Report Overview

Regulatory Affairs Outsourcing Market Highlights

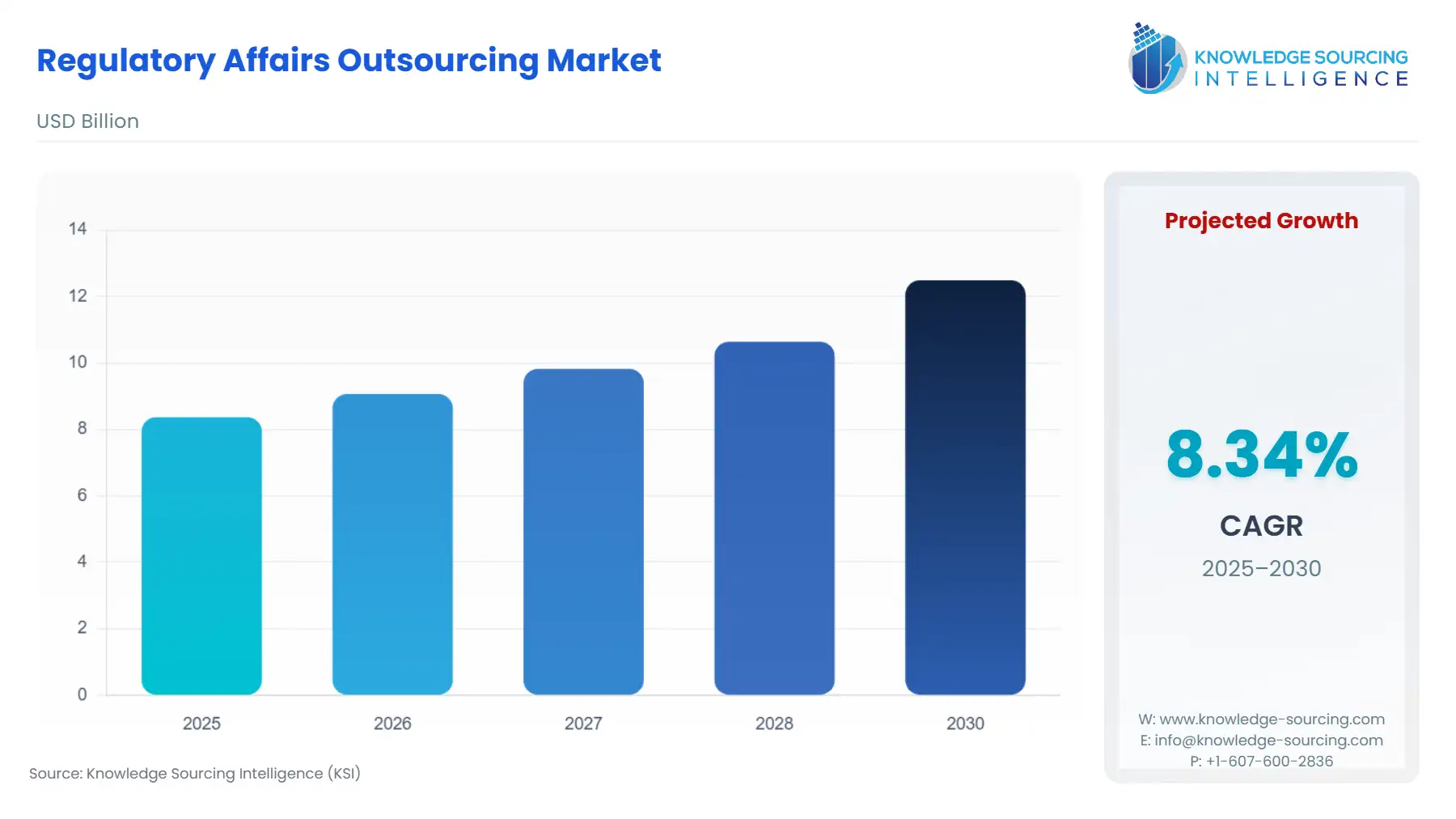

The regulatory affairs outsourcing market, at an 8.34% CAGR, is expected to grow from USD 8.369 billion in 2025 to USD 12.493 billion in 2030.

