Report Overview

Global Explosion Proof Equipment Highlights

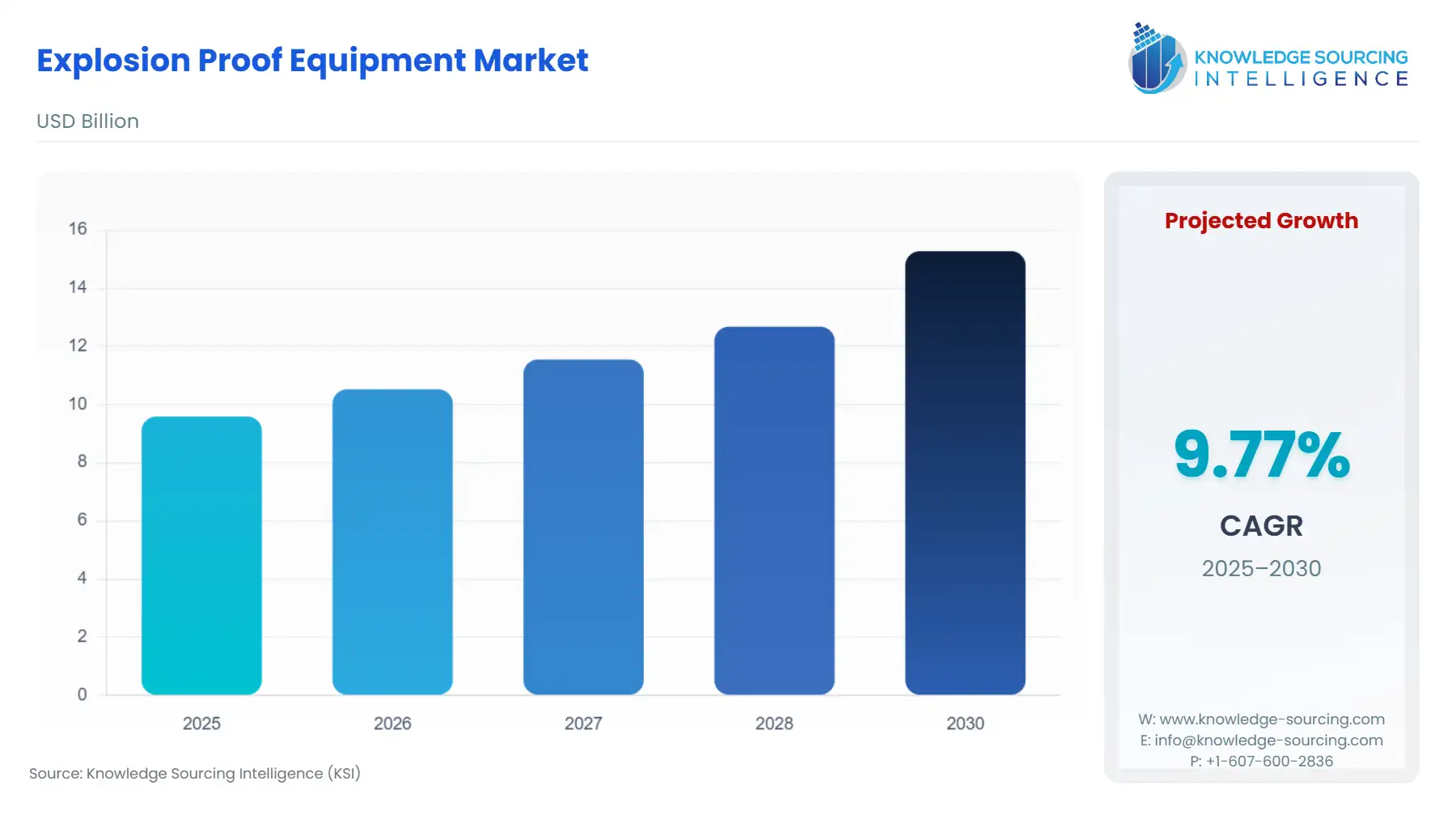

Explosion Proof Equipment Market Size:

The global explosion proof equipment market is projected to grow at a CAGR of 9.77% over the forecast period, increasing from US$9.587 billion in 2025 to US$15.278 billion by 2030.

