Report Overview

Global Beverage Market - Highlights

Beverage Market Size:

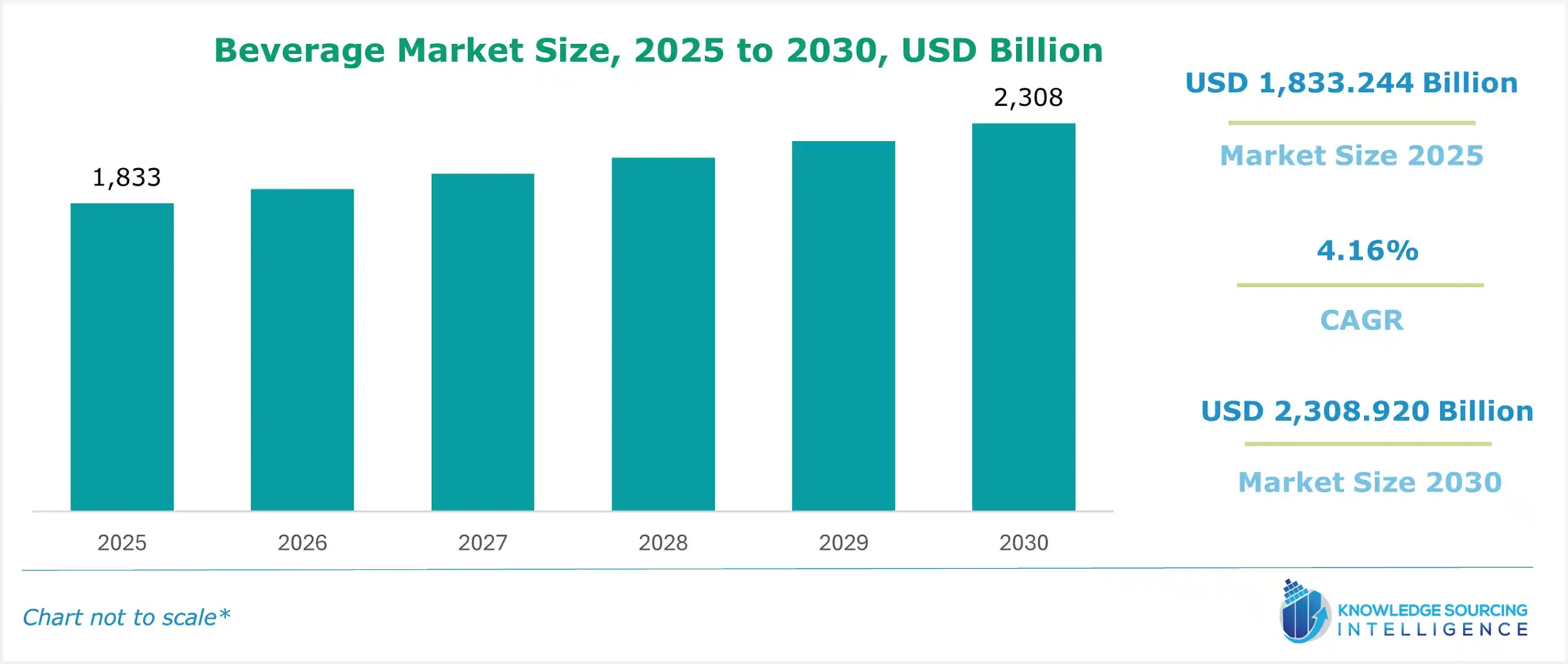

The global beverage market is projected to grow at a CAGR of 4.16% over the forecast period, increasing from USD 1,833.244 billion in 2025 to USD 2,308.920 billion by 2030.

There has been a steady rise in the global packaged beverage market, driven by an increasing consumer preference for both alcoholic and non-alcoholic beverages across various regions worldwide. Product innovations driven by changing consumer preferences for new flavour variants, alcohol packaging, and distribution, enhancing consumer access and convenience, ultimately driving market growth. Behavioural shifts supporting premiumization in consumption, health awareness, and urbanisation are changing consumption patterns. Additionally, digital sales channels and contemporary retail formats are expanding the consumption opportunity. The main players in the market are focusing on product differentiation, cross-partnership products, and sustainable practices to stay competitive. Overall, the market displays significant opportunities across a multitude of product types, product formats, distribution systems, and end-user consumption groups, while regional circumstances will drive growth in the future.

Beverage Market Overview:

The beverage market is anticipated to experience modest growth throughout the forecast period due to shifting consumer preferences towards ready-to-drink beverages, particularly in developing and emerging economies. Additionally, increasing alcoholic beverage consumption per capita and consumer preferences for high-end goods will also drive market expansion.

