lactoglobulin and lactoferrin, which are identical to dairy whey in nutritional profile but free of lactose and cholesterol. For example, TurtleTree’s LF+ lactoferrin is certified vegan and designed for sports nutrition and functional beverages, making it ideal for lactose-intolerant consumers.

Is Vegan Protein Better for Lactose-Intolerant Users?

Vegan protein powders, derived from sources like pea, rice, hemp, and soy, are inherently lactose-free and often hypoallergenic, making them a safe and effective choice for lactose-intolerant individuals. These proteins are also cholesterol-free and align with plant-based protein trends that emphasize sustainability and ethical consumption. For instance, pea protein is rich in iron and branched-chain amino acids, offering comparable muscle-building benefits to whey. However, vegan proteins may have lower leucine content compared to whey, which is critical for muscle protein synthesis. Animal-free whey from precision fermentation bridges this gap by providing high leucine content (11% more than native whey, per Verley’s claims) without lactose, making it a competitive alternative. The choice between vegan protein and animal-free whey depends on individual preferences. Vegan proteins are widely accessible, cost-effective, and sustainable, but some consumers may prefer the taste and functionality of animal-free whey for applications like high-protein beverages or smoothies. Both options cater effectively to lactose-intolerant users, with vegan proteins appealing to those prioritizing plant-based diets and animal-free whey attracting those seeking dairy-like performance without the drawbacks.

Lactose-Free Protein Powder Market Trends:

The lactose-free protein powder market is witnessing strong growth, driven by the rising prevalence of lactose intolerance and increasing demand for health-conscious nutrition. Lactose-free protein powders, offering high protein and low carbohydrate content, cater to consumers seeking digestive-friendly alternatives. This trend is particularly prominent in the Americas and Europe, where personalized nutrition is gaining traction among fitness enthusiasts and health-conscious consumers. The growing awareness of lactose intolerance has spurred demand for protein supplements that align with dietary needs. These products, valued for their lactose-free properties, provide essential nutrients without digestive discomfort, appealing to a broad consumer base. Manufacturers are innovating with diverse flavors and plant-based options, such as pea protein and rice protein, to enhance product appeal and meet vegan and allergen-free preferences. Health and wellness trends, coupled with rising fitness culture, further boost the market. Consumers prioritize clean-label products with minimal additives, driving demand for natural protein powders.

The Asia-Pacific region is emerging as a key market due to increasing disposable incomes and nutritional awareness. As functional foods gain popularity, the lactose-free protein powder market is poised for sustained growth, supported by product innovation and consumer health priorities. The lactose-free protein powder market is experiencing robust growth, driven by innovations and evolving consumer preferences. A key trend is protein ingredients innovation, with companies leveraging technologies like precision fermentation to produce lactose-free whey alternatives. For instance, Vivici’s 2024 launch of beta-lactoglobulin, a nature-identical whey protein, caters to lactose-intolerant consumers while maintaining high nutritional value. This reflects a broader shift toward sustainable protein sources, as plant-based proteins like pea and hemp gain traction for their low environmental impact. Verley’s precision-fermented whey, launched in March 2025, reduces greenhouse gas emissions by 72% compared to traditional dairy. The protein powder supply chain is also evolving, with brands optimizing sourcing and production for efficiency and transparency. Direct-to-consumer supplements are reshaping distribution, allowing companies to bypass traditional retail and offer personalized lactose-free protein powders.

Brands like TurtleTree, with their LF+ lactoferrin, are capitalizing on this trend, delivering vegan-certified, lactose-free proteins directly to fitness enthusiasts. These trends underscore the market’s focus on sustainability, innovation, and consumer-centric delivery models, positioning lactose-free protein powders as a dynamic segment in the nutrition industry.

Lactose-Free Protein Powder Market Drivers:

-

Surge in Athletics and Bodybuilding: The fitness industry is booming, with expanding facilities, memberships, and revenue. This trend, coupled with a preference for lactose-free protein powders among vegan and lactose-intolerant individuals, is boosting demand for these products.

