Report Overview

Global Wine Market - Highlights

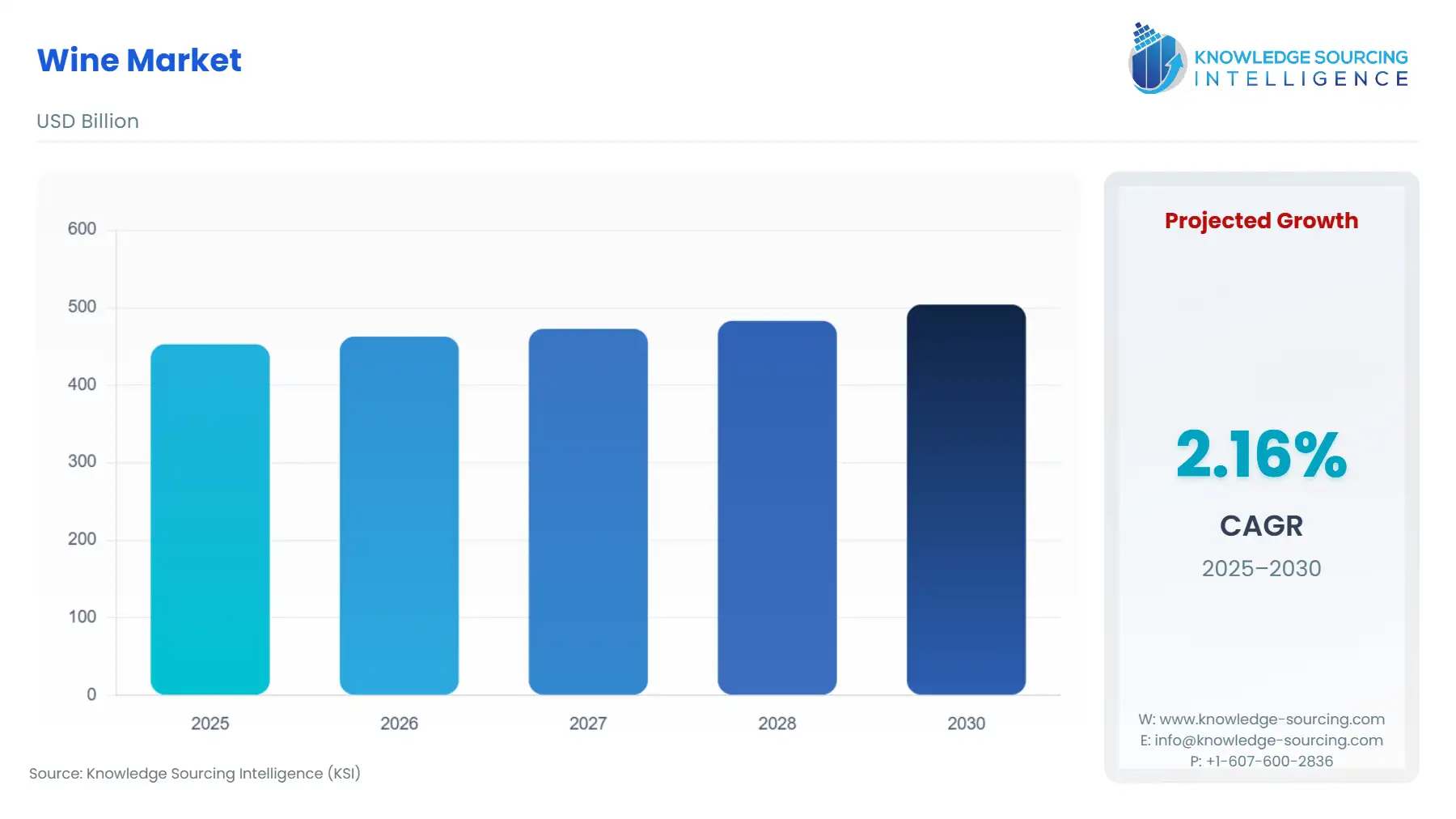

Wine Market Size:

The Global Wine Market is expected to grow from US$452.907 billion in 2025 to US$504.079 billion in 2030, at a CAGR of 2.16%.

The main drivers of the global wine market’s expansion are urban consumers' growing preference for exotic wines and the increase in alcoholic beverage consumption. Other significant elements that affect market growth include changing and evolving lifestyles, increased e-commerce platform penetration, particularly in developing economies, rising public awareness of the advantages of wine consumption, and an increase in the number of eateries, lounges, and social clubs. Increased demand for alcohol-based drinks with fewer calories, rapid advancements in packaging technology, and an increase in the premiumization of wine products worldwide all contribute to market value development.

