Report Overview

Global Non-Meat Ingredients Market Highlights

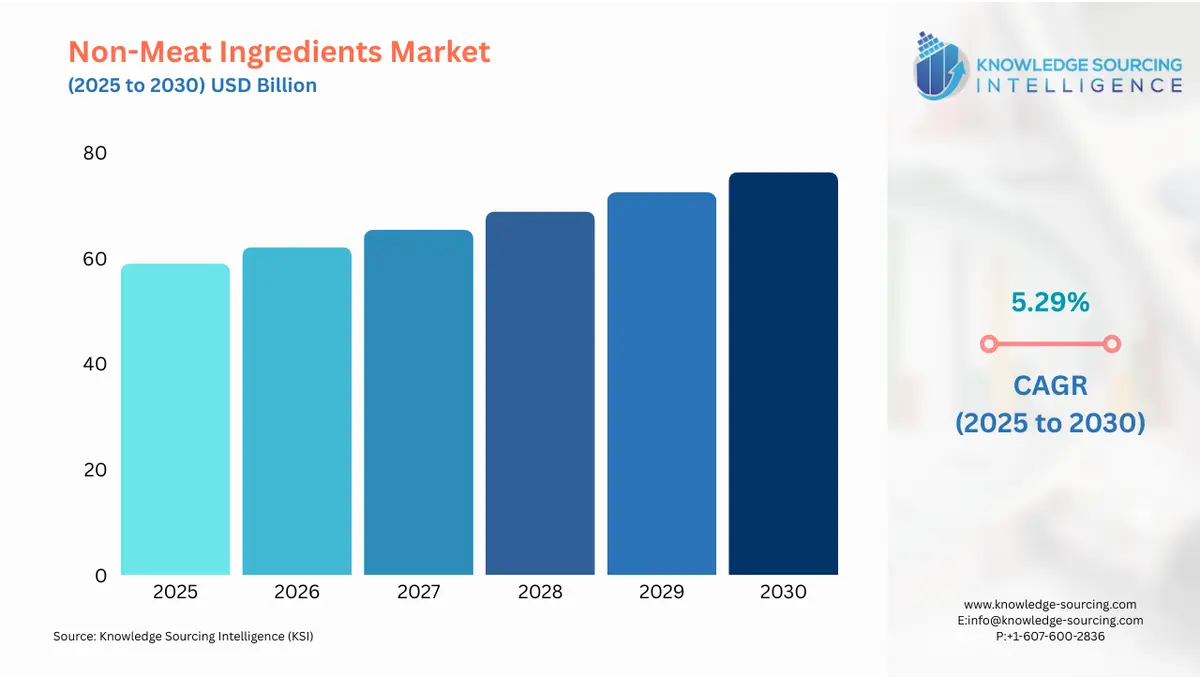

Non-Meat Ingredients Market Size:

Global Non-Meat Ingredients Market, with a 5.13% CAGR, is forecasted to grow from USD 58.955 billion in 2025 to USD 79.6 billion in 2031.

Non-meat ingredients are those ingredients that factor into the enhancement of flavour in meat or other food-related products. A few examples of non-meat ingredients include water, sodium tripolyphosphate, salt, sodium lactate, potassium lactate, sodium diacetate, lemon juice and other organic acids, and flavour agents. These ingredients help in changing the texture, taste, smell, and other characteristics of the final products, significantly improving the quality of the final product. This also improves or introduces several benefits which can be beneficial to the human body.

Non-Meat Ingredients Market Trends:

Non-meat ingredients market is expected to grow at an increasing pace due to the increasing popularity of non-meat food products being introduced to the market. The ingredients in the market include water, salt (Sodium Chloride), curing agents (nitrate and nitrite), cure accelerators, phosphates and organic acids (lactate and diacetate). These injectable solutions provide different results based on the ingredients used and help in improving and enhancing the taste, texture, smell, and other characteristics of the final products. For instance, “Enhanced Pork” is created from the addition of an injection solution into pork to enhance the flavour, smell and texture of the final product. It is also said to improve the quality of the pork being used due to non-meat ingredients being injected into it. Water has been the most traditionally used non-meat ingredient since most non-meat ingredients are water-soluble, which helps in the mixture and enhances the taste of the products.

Non-Meat Ingredients Market Growth Drivers:

Increasing population: The population is ever-increasing and leads to an increasing demand for food products. As per capita income increases, the demand for food also increases and the diets will include more calorie and more varied foods. Furthermore, it was estimated that 4.5 billion people globally were tied to the food system which is expected to show promising growth.

Increasing popularity of plant-based products: One of the main reasons for the popularity of plant-based products is the ethics, diet, and health benefits and due to this, distribution has been significantly expanding over the years. It was estimated that in 2022, 93% of U.S. households that purchase plant-based meat, also purchase conventional meat. As per the statistical information, it is shown that there is a yearly growth of 7%, which is $8 billion worth, of plant-based foods penetrating households in the U.S. This indirectly increased the demand for non-meat ingredients which will help in enhancing the characteristics like taste, texture and many others.

Advancements in technology: There have been a lot of advancements in technology in the production of plant-based food products, which include homogenization, high-pressure homogenization, extrusion technology, and many others. Technologies such as these help in creating plant-based meats, which have been increasing in popularity in India. This will propel the need for enhancements in the flavour of their food products, which boosts the growth of the non-meat ingredients market.

List of Top Global Non-Meat Ingredients Companies:

Archer Daniels Midland Company: One of the global leaders and an American multinational company known for food processing, nutrition and commodities trading worldwide.

Koninklijke Dsm N.V.: One of the global leaders and a Dutch multinational company that is known in the fields of health, nutrition and materials.

DuPont de Nemours Inc.: An American multinational chemical production and research company that was a major player in the development of Delaware.

Non-Meat Ingredients Market Geographical Outlook:

The global food supply is rising at an increasing pace, with factors such as world population and food demand increasing at a high rate. The Asia Pacific region is expected to have growth in the forecasted period of 2025 – 2030. Asia is one of the top in the dietary supply requirements and food supply in the world. Asia’s food supply includes cereals, fruit and plant-based foods and the rest are meat, pulses and beverages. This also assists in the growth of the ingredients market for enhanced flavour and characteristics for plant-based products.

Non-Meat Ingredients Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Non-Meat Ingredients Market Size in 2025 | USD 58.955 billion |

Non-Meat Ingredients Market Size in 2030 | USD 76.297 billion |

Growth Rate | CAGR of 5.29% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Non-Meat Ingredients Market |

|

Customization Scope | Free report customization with purchase |

Global Non-Meat Ingredients Market Segmentation

By Source

Plant-Based

Animal-Based

Chemical-Based

By Meat Type

Beef

Pork

Poultry

Others

By Application

Extenders

Binder

Texturizers

Flavoring Agent

Colorants

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others