Report Overview

Global Medication Dispenser Market Highlights

Medication Dispenser Market Size:

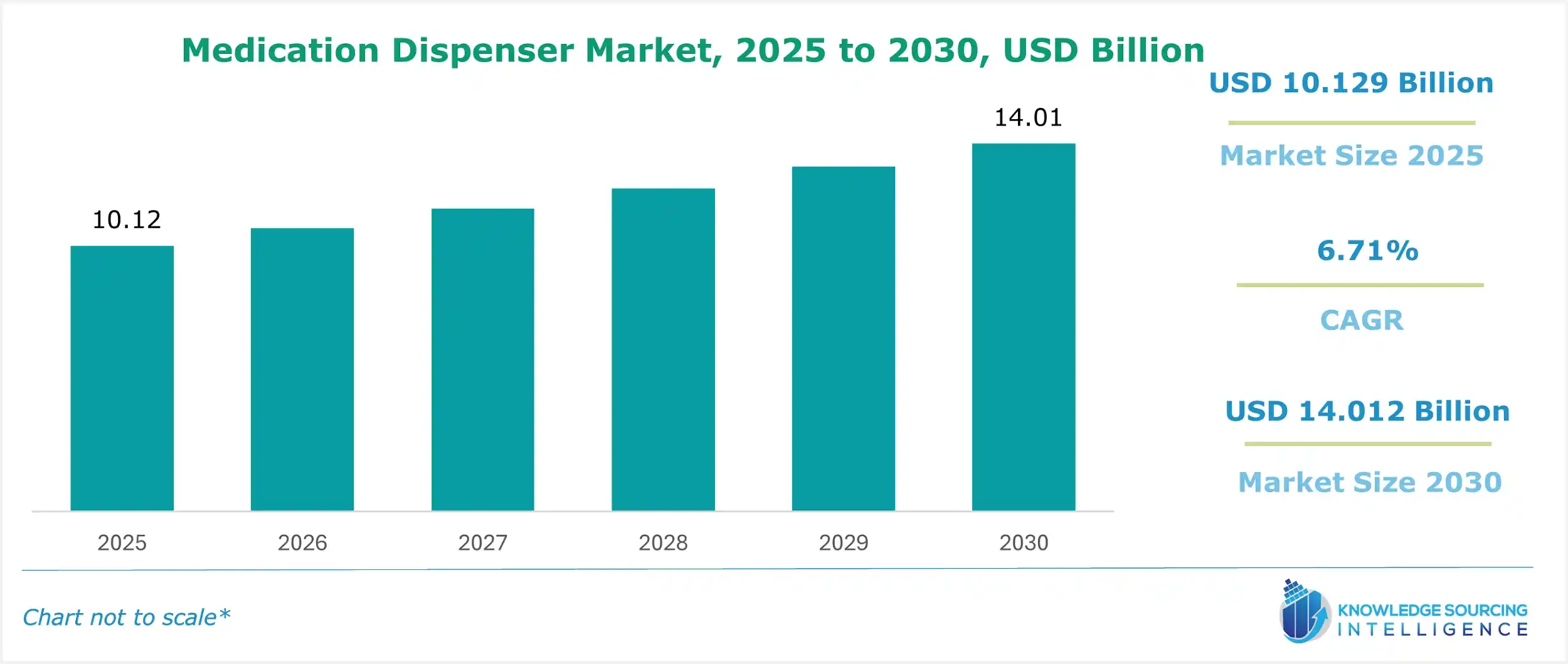

The global medication dispenser market is expected to attain US$14.012 billion in 2030 from US$10.129 billion in 2025, growing at a CAGR of 6.71%.

Manual and automatic medication dispensers are increasing in hospitals and clinics as the number of diseases and the geriatric population grows, driving the demand for healthcare services. This complicates medication administration because patients arrive in diverse circumstances and require different treatments. Medication management is becoming highly significant because medications must be administered on time, or they will not impact the body. Furthermore, as cleanliness issues and concerns can lead to the contamination of the medicines and worsen the situation, many hospitals are opting for automatic medication dispensers that have alerts and deliver medications by pressing a button. Thus, these factors augment the market’s growth during the forecast period.

________________________________________

Global Medication Dispenser Market Overview & Scope:

The global medication dispenser market is segmented by:

- Type: By type, the global medication dispenser market is categorized into manual and automatic. With the increasing global cases of Alzheimer's disease, the need for automatic medication dispensers is estimated to surge.

- End-Users: By end-users, the market is divided into hospitals & clinics and homecare. The hospitals and clinics category is estimated to grow considerably during the forecasted timeline.

- Distribution Channel: By distribution channel, the global medication dispenser market is divided into online and offline. The online channel is forecasted to grow at a higher rate as it utilizes various e-commerce platforms, offering consumers a wide variety of choices.

- Region: The Asia Pacific region is expected to increase its market share over the forecast period, owing to increased investments made to accelerate the development of the healthcare sector. Similarly, the increasing older population, especially in countries like Japan, China, and South Korea, is also boosting the regional market’s growth.

Top Trends Shaping the Global Medication Dispenser Market:

1. Advancement in healthcare technology

- The introduction of advanced technologies, like RFID, AI, and IoT, into the medication dispenser systems is expected to boost the market during the forecasted timeline.

2. Growing healthcare investment

- The growing healthcare expenditure worldwide is also among the major factors boosting the market’s expansion. Various countries, including India, China, the USA, and Canada, have introduced multiple policies and initiatives to boost investment in the healthcare sector.

Global Medication Dispenser Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing older population: The increasing global geriatric population is a major factor propelling the global medication dispenser market growth during the forecasted timeline. The World Bank, in its report, stated that the global population above the age of 65 years was recorded at 778.122 million, which increased to 804.475 million in 2023.

- Growing cases of chronic diseases: The increasing global cases of chronic diseases, which include diseases like diabetes, cardiovascular diseases, and neurological disorders, are also among the key factors pushing this market’s growth worldwide. Medication dispensers help in reducing the risk of non-adherence and severe health complications. These systems also help in reducing the risk of errors, increasing the safety of the patients.

Challenges:

- Limited awareness: The major factor restricting the global medication dispenser market growth is the limited awareness of the products across lower or middle-income nations, such as India, Bangladesh, Vietnam, and Malaysia, among others.

Global Medication Dispenser Market Regional Analysis:

- North America: The North American region is estimated to witness major global medication dispenser market growth during the forecasted timeline. The increasing cases of chronic and neurological diseases are major factors boosting this market growth. The cases of various types of chronic diseases, like diabetes, cardiovascular diseases, and cancer, witnessed major growth in North America, especially in countries like the USA and Canada. Similarly, the increasing older population of the region is also estimated to boost market expansion during the forecasted timeline.

Global Medication Dispenser Market Competitive Landscape:

The market is fragmented, with many notable players, including Medminder, Inc., Hero Health, Inc., Pharmright Corporation, e-pill, LLC, MedReady (Lifeline of Canada Holdings Ltd.), Capsa Healthcare, Igus GmbH, Koninklijke Philips N.V., BD, Evondos Group, Swisslog Healthcare, and Tosho Inc. among others.

Medication Dispenser Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Medication Dispenser Market Size in 2025 | US$10.129 billion |

| Medication Dispenser Market Size in 2030 | US$14.012 billion |

| Growth Rate | CAGR of 6.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Medication Dispenser Market | |

| Customization Scope | Free report customization with purchase |

Global Medication Dispenser Market Segmentation:

By Type

- Manual

- Automatic

By End-Users

- Hospitals and Clinics

- Homecare

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa