Report Overview

Global Microspheres Market - Highlights

Microspheres Market size:

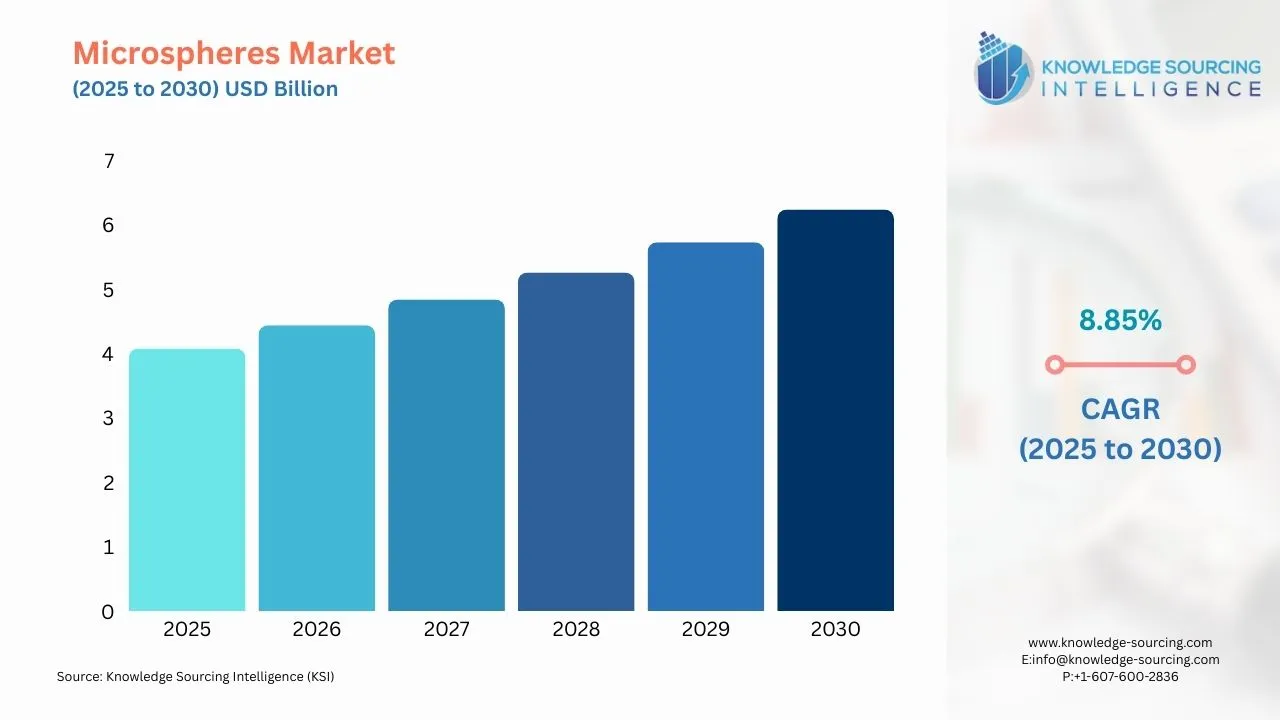

The global microspheres market is expected to grow at a CAGR of 8.85%, reaching a market size of US$6.235 billion in 2030 from US$4.081 billion in 2025.

Microspheres and nanoparticles made of biodegradable polymers, including PLGA, polylactic acid, and polycaprolactone, have been widely employed in drug delivery. Active pharmaceutical ingredients (APIs), whether small molecules or biological chemicals, can be encased in microspheres and nanoparticles for specialized drug delivery applications such as prolonged release, targeted drug administration, and API protection against premature degradation. There are various drug-loaded PLGA microsphere formulations on the market. Lupron Depot, for example, is a drug that treats prostate cancer and endometriosis by encapsulating leuprolide acetate in PLGA microspheres. It is given subcutaneously at one, three, or four-month intervals.

Microspheres Market Growth Drivers:

- Microspheres are a fascinating material in the medical and healthcare sectors due to their versatility and biocompatibility. They are vital when applied to enhanced drug delivery systems, diagnostic imaging, tissue engineering, and embolization treatment. Microspheres enable controlled and localized deliverance of a drug and optimize treatment outcomes in chronic diseases and cancer diseases with minimal side effects realized. They are also widely used to enhance the diagnostic outcome in ultrasonography and MRI as contrast agents.

PLGA and PLA microspheres degrade and are biocompatible. They are used as templates in tissue engineering, supporting the regenerative growth of injured tissues, bones, and cartilage. In embolization therapy, they are applied to not allow blood to flow in tumors and aneurysms, giving another less invasive treatment approach. All these different uses, alongside continuous advanced research in microsphere technology, are driving the increased uptake of microsphere-based products in the healthcare industry.

- New technological advancements are pushing for significant growth in the microsphere market by enhancing production precision, developing new materials, and increasing utilization in pioneering sectors such as the health sector, automotive industry, and construction. These advancements have increased the capacity to create customized microspheres for specific applications, including targeted medicine administration and sophisticated medical imaging. KUREHA offers a variety of microsphere grades suited for a wide range of thermoplastics, including advanced grades that may be used with higher-temperature polymers. KUREHA Microsphere is utilized in various applications, including ceiling materials, glass run channels, weather strips, shoe soles, foam ink, wallpaper, heat release tape, synthetic leather, and 3D printers.

To enhance fuel efficiency and minimize emissions, lightweight microspheres are increasingly being employed in composites and coatings in the automobile and aerospace industries. Furthermore, new eco-friendly and biodegradable microspheres are gaining popularity as sustainability concerns grow, driving market growth.

Microspheres Market Segment Analysis:

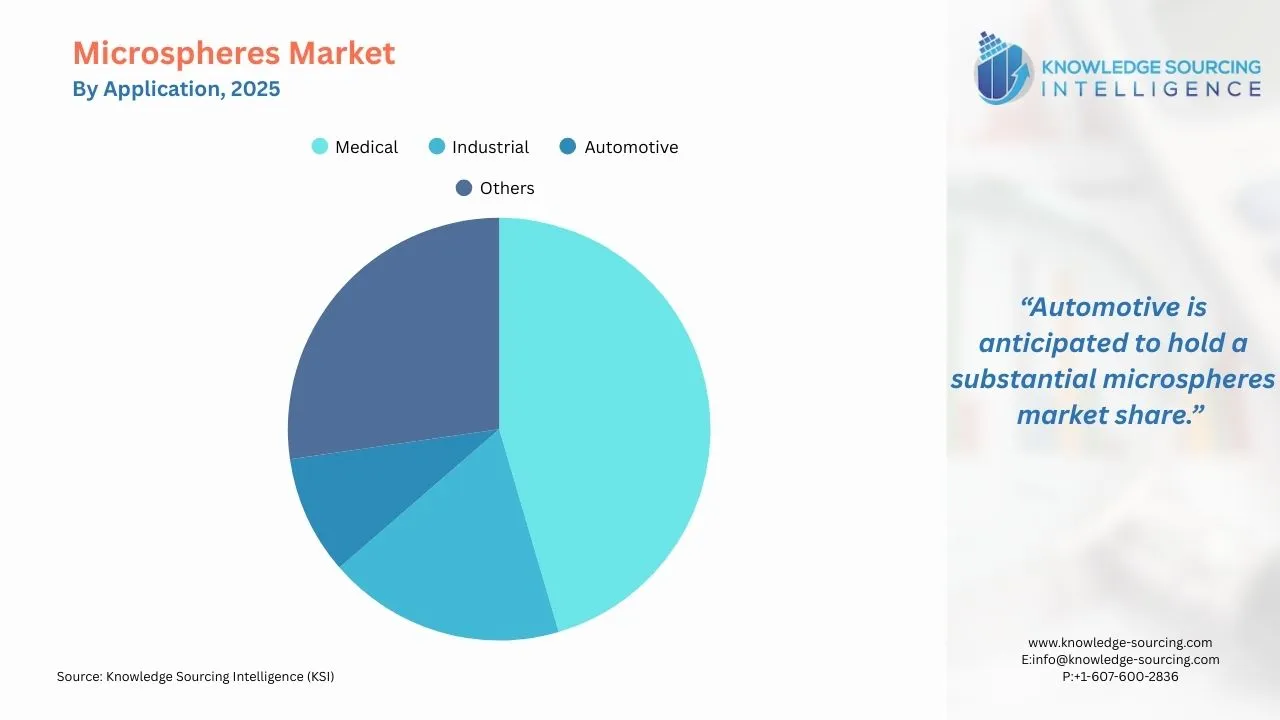

- By application, the automotive industry is anticipated to be one of the fastest-growing segments in the microsphere market.

The automotive segment shall remain one of the most promising in the global microsphere market, mainly because of the increasing demand for lightweight, high-strength materials for improving fuel efficiency and reducing emissions.

One of the most common applications of microspheres is as a filler in microsphere-coated automobile detachable parts coatings, automobile microsphere-reinforced composite materials, and automobile microsphere structural parts. Their ability to minimize part weight while maintaining strength and durability makes them excellent for car interiors and exteriors.

In this regard, in 2022, according to the International Energy Agency, the global sales of electric buses and mediate and heavy-duty trucks were estimated to be 66,000 and 60,000, respectively. These two segments comprised about 4.5% of total bus sales and 1.2% of total truck sales. Furthermore, China remains the world's leading manufacturer of electric (and fuel cell) vehicles and buses for sale. In 2022, 54,000 new electric buses and 52,000 electric medium- and heavy-duty trucks were sold in China, accounting for 18% and 4% of total sales in China and 80% and 85% of global sales, respectively. Additionally, it was stated that Chinese brands are market leaders in Latin America, North America, and Europe's bus and truck markets.

Furthermore, microspheres increase thermal insulation and acoustic qualities, improving vehicle efficiency and passenger comfort. With the adoption of electric vehicles (EVs) and legislated mileage requirements, the focus is on the materials that will help to prolong the battery life and improve overall vehicle dynamics. Tough regulations to improve car emissions pollution standards push manufacturers to incorporate microsphere-incorporated materials to achieve these standards. Advancements in the most important areas of vehicle designing and the manufacturing process and raising awareness for sustainable and high-velocity-performing automobiles have fueled the microsphere market growth in the automobile industry faster.

Microspheres Market Geographical Outlook:

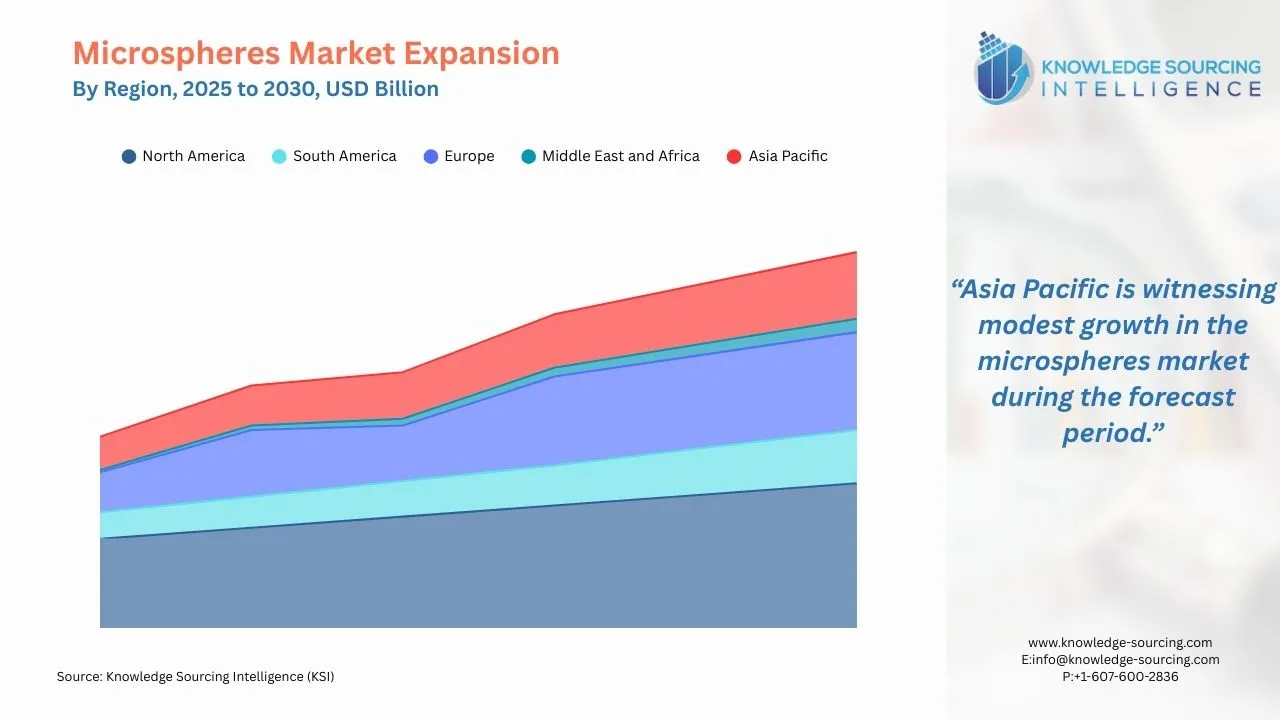

- Asia Pacific’s microsphere market is anticipated to grow significantly.

Asia Pacific's microsphere market is expected to rise rapidly as a result of growing industrialization, expanding healthcare infrastructure, and rising demand from sectors such as automotive, construction, and healthcare. Countries like China, India, and Japan are driving the rise, with increased investment in microsphere-intensive industries such as medication delivery systems, coatings, and lightweight materials. The region's thriving automotive sector, particularly with the transition to EVs, is driving up demand for microspheres in lightweight composites to increase fuel economy and decrease emissions.

According to the China Association of Automobile Manufacturers (CAAM), car sales in the country increased by 5.4 percent to 27.5 million in 2022. Similarly, per the OICA data, India's automotive production grew by 30% in 2021. The favorable government policies include the PLI schemes launched in the auto and auto components and the innovative chemistry cell for auto manufacturing, the FAME-II Policy till 2024, and a new policy of Rs 76,000 crore PLI scheme for semiconductor manufacturing that would help in this market’s growth in the country.

Furthermore, the expanding construction industry in emerging nations is increasing the usage of microspheres in paints, coatings, and building materials to improve insulation and durability. With developments in manufacturing technology and a focus on sustainability, the Asia Pacific microsphere market will likely expand rapidly in the next years.

Microspheres Market Key Developments:

- In April 2024, at the 2024 Chinaplas expo in Shanghai, China, Nouryon introduced Expancel WB microspheres, an innovative expandable microsphere for white shoe sole applications in the garment and apparel sector. Shoemakers are increasingly using white shoe bottoms to suit significant customer demand without sacrificing performance or comfort.

- In June 2022, Nouryon announced Expancel HP92 microspheres, a revolutionary breakthrough that pushes the frontiers of thermoplastic microsphere fillers in high-pressure automobile production processes. Automotive manufacturers are in high demand for lightweight materials to fulfill more stringent pollution requirements and growing customer desire for fuel-efficient vehicles that do not sacrifice performance or comfort.

List of Top Microspheres Companies:

- Cospheric

- Oakwood Labs

- 3M

- Kureha Microsphere

- Nouryon

Microspheres Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Microspheres Market Size in 2025 |

US$4.081 billion |

|

Microspheres Market Size in 2030 |

US$6.235 billion |

| Growth Rate | CAGR of 8.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Microspheres Market |

|

| Customization Scope | Free report customization with purchase |

The global microspheres market is analyzed into the following segments:

- By Material

- Glass

- Polymer

- Ceramic

- Metal

- By Application

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation

- Microspheres Market size:

- Microspheres Market Key Highlights:

- Microspheres Market Growth Drivers:

- Microspheres Market Segment Analysis:

- Microspheres Market Geographical Outlook:

- Microspheres Market Key Developments:

- List of Top Microspheres Companies:

- Microspheres Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025