Report Overview

Global Outsourcing Services Market Highlights

Outsourcing Services Market Size:

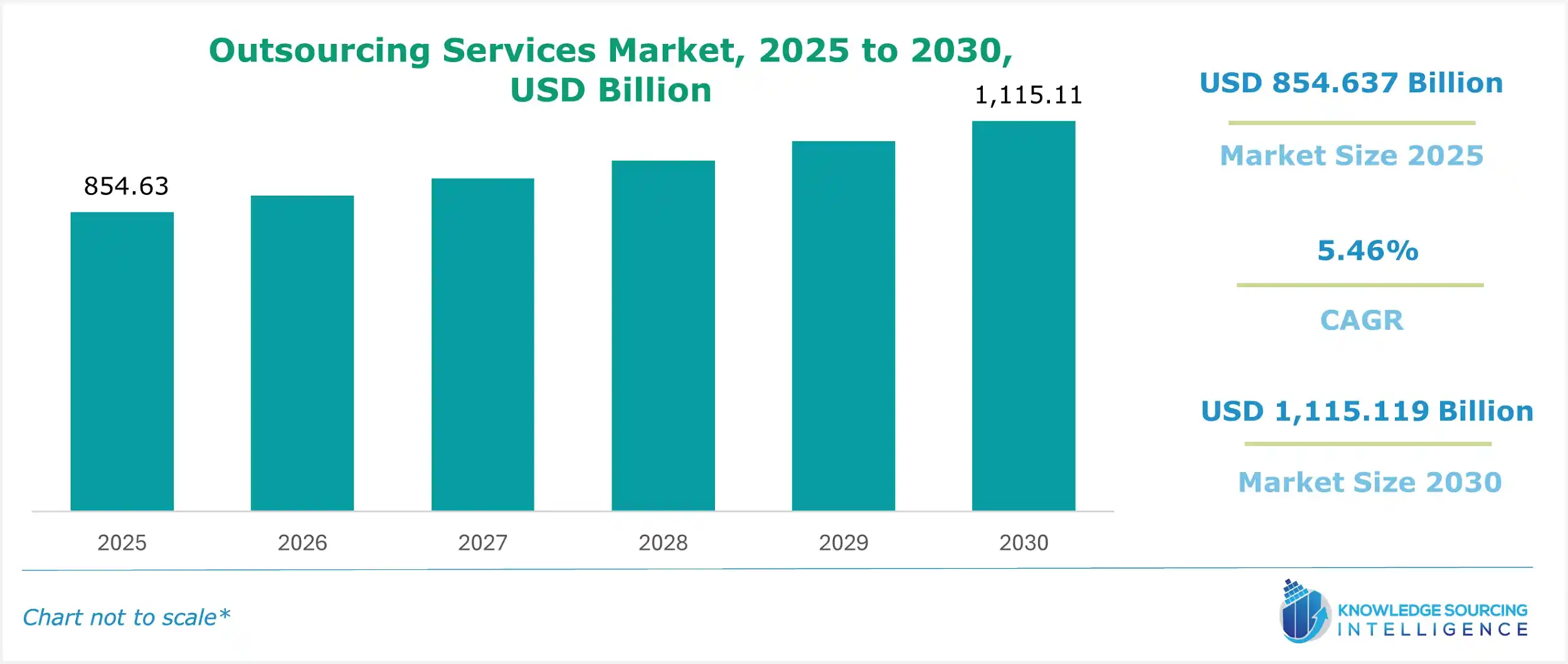

The global outsourcing services market is estimated to attain a market size of US$1,115.119 billion by 2030, from a valuation of US$854.637 billion in 2025 at a 5.46% CAGR.

Outsourcing Services Market Trends:

Outsourcing services involves companies hiring a third-party provider to operate, perform tasks, and perform other processes to decrease costs while accessing skilled professionals and improving the efficiency of the operations. Their services involve diverse function types like business process outsourcing, information technology outsourcing, and other services like logistics and financial consulting. The market is expected to grow due to a rise in demand for cost reduction, the provision of skilled talents that bolster cost-effectiveness, and technological advancement. The growing globalization, with market players entering emerging economies by utilizing infrastructure and professionals, is also contributing to the market expansion..