Regulatory Affairs Outsourcing Market Key Highlights

The global Regulatory Affairs Outsourcing Market is expanding rapidly, as life sciences organizations are tackling increased regulatory complexity, more stringent compliance scrutiny, and intensifying cost pressures across pharmaceuticals, biotechnology, and medical devices. The companies are facing a significantly higher regulatory burden, caused by rapidly changing approval frameworks, the globalization of clinical development, and increasing product safety, real-world evidence, and lifecycle documentation requirements. This trend has resulted in firms seeking external support for their most demanding regulatory functions.

As global compliance costs are rising substantially, leading to an increase in administrative workload, higher per-employee compliance costs, and the growing number of penalties for non-compliance, companies are turning to outsourcing as a strategic tool to lower fixed costs, improve submission quality, and speed up multinational product registrations.

________________________________________________________________

Regulatory Affairs Outsourcing Market Analysis

Growth Drivers

The primary factor propelling demand in this market is the increasing complexity and volume of regulatory mandates. Regulatory bodies worldwide are continuously strengthening requirements for product safety, efficacy, and quality management systems. In the United States, the high volume of new drug applications (NDAs) and the implementation of the Medical Device User Fee Amendments (MDUFA) generate a surge in required submissions and post-market compliance activities. This directly increases the workload on regulatory departments. Small and medium-sized enterprises (SMEs), which often lack a comprehensive in-house regulatory infrastructure, are compelled to outsource to manage these peak workloads and access the specialized knowledge needed for first-time right submissions.

Furthermore, the globalization of clinical trials and product launches creates a critical demand for multi-jurisdictional regulatory intelligence. Companies seeking to enter new markets, particularly in the Asia-Pacific region, require local expertise for legal representation, local language translations, and adherence to country-specific regulations. Outsourcing provides immediate access to this distributed global competence, effectively eliminating the management overhead and high cost of establishing satellite regulatory offices in dozens of countries. This flexibility and specialized access significantly accelerate time-to-market. The constant evolution in scientific areas like gene and cell therapies (ATMPs) also necessitates outsourcing, as the regulatory frameworks for these novel products are nascent and require unique, cutting-edge strategic consulting that generalist in-house teams often cannot provide.

- Expanding Pipeline of Biologics, Biosimilars, and Complex Products

One of the main reasons driving regulatory business to be outsourced is the growth of biologics, biosimilars, and other complex products. The change of pharmaceutical pipelines from the use of small-molecule drugs to the use of highly complex modalities like monoclonal antibodies, cell and gene therapies, antibody–drug conjugates, and next-generation biosimilars is causing a heavier regulatory burden at every stage of development.

These products' structural complexity, sensitivity to manufacturing variations, and increased safety scrutiny by regulators necessitate far more complex documentation, deeper scientific justification, advanced CMC (Chemistry, Manufacturing and Controls) packages, and robust post-approval lifecycle management. The gene, cell, and RNA pipeline is expected to grow at a rate that is comparable to that of the previous two years in 2024. The gene, cell, and RNA pipeline landscape has expanded by 7% since the beginning of 2024, which is consistent with the 7% and 6% annual growth rates recorded in 2022 and 2023, respectively.

Challenges and Opportunities

A key challenge facing the market is the risk of knowledge transfer dependency and subsequent quality control issues. When critical regulatory strategy and operational knowledge reside exclusively with an outsourcing partner, the client company becomes vulnerable to service disruptions or performance inconsistencies, which can delay approvals. This constraint on demand is counterbalanced by an opportunity for providers to develop more integrated, technology-driven solutions. The shift toward digital and data-driven regulatory processes, such as the adoption of the electronic Common Technical Document submissions, creates a demand for partners capable of integrating sophisticated regulatory information management (RIM) software platforms and using artificial intelligence/machine learning for compliance checks and expedited documentation generation. This technological imperative represents a significant growth opportunity for providers who can offer high-tech, end-to-end regulatory operations services.

