Report Overview

Global Organic Wine Market Highlights

Organic Wine Market Size:

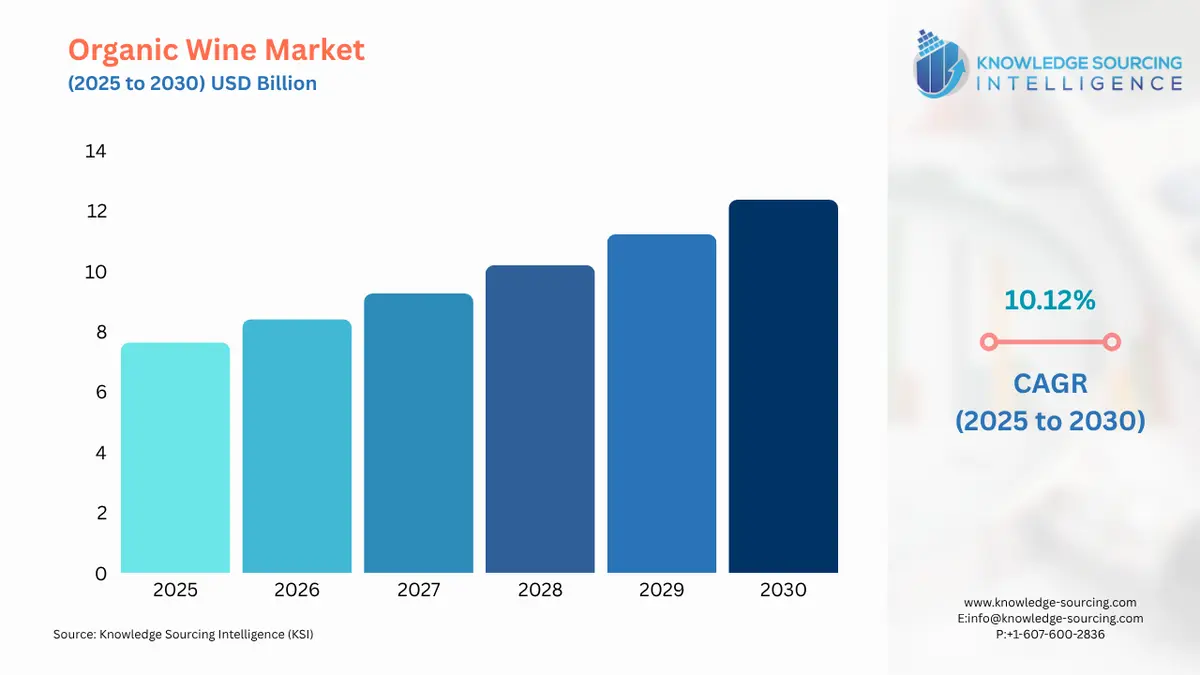

The Global Organic Wine Market is expected to grow at a CAGR of 10.12%, reaching a market size of US$12.365 billion in 2030 from US$7.635 billion in 2025.

The ongoing shift of consumers' preferences towards organic food is driving the market expansion of organic wine. Consumers prefer organic foods more often than before, aligning their eating & drinking habits with their health & wellness goals. This is leading to an increase in demand for organic food and, hence, raising the demand for organic wine. Further, rising awareness about sustainability and climate change is leading customers to demand environmentally viable products. The innovations in organic wine production are also boosting its market growth, enabling it to compete with traditional wine in terms of taste and quality. With the growing popularity of vegan diets and chemical-free food and beverage products, this factor will continue to pave the way for the global organic wine market expansion. As per the report “The World Organic Vineyard” by OIV, vineyards' conversion rate to organic production has increased considerably between 2005 & 2019 by an average of 13% per year.

When the production of wine is done according to strict organic standards, it is called organic wine. Grapes are grown according to the principles of organic farming without using synthetic fertilizers, pesticides, herbicides, or other synthetic materials. It utilizes natural materials like compost, natural fertilizers, etc., during the production of grapes. Additionally, the production process should follow the standards established by the respective government. Hence, wine becomes organic when produced according to the rules and procedures established by the government for organic farming or any related rules.

The global organic wine market has been segmented based on product, distribution channel, and geography. Based on the product, the market has been segmented as organic still wine and organic sparkling wine. Distribution channels have also classified the global wine market as online and offline.