Additionally, the growing collaboration between market players and innovative product development is also expected to potentially promote market expansion during the projected period. For instance, in July 2023, NTT Data, which is a global digital business and IT services provider, announced the launch of its outsourcing services to prevent incidents and decrease damages in the management of security. The services were first introduced in Japan, and by March 2024, were launched globally. This service will employ experienced security engineers to support the client company's requirements.

Global Outsourcing Services Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The global outsourcing services market is segmented by:

- Type: By component, the outsourcing services market is segmented into IT outsourcing, business process outsourcing, and others. The business process outsourcing segment is witnessing significant growth as businesses are demanding scalability and flexibility in their operations.

- Location: By deployment, the global outsourcing services market is segmented into onshore, offshore, and nearshore. The onshore is predicted to be the fastest-growing market share due to industries prioritizing quality control and proximity.

- Enterprise Size: By enterprise size, the global outsourcing services market is segmented into small, medium, and large. The large segment is expected to have a significant market share in this segment.

- End User: By end user, the global outsourcing services market is segmented into IT & telecommunication, healthcare, BFSI, media & entertainment, manufacturing, and others. The IT & telecom segment is rapidly expanding in the end-user segment. Rising demand for digital transformation, 5G rollout, and round-the-clock support is driving outsourcing service adoption in major sectors such as IT & Telecommunication.

- Region: Region-wise, Asia Pacific is projected to account for a considerable market share owing to the rapid improvement in SMEs' strength, followed by emphasis on exercising cost-efficiency in business operations.

Top Trends Shaping the Global Outsourcing Services Market:

1. Rising In Digital Transformation

- The growing use of cloud technologies, deployment of 5G, Internet of Things (IoT), and artificial intelligence in the IT and telecom industries has generated demand for specialized technical skills. In this regard, as per GSMA, the penetration of 5G networks in the United States is estimated to reach 94% by 2030. Outsourcing makes organizations agile and responsive in a fast-changing environment by ensuring access to innovative skills and technology at minimal in-house investments.

Global Outsourcing Services Market Growth Drivers vs. Challenges:

Drivers:

- Growing Emphasis on Cost-Effectiveness: The utilization of outsourcing services by diverse industries such as healthcare, finance, and retail sectors is enabling companies operating in such fields to exercise cost-effectiveness. These services offer companies to shift to developing regions such as India and China, which offer lower-cost labor. According to the US Bureau of Labor Statistics, the median salary of a software developer in the US was $131,450 per year and $63.20 per hour as of May 2024.

Additionally, as per Coursera data, the average salary of software developers in India, as per level of experience, is RS 15,00,000 per year for 10-14 years of experience, ?4,42,500 for developers with 0 to 1 year of experience and RS 9,00,000 for developers with an experience of 4 to 6 years. Such low-salaried representation boosts the utilization of outsourcing services as the offshore outsourcing companies employ large employees to provide competitive pricing in IT development, customer support, and other back-office operations, promoting the market growth in the coming years.

- Increase in demand from the IT and Telecommunication Sector: The demand for outsourcing services for the IT and telecommunication sector is growing at a fast rate, fueled by the growing emphasis on cost-reduction and access to skilled labor. With businesses looking to reduce operational expenses and enhance the delivery of services, outsourcing offers an adaptive method of offloading non-core activities such as infrastructure maintenance, customer care, and application development. Moreover, outsourcing vendors tend to provide round-the-clock services by taking advantage of global delivery models, thereby providing 24/7 operations and support, which is particularly important for telecom networks and worldwide IT systems.

In line with this, Appian announced its collaboration with Outsourcing Technology Co., Ltd. in August 2024 in Japan to achieve business efficiency enhancement through process automation and low-code development on the Appian Platform. In addition, managed service providers typically introduce advanced industry expertise and compliance models that allow telecom and IT companies to cope with sophisticated regulatory landscapes better.

Apart from this, the rising IT and telecommunication industry powers the outsourcing industry's growth directly. In March 2025, 13.54 million subscribers submitted their requests for Mobile Number Portability (MNP), which jumped the total MNP requests to 1105.39 million on 25th February, and further to 1118.94 million by the end of March 25, since MNP implementation.