Furthermore, customers are choosing healthier drinks due to the growing prevalence of lifestyle diseases, increased health consciousness, and rising disposable income. For instance, according to the U.S. Bureau of Economic Analysis, personal disposable income increased from US$57,577 in 2022 to US$61,242 in 2023. In addition, the market is experiencing a rise in demand for beverages with low alcohol content by volume, particularly among millennials and baby boomers. The availability of a wider range of products with better tastes has increased the sales of low-alcohol drinks and made it easier for customers to choose products that suit their preferences.

The non-alcoholic industry is experiencing a remarkable increase in interest in low-alcohol and no-alcohol beverages, largely due to the "sober curious" movement. For example, globally, non-alcoholic beer experienced a 9% increase in volume in 2024, marking it as the fastest-growing segment within the beverage alcohol industry.

There is evidence of premiumization whereby consumers are opting for better-quality, often locally sourced, products. Companies such as Fever-Tree have benefited from this trend, experiencing increased demand for their premium tonic waters and soft drinks.

New technologies are revolutionising the beverage alcohol sector, as the arrival of new AI and automated technologies has improved production efficiencies and product customisation. For instance, Coca-Cola's $75 million investment in a new canning line in Brisbane will expand its capacity to meet increased demand for energy drinks, specifically Monster Energy, which maintains a 40.3% volume share in this industry.

Coca-Cola, as one of the largest beverage companies worldwide, shows a steady increase in profitability from 14,616 million USD in 2024 to 14,787 million USD in 2025, reflecting approximately 1.2% growth. While this data represents a single company, its extensive global presence makes it a useful proxy to understand trends in consumer demand, operational efficiency, and market expansion within the beverage industry.

Plant-based milk options like oat milk, almond milk, pea milk, and potato milk are surging, appealing to vegan and lactose-intolerant consumers. Enhanced water and sparkling water meet hydration demands, while craft beer and premium spirits, including craft spirits, emphasize quality and innovation. In July 2025, PepsiCo launched a Prebiotic Cola, targeting gut health and functional beverages, particularly among the Gen-Z population. The market reflects diverse, health-conscious consumer preferences. Moreover, the industry-wide availability of flavorful, low-alcohol options has significantly boosted demand for lighter beverages, simplifying consumer selection and catering to diverse taste preferences and lifestyle goals.

Beverages Market Trends:

The global beverage market is evolving with the health and wellness trend driving demand for clean-label beverages and sustainable beverages. The sober curious movement fuels growth in no- and low-alcohol options, aligning with conscious consumption preferences. Premiumization emphasizes high-quality, artisanal offerings, while personalization tailors flavors and formulations to individual tastes. Convenience culture boosts on-the-go beverages like RTD coffee and tea, catering to busy lifestyles. Sustainable practices, including eco-friendly packaging and sourcing, gain traction as consumers prioritize environmental impact. These trends reflect a shift toward health-focused, ethical, and convenient beverage solutions, shaping a dynamic and consumer-centric industry landscape.

Beverages Market Growth Drivers:

The growing demand for healthy drinks is accelerating market growth

Customer demand for health drinks shows strong growth trends that match overall beverage market expansion. The consumer market shows clear patterns in which buyers choose different products. According to American Health magazine, health-conscious consumers are interested in beverages beyond hydration and are focusing on ones that are vitamin-fortified and loaded with minerals, antioxidants, and probiotics. Such beverages are perceived to provide immunity enhancement, a boost in energy levels, improvement in digestion, and overall well-being. In the United States, about 20,000 people die from alcohol-related cancers each year. This, in turn, fuels the demand for healthy drinks.

Additionally, increasing consciousness over the intake of high sugar and growing chronic diseases has shifted consumers' preferences away from sugary soft drinks and toward healthier options. Functional beverages such as energy drinks, sports drinks, immune boosters, and digestive aids have become significant categories.

Expansion of Functional & Nutraceutical Beverages

The global beverages industry is witnessing major expansion in the functional and nutraceutical category, largely due to the rising consumer knowledge of health, wellness, and preventive care. Consumers want more than just hydration or refreshment; they are becoming increasingly health-conscious and choosing beverages that provide a measurable health advantage, such as boosting immunity, aiding digestion, and so on.