Organic Wine Market Growth Drivers:

- Growing demand for organic products is boosting the market growth of organic wine

The health and wellness trend among consumers is significantly driving the market of organic wine as more consumers are inclined towards organic products. As per reports by the International Federation of Organic Agriculture Movements (IFOAM), the global organic farming area has increased by over 20 million hectares in 2022, representing a 26.6% increase in area under cultivation compared to 2021. This inclination towards organic products is leading related industries to expand, such as driving the demand for organic wine. Organic wine contains natural ingredients and fewer additives and is associated with sustainability, thus driving consumers to demand organic wine. In the coming years, this trend in health and wellness will continue and will be even more than before, propelling the organic wine market to significant growth in the forecast period.

- The benefit associated with organic wine over traditional synthetic wine will boost the market

As per reports by Willer and Lernoud, the area of production under organic grapes has increased from 87,655 hectares in 2004 to 4,03,047 hectares in 2017, showing a significant boost to the organic wine market. Producers and consumers are interested in sustainable and organic wine as it combines environmental benefits, making it helpful for farmers to have reduced investment in production and chemical-free wine, impacting consumers' healthy lifestyles. The associated benefits of organic wine are thus helping it expand its market.

Organic Wine Market Segment Analysis:

- Organic Still Wine will continue to dominate in the forecast period, although the sparkling wine market will have considerable growth

The demand for organic still wine is overall higher globally than for sparkling wine. Consumers' preference for red, white, and rose wines under the still wine category are dominating the organic wine market rather than the newly emerging demand for sparkling wines among the youth. Still, wine has a wider variety and more regular consumption, aligning with normal daily life.

European regions are home to the world’s total wine production and consumption. For example, Spanish consumers have a topmost preference for wines like Alvardo Palacios Priorat Finca Dofi, Mas Martinet Viticultors Priorat Cami Pesseroles (Still Wines) in 2021 suggested by Wine Spectator in its annual ratings of wines.

Hence, the still wine segment will continue to dominate the organic wine market in the coming years, too. However, the demand for sparkling wine is also growing at a faster rate, particularly driven by the younger generation.

- Europe will continue to hold the largest share of global organic wine production, though new emerging markets like North America will be significantly growing.

Region-wise, the global market is segmented into Asia-Pacific, North America, South America, Europe, Middle East and Africa.

The European countries will continue to hold the largest market share in global vine production. It is evident from the data reported by OIV in its report “The World Organic Vineyard” that out of the top 10 leaders in the organic production of vines in 2019, Spain, Italy, and France constitute 75% of the world’s certified organic vineyard surface area. European countries like Germany and Austria constitute 2% and 1%, respectively, with Austria, Greece, Bulgaria, Portugal, Romania, and Croatia constituting 24.9 kha of the area under organic vineyards. Hence, Europe will continue to dominate organic wine production in the coming years.

Though Europe holds a significant share of the global organic wine market, the last two decades have seen the emergence of some new regional markets. The annual growth rate has changed drastically from 2014 to 2019. Countries like the USA, Egypt, South Africa, Switzerland, and Turkey have seen drastic increases in the production of organic vines. For instance, the United States of America had 16.3 kha of area under organic vineyards in 2019, representing 3.6% of the world's total. As the world's largest organic product market, North America is also anticipated to be a significantly growing market for global vine production.

Organic Wine Market Major Challenges:

- High production cost is a key challenge for the global organic wine market

Though the organic wine market will be having considerable growth in the coming years, it will also face certain restraints. The high production cost of organic vines due to stringent regulations and standards that farmers must adhere to certify their vines as organic is posing a serious challenge to these farmers. This narrows the market distribution and the availability of organic wines at a fair price to the market, restraining the global organic wine market.

Organic Wine Market Key Developments:

- In September 2024, Members of Organic Wines South Africa announced its formation on the 4th of September. The association aims to promote the sustainability of their agricultural processes and the organic production of their wines.

- In July 2024, Pernod Ricard partnered with Australian Wine Holdco Limited to sell its international strategic wine brands, including Jacob’s Creek, Orlando, and St Hugo.

- In August 2023, Line 39 Wines, a premium wine brand, expanded its portfolio in the Better for You category by releasing Line39 Organic. It includes three new wines sourced from California Certified Organic Farmers.

List of Top Organic Wine Companies:

- Bronco Wine Company

- Casella Cellar

- Harris Organic Wines

- Avondale

- ELGIN RIDGE WINES

Organic Wine Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Organic Wine Market Size in 2025 | US$7.635 billion |

| Organic Wine Market Size in 2030 | US$12.365 billion |

| Growth Rate | CAGR of 10.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Organic Wine Market |

|

| Customization Scope | Free report customization with purchase |

Organic Wine Market Segmentation:

- By Product Type

- Organic Still Wine

- Organic Sparkling Wine

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America