- Increase in Key End-Use Industries: The cost reduction provided through the use of outsourcing services is being utilized in diverse industries other than the IT and telecom, like healthcare, finance and retail, and e-commerce sectors. The outsourcing services are utilized for logistics maintenance, customer services, and inventory management in the e-commerce and retail industry, and work in helping retailers manage cost-effectiveness.

The increase in the e-commerce industry will lead to a rise in the adoption of outsourcing services for cost-saving opportunities provided by the integration of this service. As per the data from IBEF, the Indian e-commerce market was valued at US$123 billion in the financial year (FY) 2024, which is predicted to grow to a value of US$292.3 billion in FY2028, which is growing with a CAGR of 18.7 percent. Major market players are offering outsourcing services for multiple industries such For IBM has a well-established global presence and is one of the pioneering outsourcing service providers with a portfolio inclusive of business process outsourcing (BPO), procurement & consulting services, and HR outsourcing services.

The company’s modern approach integrates advanced solutions such as Artificial Intelligence with its services, which enables it to exercise transparency and flexibility, thereby accelerating its value creation. Its constant innovations have made the company the leading finance and accounting BPO provider as per the “2025 Gartner® Magic Quadrant™”. Moreover, forming strategic partnerships and acquiring consulting firms has further improved the company's market presence.

Challenges:

- Communication Issues: The outsourcing services involve connecting globally with diverse time zones and languages, which could result in ineffective communication. This can lead to misalignment in information and delayed response, hampering the projects, leading to limit the adoption of this market.

Global Outsourcing Services Market Regional Analysis:

- North America: The region is predicted to account for a significant market share, owing as the Service sector has picked up growth in the regional countries like the United States, and positive investment inflows by foreign entities to establish their operations in the US market have also elevated the country’s corporate culture. Likewise, the US-based companies, especially those operating in the IT field, are aiming to exercise cost reduction & efficiency, owing to which they are investing in third-party services.

Moreover, the global demand has picked up pace for specialized services, with US-based companies playing a major role. According to the “OA500 2024” report issued by Outsource Accelerator, from the top 500 global outsourcing firms, nearly 278 or 55.6% are headquartered in the United States, followed by India with 12.6%. Hence, the same source also specified that the availability of skilled labor and advanced technology is mainly driving the nation’s outsourcing sector.

Likewise, the major market players such as Accenture, IBM, and Capgemini SE are investing to offer varied outsourcing services that meet the diverse corporate demand. Moreover, the high number of small enterprises, followed by the improved strength of start-ups, is also acting as an additional driving factor. For instance, according to the US Census Bureau, the March 2025 projected business formation statistics stood at 28,524, which represented a 5% growth over the preceding month.

Global Outsourcing Services Market Competitive Landscape:

The market is fragmented, with many notable players, including Accenture Plc, Tata Consultancy Services Limited, Cognizant, Wipro, HCL Technologies Limited, Capgemini SE, IBM, Infosys Limited, DXC Technology Company, NTT DATA Inc., Genpact, Concentrix Corporation, Teleperformance SE, and ExlService Holdings, Inc, among others.

- Product Launch: In February 2025, Firstsource Solutions Limited unveiled its new vision, UnBPO™, a revolutionary change from the conventional models of outsourcing. Through the emphasis on expertise, innovation, and results-driven solutions, Firstsource is transforming the sector and shaping a future-fit organization.

Outsourcing Services Market Scope:

| Report Metric | Details |

| Outsourcing Services Market Size in 2025 | US$854.637 billion |

| Outsourcing Services Market Size in 2030 | US$1,115.119 billion |

| Growth Rate | CAGR of 5.46% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Outsourcing Services Market |

|

| Customization Scope | Free report customization with purchase |

Outsourcing Services Market Segmentation:

By Type

By Location

- Onshore

- Offshore

- Nearshore

By Enterprise Size

- Small

- Medium

- Large

By End-User

- IT & Telecommunication

- Healthcare

- BFSI

- Media & Entertainment

- Manufacturing

- Other

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others