Report Overview

Global Nutricosmetics Market - Highlights

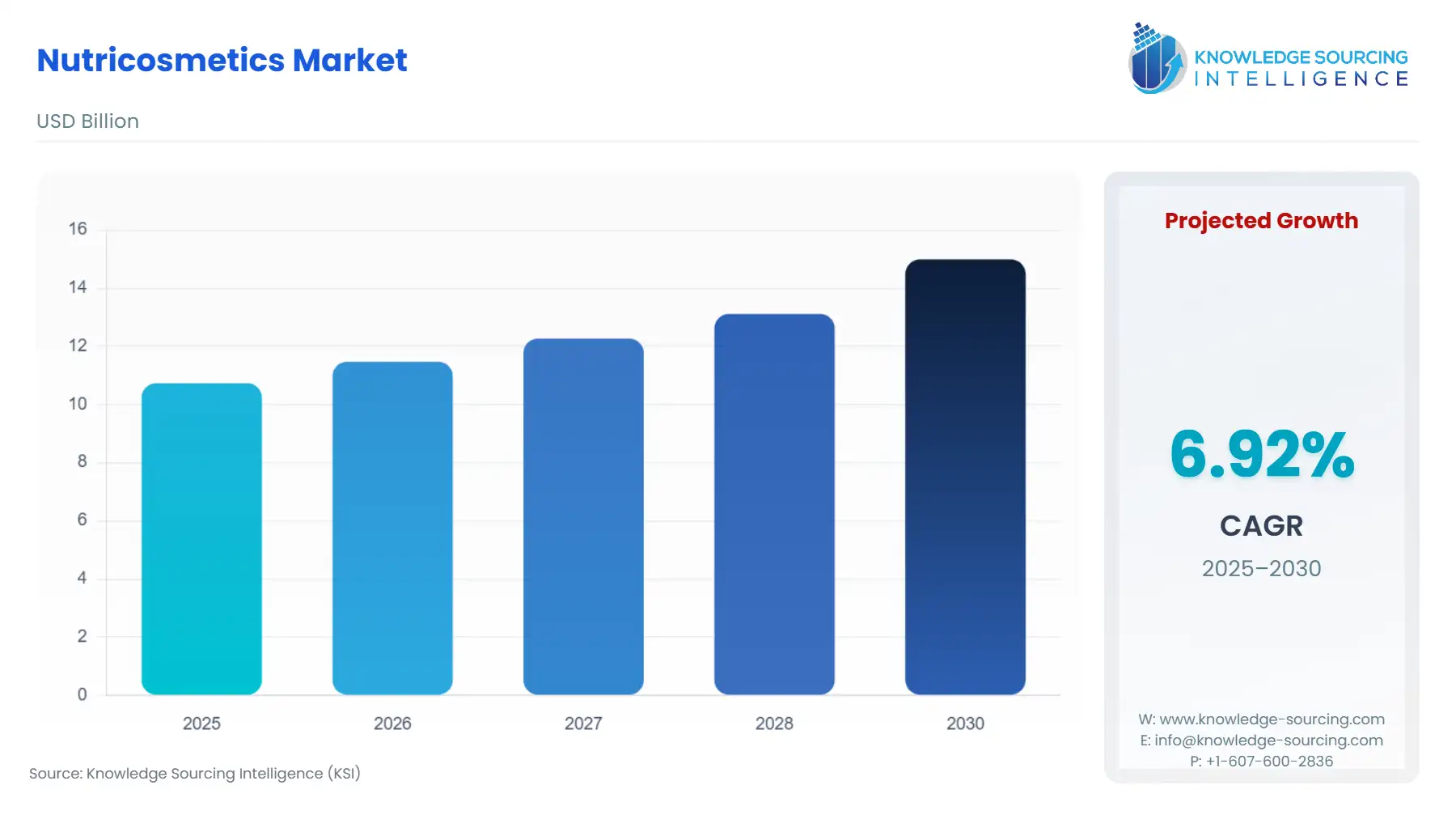

Nutricosmetics Market Size

The Global Nutricosmetics market is expected to grow at a CAGR of 6.92%, reaching a market size of US$14.995 billion in 2030 from US$10.733 billion in 2025.

Nutricosmetics refers to orally ingested nutritional supplements that are formulated and marketed specifically for beauty purposes. Consumers nowadays understand that the topical application of any cosmetic product or treatment can only deliver superficial results. As such, they are incorporating nutricosmetics into their routine to treat issues such as cellulite and acne from the inside.

Rising average per capita income across many countries and growing urbanization are boosting the nutricosmetics market worldwide. The global aging population is driving up demand for nutricosmetics. Furthermore, a gradual shift towards less invasive skin treatment procedures will further bolster the market expansion. The rising number of beauty-conscious consumers is escalating the demand for topical creams and serums as well as supplements and powders to treat different skin and hair problems from the inside out. With consumers’ ever-growing pursuit of wellness, the demand for nutricosmetics is augmenting significantly for thicker hair, stronger nails, and various skin concerns such as acne and fine lines.