Gallup, a company that annually surveys consumers about their consumption habits every July, reported that in 2024, 58% of U.S. adults, 18 years old and above, had "an opportunity to consume alcoholic beverages like spirits, wine, or beer", which is lower than 62% in 2023. Such a trend has been the main driver behind the creation of numerous functional beverages that cover a variety of categories, such as protein shakes, fortified juices, sports, and energy drinks, probiotic and prebiotic drinks, herbal infusions, and plant-based alternatives. The increasing popularity of the fitness culture, the rising incidence of lifestyle-related health issues, and the increasing requirement for clean-label, natural, and nutrient-rich ingredients are driving this segment forward.

In America, the growth of functional and nutraceutical beverages is strongly supported by various federal programs that seek to improve consumer safety, stimulate innovation, and ensure product transparency. The Food and Drug Administration (FDA) is at the forefront of the whole process by setting the criteria for labeling and health claims. Recently, the FDA introduced new labeling standards for functional foods, including beverages. The main idea of the new guidelines is to present more precise and accurate information on the health-promoting properties of functional ingredients, thus increasing the consumers' trust and fostering the market expansion in the country.

Beverage Market Segment Analysis:

By type, alcoholic beverages are expected to witness significant growth in the global beverage market

The market is experiencing huge growth under market trends and opportunities. The main motive behind this surge in demand is, in fact, the increasing appeal of premium and craft alcoholic beverages, which reflects how consumer preferences toward better and unique experiences are also changing.

Furthermore, the development of cocktail culture has boosted innovation in the industry. New flavors and products have been developed. In September 2024, the Coca-Cola Company and Bacardi Limited announced their partnership for an RTD-premixed cocktail containing Coca-Cola. The factor is that beverage companies are making high-quality raw materials in order to fulfill premium drink demands from customers.

By Type, the non-alcoholic beverages segment is also experiencing rapid growth

The global non-alcoholic drinks industry is experiencing significant growth due to shifting consumer focus towards health, wellness, and functional benefits. Some major segments of this market are carbonated soft drinks, bottled water, fruit juices, ready-to-drink (RTD) teas and coffees, sports and energy drinks, as well as functional beverages supplemented with vitamins, minerals, probiotics, and other health-promoting ingredients. The trend toward market expansion is being further supported by the increasing demand for low-sugar, low-calorie, and plant-based products, and the rising popularity of non-alcoholic beer and wine alternatives.

Food and drink price levels differ drastically from one EU country to another. In 2024, the cost of food and drinks without alcohol in Luxembourg was higher by 25% than the average of the EU. The highest prices for non-alcoholic beverages were recorded in Ireland, where they were 40% above the EU average. The rising appeal of non-alcoholic alternatives, including alcohol-free beers and wines, has additionally deepened competition within the market and raised prices. While customers are preferring to choose healthy and selecting more expensive options, producers are also changing their pricing policies to fit these evolving tastes.

Numerous government programs in Europe have a significant impact on the non-alcoholic drink market, not only through legal measures but also through labelling and tax policies. The European Union's General Food Law (Regulation (EC) No 178/2002) is the source of the fundamental principles for food safety and consumer rights throughout the member countries. Moreover, the EU suggested some standardized names for non-alcoholic and low-alcohol wines, for example, 'Alcohol-free,' '0.0%,' and 'Alcohol light,' to unify the terminology and facilitate market development.

By packaging type, cans are expected to witness significant growth in the global beverage market

Cans are lightweight and less fragile compared to glass bottles, which increases their demand among customers. Moreover, the growth of canned beverages is also anticipated to rise as they are convenient, portable, and versatile for several occasions. Additionally, the increasing concern for both social causes and the environment will allow greater selling potential for beverage cans, which are easy to use and, at the same time, friendly to the environment. For example, aluminum cans can be reused as they are environmentally acceptable products compared to others.

Moreover, the market is also anticipated to grow because of the rising popularity of energy and sports drinks worldwide. Energy drinks are considered the most preferred dietary supplement globally, with the benefits of enhanced mental alertness and physical performance.

By distribution channel, online is expected to witness significant growth in the global beverage market

The primary driver responsible for the growth in this segment is the change in consumer shopping behavior. Furthermore, the convenience of rapid delivery, comfortable and reasonable access to technology, and the ability to buy from anywhere are the primary factors augmenting the online beverage market globally. For instance, Statistisches Bundesamt (Destatis) data states that between 2014 and 2024, EU residents' online shopping has grown dramatically, with 77% of all EU citizens shopping online as of 2024. With 96% of its population shopping online, Ireland leads the pack, followed by the Netherlands, Denmark, and Sweden. Germany ranks eighth, with 83% of its population shopping online.

Beverages Market Geographical Outlook:

In North America, driven by rising premiumization in the US and Canada, consumer demand for ready-to-drink and health-focused beverages is fueling robust market growth.

