Report Overview

Global Marine Fuel Market Highlights

Marine Fuel Market Size:

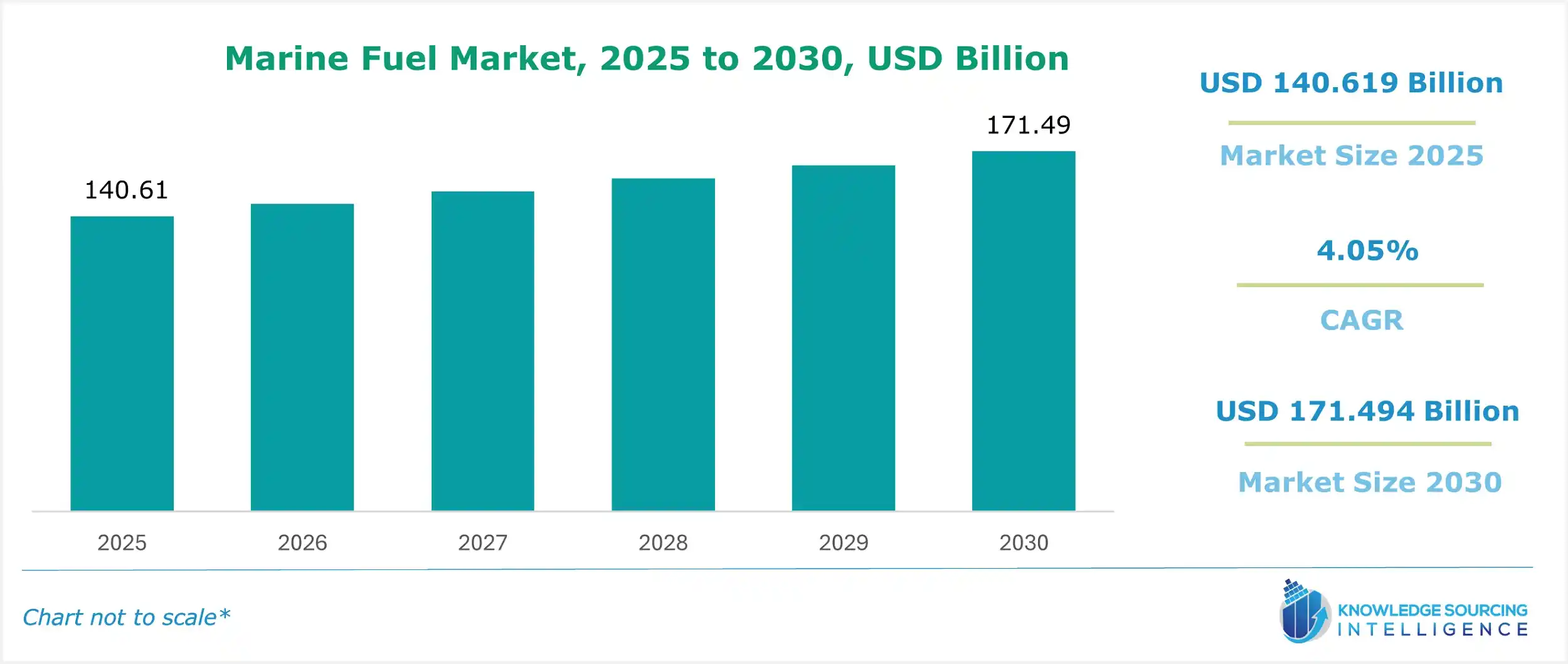

The Global Marine Fuel Market is expected to grow at a compound annual growth rate (CAGR) of 4.05% from USD 140.619 billion in 2025 to USD 171.494 billion in 2030.

Marine Fuel Market Trends:

Over 80% of the world’s trade volume is carried by sea, making maritime transport essential to the global economy. This heavy reliance on seaborne logistics substantially drives the demand for marine fuel.

At the same time, the maritime time is increasing as well, making the demand for marine fuel critical in the global shipping industry, providing the essential energy source for vessels involved in cargo transport, offshore operations, and naval activities. As international trade is expanding, the global marine fuel market is showing increasing trajectories as it forms the backbone of global logistics.

The market encompasses a diverse range of fuel types, including high sulfur fuel oil (HSFO), very low sulfur fuel oil (VLSFO), marine gas oil (MGO), liquefied natural gas (LNG), and emerging alternative fuels like biofuels and methanol.