The expansion of the oil and gas sector is a notable driver. Workers in the oil and gas sector frequently have to work in dangerous environments. Safety should always come first in locations where there are enough combustible liquids, gases, vapors, or combustible dust to cause a fire. It is crucial to guarantee that operators are constantly informed of and safeguarded from external hazards. Furthermore, facilities offshore, in factories, and in refineries are frequently exposed to combustible materials. The production and rigorous testing of explosion-proof assets are required by manufacturers to reduce the risk of igniting.

Increased harmonization in explosion-proof equipment guidelines around the world will further assist market expansion during the forecast period. Internationally harmonized design accords were created in IEC standards fairly early on in the field of electrical engineering. This was mostly carried out following CENELEC guidelines. The agreement in content and registration number between the necessary IEC/ISO (global), EN (Europe), and standards publications is an obvious indicator of harmonization (60079 series).

Explosion Proof Equipment Market Growth Drivers:

- Growing technological advancements and increased demand for worker safety in the industry.

The explosion-proof equipment market will grow as the demand for worker safety grows and technology advances at a rapid pace. The number of fatal injuries in the mining, quarrying, and oil and gas extraction industry rose from 78 in 2020 to 95 in 2021, a 21.8 percent increase, according to the US Bureau of Labor Statistics.

Within mining, coal mining had 19.6 fatalities per 100,000 full-time equivalent workers, while oil and gas extraction had 9.8 fatalities per 100,000 full-time equivalent workers in 2021. Furthermore, underground mining poses several challenges, including a lack of sufficient ventilation, exposure to hazardous gases, and negative health effects. Due to this reason, governments around the world are regulating mining laws to ensure greater safety concerns. The companies are providing uncompromised safety for the most demanding applications and in the most difficult places.

- Increasing application in the oil and gas industry.

The global explosion-proof equipment market within the oil and gas industry is growing at a fast pace. Primarily, stringent safety regulations have been enforced by governments and regulatory bodies. This is because explosions and fires have to be prevented in hazardous environments, and it is essential that explosion-proof equipment be used across all stages of oil and gas operations. As per the Ministry of Labour & Employment (Government of India), for each hazardous material capable of leading to toxic explosion or bulk fire hazard certain threshold quantities have been prescribed. If these quantities are exceeded, the installation is regarded as an identified major hazard.

Moreover, with increased demand for global energy consumption caused by a rise in population and economic growth, oil and gas exploration and production activities must also be heightened. Higher levels of these activities automatically increase the need for explosion-proof equipment as well, so operations are ensured to be conducted safely in hazardous environments.

For instance, China, the world's top crude oil importer, imported 11.3 million barrels per day (b/d) in 2023, 10% higher than in 2022, according to China customs statistics. Further, China's refiners imported unprecedented amounts of crude oil in 2023 to support the country's burgeoning refining capacity and generate feedstocks for its petrochemical industry. According to the IEA, India Energy Outlook 2021, primary energy demand is expected to nearly double to 1,123 million tonnes of oil equivalent, as India's gross domestic product is expected to increase to US$ 8.6 trillion by 2040.

Offshore oil and gas exploration and production remain a fast-growing component of the overall market. The hostile and inherently risky environment of operation for offshore platforms and rigs often results in frequent gas leaks and potential explosions. Hence, the utilization of explosion-proof equipment becomes inevitable for both safety and continued operations during such incidents.

Explosion Proof Equipment Market Geographical Outlook:

- The North America region is expected to witness significant growth in the global explosion proof equipment market.