-

Rising Prevalence of Lactose Intolerance and Health Awareness: The high global prevalence of lactose intolerance, affecting approximately 65% of the population, is a significant driver for the lactose-free protein powder market. Many individuals experience digestive issues like bloating and diarrhea from consuming dairy-based proteins, prompting demand for alternatives like plant-based protein and animal-free whey. Increased consumer awareness of health and nutrition, fueled by social media and fitness communities, has further amplified the need for functional protein powders that cater to dietary restrictions. For instance, educational campaigns and self-diagnosis trends have encouraged consumers to seek lactose-free options that support muscle recovery and overall wellness without discomfort. Innovations like precision fermentation protein, which produces lactose-free whey, align with this trend by offering high-quality protein without dairy-related drawbacks. This driver is particularly strong in regions like Asia, where lactose intolerance rates are higher, expanding the market for dairy-free protein products.

-

Growth of Plant-Based Protein Trends and Vegan Diets: The surge in plant-based protein trends is a key driver, as consumers increasingly adopt vegan and flexitarian diets for health, ethical, and environmental reasons. Plant-based protein powders, such as those derived from pea, rice, and hemp, are naturally lactose-free, making them ideal for lactose-intolerant individuals. The rise of veganism, particularly among younger demographics, has spurred innovation in sustainable protein sources, with companies like Orgain launching organic, plant-based protein blends to meet this demand. These products often incorporate additional health benefits, such as added probiotics or adaptogens, enhancing their appeal as functional protein powders. The environmental benefits of plant-based proteins, which require less water and land than dairy, further drive consumer preference. Social media platforms and influencer endorsements have amplified this trend, positioning plant-based protein as a mainstream choice for health-conscious and environmentally aware consumers.

-

Advancements in Precision Fermentation Protein Technology: Technological breakthroughs in precision fermentation protein are revolutionizing the lactose-free protein powder market by enabling the production of animal-free whey. Companies like Perfect Day and Vivici use microbial fermentation to create whey proteins that are identical to dairy-derived whey but free of lactose and cholesterol. For example, Vivici’s 2024 launch of beta-lactoglobulin offers a sustainable, high-protein alternative for lactose-intolerant consumers. This innovation addresses the demand for functional protein powders that deliver the amino acid profile of whey without digestive issues. Precision fermentation reduces reliance on traditional dairy farming, aligning with sustainable protein sources and appealing to eco-conscious consumers. The scalability of this technology is improving, with companies like TurtleTree expanding production to meet growing demand for animal-free whey in sports nutrition and functional beverages. This driver is reshaping the market by offering novel solutions for lactose-intolerant athletes and health enthusiasts.

Lactose-Free Protein Powder Market Restraints

-

High Production Costs of Precision Fermentation Protein: The lactose-free protein powder market faces a significant restraint in the high production costs associated with precision fermentation protein and advanced protein ingredients innovation. Producing animal-free whey through precision fermentation requires substantial investment in research, development, and specialized facilities, which increases product prices. For instance, Verley’s launch of precision-fermented whey highlighted costs as a barrier to widespread adoption, despite its sustainability benefits. Similarly, sourcing high-quality plant-based protein ingredients, such as organic pea or hemp, involves complex supply chains and premium pricing, making these products less affordable than traditional whey. This cost barrier limits accessibility for price-sensitive consumers, particularly in developing markets, and slows market penetration. While economies of scale may reduce costs over time, current pricing challenges hinder the ability of dairy-free protein products to compete with conventional protein powders in terms of affordability.

-

Sensory and Nutritional Challenges of Plant-Based Protein: Plant-based protein powders, while popular, face sensory and nutritional challenges that restrain market growth. Many consumers find that plant-based protein powders, such as those made from pea or rice, have gritty textures or earthy flavors, which can detract from the user experience compared to the smoother, creamier profile of dairy-based whey. For example, a recent consumer feedback study highlighted taste as a barrier to repeat purchases of plant-based protein products. Additionally, some plant-based proteins have lower levels of essential amino acids like leucine, which is critical for muscle synthesis, compared to animal-free whey or dairy-based proteins. These limitations can reduce consumer satisfaction and loyalty, particularly among athletes seeking optimal performance. Ongoing protein ingredients innovation aims to address these issues, but current sensory and nutritional drawbacks continue to pose challenges for widespread adoption in the lactose-free protein powder market.