In the forecast period, the marine fuel market will witness significant changes due to increasing focus on sustainability. The demand for fuels such as low-sulfur fuels and LNG will rise owing to the growing environmental regulations in the maritime trade industry. Technological advancements, such as marine fuel production technology like biofuels, will transition the market from traditional fuel to innovative fuels offering sustainability.

Marine Fuel Market Overview & Scope:

The Global Marine Fuel market is segmented by:

- Type: The global marine fuel market is segmented by type into fuel oil and gas oil. Marine fuel oils are heavy fuel oils such as HSFO and VLSFo that generally have varying sulfur content. HSFO typically has a high sulfur content, while VLSFO has a significantly lower sulfur content, which complies with the IMO 2020 regulations. The marine gas oil market is projected to witness a noteworthy CAGR during the forecast period. This growth is driven by the low sulfur content in marine gas oil when considering other commercially available options. However, the high cost of marine gas oil will significantly raise fuel costs for suppliers as diesel-range material is far more valuable than residual oil.

The maritime industry's transition to sustainability, strict international rules, and shifting global trade dynamics are the main factors driving the significant evolution of the worldwide marine fuel oil market. Although fuel oil is still the foundation of marine propulsion systems, particularly in commercial shipping, regulatory actions are significantly altering its composition and source.

This has caused the demand for High Sulfur Fuel Oil (HSFO) to gradually fall, while also hastening the adoption of Very Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO). Alternative marine fuels such as hydrogen, ammonia, biofuels, and liquefied natural gas (LNG) are also gaining traction, although their broad use is hampered by their high costs and inadequate infrastructure. The need for bunker fuel in ports like Singapore, Rotterdam, and Fujairah has increased due to the rerouting of important shipping channels caused by geopolitical tensions and disturbances, such as the Red Sea disputes.

- End-User: The global marine fuel is segmented by end-use into the following categories: oil tankers, gas tankers, chemical tankers, general cargo vessels, and others. Among these, oil tankers hold a significant share due to their large-scale fuel consumption for long-haul operations. Gas tankers are witnessing steady growth driven by increasing global LNG trade. Chemical tankers are also anticipated to grow at a moderate rate, supported by the expanding petrochemical industry.

- Region: The Global Marine Fuel market, by geography, is segmented into regions including North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American region is expected to have a considerable share of the global marine fuel market. The U.S. marine industry is growing upward, as per the report by the NAOO office of the U.S. government. Rising regulatory compliance will drive the marine fuel market expansion due to environmental concerns and a growing focus on sustainability.

Asia-Pacific holds a significant share of the marine fuel market due to high maritime trade volume. The rising economies in the Asia-Pacific countries, such as China, India, and Korea, are also driving maritime trade. According to the UNCTAD statistics, Asia was the largest trading region in the world in 2023. Asian countries continue to dominate the cargo handling performance. Major ports globally are in Asia, showing the high resilience of Asia in maritime trade.

Top Trends Shaping the Marine Fuel Market:

- Decarbonization and Regulatory Pressures

The shipping sector, which accounts for about 3% of the world's greenhouse gas emissions, is under growing pressure to go green. The International Maritime Organization (IMO) has an objective to reach net-zero emissions by about 2050. To facilitate this effort, the IMO is contemplating the establishment of a global carbon pricing scheme, possibly a flat-rate charge per ton of emissions or a credit trading system. This effort seeks to encourage cleaner fuel and technology adoption throughout the shipping industry.

- Rise in Alternative Marine Fuels

To respond to regulatory requirements and environmental pressures, the sector is investigating many different alternative fuels. Methanol has been one of the most popular choices, with more than 100 vessels contracted to operate on methanol, including dual-fuel engines that can use methanol and conventional fuels. Ammonia is also attracting increasing interest for its possible zero carbon emissions on burning. s

Marine Fuel Market Growth Drivers:

Drivers:

- Growing Maritime Trade: The steady expansion of global maritime trade stands out as a key driver of the marine fuel market. As per the data by the UNCTAD, global maritime trade grew by 2.4% in 2023 to 12.3 billion tons, rebounding from the 2022 contraction. The sector is projected to grow by 2% in 2024 and an average of 2.4% annually through 2029.

As global trade volumes continue to rise, particularly in emerging economies across Asia-Pacific, Africa, and Latin America, due to rising demand for goods, rapid industrialization, and trade, and others, there is a parallel increase in the number and frequency of cargo ship operations. This directly boosts the demand for marine fuels.