Nutricosmetics Market Growth Drivers:

- Rising consumer awareness of beauty from within is driving market growth

Globally, people are becoming more health-conscious, and this is evident from various reports such as the National Health & Nutrition Examination Survey, which states that among U.S. adults aged 20 and over, 57.6% used dietary supplements in the past 30 days. Consumers are becoming more conscious of their skin health amidst the changing global environment and increasing pollution. The segment of the population who believes that beauty can be achieved from within by supplementing those vital vitamins, minerals, and other nutrients into their body has increased. Nutricosmetics supplements help in improving the health of individuals’ skin, hair, nail growth, etc. Thus, it is anticipated that the growing consumer awareness of beauty from within will be driving the market.

- Growing health and wellness trends, along with the aging population, are driving the market

Over the past decade, we have witnessed increasing health consciousness among people. There is a growing health and wellness trend worldwide. The rising health-conscious population is demanding products and services that can help in improving their overall health. Nutricosmetics help to improve the health of skin, hair, nails, etc., from within, increasing demand for them. At the same time, the increasing aging population is driving the market for anti-aging supplements. As per the World Population Prospects 2022, the percentage of the global population aged 65 and above is expected to rise from 10% in 2022 to 16% in 2050. Thus, supplements that are targeted at reducing wrinkles, fine lines, sagging skin, etc., are being demanded by the growing aging population, leading to the nutricosmetics market expansion.

Nutricosmetics Market Restraints:

- Consumer preference for products that give instant results can act as a market restraint for the global nutricosmetics market

The cosmetics, skincare, and hair care markets that give more visible results can be a restraining factor for the nutricosmetics market. As they take longer to show results, people prefer faster, topical beauty solutions for their skincare and haircare health rather than nutricosmetic supplements. The lack of awareness among consumers about the benefits of nutricosmetics is limiting their preference for nutricosmetics over topical solutions. This is limiting the market expansion of nutricosmetics.

Nutricosmetics Market Segment Analysis:

- The skincare segment based on product type will have the largest market share

By product type, skincare currently holds the largest market share and is anticipated to retain its position until the end of the forecast period. There is an increasing consumer awareness of skin health. Increasing demand for effective anti-aging treatments among the rising global aging population is spurring the demand for nutricosmetics with collagen as an ingredient. People's desire to look younger is driving up sales of various nutricosmetics products to improve skin texture. Hence, the skincare segment will have the largest market share.

Nutricosmetics Market Geographical Outlook:

- APAC will continue to hold a dominant market share of nutricosmetics during the forecast period

Geographically, the global nutricosmetics market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, Asia-Pacific will be leading the global nutricosmetics market. Owing to the high demand and investments in countries, especially Japan, China, and South Korea for nutricosmetics, Asia-Pacific will be leading the global market. Furthermore, the increasing number of retailers interested in selling nutricosmetics in APAC countries also contributes to the market growth. Increasing per capita income in APAC countries is putting consumers in a better position to afford nutricosmetics. Moreover, the booming e-commerce industry is also supporting the rising sales of nutricosmetics in the region, with many new companies selling their products via online distribution channels only.

Nutricosmetics Market Key launches:

- In May 2024, Roquette, a global leader in plant-based ingredients and a top pharmaceutical and nutraceutical excipients provider, introduced LYCAGEL® Flex. It is a hydroxypropyl pea starch premix designed for nutraceutical and pharmaceutical soft gel capsules in the nutricosmetics market.

- In November 2023, TOSLA Nutricosmetics partnered with Triiije Architects to build TOSLA 3, a state-of-the-art headquarters and Super Factory to enhance R&D, manufacturing, and sustainability in the growing nutricosmetics market.

List of Top Nutricosmetics Companies:

- Shiseido Co., Ltd.

- VLCC Personal Care

- Vemedia

- MOON JUICE

- The Beauty Chef

Nutricosmetics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Nutricosmetics Market Size in 2025 | US$10.733 billion |

| Nutricosmetics Market Size in 2030 | US$14.995 billion |

| Growth Rate | CAGR of 6.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Nutricosmetics Market |

|

| Customization Scope | Free report customization with purchase |

Nutricosmetics Market Segmentation:

- By Type

- Capsules and Softgels

- Tablets

- Beverages (Including Tinctures)

- Powder

- Gummies and Functional Food

- Others

- By Ingredient

- Vitamins

- Antioxidants

- Collagen

- Omega 3 Fatty Acids

- Others

- By Product Type

- Skincare

- Haircare

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America