The market for explosion-proof equipment in the United States is one of the most important sectors, driven by strict safety laws and the fact that most businesses have hazardous surroundings. A significant factor shaping the market is government regulations. Strict safety regulations enforced by organizations like the Mine Safety and Health Administration (MSHA) and the Occupational Safety and Health Administration (OSHA) mandate that explosive-proof equipment be used in dangerous areas. These standards are essential drivers of demand as companies must meet them to avoid fines and to protect workers. Compliance with these standards requires regular inspections and updates of existing equipment, which increases the market's steady demand. The details of these standards, such as the certification requirements and testing procedures, determine the kind of equipment that is in demand and the technology that the market will adopt. For instance, the growing usage of intrinsically safe equipment is a move toward safer, more efficient technologies.

The oil and gas sector is a significant user, despite the inherent dangers of flammable and explosive products. Significant demand is also represented by refineries, mining operations, and chemical processing facilities. Furthermore, in order to ensure safe operation, the growing use of automation and robots in hazardous regions calls for equipment that is explosion-proof. The demand is further increased by the rise of renewable energy sources, especially wind and solar power since these installations frequently call for equipment that can survive potentially explosive situations. The future growth prospects for the market are optimistic. The ongoing need for better safety in hazardous environments and constant technological developments propels the market growth. Moreover, increased focus on automation and digitalization in industries is opening further opportunities for explosion-proof equipment manufacturers. Economic fluctuations and changes in government regulations, however, will continue to impact the dynamics of the market.

Explosion Proof Equipment Market Segments Analysis:

- The Transformers category under the Equipment segment of the global explosion proof equipment market is expected to grow significantly.

The global explosion-proof transformers market is growing rapidly due to several factors. Safety regulations in hazardous industries such as oil and gas, chemicals, and mining are strict, mandating the use of explosion-proof equipment, including transformers, to avoid accidents and protect workers. The mining market value in Mexico was USD 3.3 billion in 2022. Half of Mexico's mining production is the extraction of precious metals, while the remaining output is composed of 40 percent non-ferrous, six percent metallurgy, and seven percent non-metallic ores.

In addition, rapid industrialization in developing economies, especially in Asia-Pacific, is leading to an upsurge in demand for power infrastructure, which includes transformers. This increased industrialization, coupled with the increasing thrust on safety, is creating a strong market for explosion-proof transformers. In this regard, installed power generation capacity in China was 2,919.65 million kilowatts by the end of 2023, up by 13.9 percent from 2022.

Explosion Proof Equipment Market Key Developments:

- In October 2024, Siemens Smart Infrastructure completed the acquisition of Denmark-based fire suppression technology leader Danfoss Fire Safety. This buyout adds high-pressure water mist and low-pressure CO? systems to its portfolio in alignment with Siemens' sustainability objectives. Siemens will allow SEM-SAFE Fire Safety A/S, the former Danfoss group, to operate as an independent company and contribute to its commitment to making environmentally friendly fire suppression solutions a reality for several industries. The acquisition will strengthen Siemens' growth in key markets worldwide.

List of Top Explosion Proof Equipment Companies:

- CorDEX Instruments

- Adalet

- Supermec Pte. Ltd.

- Pepperl+Fuchs GmbH

- Extronics Ltd

Explosion Proof Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Explosion Proof Equipment Market Size in 2025 | US$9.587 billion |

| Explosion Proof Equipment Market Size in 2030 | US$15.278 billion |

| Growth Rate | CAGR of 9.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Explosion Proof Equipment Market |

|

| Customization Scope | Free report customization with purchase |

Explosion Proof Equipment Market Segmentation:

- By Hazardous Zone

- Zone 0

- Zone 1

- Zone 2

- Zone 20

- Zone 21

- Zone 22

- By Equipment

- Air Conditioners

- Transformers

- Distribution Boxes and Empty Enclosures

- Lighting Technology

- Others

- By Industry Vertical

- Pharmaceutical

- Chemical

- Oil & Gas

- Mining

- Waste Management

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific Region

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America