Report Overview

Artificial Intelligence (AI) In Highlights

AI in Medical Imaging Market Size:

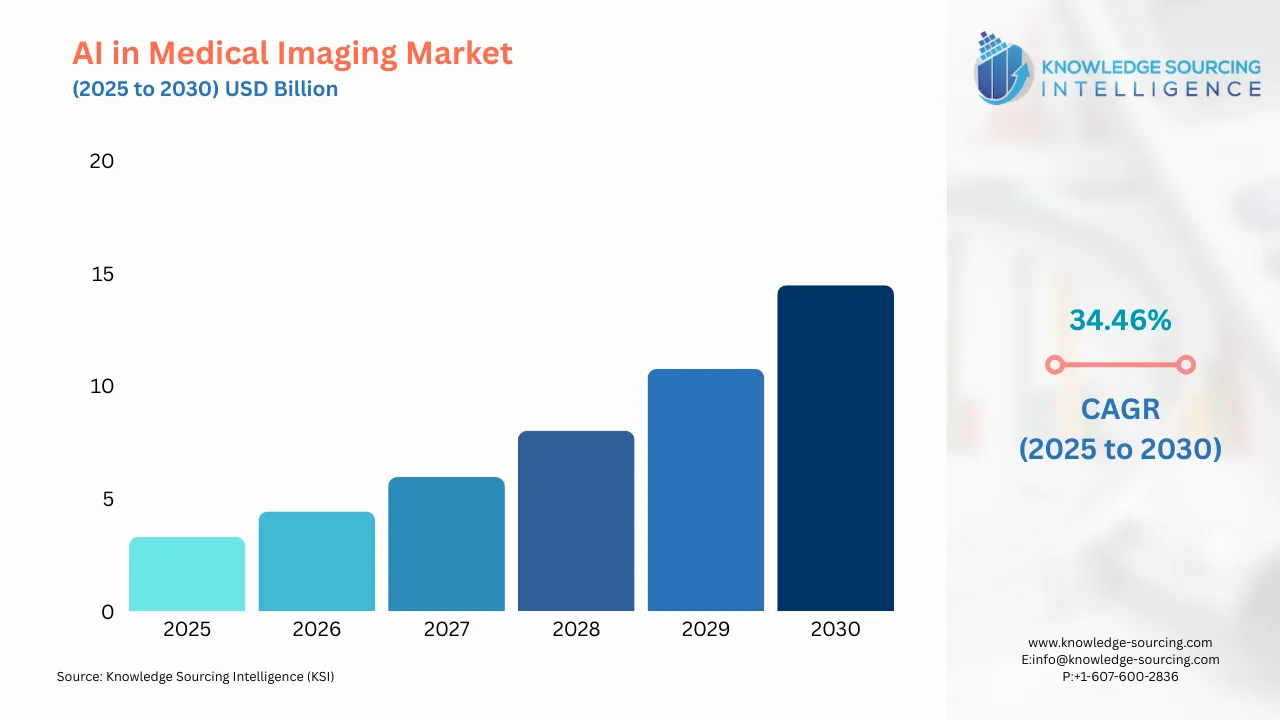

The AI in Medical Imaging Market is projected to witness a CAGR of 34.46% during the forecast period to reach a total market size of US$14.470 billion by 2030, up from US$3.290 billion in 2025.

As a result of the rising adoption of man-made brainpower innovations in the medical care industry, artificial intelligence (AI) in the medical Imaging market has developed fundamentally. AI in the medical imaging market has expanded due to the growing demand for diagnostic tools that are both more accurate and more effective. Key companies own the market share in medical imaging and AI since they are actively developing and integrating AI algorithms into medical imaging systems. Its members include innovation organizations in medical services, producers of imaging hardware, and programming engineers. The market growth has created room for anticipation of further development and innovation that will improve the results of medical imaging.

The AI in Medical Imaging market is experiencing significant growth due to rapidly evolving artificial intelligence technologies that are revolutionizing diagnostic imaging by enhancing accuracy, efficiency, and workflow automation. For instance, GE Healthcare’s AIR Recon DL, combined with Sonic DL technology, transforms MRI by delivering up to 60% sharper images and improved signal-to-noise ratio, while Sonic DL reduces scan times by up to 83%. Additionally, the AIR x platform speeds up setup time by up to five times and cuts usage of resources and efforts.

The demand for early and precise diagnosis is growing, leading to a significant increase in imaging volumes, driven by the rising number of people with diseases and the need for efficient and cost-effective imaging. In addition, the global shortage of skilled radiologists is driving the need for AI solutions that can reduce diagnostic errors, accelerate image interpretation, reduce scan time, and improve patient outcomes.