The demand for beverages is high in North America due to the rising demand for flavored water among people, especially millennials. With the increasing popularity of soft drink options, the consumption of various beverages is on the rise. Due to the increased levels of diabetes throughout the country, there is a massive shift among consumers toward healthier lifestyles, including a balanced diet and the consumption of natural sweeteners.

Moreover, in January 2025, Positive Beverage, which provides some refreshments and energy drinks, focusing on health, announced that Positive Energy products were available in Albertsons and Vons grocery stores in Southern California. More than 280 Albertsons and Vons stores in the state were about to stock Positive energy, a sign of positive feedback and further growth.

As one of the leading economies with a high consumption rate, the United States provides a major scope for the beverages market, fuelled by the growing transition towards premium drinks, coupled with the ongoing adoption of digital channels to garner a wider customer base. Moreover, the rapidly growing urban population has further increased the demand for high-quality spirits and wine, and the US, a major non-alcoholic producing nation, is investing to expand its production and consumption capacity. According to the “2024-2025 Global Wine Trade” report issued by the International Trade Council, the US wine industry has shown constant evolution in wine taste, which has reshaped the demand preference.

Likewise, according to the National Institute of Health, nearly 79% of Americans have tried alcohol at some point. Moreover, the outdoor culture in the country is witnessing constant growth, fuelled by the improved prevalence of social gatherings, which has also impacted the frequency of beverage consumption. For instance, according to a research study conducted by the Bank of America, consumer spending on bars experienced 1% year-on-year growth in January 2025. Additionally, the same study also revealed that bar spending by baby boomers also experienced 4% year-on-year growth in the same month, while spending by Gen Z and millennials witnessed a steady improvement.

Besides, the ongoing shift towards premium alcoholic beverages, the growing health awareness and self-consciousness among Americans have provided a new framework that is impacting the overall beverage industry in the US. Hence, demand for healthy beverages has provided a positive outlook. According to the USDA’s “Fruits and Tree Nuts Outlook March 2025” report, the US import of orange juices from October 2024 to January 2025 witnessed a 5% growth, while lemon juice import from August 2024 to January 2025 experienced a 20% growth.

The adoption of a healthy lifestyle has also impacted bottled water demand, and according to the Beverage Marketing Corporation, in 2024, the per capita bottled water consumption in the United States stood at 47.3 gallons, representing a 2.1% growth over the preceding year. The same source also stated that energy drinks experienced a 1.62% growth in the same year. The well-established presence of global companies, namely PepsiCo, Coca-Cola Company, Red Bull, Bacardi Limited, and Carlsberg Breweries A/S, which offer an extensive range of beverages in the US market, is further driving the overall market expansion.

Beverages Market Key Developments:

February 2026: Coca-Cola expands cherry portfolio with Cherry Float launch The Coca-Cola Company officially launched Coca-Cola Cherry Float and Diet Coke Cherry nationwide in the U.S. and Canada, featuring a new blend of cherry flavor with creamy vanilla notes.

January 2026: Starbucks introduces Caramel Protein and Dubai Chocolate drinks Starbucks launched its 2026 winter menu featuring functional Caramel Protein Latte and Matcha beverages with up to 31 grams of protein, alongside limited-edition Dubai Chocolate drinks inspired by 2025 social media trends.

December 2025: PepsiCo outlined its preliminary 2026 financial outlook and priorities, including innovation, supply-chain optimization, and expanded beverage presence to drive growth and improve shareholder value in the coming year.

October 2025: The Coca-Cola Company announced plans to introduce 7.5-ounce single-serve mini cans of Coca-Cola, Coke Zero Sugar, Sprite, and Fanta in U.S. convenience stores beginning January 1, 2026 to attract cost-conscious and on-the-go consumers.

May 2025: PepsiCo completes acquisition of prebiotic soda brand Poppi for $1.95 billion, accelerating its expansion into functional, better-for-you beverages and enhancing its portfolio with low-sugar, prebiotic products.

List of Top Beverage Companies:

The Coca-Cola Company

Nestle

Pepsi Co Inc.

Appalachian Brewing Company

Beverage Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1,833.244 billion |

| Total Market Size in 2030 | USD 2,308.920 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Packaging Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Beverages Market Segmentation:

By Type

Alcoholic Beverages

Beer

Wine

Spirits

Non-Alcoholic Beverages

Bottled Water

Carbonated Soft Drinks

Fruit Juice

Milk

Dairy

Almond

Soy

Rice

Oat

Cashew

Coconut

Others

By Packaging Type

Cans

Bottles

Others

By Distribution Channel

Online

Offline

Supermarkets

Restaurants & Bars

Hotel Lounge

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific Region

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others