- Decarbonization and Sustainability Goals: The growing awareness of climate change and the urgent need for sustainable maritime operations has emerged as a major driver of the marine fuel market. The push towards climate sustainability and increasing investment by various stakeholders within the shipping industry is driving the market towards the development of low-emission fuels like LNG, biofuels, and green methanol.

Thus, the growing focus towards decarbonisation and increasing sustainability goals is leading the market to transform, driven by regulatory, environmental, and technological pressures. For instance, the International Maritime [1]Organization's[1] global limit on sulphur in ships’ fuel oil from 1st of January 2020, marked a major turning point for the marine fuel industry. This regulation capped the sulphur content in ship fuel oil to 0.5% from 3.5% from January 1, 2020, which meant a 77% drop in overall SOx emissions from ships, equivalent to an annual reduction of approximately 8.5 million metric tonnes of SOx. This forced a widespread shift away from high-sulphur fuel oil (HSFO) towards compliant alternatives such as very low-sulphur fuel oil (VLSFO), marine gas oil (MGO), and others.

In addition to these global shipping regulations, increasing country-specific policies are further driving the marine fuel market toward cleaner alternatives. Several nations have implemented or proposed carbon pricing mechanisms, fuel taxation, and emission trading schemes to curb shipping-related emissions. For instance, Norway announced a new CO2 tax that is effective from 2025, which is changing the regulatory landscape for ship owners. It has set a CO2 tax specifically for emissions from ships engaged in foreign trade at NOK 1.33 per liter of marine fuel used, making shipowners financially accountable for their carbon emissions, encouraging them to use cleaner fuels.

Marine Fuel Market Regional Analysis:

- North America: The American marine fuel market is recording strong growth, driven by the growth of maritime commerce and strategic port infrastructure investments. As a regional hub of international shipping dynamics, ports like Los Angeles, Houston, and New York are experiencing rising cargo volumes motivated by growing consumer demand, U.S. manufacturing exports, and shifting global trade flows. Following this, in 2023, the U.S. transportation system moved a daily average of about 55.5 million tons of freight valued at more than $51.2 billion. This is equivalent to approximately 20.2 billion tons or $18.7 trillion of freight moved annually, as per the U.S. Department of Transportation.

As per the same source, the value of shipments by water increased from USD 242 billion in 2020 to USD 256 billion in 2023. It is further estimated to grow to as much as USD 439 billion by 2050.

This increase in maritime trade directly increases the demand for marine fuels on all types of vessels, from container vessels and tankers to bulk ships. At the same time, infrastructure investments supported by federal programs, like the Port Infrastructure Development Program, are increasing bunkering capacity and fuel handling capabilities, making U.S. ports more competitive and better prepared to accommodate changing marine fuel requirements.

Global Marine Fuel Market Key Developments:

- November 2025: The International Maritime Organization (IMO) net-zero proposal, supported by industry players including Fortescue Metals Group, highlights that under a global carbon levy and reward scheme, green ammonia could become cost-competitive with VLSFO for marine bunkering by 2030—marking a key shift in zero-carbon shipping fuel economics.

- November 2025: The European Commission adopts its Sustainable Transport Investment Plan (STIP) to scale production of renewable and low-carbon fuels in waterborne and aviation sectors, unlocking private-sector deployment of fuels such as e-methanol and bio-methanol to meet the mandates of the FuelEU Maritime Regulation.

- September 2025: Yara International (through its clean ammonia division, Yara Clean Ammonia), in partnership with CMB.TECH and North Sea Container Line initiate construction (steel-cut ceremony) of the 1,400 TEU containership “Yara Eyde”, scheduled for delivery mid-2026 and powered by clean ammonia—representing a milestone in decarbonising the shipping fuel supply chain.

List of Top Marine Fuel Companies:

- Shell plc

- Neste Oyj

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

Marine Fuel Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Marine Fuel Market Size in 2025 | USD 140.619 billion |

| Marine Fuel Market Size in 2030 | USD 171.494 billion |

| Growth Rate | CAGR of 4.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Marine Fuel Market |

|

| Customization Scope | Free report customization with purchase |

Marine Fuel Market Segmentation:

- By Type

- Fuel Oil

- Gas Oil

- By End-User

- Oil Tanker

- Gas Tanker

- Chemical Tanker

- General Cargo

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America