The increasing volume of medical imaging solutions, driven by high demand due to the rising prevalence of diseases, is one of the key factors driving market growth. A Vizient company, Sg2, projects that outpatient imaging volume will grow by 10% and advanced imaging to grow by nearly 14% over the next ten years. Key areas will be PET with 23% share, Ultrasound with 16% and CT with 15%.

As the volume of medical imaging solutions grows, it increases the pressure on the workforce, which already has shortages. Additionally, the demand for faster, accurate, and well as cost-effective solutions is leading to market growth.

Regulatory approvals such as FDA clearances are accelerating adoption, while strategic partnerships between AI startups and established medical device manufacturers are expanding the market reach. For instance, in February 2025, GE Healthcare collaborated with Enlitic to transform the landscape of medical imaging data migration and cloud solutions, aiming to empower healthcare providers worldwide by leveraging AI-driven technology to enhance operational efficiency and care decision capabilities. Enlitic’s Ensight Suite will embed AI automation and data intelligence into migration tools for GE HealthCare’s cloud and on-premise transition, ensuring a seamless transition to the cloud.

The AI in Medical Imaging market is witnessing rapid evolution fueled by increasing investments, strategic partnerships, supply agreements, and collaborations among key industry players. For instance, in January 2025, GE Healthcare signed an imaging AI deal worth over $249 million with a 31-hospital system for handling ongoing acquisition, installation, maintenance, and staff training for medical imaging technology used by Nuffield. It underscores the expanding ecosystem integration and comprehensive service offerings in this evolving market.

AI in Medical Imaging Market Trends:

Artificial intelligence in the medical imaging market is expanding rapidly, and the medical services business is being rethought by changing demonstrative imaging. To improve accuracy, efficiency, and patient outcomes, medical imaging systems are incorporating machine learning and deep learning algorithms.

In medical scans like X-rays, CT scans, MRIs, and ultrasound, AI in the Medical Imaging market enables enhanced image processing, automated interpretation, and the identification of anomalies. These man-made consciousness-fueled innovations can help radiologists and doctors find and analyze infirmities like malignant growth, cardiovascular infection, neurological issues, and skeletal muscle peculiarities.

AI in Medical Imaging Market Players and Products:

- GE Healthcare: General Electric Healthcare offers a wide range of medical imaging products using AI. For example, its Edison platform is integrated with AI algorithms to enhance patient diagnosis and treatment. They also offer AI-based X-rays, CT scans, MRIs, ultrasounds, and others.

- Siemens Healthineers: Siemens Healthineers provides AI-driven clinical imaging products. It offers AI algorithms for automated image analysis and interpretation that can aid radiologists in improving diagnosis and workflow accuracy.

- Philips Healthcare: Philips Healthcare provides AI-enhanced medical imaging through the IntelliSpace platform. Its AI systems offer automated processing for medical pictures to aid in improving the diagnosis and characterization of diseases across multiple imaging modalities.

- NVIDIA Corporation: The company designs, investigates, and develops AI software and technology for medical imaging. Medical imaging uses the company's GPUs and AI platforms to accelerate image analysis by allowing real-time image processing, thus enabling deep learning algorithms.

- AIDOC: AIDOC is a radiography platform powered by AI. It prioritizes the important findings by looking at medical images. The algorithms make it easier for radiologists to find anomalies and treat their patients quickly.

AI in Medical Imaging Market Growth Drivers:

- Growing demand for accurate and timely diagnosis of illness:

The growing demand for precise imaging is anticipated to drive AI adoption in medical imaging since there is growing interest in the perfect and ideal identification of illness. According to the statistics provided by the National Library of Medicine, AI usage in medical imaging has significantly improved diagnostic accuracy. AI algorithms have shown high sensitivity and specificity for the detection of ailments, which has, in turn, enabled patients to experience better outcomes of treatments much earlier than usual. Due to the demand for more accurate diagnosis of diseases by healthcare professionals, AI-driven medical imaging solutions are gaining importance daily.

The global healthcare landscape is experiencing a rise in chronic diseases like cancer, heart disorders, neurological conditions, and respiratory issues. Quick and accurate diagnosis is key to improving survival rates and treatment outcomes for these diseases. In this regard, according to the American Cancer Society, 2,041,910 new cancer cases are estimated for 2025, of which 1,053,250 are estimated in males and 988,660 in females.

Traditional imaging methods are effective but often slow and can lead to human errors. AI-powered imaging tools help overcome these challenges by providing fast, accurate, and consistent analysis of medical images. This allows clinicians to find diseases earlier.