Supply Chain Analysis

The Regulatory Affairs Outsourcing market is a service-based ecosystem, making its supply chain predominantly a talent and information supply chain. The core inputs are human capital—highly specialized regulatory affairs professionals, regulatory scientists, and medical writers—and regulatory intelligence (up-to-date knowledge of global mandates). Key production hubs are concentrated in regions with large pools of skilled life sciences professionals and favorable cost structures, including North America, Western Europe, and increasingly, high-growth, low-cost locations in India and Eastern Europe. The primary logistical complexities involve maintaining consistent quality standards, data security across international borders (e.g., GDPR compliance), and the seamless, real-time transfer of sensitive regulatory documentation between the client and the outsourcing partner.

Government Regulations

The regulatory environment is the foundational demand driver for this market. Key government regulations continually increase the complexity and demand for outsourced expertise.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | Medical Device Regulation (MDR) & In Vitro Diagnostic Regulation (IVDR) | Directly increases demand by imposing significantly stricter requirements for clinical evidence, technical documentation, and post-market surveillance. Small-to-mid-sized medical device and IVD manufacturers must outsource the remediation of legacy technical files to meet the elevated criteria. |

| United States | Food and Drug Administration (FDA) | The agency's emphasis on electronic submissions (eCTD) and the use of Real-World Evidence (RWE) in submissions creates demand for outsourced regulatory operations and specialized consulting expertise to integrate these data modalities into regulatory dossiers. |

________________________________________________________________

Regulatory Affairs Outsourcing Market In-Depth Segment Analysis

By Service: Clinical Regulatory Support

Demand for Clinical Regulatory Support is surging, primarily fueled by the acceleration of specialized drug development, particularly in areas like oncology and rare diseases. The shift from traditional randomized controlled trials to innovative designs—such as adaptive trials, platform trials, and the incorporation of synthetic control arms—introduces a higher degree of technical and regulatory complexity. Each non-standard design requires novel regulatory strategies, precise protocol compliance documentation, and expert interaction with health authorities to gain approval. Furthermore, the global expansion of clinical trials into emerging markets necessitates specialized outsourcing to manage multiple country-specific clinical trial applications, ethical approvals, and local regulatory reporting requirements, tasks that overwhelm in-house regulatory clinical operations teams. The use of decentralized trial components and digital health technologies further compounds the compliance burden, making external expertise in these evolving areas non-negotiable for maintaining study timelines and data integrity.

By End-User: Pharmaceutical and Biotechnology Companies

Pharmaceutical and Biotech firms operate in a dynamic environment where products must be compatible at the regional and country-level. Hence, this can be achieved through the development of a regulatory strategy that enables such firms to receive pre-clinical trial applications and post-marketing regulatory support. The ongoing efforts of pharmaceutical firms to exercise cost containment, followed by emphasis on increasing access to specialized medical areas in different regions, are driving their preference towards regulatory affairs consultants.

Similarly, the ongoing development of new drugs, vaccines and biologics, coupled with constant technological advancements, has accelerated the focus on a product’s lifecycle management and necessary information that ensures compliance with regulatory bodies, such as the Food and Drug Administration (FDA).

Hence, various strategic collaborations between CDMOs and regulatory services providers have transformed the market landscape for pharmaceutical firms. For instance, in May 2025, Recipharm, a global contract development and manufacturing organization (CDMO), collaborated with ProductLife Group (PLG), which combined Recipharm’s manufacturing expertise in small molecule, advanced therapies, medicinal products (ATMPs), and traditional biologics with PLG’s regulatory affairs services, thereby providing comprehensive support to pharmaceutical firms from early-stage development to product approval.

Major pharmaceutical manufacturers are actively participating in improving their drug portfolio by extending their reach across varied medical fields. For instance, according to Sanofi’s Q1 2025 report, the company achieved six regulatory approvals for medicines across oncology, rare disease, and immunology. With efforts to gain dominance in emerging medical fields and biosimilars, the demand for expertise that provides access to such areas at a lower cost has played a major role in driving the usage of regulatory affairs consultants in pharmaceutical & biotech companies.

________________________________________________________________

Regulatory Affairs Outsourcing Market Geographical Analysis

US Market Analysis (North America)

The pharmaceutical and medical sectors in the United States are constantly evolving to meet the current market trends. With the growing focus on emerging fields, including personalized medicine, biosimilars, companion diagnostics and orphan drugs, governing authorities, such as the U.S. Food and Drug Administration (FDA), are frequently updating their guidelines, which heightens the need for compliance support. Overseas-based pharmaceutical manufacturers operating within the US must comply with such updates; they require the necessary expertise, which has become a major driving factor.

