Report Overview

Polyols Market - Strategic Highlights

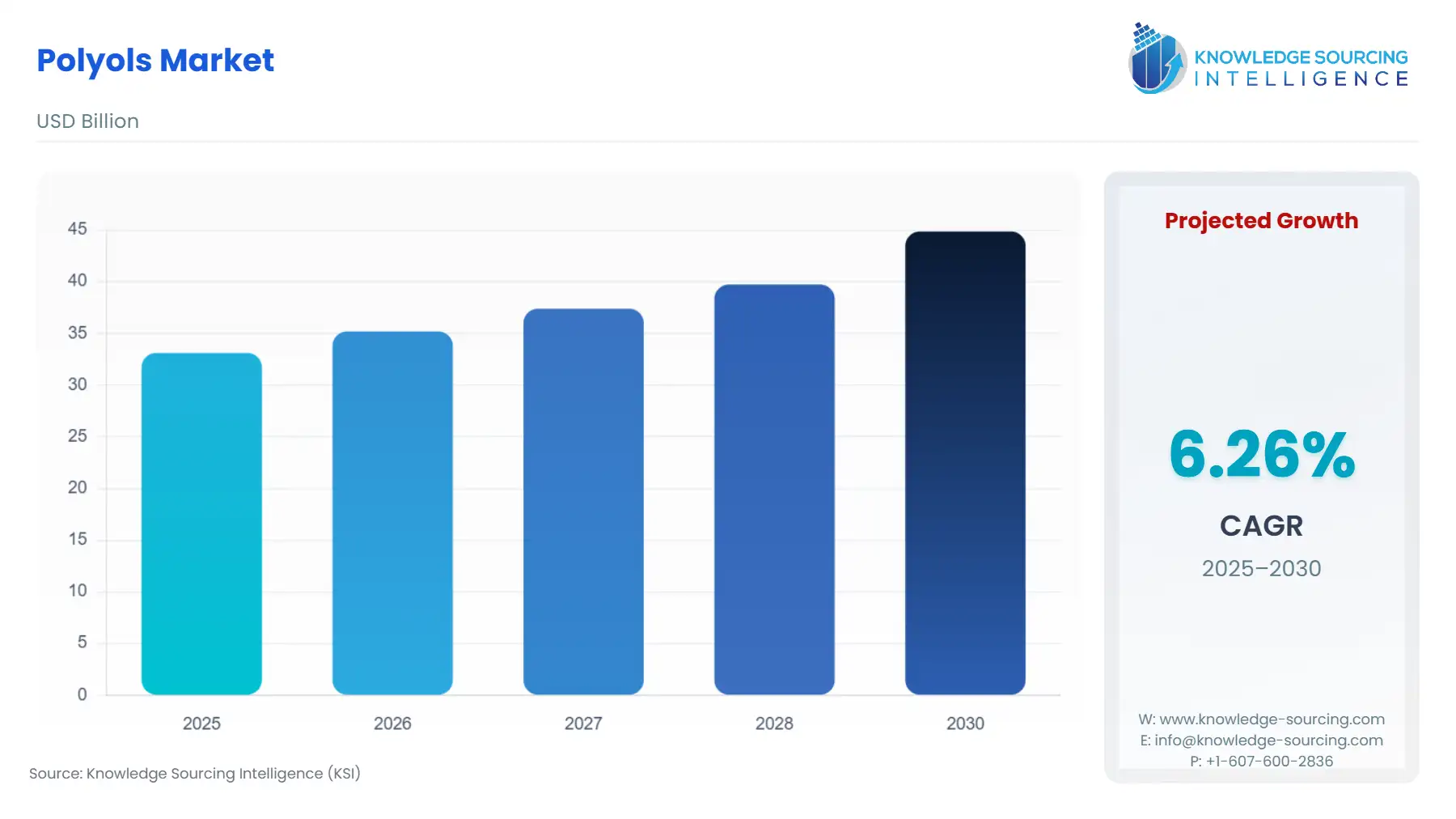

Polyols Market Size:

The Polyols Market is expected to grow from US$33.126 billion in 2025 to US$44.873 billion in 2030, at a CAGR of 6.26%.

Polyurethane is a major driver of the polyols market, a crucial segment within the global chemical industry and the broader macroeconomy. Much organic molecule input is mandated by Polyols for both soft and rigid polyurethane foam production, coatings, adhesives, sealants, and elastomers to be manufactured. The increasing need for lightweight automotive parts, as well as green insulating materials & energy-efficient buildings, has dramatically escalated global demand for Polyols. Agricultural-based polyols are bio-based polyols that derive from resources such as corn, soybean oil, and castor oil. They are increasingly being demanded because another option that is safe for sustainability to replace petrochemical polyols is more recognized under more consumer awareness plus ecological regulations.

Polyols Market Overview & Scope

The polyols market is segmented by:

- Type: The market for polyols by type is divided into polyether polyols, polyester polyols, and natural/bio-based polyols. The market is dominated by polyether polyols, which are also anticipated to expand at the fastest rate. These polyols are favored due to their outstanding qualities, which include great flexibility, strong resistance to hydrolysis, and extensive use in the manufacturing of rigid and flexible foam. This market is expanding quickly due to the growing need for flexible polyurethane foams in furniture, bedding, and car cushioning applications. The popularity of polyether polyols is also influenced by their improved processability and reduced production costs.

- Application: The market for polyols by application is divided into flexible polyurethane foams, rigid polyurethane foams, coatings, adhesives & sealants, elastomers, and others. The fastest-growing application segment is rigid polyurethane foams because of their vital function in industrial equipment, freezers, and buildings' thermal insulation. The use of stiff PU foams is being pushed, particularly in developed economies, by the increased focus on energy efficiency and green building certifications like LEED and BREEAM. Their exceptional insulating qualities and capacity to lower energy usage have made them essential in the HVAC and construction sectors.