In addition to this, the global surge in clinical trials is also highlighted by WHO data. It states that in the Americas, the number of clinical trials has increased from 11,156 in 2015 to 11,974 in 2023. In Europe, the number of clinical trials has increased from 12,672 in 2016 to 15,390 in 2023. This steady growth reflects the expansion of research into novel therapies and diagnostic tools, which inherently requires precise and early identification of diseases for patient recruitment, monitoring, and outcome measurement.

Therefore, AI algorithms, especially those using deep learning and neural networks, are great at identifying patterns and abnormalities that may not be noticeable to the human eye. These abilities boost the diagnostic confidence of radiologists, lower the chances of misdiagnosis, and aid evidence-based decision-making. For instance, AI is increasingly used in mammography to spot early signs of breast cancer and in chest X-rays to find early-stage lung issues.

Moreover, hospitals and clinics are increasingly under pressure to efficiently handle a large number of patients, particularly in urban and densely populated areas. AI speeds up radiological assessments, enhances workflow efficiency, and helps prioritize urgent cases. As healthcare providers work to meet increasing patient expectations and provide precise medicine, the demand for AI-driven diagnostic tools keeps rising, making early and accurate diagnosis a key part of AI use in medical imaging.

- Integration of AI algorithms with medical imaging systems:

AI algorithms integrated into medical imaging systems represent one of the most extensive growth opportunities for AI in the medical imaging market. The integration allows robotized clinical pictures to be investigated for enhanced anomaly distinguishing proof and the extension of conclusion precision. With AI-impacted medical imaging, huge amounts of imaging information can be dissected and deciphered much faster than before and with significantly higher accuracy, allowing better choices by healthcare experts for their patients. Improvements within the field are being propelled by the seamless integration of AI algorithms into medical imaging devices and rebuilding the way medical imaging is conducted and understood.

- More investments and funding towards AI in medical imaging research and development:

Rising ventures and funding for artificial intelligence in clinical imaging and innovative work have catalyzed the business sector's development. With more funding, more developers and researchers will have increased resources to research new AI algorithms, improve existing technologies, and increase the capabilities of medical imaging systems. This investment opens up routes toward more precise diagnoses, better patient outcomes, and better healthcare provision while at the same time encouraging innovation and driving further developments within the sector. Increased funding for AI in medical imaging is a clear indication that the industry recognizes its potential and is dedicated to further research on the application of AI.

AI in Medical Imaging Market Segmentation Analysis:

- The hospitals & clinics segment is experiencing significant growth

By end-user, the Artificial Intelligence (AI) in Medical Imaging market is segmented into hospitals & clinics, diagnostic image centers, research institutes, and others. Hospitals and clinics are at the forefront of adopting AI in medical imaging due to their central role in diagnostic workflows and patient care delivery. These healthcare institutions face mounting pressure to deliver accurate diagnoses quickly, manage growing patient volumes, and reduce diagnostic errors. AI technologies help meet these demands by automating image interpretation, identifying abnormalities with high precision, and assisting radiologists in clinical decision-making. This results in faster diagnosis, improved patient outcomes, and better allocation of radiology resources.

In this regard, according to the American Hospital Association, community hospitals in the United States accounted for 84% share of the total hospitals, followed by non-federal psychiatric hospitals.

Moreover, as per PIB, as of March 31, 2023, India had a total of 1,69,615 Sub-Centres (SCs), 31,882 Primary Health Centres (PHCs), 6,359 Community Health Centres (CHCs), 1,340 Sub-Divisional/District Hospitals (SDHs), 714 District Hospitals (DHs), and 362 Medical Colleges (MCs) serving both rural and urban areas.

Additionally, the hospital and clinic environment is also seeing large investments in the creation and deployment of AI-enabled solutions. These investments are fueling innovation in domains like the creation of increasingly precise AI-enabled diagnostic instruments, the development of individualized treatment planning platforms, the progress of remote patient monitoring technologies, and the seamless integration of AI solutions with current healthcare infrastructure. Consistent with this, according to the World Economic Forum, venture capital invested in healthcare AI in the US alone in 2024 reached $11 billion, with added funding from institutional investors and other organizations in the massive $4.5 trillion US healthcare market.

Moreover, as hospitals and clinics increasingly shift toward value-based care, AI plays a crucial role in improving efficiency and reducing costs. By minimizing the need for repeat scans and enabling early disease detection, AI supports more timely and effective treatments, reducing hospital stays and readmission rates. The growing availability of cloud-based AI platforms also allows smaller clinics to access cutting-edge diagnostic tools without large capital investments, democratizing high-quality care and accelerating AI adoption in this end-user segment.

AI in Medical Imaging Market Geographical Outlook:

- North America is leading in AI in the medical imaging market.