Lactose-Free Protein Powder Market Segment Analysis

-

Plant-Based Proteins are anticipated to lead the market growth: Among the types of lactose-free protein powders, plant-based proteins dominate due to their inherent lactose-free nature and alignment with growing consumer demand for sustainable protein sources and plant-based protein trends. Derived from sources like pea, rice, hemp, and soy, these proteins cater to lactose-intolerant individuals and those adopting vegan or flexitarian diets. Plant-based proteins are favored for their hypoallergenic properties, often being gluten-free and cholesterol-free, making them suitable for diverse dietary needs. Innovations in protein ingredients, such as improved flavor profiles and textures, have bolstered their appeal. For instance, Orgain’s organic pea and pumpkin seed protein blends emphasize enhanced taste and nutritional benefits, targeting health-conscious consumers. The environmental sustainability of plant-based proteins, requiring less water and land than dairy, further drives their popularity. Their versatility in applications, from smoothies to functional foods, solidifies their position as the leading type in the lactose-free protein powder market.

-

The Organic segment is rising exponentially: In the category segmentation, organic lactose-free protein powders are the leading segment, driven by consumer demand for clean-label, chemical-free products. Organic proteins, whether plant-based or produced via precision fermentation, appeal to health-conscious and environmentally aware consumers who prioritize natural ingredients and sustainable sourcing. The organic segment includes powders free from synthetic pesticides, GMOs, and artificial additives, aligning with broader wellness trends. For example, Nestlé’s 2025 expansion of its organic, plant-based protein line under the Garden of Life brand reflects the growing preference for organic supplements that support ethical and eco-friendly practices. These products often command premium pricing due to rigorous certification processes and high-quality sourcing, but their appeal lies in transparency and perceived health benefits. The organic segment is further boosted by regulatory support for organic certifications and consumer trust in brands that prioritize sustainability and purity.

-

Online Retailers are expected to grow significantly: Online retailers lead the distribution channels for lactose-free protein powders, driven by the rise of direct-to-consumer supplements and e-commerce convenience. Platforms like Amazon, company websites, and specialized health retailers offer extensive product ranges, personalized subscription models, and competitive pricing, making them the preferred channel for consumers. The shift to online purchasing has been accelerated by digital marketing and influencer endorsements, which promote lactose-free protein powders to fitness enthusiasts and health-conscious buyers. For instance, Jacked Factory’s direct-to-consumer platform expansion emphasizes tailored recommendations and subscription discounts for plant-based and animal-free whey products, enhancing accessibility for lactose-intolerant consumers. Online retailers also provide detailed product information and customer reviews, aiding informed purchasing decisions. The convenience of home delivery and the ability to compare organic and conventional options further cement online retailers as the dominant distribution channel in this market.

Lactose-Free Protein Powder Market Geographical Outlook:

-

North America: The lactose-free protein powder market is propelled by major U.S.-based companies like Abbott, DuPont, and Mead Johnson & Company LLC. These firms lead in product innovation and marketing efforts for lactose-free protein powders.

-

Asia-Pacific: Rapid urbanization and rising incomes in countries like China, India, and Southeast Asia are driving market growth. Increased awareness of lactose-free protein powder benefits, combined with higher disposable incomes, is encouraging consumers to opt for premium alternatives to traditional protein supplements.

Lactose-Free Protein Powder Market Key Developments:

-

In March 2025, Verley launched a pioneering range of animal-free whey protein powders utilizing precision fermentation. The product portfolio includes three formulations: FermWhey Native for sports nutrition, FermWhey Gel for spoonable dairy and cheese products, and FermWhey MicroStab for heat- and acid-resistant UHT beverages and fresh dairy.

-

In March 2025, Vivici introduced Vivitein BLG, a precision-fermented, animal-free dairy protein, i.e., beta-lactoglobulin protein, in the US market.

Lactose-Free Protein Powder Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,607.818 million |

| Total Market Size in 2031 | USD 2,215.051 million |

| Growth Rate | 6.62% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Category, Packaging Type, Distribution Channel |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Lactose-Free Protein Powder Market Segmentation:

-

By Type

-

Whey Protein

-

Casein Protein

-

Milk Protein Concentrates

-

Plant-based Proteins

-

-

By Category

-

Organic

-

Conventional

-

-

By Packaging Type

-

Bottles

-

Pouches

-

Tubs

-

Sachets

-

-

By Distribution Channel

-

Online Retailers

-

Supermarkets/hypermarkets

-

Specialty Stores

-

Convenience Stores

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

-