Wine Market Growth Drivers:

- Growing consumption and developments are driving market growth.

According to a study published in May 2020 and supported by the European Association of Wine Economists and the Chaire Vins et Spiritueux de INSEEC U., wine consumption has significantly increased during the confinement phase because of the coronavirus outbreak in Spain and the rest of Europe. Additionally, according to a proposed regulatory action that was made public by the California Department of Food and Agriculture in June 2023, the limits of grape crush districts 5 and 17 would be altered, which is a portion of the Sacramento River Delta and a source of grapes cultivated in greater quantities and at lower costs than those grown in District 17 (Clarksburg), would be excluded from District 5's eastern limit in California.

According to data made public by the OIV (Organization of Vine and Wine) in April 2022, wine exports worldwide reached €37.6 billion ($41.24 billion) in 2022, an increase of 9% from 2021. Also, 258 million hectoliters of wine were produced worldwide in 2022, a 1% decrease from the previous year. According to the OIV, production in the EU was 161.1 million hectoliters in 2022, up 4% from 2021 and in line with the average of the previous five years. Production in the US decreased by 7% to 22.4 million hectoliters. Production fell by 8%, 7%, and 6% in Argentina, Chile, and South Africa, respectively.

- The emergence of E-commerce platforms and product innovation

In recent years, buying alcohol online has grown in popularity, and this trend is anticipated to continue over the projected period. The advantages for customers include a pleasant shopping experience, prompt home delivery, a variety of offers, and others. As a result, key markets like the U.K., U.S., Italy, Spain, and others are heavily reliant on the Internet sales channel. According to the Netherlands Ministry of Foreign Affairs, online sales are anticipated to increase annually by about 15% in industrialized countries like Europe and North America. To increase their sales in the market, manufacturers are concentrating on creating new e-commerce platforms and forming partnerships. E-commerce is fueled by technical improvements and expanded distribution networks.

Future expansion of the wine industry is anticipated to be fueled by customers' evolving tastes and preferences as well as the rising desire for new and exotic flavours like Riesling wine and other tropical fruit wines. For a larger market share, the competitors in the industry are forming acquisitions. For instance, Pernod Ricard announced a collaboration with Sovereign Brands in October 2022 to expand its portfolio of high-end wines and spirits.

- The benefits of red wine.

Research has shown that red wine is the healthiest wine of all. Red wine benefits heart disease and increases blood antioxidants, and improvement in chronic disease. According to the USDA Foreign Agricultural Services, red wine constituted around 49% of sales in 2019, with 13% of white wine and the remaining others. The rising awareness and health consciousness among the people, coupled with the improved standard of living, is expected to propel the wine market, particularly the red wine market.

The benefit of red wine in heart disease and the rising number of cardiovascular diseases is further expected to aid the red wine market growth. Furthermore, according to the report of National Liquor News in September 2021, there was more demand for organic red wine due to its health benefits, such as lowering cholesterol level, thereby improving heart health. These benefits and the constant development, coupled with new launches, are anticipated to drive the red wine market growth.

Wine Market Geographical Outlook:

- China is expected to be a key market.

China's wine market has experienced significant growth and transformation over the past decade. Historically, China was not known as a major wine-consuming nation, but in recent years, it has emerged as one of the largest and fastest-growing markets for wine. One of the primary factors driving the growth of the wine market in China is the increasing affluence and changing lifestyle of its population. As disposable incomes have risen and the middle class has expanded, there has been a growing interest in wine as a symbol of sophistication and social status. Wine consumption has become popular not only among the elite but also among the emerging middle class.

Another key factor contributing to the growth of the wine market in China is changing dietary habits. As Chinese consumers have become more health-conscious, there has been a shift towards wine consumption as a healthier alternative to spirits and other alcoholic beverages. Wine is often perceived as a more natural and less harmful choice. Furthermore, the Chinese government's efforts to promote domestic wine production have played a significant role in shaping the market. In recent years, China has made substantial investments in its wine industry, both in terms of vineyard cultivation and winemaking technology. This has resulted in the development of a domestic wine industry that has gained recognition and improved quality.

Wine Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$452.907 billion |

| Total Market Size in 2031 | US$504.079 billion |

| Growth Rate | 2.16% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Wine Market Segmentation:

- By Type

- Red

- White

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America