North America is leading the world market with a huge share of the medical imaging AI market. The regional growth can be attributed to the modern healthcare infrastructure, high healthcare expenditure, and the considerable presence of key companies or research institutions. Besides that, favorable government initiatives and policies promoting the use of AI in healthcare add to the market's share. The increasing demand for effective diagnostic tools, early illness identification, and personalized treatment plans bolsters North America's share of the AI market in medical imaging.

AI in Medical Imaging Market Key Developments:

- In March 2025, Philips collaborated with NVIDIA to build a foundational model for MRI, which will be powered by NVIDIA’s advanced AI computing platform. It is a key step towards advancing AI capabilities in medical imaging. The foundational model will enable zero-click planning of scans across different anatomies, with the potential to dramatically speed up workflows and increase throughput, while capabilities like denoising, super-resolution, and sharpening will allow for more precise diagnoses.

- In March 2025, Philips collaborated with NVIDIA to build a foundational model for MRI, which will be powered by NVIDIA’s advanced AI computing platform. It is a key step towards advancing AI capabilities in medical imaging. The foundational model will enable zero-click planning of scans across different anatomies, with the potential to dramatically speed up workflows and increase throughput, while capabilities like denoising, super-resolution, and sharpening will allow for more precise diagnoses.

- In September 2024, Samsung Medison acquired French AI startup Sonio, specialising in AI-powered obstetrics ultrasound reporting and real-time exam quality assessment. It aims to enhance Samsung’s AI capabilities in maternal-fetal imaging.

- In June 2024, Qure.ai announced a strategic partnership with Strategic Radiology, a coalition of over 1,700 independent radiologists across the U.S., to enhance diagnostic accuracy and operational efficiency through AI integration. This development significantly strengthens Qure.ai’s presence in the U.S. market and represents a key move in market expansion.

- In January 2024, Samsung announced a partnership with AI leader Lunit, aiming to integrate Lunit’s AI-powered chest X-ray analysis solutions, Lunit INSIGHT CXR and Lunit Insight CXR Triage, into Samsung’s premium digital radiography devices GM85 and GC85A Vision.

- In 2024, GE HealthCare agreed to acquire MIM Software, a global provider of medical imaging analysis and artificial intelligence (AI) solutions.

- In 2024, GE HealthCare agreed to acquire Intelligent Ultrasound Group PLC’s (Intelligent Ultrasound) clinical artificial intelligence (AI) software business.

- In November 2023, Philips launched a new AI-enabled innovation that will free healthcare providers to focus on patient care. At RSNA23, the world’s largest imaging conference, this solution was provided, which will help shorten procedure times and make operations user-friendly.

- In October 2022, the medical open network of AI, MONAI, integrated with Google Cloud’s Medical Imaging Suite to enable data interoperability for medical imaging workflows.

- In June 2022, Quantiphi, an AI-enabled digital engineering company, announced its selection as a launch partner for Google Cloud’s Medical Imaging Suite, a novel industry solution that leverages artificial intelligence (AI) for medical imaging.

List of Top AI in Medical Imaging Companies:

- General Electric Company

- IBM Corporation

- Koninklijke Philips N.V.

- NVIDIA Corporation

- Siemens Healthineers AG

Artificial Intelligence (AI) in Medical Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Medical Imaging Market Size in 2025 | US$3.290 billion |

| AI in Medical Imaging Market Size in 2030 | US$14.470 billion |

| Growth Rate | CAGR of 34.46% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Medical Imaging Market |

|

| Customization Scope | Free report customization with purchase |

Artificial intelligence (AI) in medical imaging market is segmented and analyzed as below:

- By Offering

- Software

- Services

- By Technology

- Machine Learning

- Deep Learning

- Computer Vision

- By Application

- Oncology

- Neurology

- Cardiology

- Pulmonary

- Orthopedics

- Others

- By End User

- Hospitals & Clinics

- Diagnostics Image Centers

- Research Institutes

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Other

- North America

Our Best-Performing Industry Reports:

- Artificial Intelligence (AI) For Insurance Market

- Artificial Intelligence (AI) in Medical Billing Market

- AI (Artificial Intelligence) in Simulation Market

Navigation

- AI in Medical Imaging Market Size:

- AI in Medical Imaging Market Highlights:

- AI in Medical Imaging Market Trends:

- AI in Medical Imaging Market Players and Products:

- AI in Medical Imaging Market Growth Drivers:

- AI in Medical Imaging Market Segmentation Analysis:

- AI in Medical Imaging Market Geographical Outlook:

- AI in Medical Imaging Market Key Developments:

- List of Top AI in Medical Imaging Companies:

- Artificial Intelligence (AI) in Medical Imaging Market Scope:

Page last updated on: September 19, 2025