Likewise, the ongoing investment in research and new drug development in the United States has created a surge in clinical trial frequency, and major pharmaceutical manufacturers are investing in expanding their base in the US market. For instance, according to AstraZeneca’s H1 & Q2 2025 report, the company announced plans to invest USD 50 billion in the United States by 2030, which included the establishment of manufacturing and R&D units. As per the same report, the US accounted for nearly 41.55% of the company’s total revenue in the same period.

Additionally, the demand for new drugs & biologics is gaining traction in the US market, which has led to new approvals. For instance, in 2024, the U.S. FDA’s Centre for Drug Evaluation and Research (CDER) approved 50 novel drugs for a broader patient population. Moreover, on 18th November 2025, AbbVie announced the U.S. FDA approval of its “EPKINLY” for treating adults suffering from relapsed or refractory (R/R) follicular lymphoma.

Hence, such ongoing drug approvals, followed by investment plans announced by major pharmaceutical firms to expand their business in the US market, are projected to accelerate the demand for specialized services for preclinical planning, regulatory submission, and trial approval.

Brazil Market Analysis (South America)

The Brazilian market is largely influenced by the need for international companies to navigate the specific requirements of the National Health Surveillance Agency. As a key emerging market, foreign pharmaceutical and medical device companies require local expertise for product registration and legal representation. The local market is driven by the necessity to reconcile global regulatory dossiers with ANVISA's unique submission requirements and timelines, creating significant demand for outsourced local regulatory strategy and product registration services.

Germany Market Analysis (Europe)

Germany's market is heavily impacted by the European Union's implementation of pan-European regulations such as MDR and IVDR. As a major hub for medical device manufacturing, German companies face immense pressure to re-certify legacy devices under the significantly stricter new frameworks. This transition has generated a massive, short-to-medium-term demand spike for outsourced technical documentation remediation, clinical evaluation report updates.

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market exhibits growth potential driven by government initiatives to modernize its healthcare infrastructure and attract foreign investment. Local demand for outsourcing is centered on achieving compliance with the Saudi Food and Drug Authority (SFDA). International companies entering the region require outsourced services for local registration, often needing partners who can manage the necessary localization of labeling, packaging, and specific documentation required for market access in the Gulf Cooperation Council (GCC) area.

Japan Market Analysis (Asia-Pacific)

Japan represents a highly sophisticated market with demand dictated by the rigorous standards of the Pharmaceuticals and Medical Devices Agency (PMDA). Japanese companies expanding globally and foreign companies seeking entry into Japan require specialized regulatory translation, clinical trial notification, and consultation services to manage PMDA's unique review processes and standards. The demand centers on regulatory strategy for innovative products and the efficient management of the post-market safety management system (PMS) requirements.

________________________________________________________________

Regulatory Affairs Outsourcing Market Competitive Environment and Analysis

The competitive landscape is characterized by a mix of large, multinational Contract Research Organizations (CROs) that offer end-to-end regulatory services as part of a broader development portfolio and smaller, highly specialized consulting firms focusing on niche areas like specific medical device classes or therapeutic areas. The market relies on verifiable expertise, a deep bench of subject matter experts, and established relationships with global health authorities.

Regulatory Affairs Outsourcing Market Company Profiles

- ICON plc: ICON is a major global player, positioning itself as an end-to-end development partner. Its strategy focuses on integrating regulatory services deeply into its broader clinical research and commercialization offerings.

- Parexel International Corporation: Parexel is strategically focused on providing a full suite of services that help biopharmaceutical and medical device clients accelerate their product development.

Regulatory Affairs Outsourcing Market Segmentation

- By Type

- Functional Service Provider (FSP)

- Full-Service Outsourcing (FSO)

- By Service

- Regulatory Strategy & Consulting

- Clinical Regulatory Support

- Product Registrations

- Regulatory Writing and Publishing

- Legal Representation

- Others

- By Product Type

- Pharmaceuticals

- Biologics & Biosimilars

- Medical Devices

- Vaccines

- Others

- By Enterprise Size

- Small & Medium Enterprise (SMEs)

- Large Enterprise

- By End-User

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America