- End-User: The end-use industry for polyols with the fastest rate of growth is the building and construction sector, which is fueled by rising infrastructure development investments, particularly in emerging markets in the Middle East and Asia-Pacific. The usage of polyols in rigid foams and sealants is being directly impacted by the rise in demand for energy-efficient insulating materials as well as the movement toward sustainable and smart buildings. Regulations and government incentives for green building are also supporting the segment's expansion.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East, Africa, and Asia-Pacific. Asia-Pacific is anticipated to hold the largest share of the market, and it will be growing at the fastest CAGR.

Top Trends Shaping the Polyols Market

1. Transition to Sustainable and Bio-based Polyols

An increasing trend is the substitution of bio-based polyols made from renewable resources, including corn, soybean, castor, and palm oils, with petroleum-based ones. Consumer demand for sustainable materials, carbon footprint reduction goals, and environmental concerns are the main forces behind this change. Bio-based polyols are becoming more popular in sectors like furniture, building, and automobiles because of their similar performance qualities and environmental friendliness. Globally, governments and regulatory agencies are also enforcing laws and providing incentives to promote the use of more environmentally friendly raw materials. BioPTMG, a plant-based polyol intended for use in polyester and polyurethane, was introduced by Mitsubishi Chemical Group. It provides great resilience, flexibility, and durability on par with alternatives derived from petroleum. Kahei Co., Ltd. used this material in bio-synthetic leather products that were introduced by "tonto" (Triple A Co., Ltd.), such as tissue cases and shoulder bags.

2. Growing Interest in Green and Energy-Efficient Building Materials

The need for polyols in the manufacturing of rigid polyurethane foams used for thermal insulation in buildings has grown because of the global emphasis on sustainable development and energy conservation. These foams have a major impact on lowering energy usage in both commercial and residential buildings. Particularly in North America and Europe, the use of insulating materials containing polyols is increasing due to certifications like LEED, BREEAM, and other green building requirements.

Polyols Market Growth Drivers vs. Challenges:

Opportunities:

- Quick Development of the Transportation and Automobile Industries: Lightweight and high-performing polyurethane parts created using polyols are being used more in the automotive industry for bumpers, headrests, interior panels, and seat cushions. Automakers are concentrating on materials that lower vehicle weight and improve fuel economy as EVs and fuel-efficient vehicles gain popularity. Modern cars benefit greatly from the superior weight-to-strength ratios and comfort provided by polyurethane foams based on polyols.

- Innovations in Technology for Recycling and Circular Economy Projects: The development of recyclable and reusable polyol materials is gaining traction, particularly considering international initiatives to cut plastic waste and transition to a circular economy. Research on recovering polyols from end-of-life items and chemically recycling polyurethane foams is accelerating. Leading chemical corporations are investigating depolymerization techniques and closed-loop recycling systems to address sustainability issues.

Challenges:

- Variability in Raw Material Prices: The price volatility of raw materials, especially those generated from petrochemicals like ethylene oxide and propylene oxide, is one of the biggest factors limiting the market for polyols. Price swings for these feedstocks are caused by shifts in demand, supply chain interruptions, geopolitical unrest, and crude oil prices. Price strategies for downstream polyurethane goods are unpredictable due to unstable raw material costs, which have a direct impact on the production costs and profitability of polyol manufacturers.

- Environmental Issues with Polyols Based on Petrochemicals: Polyols derived from petroleum are carbon-intensive and non-renewable, which poses major environmental issues. Environmental deterioration and considerable greenhouse gas emissions are linked to their manufacture and consumption. Public pressure and regulatory scrutiny have resulted from this to lessen dependency on chemicals derived from fossil fuels. Producers in areas with stringent environmental regulations, including the European Union and some parts of North America, must pay carbon taxes, comply with compliance requirements, and make costly changes to fulfill waste management and emission standards.

Polyols Market Regional Analysis:

- Asia-Pacific: The market for polyols in the Asia-Pacific region is expanding rapidly due to factors such as urbanization, industrialization, and rising demand from end-use industries like packaging, automobiles, furniture, and construction.

- China: China is the region's largest producer and consumer thanks to its extensive industrial sector, growing building industry, and government assistance for energy-efficient infrastructure. Flexible polyurethane foams and coatings derived from polyols are in high demand due to the nation's thriving automotive sector.

- India: Rising infrastructure development, government housing programs like "Housing for All," and a burgeoning middle class are all contributing to India's status as one of the fastest-growing economies. These factors are increasing demand for consumer durables and comfort-based goods like furniture and mattresses.

Polyols Market Competitive Landscape:

The market is moderately fragmented, with many key players including BASF SE, Covestro AG, Dow Chemical Company, Huntsman Corporation, Shell Chemicals, Mitsui Chemicals, Inc., and LANXESS AG.

- Collaboration: In April 2024, Sanyo Chemical and Econic Technologies collaborated to create CO?-based polyols, which will reduce dependency on fossil fuels for more environmentally friendly polyurethane applications and promote carbon neutrality by integrating CO? into polyol production.

- New Product Launch: In May 2024, MOL launched a €1.3 billion polyols complex in Hungary with the goal of strengthening MOL's market position and reducing reliance on imports by producing high-quality polyols for construction and automotive applications.

Polyols Market Scope:

| Report Metric | Details |

| Polyols Market Size in 2025 | US$33.126 billion |

| Polyols Market Size in 2030 | US$44.873 billion |

| Growth Rate | CAGR of 6.26% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Polyols Market |

|

| Customization Scope | Free report customization with purchase |

Polyols Market Segmentation:

By Type

By Application

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-User

By Region

- North America

- USA

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others